CT757fan/E+ via Getty Images

Introduction

L3Harris Technologies (NYSE:LHX) just reported its earnings. Besides that, this gives us a good look into current operations, it’s a source of information regarding a wide range of topics like the defense budget, the war in Ukraine, and the company’s struggles with supply-chain-related headwinds. As L3Harris is one of my largest dividend growth investments, we’re going beyond the earnings to once again establish the case for L3Harris as a long-term dividend growth stock. I believe the company is significantly undervalued and offers opportunities for a wide range of dividend (growth) investors thanks to its yield, dividend growth potential, and a lot of other factors that will be discussed in this article.

So, let’s get to it!

A Well-Diversified Defense Giant

I’m painting with a broad brush here, but I believe that L3Harris is one of the best ways to buy defense exposure thanks to its diversified exposure. For example, while Lockheed Martin (LMT) is highly dependent on the F-35 program, L3Harris does not have any major projects.

The company has three business segments:

- Integrated Mission Systems

[…] including multi-mission intelligence, surveillance and reconnaissance (“ISR”) and communication systems; integrated electrical and electronic systems for maritime platforms; and advanced electro-optical and infrared (“EO/IR”) solutions.

[…] including space payloads, sensors and full-mission solutions; classified intelligence and cyber defense; avionics; and electronic warfare.

[…] including tactical communications; broadband communications; integrated vision solutions; and public safety radios; global communications solutions.

Moreover, this year, it went from four to three business segments, which means the company also still includes commercial aviation products, commercial pilot training equipment, and mission networks for air traffic management. These were formerly part of its Aviation Systems segment.

Adding to that, and this is important if you’re new to L3Harris, the reason I’m not backtesting the stock in this article or showing you financial data prior to 2019 is that L3Harris is the result of a 2019 merger between L3 and Harris.

