Voyagerix/iStock via Getty Images

Investment thesis

With a recession looking ever closer, investing in solid companies that generate high cash flows is crucial. Altria Group (NYSE:MO) is one of those companies that has shown resilience to market downturns since the beginning of the year, thanks largely to its solid free cash flow and high dividends. The profitability margins of its business are its strength, and it ensures that even if demand for cigarettes is down the company still manages to generate a huge amount of money. In addition, new investments related to cannabis and e-cigarettes could bring new life to the company and enshrine a new period of growth. According to my assumptions, the fair value of this company is $66 per share, so the stock is currently undervalued.

Why investing in Altria

Considerations on the tobacco industry

Investing in Altria means investing in a leading tobacco company that generates huge cash flows each year with which it pays an equally large dividend to its shareholders, as well as implementing buyback programs. It is very common to find people who prefer to avoid this type of investment as they do not consider it ethically sound since through its products it harms the health of consumers, which is why they often try to black out sin stocks. As reasonable as all this may be, selfishly I believe that the goal of an investment should be profit, and if the public tries to black out sin stocks I consider it only a benefit since I can buy them at a lower price. After all, Altria has never forced anyone to buy a pack of Marlboro.

The fact that tobacco is disfavored by society makes Altria a potentially risky investment since with increasingly stringent regulations on tobacco use it is believed there will be fewer and fewer consumers. This reasoning is not wrong, but some points must be made in this regard:

- Altria is trying to reduce its dependence on cigarette sales by investing in new market segments.

- Tobacco use in the U.S. is still a serious problem. According to 2020 data, 13 out of 100 U.S. adults aged 18 and older smoke cigarettes, about 30.8 million people. Moreover, while the percentage of those who smoke assiduously (20 cigarettes a day or more) has been declining since 2005, those who smoke up to 9 a day are increasing.

Although the overall trend of smokers has been declining sharply since the 1960s, tobacco companies continue to generate huge amounts of cash flow because their business model allows them to operate on extremely high profit margins. To best render the idea of this concept, I will conclude this paragraph with a famous quote from Warren Buffett in 1987 about companies that sell tobacco:

I’ll tell you why I like the cigarette business. It costs a penny to make. Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty.

Better performance in difficult times

Although we do not know in advance how the S&P 500 will end this year, we can say that so far there have been many difficulties. The world’s most important index is particularly suffering under the weight of high inflation and the slowdown in the U.S. economy evidenced by two quarterly declining GDPs. In June we reached a bottom at -25% from the highs, but I personally believe that in the coming months if not next year we will reach a new bottom, which is why I am protecting my portfolio with defensive companies. If my expectations become reality the real recession is yet to come, and at that point having companies like Altria that provide solid free cash flow will be crucial.

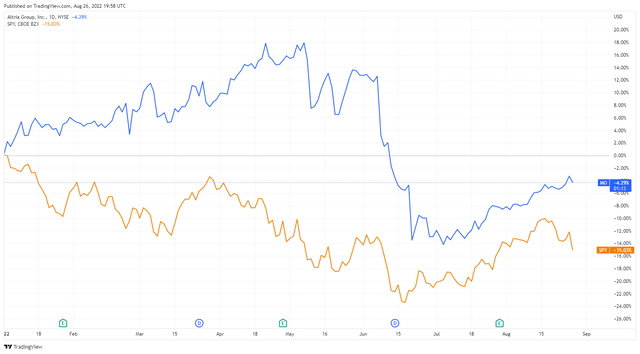

If we compare the YTD return of the S&P 500 and Altria, it is easy to observe how the sin stock has vastly outperformed the S&P 500, and I am not even considering the 2 large dividends issued since the beginning of the year. For those who, like me, believe in a bearish thesis, a stock that can so well amortize a 25% loss of the S&P 500 is certainly something to consider. Should the S&P 500 lose up to 35-40% from the highs we can expect Altria to continue to play its defensive role: this is not a certainty but so far the numbers are on its side. Of course, if on the other hand the S&P 500 were to rebound to new highs we cannot expect a defensive stock like Altria to do as well; after all, its beta is only 0.64.

High and sustainable dividend yield

The most relevant aspect of an investment in Altria is probably its dividend. The company has been issuing an increasing dividend for 52 years and currently has a dividend yield (FWD) of 7.76%.

