Scharfsinn86

Intro

We wrote about FutureFuel Corp. (NYSE:FF) in September of last year when we stated that stock was very close to bottoming out. One of the reasons behind our bullish pretense was the fact that management had the conviction to pay out a special dividend of $2.50 per share in June of last year when the company had lost close to half of its market cap since the turn of the year. Suffice it to say, this dividend at the time made up over a third of the prevailing share price, so investors who were able to buy shares before the stock went ex-dividend essentially got close to a 35% discount on their investment. Furthermore, despite the volatility in recent times, FF has continued to distribute the quarterly dividend of $0.06 per share, which means the regular dividend currently yields approximately 3.32%.

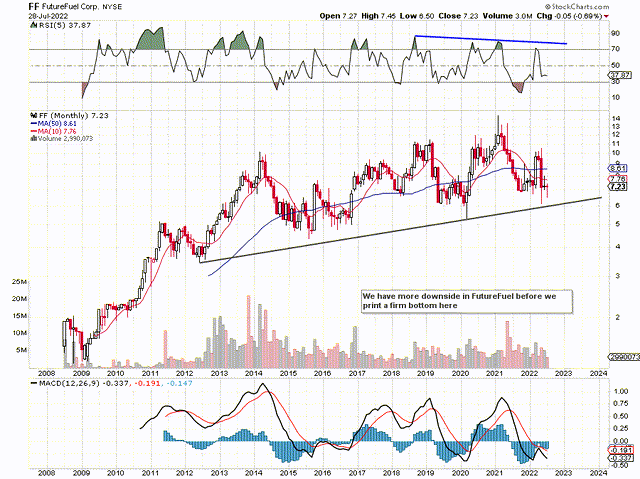

Long-term investors will know all too well that having sound management who really looks out for shareholders is an excellent place to start with a long-term investment. Furthermore, companies with strong balance sheets, keen valuations, and sustained profitability are what we look for in our value plays. In saying this, as we can see from FutureFuel’s technical chart below, investors need to be prepared for a drop to roughly the $6 level (Long-term support) before we see a sustained bottom in this stock. Bearish divergences are presenting themselves in the long-term RSI momentum indicator and shares from a profitability standpoint in fact are not all that cheap (GAAP earnings multiple of 13.98).

FutureFuel Technical Chart (Stockcharts.com)

Margin Headwinds

In fact, FutureFuel’s profitability is the real issue here, and until the market sees a clear line of sight to sustained earnings growth, shares may hover around the depicted support area for some time to come. We state this because of how FutureFuel’s income statement has changed in recent times. Suffice it to say, it is all about gross margin as this key metric (which usually designates whether the company in question has a sound moat) comes in for extra scrutiny among analysts in inflationary times. This stands to reason gross margin incorporates everything on the front end to prepare the product for sale from raw materials (Feedstock price increases) to delivery expenses to packaging-related costs, etc.

FutureFuel’s gross margin over the past four quarters comes in at 8.42% which is well behind its 5-year average of almost 20%. Costs are practically all on the front-end in FutureFuel as its trailing net profit margin presently comes in at roughly 7%. To give you an idea of how FutureFuel’s much lower gross margin is affecting its income statement, ponder the following. For every $1 in revenues, FutureFuel generates, the company makes $0.085 when we take the costs of goods sold out of the equation. Now with inflation continuing at double digital percentages at present, let’s take a conservative estimate and say that FutureFuel’s cost of goods sold will increase by only 4% over the next 12 months.

This means its present costs of $0.915 will increase to over $0.95 ($0.035 increase). Although a 4% spike in the cost of goods sold may not look like much on the surface, those $0.035 of extra costs (All things remaining equal) would potentially cut the company’s net profit from its present $0.07 to $0.035 further down the income statement. This would be a 50% drop in bottom-line (What the market is really focused on) earnings which is substantial, to say the least.

There are a few concepts to be understood from the above example. For one, companies that report higher gross margins are obviously ahead of the eight ball as their costs of goods sold make up a smaller percentage of their top-line sales. This means the impact of inflation on their costs is lower and doubly so if their net profit margins are in solid double-digit territory. Margin protection is crucial in inflationary environments, especially if the possibility of passing on price increases on the back-end to customers is not forthcoming.

Conclusion

Therefore, to sum up, this is the predicament FutureFuel is in at present, which is why we do not want to see any more erosion of that crucial gross margin metric. Let’s see what the second quarter brings. We look forward to continued coverage.

Be the first to comment