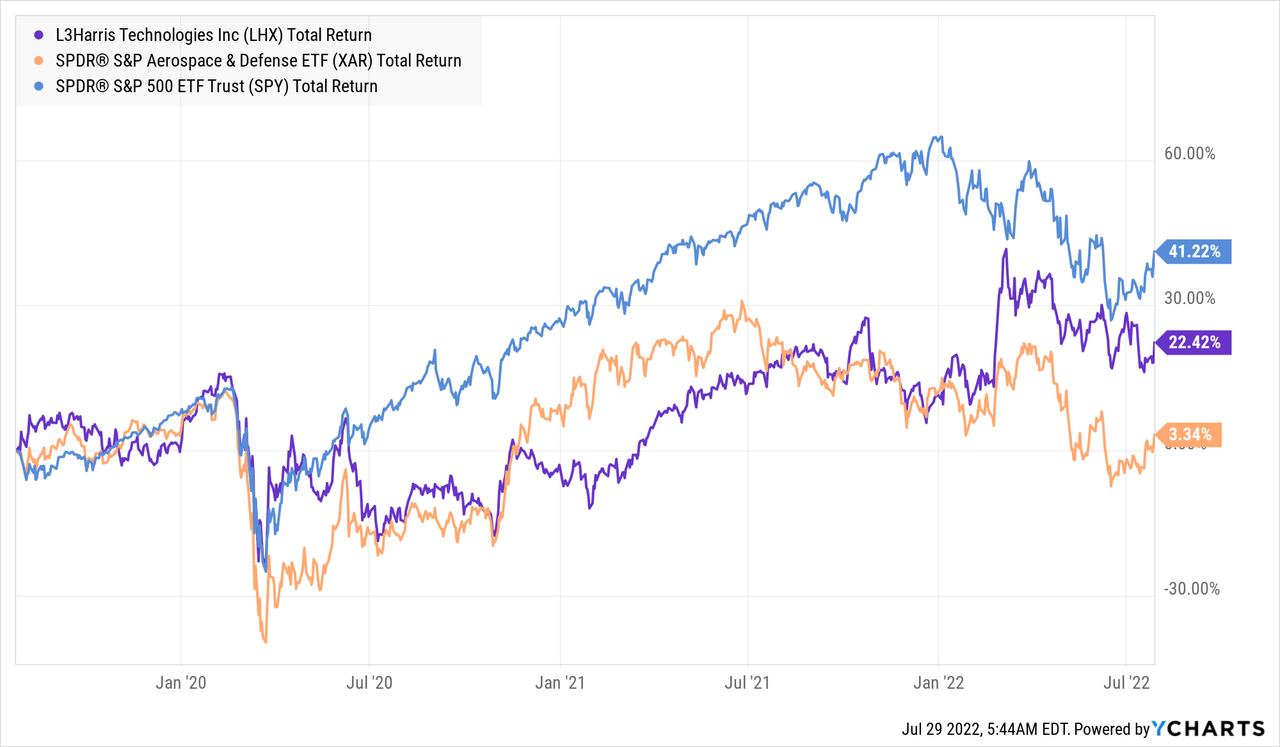

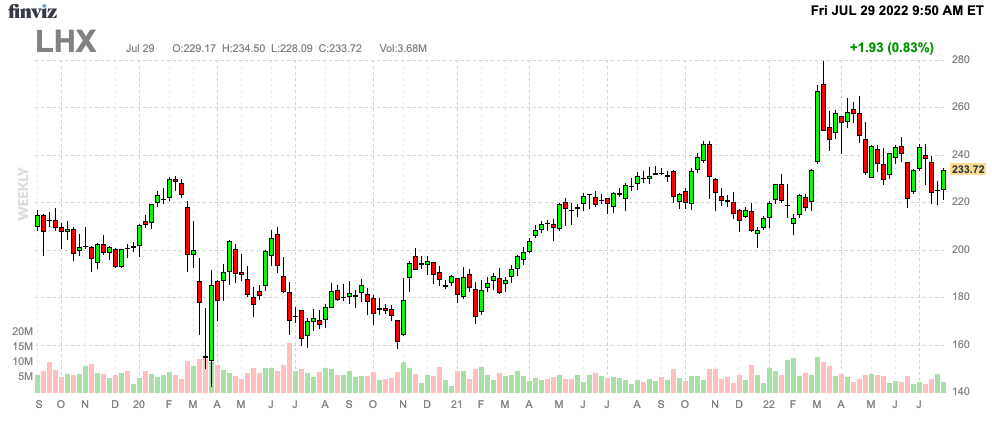

Over the past three years, L3Harris has returned 22.4%. This lags the S&P 500 by almost 20 points – despite outperformance since early 2022 – but it beats the SPDR S&P Aerospace & Defense ETF (XAR). The single biggest reason for underperformance is the pandemic. It took LHX more than a year to get back to pre-pandemic levels as the market focused on tech and growth stocks, which meant that everything related to aerospace was left behind. Then, in 2021, supply chain issues became worse, which impacts L3Harris and its peers.