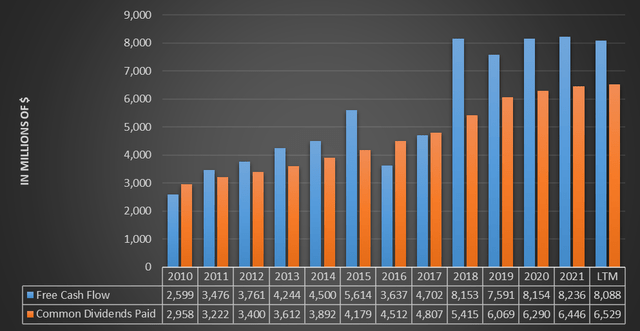

Certainly, the weight of the dividend when compared to free cash flow is significant, and in the past the company has shown to increase the dividend even when not supported by higher free cash flow. However, it should be considered that this is a huge dividend, so it is reasonable to expect the payout ratio to be that high. In the long run, Altria’s free cash flow has shown good growth and as of today there is still a margin of safety to be able to increase the dividend again, which is why I am not worried about the sustainability of the next 4-5 years. In addition, Altria does not even need a large spread between free cash flow and the dividend because the company’s investments are relatively low. From 2010 to the present, capex has never exceeded $250 million annually. The only large expenses the company has incurred relate mainly to acquisitions, but this is not an ordinary expense.

Regular buybacks

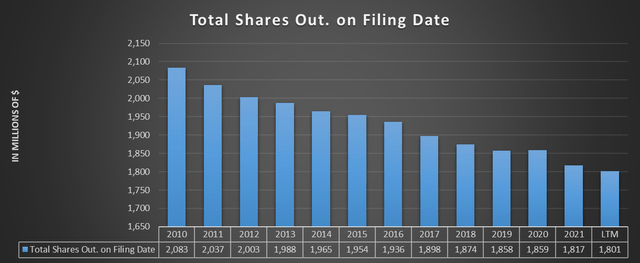

As if a dividend yield of nearly 8% were not enough, this company also used to remunerate its shareholders by purchasing its own shares.

Except for 2020, each year the company has purchased a small amount of its own shares. While in the short run no particular difference can be seen, in the long run the benefits are much more visible. Through this process, the company increases shareholder ownership, as well as increasing other financial ratios such as EPS and dividend per share. This is, in my opinion, a relevant aspect, as it testifies that the company does not finance its dividends and investments by diluting its shareholders, but simply by conducting its operations. Some companies promise high dividends on the one hand but dilute their shareholders on the other, resulting in a less favorable overall total effect for shareholders.

Altria expects to buy back its own shares in the second half of 2022 for an additional $750 million.

Expectations about Altria’s future

When you have been issuing a growing dividend for more than 50 years and you are a leader in an industry where you cannot even advertise (this prevents the entry of new competitors), it is difficult to expect that in a 2-3 year the future will be that different from the present. However, there are some aspects that could potentially have an important impact on Altria’s very long term, and they relate to its Vision 2030. Here are the two most interesting segments.

Smoke-free portfolio

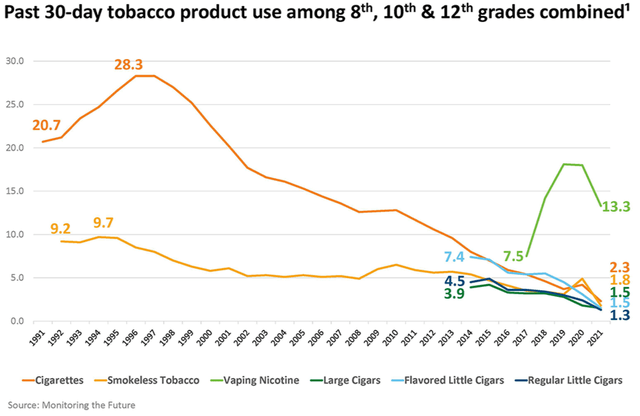

In recent years, most tobacco companies, including Altria, have been trying to change the composition of their revenues by trying to increase the sale of products that are less harmful to health. In particular, Altria seems to be focused heavily on reducing youth smoking, especially as it relates to smokers younger than 21.

Looking at this graph, it would seem that Altria is getting the desired results as young people are less willing to smoke a cigarette. On the other hand, however, this reduction in demand has been supported in part by the sale of e-cigarettes, which in any case contain nicotine to develop an addiction. After all, how could we expect a company to go against its own interests? Altria obviously wants to harm the health of its consumers as little as possible, but if this means selling fewer cigarettes (thus decreasing revenues) then it is necessary to sell a product that is less harmful and more accepted by society. From an economic point of view I consider this to be a correct (although almost forced) choice to prevent future declines in revenues due to less cigarette consumption.

Moreover, overall, it must be said that heat-not-burn tobacco products are growing strongly; therefore, it cannot be ruled out that in the distant future a large part of the company’s revenues may be produced by the latter. In 2019 this market was valued at $7.3 billion and is projected to grow at 32.8% CAGR until 2027. This trend is mainly supported by young people.

