Daniel Boczarski/Getty Images Entertainment

La-Z-Boy Incorporated (NYSE:LZB) remains a primary figure in the home furniture industry. Since the pandemic, it has basked in the upsurge in demand for its furniture. It is logical, given the impact of the housing market boom on discretionary spending. As such, it maintains robust, profitable, and sustainable operations. Revenue growth and margin expansion remain evident as its capacity increases.

However, the fluctuations in the housing market are a concern today. The skyrocketing prices and mortgage rates appear to discourage many buyers. That is why downward pressures on the stock price are visible. But, the underlying power of the company must not be completely ignored. It is capable of stabilizing and sustaining its performance and dividend payments.

Company Performance

La-Z-Boy Incorporated remains the primary reclining chair provider in the US. It is also one of the largest home furniture businesses in the country. Amidst the supply chain disruptions, inflationary pressures, and geopolitical disturbances, it remains robust. It continues to provide quality brands to millions of customers across regions. Thanks to its massive distribution streams that allow it to meet the market demand.

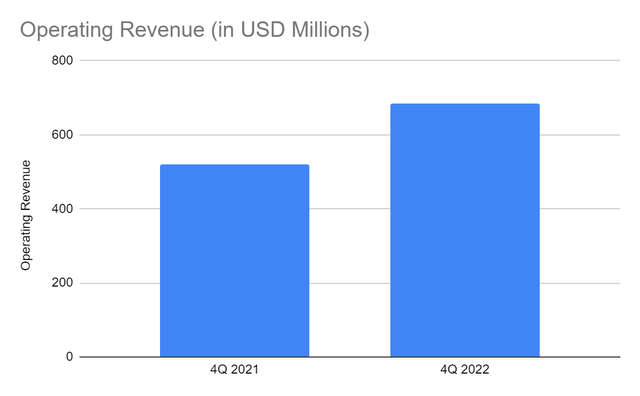

This quarter, its operating revenue amounts to $684 million, a 32% year-over-year growth. It operates in wholesale, retail, and corporate segments. All of these show impeccable revenue growth. It is most visible in Joybird, which is 62% higher than in the previous year. Indeed, the company benefits from a solid customer base and increased demand. It is also driven by the expansion in its operating capacity. Its prudent investment in Neosho, MO speeds up the upgrades and renovations in the upholstery plant. So, it enjoys a larger production capacity to meet the evolving market needs and preferences. It appears timely, given the upsurge in home furnishing demand.

Operating Revenue (MarketWatch)

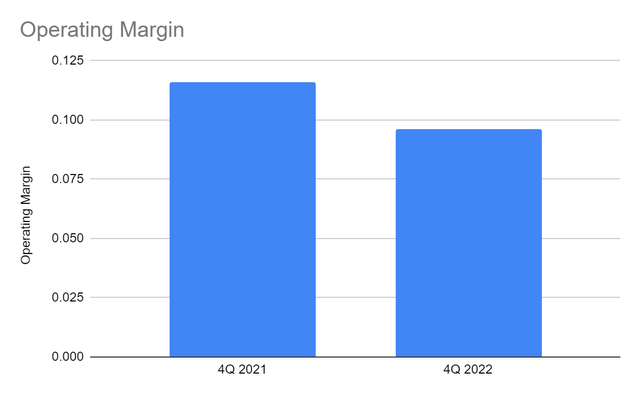

La-Z-Boy innovates and expands to stimulate efficiency and fortify its manufacturing footprint. It is also a strategic move to stabilize its operations amidst external pressures. As such, it remains unperturbed as the globe transitions to a post-pandemic environment. It also helps keep its costs and expenses manageable. Its new infrastructure may improve its distribution streams for a more efficient supply chain. It may also allow it to enhance its asset management and keep up with backlogs. Its enhanced production and distribution facilities may lead to economies of scale. It can also be seen in its operating margin of 0.116 vs 0.096 in 4Q 2021.

Operating Margin (MarketWatch)

