Valery Yurasov/iStock via Getty Images

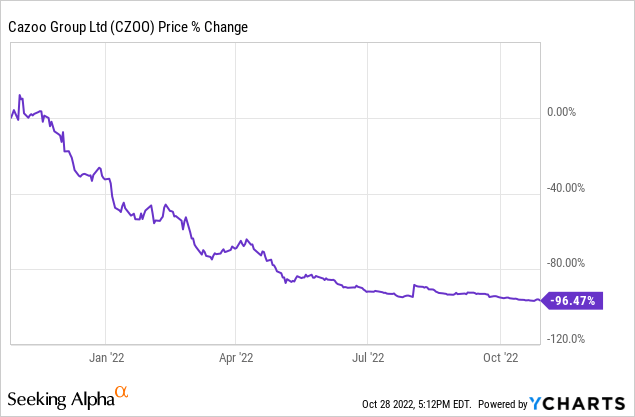

Shares in Cazoo (NYSE:CZOO) have fallen more than a whopping 95% in the last year. Cazoo is high-growth company and current valuation is really cheap. But the problem is, there are a lot of risks involved in investing in Cazoo, and there’s a real chance the company could go bankrupt. I’d like to introduce you to the risks and opportunities associated with that investment so that you can evaluate for yourself if Cazoo is worth investing.

What Is Cazoo?

Cazoo’s mission is “We want to make buying your next car no different to ordering any other product today.” The company was founded in 2018 by Alex Chesterman, who is CEO and owns 23.37% of the entire company. Cazoo buys used cars, then has them repaired, and then sells them at a higher price than they bought them for. So Cazoo simply sells used cars. That’s how the company makes its money.

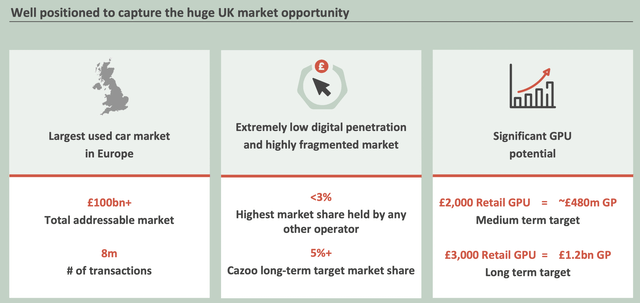

The company initially operated only in the UK, then grew to Italy and Spain, but recently Cazoo announced that it was leaving all operations in Europe and would now focus only on the UK, where it was most profitable for them. This is, in my opinion, a smart move on the part of the management of the company. The company estimates that the total addressable market is over £100 billion in the UK. The long-term target market share company is over 5%. The market opportunity in used cars, it’s really huge.

You can see that customers really like Cazoo, as the company has over 28,000 reviews on Trustpilot and has 4.7/5 stars.

TAM Cazoo (Cazoo Investor Presentation)

Why Is The Stock Down Over 95% In The Past Year?

There are several reasons why there has been such a big drop in CZOO’s share price over the last year. The first, of course, is high inflation in the UK. But the reason high inflation is so bad for Cazoo is that CZOO has really low margins.

Interest rates are also rising with high inflation, which is also not good. In fact, Cazoo is losing money, and it is estimated that this will be the case until 2025. Investors have been keen to sell fast-growing and high-loss companies over the last year. Cazoo belongs to exactly that category.

The war in Ukraine caused the company’s shares to plummet even further as the price of oil went up and with it the price of fuel. People, therefore, drive fewer cars because it is more expensive. That’s definitely not good news for CZOO. Overall, the current macroeconomic situation in the UK is certainly not at all favorable to a company like Cazoo. These are the main reasons why Cazoo’s stock has fallen so much in the last year.

The Growth Of Cazoo

Since its inception, Cazoo has grown sales by hundreds of percent. It is estimated that such rapid growth will continue in the future. Now, I’d like to introduce you to a few of the strategies that CZOO will use for further growth.

The first is definitely to continue to increase brand awareness in the UK. The company currently estimates that it has brand awareness in the UK at over 80%. When new customer thinks about buying a car, they can think of Cazoo selling used but quality cars. Increasing brand awareness is definitely a smart step for further growth.

Increasing the number of CZOO in-house reconditioning capacities is another growth strategy. The company can currently repair over 120,000 cars a year from the current eight locations. If they increase the number of these locations, it will definitely contribute to the further growth of the company.