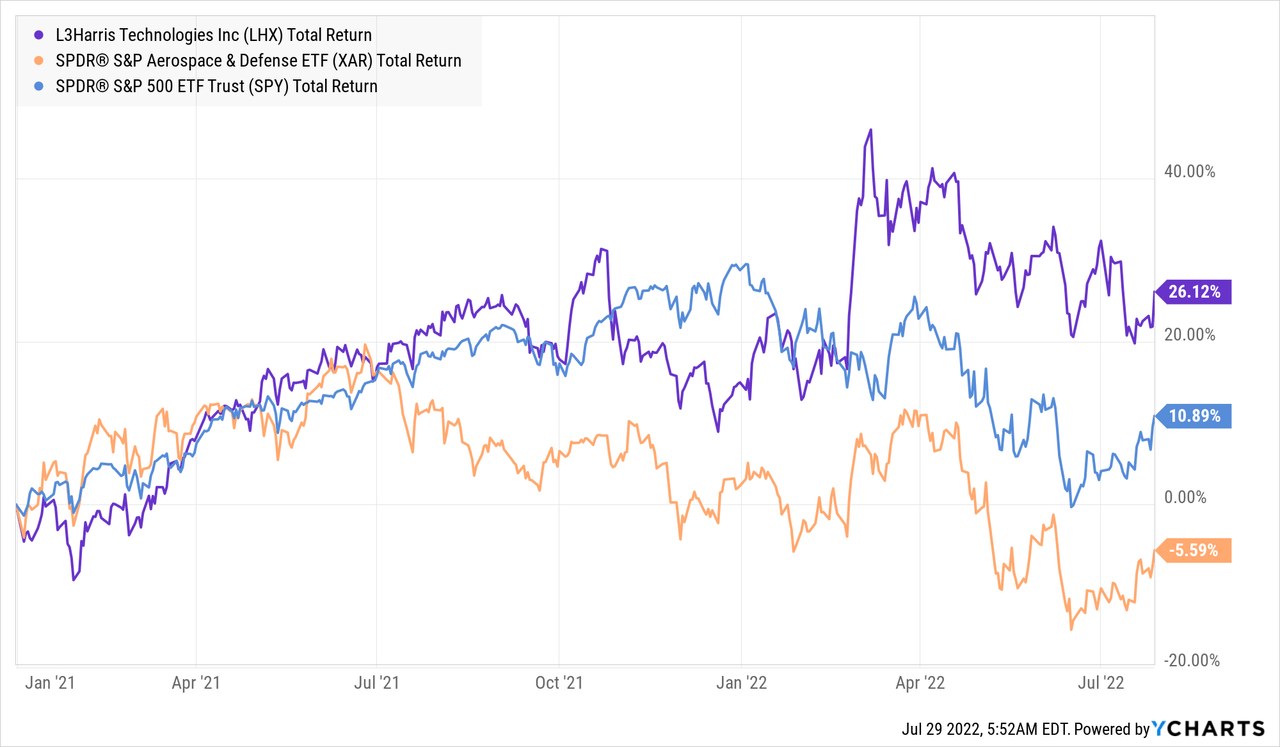

If we go back to January of 2021, LHX has returned 26%. This beats the S&P 500 by 16 points for two reasons. First, this period saw the return of “value” stocks. That was prior to the war, which is reason number two. Although most defense companies have erased the gains that were made when Russia invaded Ukraine, LHX is still up from these levels for reasons I will discuss in this article.

But first, let’s take a look at the dividend.

The LHX Dividend

L3Harris investors currently receive $1.12 per share per quarter. The next payment is on September 16, for shareholders of record on September 2.