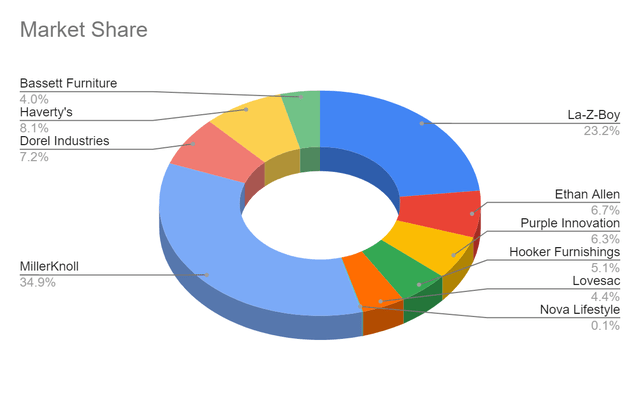

If we will compare LZB to its close peers, we can see that it remains true to its words. It remains one of the largest providers of home furniture, such as recliners and sofas. It holds a market share of 23.2% vs 23%, showing that it maintains its strong market positioning. Also, its revenue growth is higher than the market average of 20%. But, it may have to work harder, given the rise in e-commerce and direct-to-consumer. The competition gets tighter in the presence of Amazon (AMZN) and Wayfair (W). Even so, it may also be an opportunity for the company to expand its niches. It may be possible as it builds infrastructure to improve its distribution streams. But of course, it may take more time and effort. Also, the company remains dedicated to improving its retail segment and direct-to-consumer segment. In fact, Joybird shows a massive increase from the comparative time series. It may still be at a disadvantage when compared to Amazon and Wayfair. But, it has a potential for sustained expansion.

External Pressures

The housing market has spillovers to discretionary spending. As more houses are purchased and occupied, home furnishings become more of a staple. Yet, the recent trend in the housing market is disappointing. House prices have skyrocketed in the last two years due to the drop in interest and mortgage rates. Today, the median price of houses in the US has already exceeded $400,000. Macroeconomic pressures start to intensify as inflation remains above 8%. In turn, interest and mortgage rate hikes may follow. It is no wonder that the demand for houses is starting to falter. It is another concern that may affect the demand for home furniture.

But, we also have to consider the rising prices of materials and labor to build houses. Right now, the US is in shortage of over five million houses, which may take many years to fill the gap. That is why the housing market remains a staple for millions of Americans. Also, a portion of its demand is shifting to renting new and old houses. Rental rates are also on the rise, but they are starting to cool down. The average increase in 2022 vs 2020 and 2021 decreases from 18-24% to 14-18%. Amidst the housing shortage, rent remains a cheaper alternative for now. Either way, home furnishings will remain a staple for many new homeowners and renters.

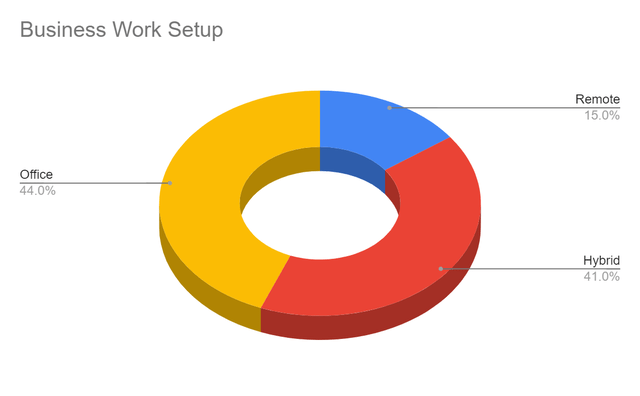

Moreover, its products may have more demand as more employees choose remote work setups. Currently, 44% of companies still do not permit remote work setups. But, it is evident that the business world evolves. A recent survey conveys that over 20% of employees would quit if forced to return to the office. The percentage appears to increase further to 33% and even higher at 50%. Over 70% of employers intend to increase their spending to sustain remote and hybrid work setups. These include virtual communication tools and comfortable seats and tables for employees. With more people staying and working at home, recliners and sofas may remain popular.

Business Work Setup (Apollo Technical)

The Solid Financial Position of La-Z-Boy Incorporated

La-Z-Boy Incorporated continues to show robust performance even in a volatile market landscape. It has a tight grip on the market with its impressive revenue growth and market share. Also, it expands and innovates to sustain its performance and enhance efficiency. Today, there are noticeable risks and opportunities in the market. Some of them are already in the previous section. What is more important is how the company can sustain its growth. It is shown by its solid Balance Sheet.

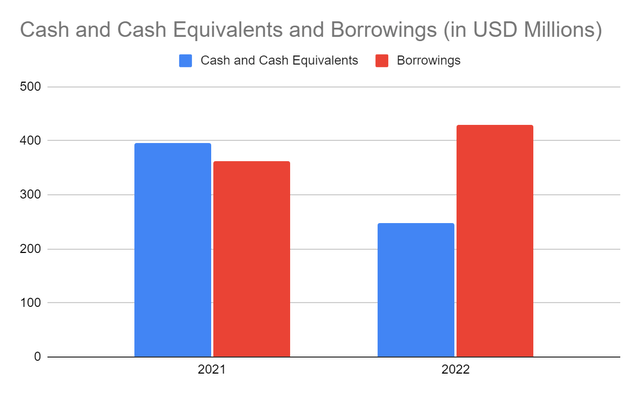

Cash and cash equivalents are lower at $248 million vs $395 million. Borrowings are higher now at $430 million vs $362 million. Yet, it is in line with the continued expansion and innovation of the company. It also invests in more infrastructure for better distribution and manufacturing streams. The increased capacity can also be seen in the higher value of inventories and PPE. Its current ratio remains reasonable at 1.41%, showing that it can cover its current liabilities. Likewise, its Net Debt/EBITDA of 0.95x proves it can cover its borrowings. It means that the company generates reasonable income for its increased financial leverage. It is way lower than the maximum ratio of 3-4x.