Cazoo, of course, wants to continue to increase the number of retail units sold. This will be done primarily by advertising. For greater profitability of the company, it will be important to increase Gross Profit per Unit (GPU). This will be achieved primarily through more car purchases, direct from consumers, and more efficient car repair. These are some of the strategies that Cazoo will use for further growth and in 2022 it is estimated that CZOO will grow sales by 92%.

Q3 2022 Financials

Now let’s take a look at the Q3 2022 financials of the company. Cazoo had sales of £347 million this quarter, an increase of 103% YoY. That’s a very fast growth in sales. The company sold 23,775 cars in the UK for this quarter, an increase of 82% YoY. The Retail GPU was £488 this quarter, that’s down £313 in the same quarter the previous year, as the company’s retail GPU was £801 in Q3 2021. This decline in GPU YoY is definitely not good news. The UK Gross Profit of the company was £10 million. This is a decrease of £1 million from last year.

But the biggest disappointment for me personally was the UK Gross Margin. This was only 3%, which is 3.7% lower than in the same quarter the previous year. The lower Gross Margins compared to last year are mainly due to a rather worse macroeconomic situation. But management said they will now focus much more on higher profitability.

The company currently has a strong cash position of £308 million and a self-funded inventory of over £150 million. According to guidance for Q4 2022, management expects the retail unit sales growth rate to be over 100%. Management also expects a significant improvement in the UK Retail GPU and continues to expect the company to be cash flow positive before it would need additional external capital. That’s positive news.

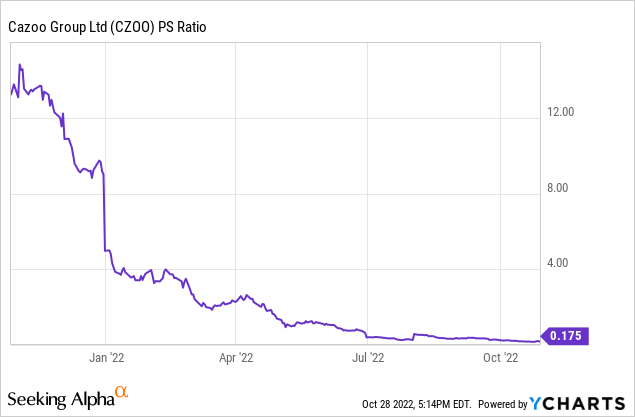

Valuation Of Cazoo

CZOO’s current valuation is cheap. The company trades at Price/Sales of 0.17x. Price/Sales was much higher a year ago. Here you can see that a lot can change in the market in one year. This should be borne in mind for any investment. Price/Book of the company is currently only 0.43x.

That’s really low, and the company is now trading at less value than it now holds in cash. Forward Price/Sales of CZOO, is only 0.15x. The company could become profitable sometime around the turn of 2025/2026, according to analyst estimates. Whether Cazoo will really become profitable only time will tell, and right now no one knows for sure, because there is a real risk that the company will go bankrupt by then if it fails to become profitable.

Risks

Cazoo has a lot of risks, the main ones I’d like to introduce to you now. The first risk CZOO currently has is that the company has very low margins. While management is working on the problem, it is certainly not ideal at all, especially with the current record-high inflation in the UK. Therefore, the fact that the company’s margins are increasing needs to be monitored.

The second risk for CZOO is the current poor macroeconomic situation. In the current situation, people can wait to buy a car until the macroeconomic situation improves and there is less uncertainty everywhere. That’s definitely not good news for a company that sells used cars like Cazoo. Competition is also a risk that investors should definitely not overlook.

And perhaps the biggest risk the company has right now is its unprofitability. This is definitely not good in the current macroeconomic environment. Analysts estimate that the company will not be profitable for at least three years. While the management of the company says that Cazoo is doing well with the current cash position and that it won’t need any more external funding, it’s certainly not something I’m that confident about. These are the 4 main risks that Cazoo has right now, and investors need to remember that there is a real risk that the company will go bankrupt.

Conclusion

Cazoo is a fast-growing, founder-led business. The company’s current valuation is cheap, but there are plenty of risks investors should keep in mind. The main ones are the current poor macroeconomic situation and the company’s unprofitability. With Cazoo, there is a real risk that it may go bankrupt. This is something that I think investors should bear in mind. The returns however from this price could be in the hundreds of percent. Overall, I think Cazoo offers high risk and also high reward, but I certainly wouldn’t recommend investors have CZOO as some kind of bigger portfolio position.

Be the first to comment