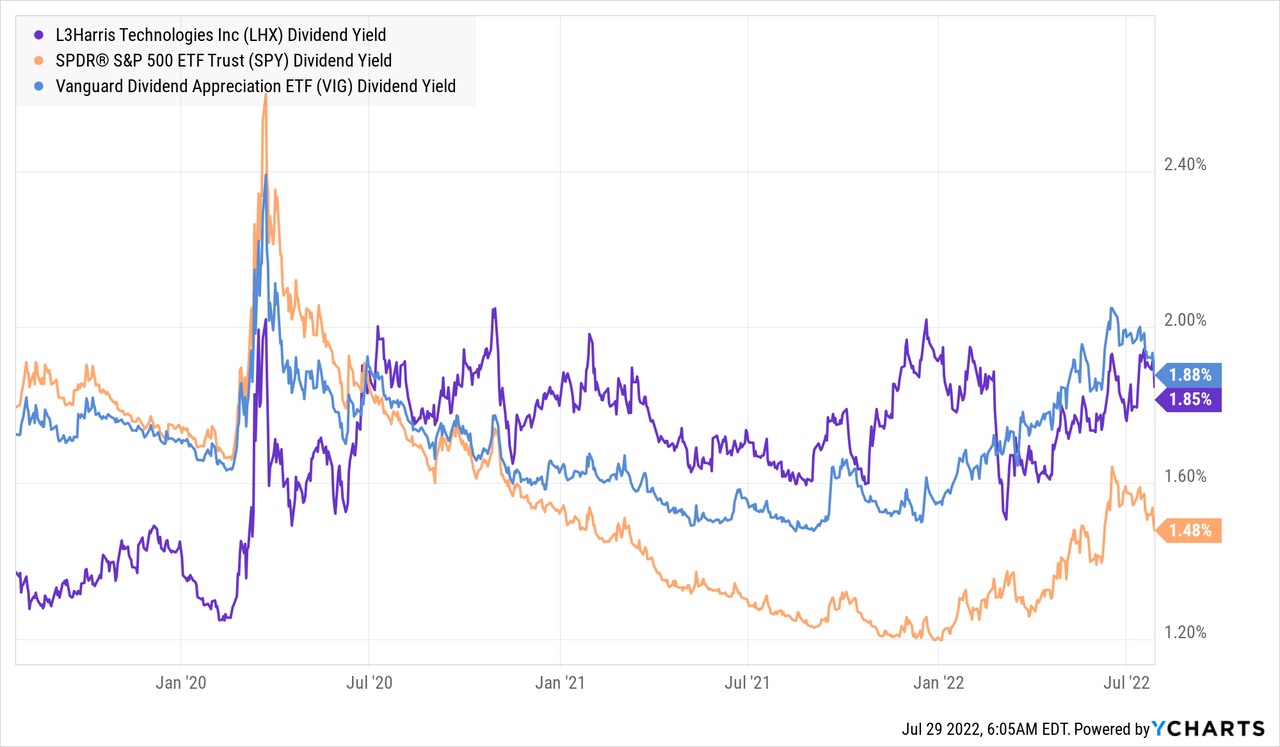

$1.12 is $4.48 per year. That’s 1.9% of the company’s stock price.

This yield is in line with the Vanguard Dividend Appreciation ETF (VIG) yield and roughly 40 basis points above the S&P 500 yield.

In other words, the only group of investors that are excluded right off the bet is investors who require a high and steady stream of income from their dividends right now.

Dividend growth investors and even investors 10 years ahead of their planned retirement are in a very good place.

With a yield below 2%, the focus needs to be on dividend growth. Otherwise, one may as well buy a high-yield stock.

In the case of LHX, we don’t have a long history of dividend growth (2019 merger), but that’s OK as there’s plenty of data to use for a strong dividend growth case.

First of all, these are the most “recent” dividend hikes:

- February 2022: 9.8%

- February 2021: 20.0%

- February 2020: 13.3%

Not bad, right?

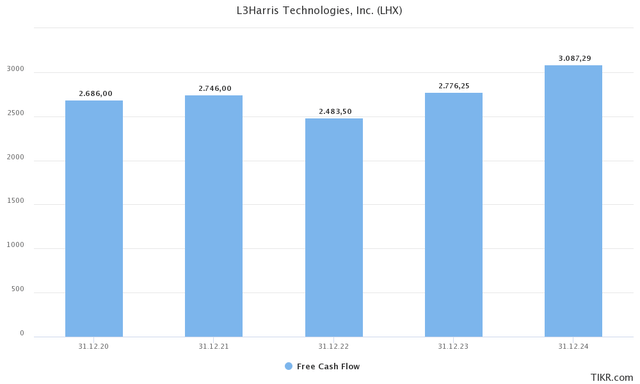

While it’s hard to predict future dividend growth rates, LHX is in a fantastic place to maintain high dividend growth for one major reason: it generates a lot of cash.