Cash and Cash Equivalents and Borrowings (MarketWatch)

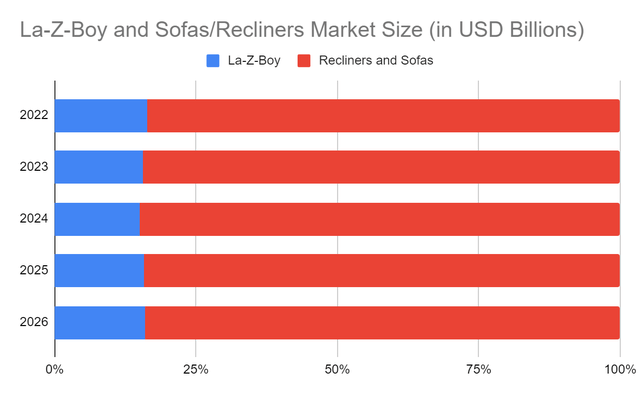

Moreover, its efforts are paying off, given its increased ROA from 2% to 2.9%. It earns more as it expands its operations amidst inflationary pressures. As such, the company is viable to sustain its current size and potential expansion. Borrowings and dividends are still well-covered. It has a high capacity to maintain its strong market positioning. Note that the market offers more opportunities despite economic uncertainty. In fact, the global furniture market and recliner and sofas market may increase by 5.6% and 9.3% on average.

La-Z-Boy and Home Furniture Sofas and Recliners Market Size (PR Newswire and Author Estimation)

Stock Price Assessment

The stock price of La-Z-Boy Incorporation has been in a downtrend for more than a year now. At $24.58, it has already been cut by 32% from the starting price. The decrease highlights the undervaluation further. Even in my previous article, I recommended it as a buy. Today, it is already discounted by 46%, making it cheaper.

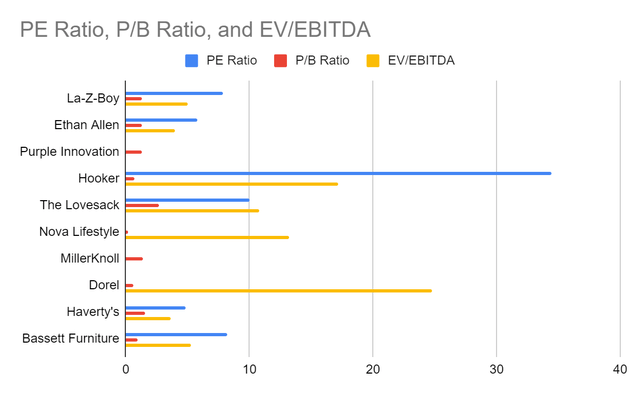

The stock is trading at a 7-8x earnings multiple, which is better than Bassett (BSET) and Hooker (HOFT). It is also one of the best when it comes to EV/EBITDA Ratio with a multiple of 5x. With regards to its book value, the P/B Ratio is quite high at 1.29. But, it is far better than in the comparative period with 1.43. It also suggests the continued improvement in its fundamentals as it expands.

PE Ratio, PB Ratio, and EV/EBITDA (Seeking Alpha)

Also, the company remains consistent with its dividend payments. The dividend yield of 2.85% is within the market average. We may assess the stock price using the DCF Model and the Dividend Discount Model.

DCF Model

FCFF $204,200,000

Cash and Cash Equivalents $248,800,000

Borrowings $430,100,000

Perpetual Growth Rate 4.2%

WACC 8.8%

Common Shares Outstanding 43,093,500

Stock Price $24.65

Derived Value $51.16

Dividend Discount Model

Stock Price $24.65

Average Dividend Growth 0.09433043147

Estimated Dividends Per Share $0.66

Cost of Capital Equity 0.1098052793

Derived Value $46.67303296 or $46.67

Both models affirm the supposition that the stock price is undervalued. It appears very cheap, which may offer more opportunities for higher gains. For the next 12-24 months there may be a 47-52% upside.

Bottom line

La-Z-Boy Incorporated has a robust performance with increased revenues and margins. It is very liquid, allowing it to sustain its operations and cover its payables. Yet, the stock price moves in the opposite direction. It is an excellent bargain with modest dividend payments. The recommendation is that La-Z-Boy Incorporated is a buy.

Be the first to comment