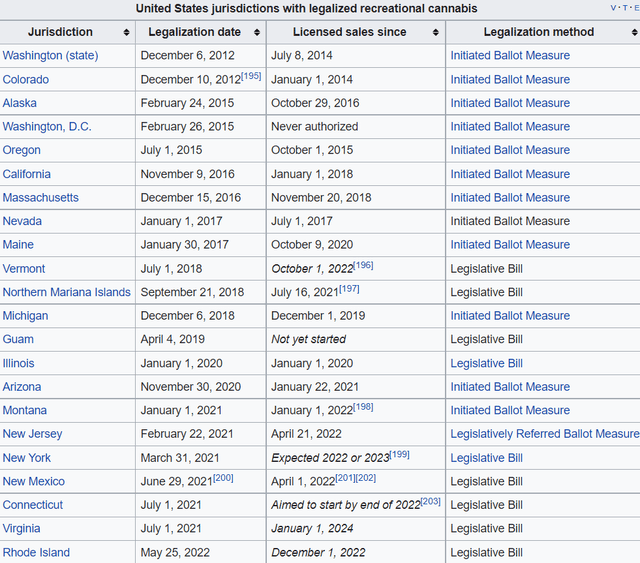

Legalized U.S. cannabis market

The cannabis market in the U.S. has become a great opportunity, as it is evident that more and more states have been legalizing its use since 2012. I have no reason to think that this trend will stop, in fact I believe that over the next decade it will be the norm to consume cannabis for recreational purposes.

Altria has decided to enter this market in 2019 through the acquisition of 45% of Cronos Group for $1.8 billion. This is a leading global Canadian cannabinoid company, and will be part of Altria’s diversification strategy. As of now, it is still premature to draw initial conclusions from this investment as it is still an undeveloped market. According to Grandviewresearch analysts’ estimates, in 2021 the U.S. cannabis market was worth only $10.8 billion, but from 2022 to 2030 a 14.9 % CAGR is expected.

Thus, this is a very long-term investment but at least it shows management’s willingness to depart from the dependence of cigarette sales.

Final thoughts

In light of what has been said so far, what can be seen is that despite a general reduction in tobacco consumption, Altria continues to generate a huge amount of free cash flow thanks to the industry’s large margins. The main problem is that it is difficult to determine in advance when the demand for tobacco consumption will be so low as to severely damage Altria’s revenues; however, at least for now we are facing a sustainable scenario. The smoking habit is deeply rooted in consumers, and I do not think it reasonable to expect a too rapid decline resulting from the cigarette segment.

In any case, the company is showing that it understands the nature of this problem, which is why it is veering toward investments in markets that are still relatively young. The success of these investments will determine the future of this company, which seems to want to adapt to the new social necessities. Here are the company’s statements on the subject:

Today over 20 million U.S. adult smokers seek less harmful alternatives to cigarettes. This is a pivotal moment. With adult smoker demand for non-combustible alternatives, innovation and an appropriate regulatory framework, we have the opportunity to make more progress on harm reduction in the next 10 years than we have in the past 50 years. In fact, our future success depends on it. Over the next 10 years, we will invest in our business and our people to transform Altria and our industry.

Fair value

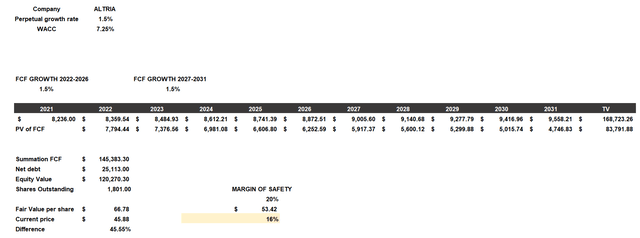

To conclude this article, I will estimate through a discounted cash flow what could be the fair value of Altria. This model will be constructed as follows.

- The cost of equity will be 8.75% and considers a beta of 0.64, a market country risk premium of 4.20%, a risk-free rate of 3.50%, and additional risks of 2.50%. The latter value is so high because I wanted to discount any legal and income problems that may arise in the future. This is a sector that is not loved by the community, so I think it is fair to require a higher yield. The after-tax cost of debt will be 4.08%.

- Given a capital structure composed of 70% equity and 30% debt, the resulting WACC is 7.25%.

- The growth rate will be 1.50% until 2030. Even though the demand for cigarettes has been declining for decades, Altria has demonstrated the ability to increase its free cash flow over the long term. I am especially confident in the sales growth of the alternative segments related to the latest investments.

According to my assumptions, Altria’s fair value is $66 per share, much more than the current $45. Moreover, if we wanted to consider a 20% margin of safety, Altria would still be a buy. Even including a growth rate close to 0% the company would still be undervalued, yet more evidence that its current cash flows are already a reason to invest in this company, regardless of growth.

Be the first to comment