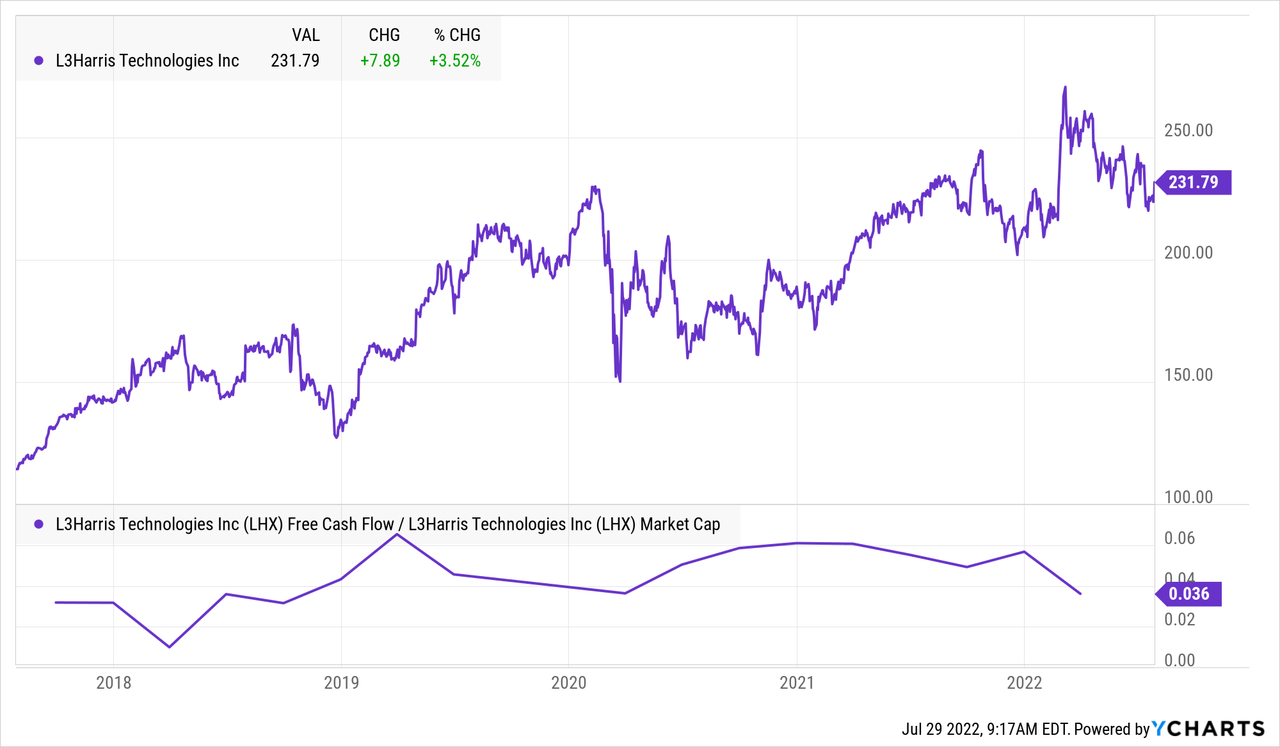

While free cash flow growth between 2020-2024E is just 2.7%, we’re dealing with an implied 2023 free cash flow yield of 6.0%, which is based on the company’s $46.3 billion market cap.

Note that free cash flow is cash a company can spend without having to fear that it hurts its business – if the balance sheet is healthy. It is net income adjusted for non-cash operating items and capital expenditures.

An (implied) 6.0% FCF yield means that the company can return roughly 6% of its market cap to shareholders per year – and more if FCF keeps growing.

This means that its 1.9% yield is safe and enjoys a lot of upside potential. The same goes for buybacks.

Between 2020 and 2Q22, the company has reduced its shares outstanding from 216 million to 194 million. That’s a decline of 10% helping to improve the value per outstanding share.

Net debt is expected to remain at roughly $6.0 billion in the years ahead. That’s less than 1.5x EBITDA meaning the company can distribute free cash flow to shareholders, directly via dividends and indirectly using buybacks.

Now, in order to explain why I believe that free cash flow can grow faster than 2.7% in the years ahead, let us use the just-released quarterly numbers, which included a lot of data and comments.

L3Harris’ Fantastic Numbers & Comments Support The Bull Case

In its 2Q22 quarter, LHX did $4.13 billion in revenues. That’s 12.1% below the prior-year level and $100 million less than expected.

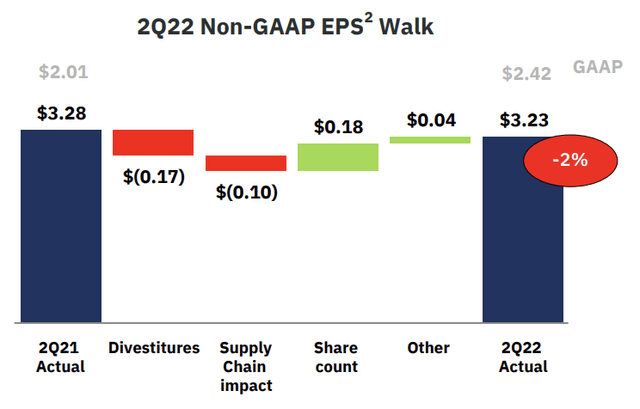

Non-GAAP EPS came in at $3.23, which is $0.05 higher than expected. That’s a decline of 2%.

In this case, the revenue decline is nothing to worry about. Defense companies are often dependent on the timing of new contracts. In this case, the company also mentioned supply chain headwinds as organic revenue declined by 6% (adjusted for acquisitions/divestitures).

As the bridge below shows, organic EPS would be up if it weren’t for divestitures. The same goes for GAAP EPS. The impact of supply chains was $0.10, which was more than offset by share buybacks.

The company mainly suffered from supply chain problems in its Communication Systems segment. The impact was $60 million and in line with management expectations. The company is in a good position to mitigate certain supply chain risks and it expects disruptions to persist as the supply chain environment remains “fluid”. This is incorporated in the company’s guidance.

L3Harris is working closely together with suppliers, which will help the company to mitigate long-term risk, in my opinion.

Moreover, I believe that economic weakness is a good thing for L3Harris. Don’t get me wrong, I’m not rooting for a recession, but if it were to happen, it could ease supply chain and inflation problems without hurting L3Harris’ sales as the company has close to zero commercial aviation exposure.

Supply chain problems are known to cause inflation as it reduces supply. L3Harris was able to mitigate most supply-chain-related inflation problems by focusing on operational improvements.

In addition, for the full year, and consistent with initial guidance, L3Harris expects impacts to be mitigated by continued productivity improvements. Over the medium term, with a balanced portfolio of fixed-price and cost-reimbursable contracts along with a relatively short duration of approximately one year, on average, for its backlog, the company is positioned to further offset potential impacts.

Note that roughly a quarter of total contracts are cost-reimbursable.

Now, onto demand.

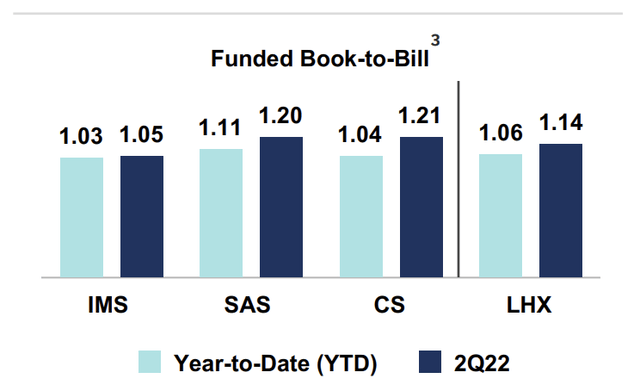

L3Harris receives orders faster than it can turn backlog into revenues. The (fully funded) book-to-bill ratio came in at 1.14, bringing to YTD number to 1.06. Orders include $250 million for F-35-related products, $700 million for satellite systems, and $300 million for tactical radios. That’s just three things out of a really long list.

A strong order flow is expected to continue. The Department of Defense budget for Government Fiscal Year (“GFY”) 2022 is 6% higher and there’s notable funding support for Ukraine and higher spending plans for GFY2023.

A total of $55 billion in aid has been approved so far. Half of it is defense-related, which benefits LHX due to products like night vision goggles, intelligence, surveillance, and related products.

Moreover, and with regard to the GFY2023 defense budget:

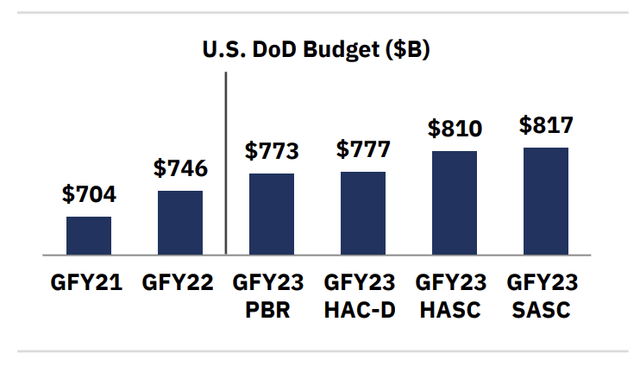

Following the U.S. President’s Budget Request (“PBR”) of $773 billion for the DoD in GFY23, representing a 4% increase year-over-year, the congressional mark-up process has advanced. Both the U.S. Senate Armed Services Committee (“SASC”) and House Armed Services Committee (“HASC”) proposed additional spending of $45 billion and $37 billion, respectively.

Estimates are that the GFY23 budget could be $817 billion if the SASC gets what it wants. That would be up 9.5% versus this year.

Moreover, NATO ex US is expected to run on a $368 billion budget this year. That’s 40 basis points below the 2% GDP target, which means there’s room for an additional $80 billion. This isn’t just a calculation, but it’s also based on NATO’s Stoltenberg who wants to make 2% spending a minimum:

“Two percent is increasingly considered a floor, not the ceiling,” he said.

With regard to capital deployment, $217 million in dividends was paid. LHX bought back $421 million worth of shares. It now has $1.8 billion left under an already authorized buyback program.

L3Harris also sold two small business entities from its IMS segment for $20 million and bought a 7% ($11 million) stake in Mynaric, its preferred provider of laser communications.

So, what about the valuation?

Valuation

LHX has a $46.3 billion market cap, $6.0 billion in expected longer-term net debt, $520 million in pension-related liabilities, and $100 million in minority interest. This pushes the enterprise value up to $52.9 billion.

That’s 13.2x expected EBITDA of $4.0 billion,

I believe that this is a very decent valuation. The same goes for the implied free cash flow yield of 6.0%, which is roughly the higher bound of the post-merger range.

Moreover, I believe the company can accelerate EBITDA once supply chain problems fade. In 2020 and 2021, the company had EBITDA margins of 23.7% and 24.5%, respectively. In 2022, 2023, and 2024, EBITDA margins are not expected to exceed 21.6%.

Without growing sales, a return to 24% in EBITDA margins would result in $4.5 billion in EBITDA (and an implied free cash flow yield of 10%) after 2023. It’s a wild card, but I believe this is something to keep in mind.

Takeaway

L3Harris continues to be one of my all-time favorite dividend stocks. The company has a well-diversified business portfolio, relationships will all major western defense companies, and the ability to withstand inflationary and supply chain pressures.

The dividend yield is close to 2% while dividend growth is expected to remain high due to very high free cash flow and an expected rebound in growth as the company benefits from higher orders related to improving defense spending in the US and other NATO countries.

The valuation is very attractive and I have little doubt that the company will outperform the market on a long-term basis.

FINVIZ

In other words, this is a great dividend stock for everyone who isn’t dependent on high income from investments. Moreover, I believe it deserves the “sleep well at night” stamp as well.

(Dis)agree? Let me know in the comments!

Be the first to comment