genkur

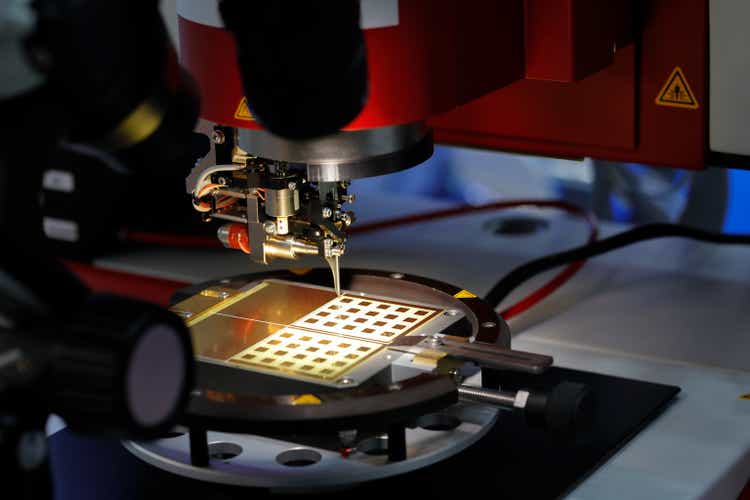

There are still a few weeks left, but Kulicke and Soffa Industries (NASDAQ:KLIC) should be satisfied with how things have gone in the fourth quarter given the circumstances. KLIC issued guidance that was much worse than expected, which would likely have resulted in a selloff under different circumstances. Yet, the stock has rallied in what has also been a difficult year, allowing KLIC to narrow its losses for the year. However, there is reason to believe the rally may have run its course and the stock could change course once more. Why will be covered next.

A wall stands in the way

It has not been easy this year for KLIC, a supplier of equipment and other solutions for the semiconductor and LED markets. The stock headed into the fourth quarter of 2022 having lost 37% of its value for the year. However, the stock has since rallied with a gain of 23%, narrowing losses for the year to 20% YTD. In comparison, the iShares PHLX Semiconductor ETF (SOXX) has lost 30% YTD. The chart below shows how the stock is looking to end a difficult 2022 on a strong note.

However, the stock appears to be having problems moving higher. If the recent highs are connected, an upper trendline appears as shown above. The stock is unable to get past this trendline, which indicates the presence of resistance. Resistance can be breached, but the fact that the stock has spent weeks trying and coming up short suggests at the very least it won’t come easy.

It’s also worth noting how the stock has moved lower and lower over time, even though the rate of decline has slowed down from where it was earlier in the year. A lower trendline can be formed by connecting the recent lows, which runs parallel to the aforementioned upper trendline. The stock has moved within the channel bounded by these two trendlines and with the highs and the lows going down, so too is the stock. The trend appears to be down.

The shorts expect lower prices and they have their reasons

The stock has gained ground in the fourth quarter, but the shorts seem to believe these gains won’t prove to be sustainable. Short interest has been going up along with the stock in Q4. Short interest stood at 6.74M shares at the start of Q4, but it has since risen to 7.57M shares according to the latest data, which translates to a short float of 13.7%. It’s also not far away from the 7.93M shares at the start of 2022.

This suggests the shorts are confident the stock has further to fall before the bottom is in. If the shorts think there are lower prices ahead, then the most recent earnings report from KLIC has likely strengthened their conviction, which could explain why short interest went up after the release of the report. While there were gains to be found in the last earnings report to be released in 2022, they were offset by setbacks elsewhere.

For instance, FY2022 GAAP EPS increased by 22.7% YoY to $7.09 and non-GAAP EPS increased by 21.4% YoY to $7.45. The bottom line increased even though FY2022 revenue declined by 0.9% YoY to $1,503.6M. KLIC finished with cash, cash equivalents and short-term investments of $775.5M on its balance sheet, up $35.7M YoY. The table below shows the numbers for FY2022.

|

(GAAP) |

FY2022 |

FY2021 |

YoY |

|

Revenue |

$1,503.6M |

$1,517.6M |

(0.92%) |

|

Gross margin |

49.8% |

45.9% |

390bps |

|

Operating margin |

31.3% |

27.2% |

410bps |

|

Income from operations |

$470.1M |

$412.4M |

13.99% |

|

Net income |

$433.5M |

$367.2M |

18.06% |

|

EPS |

$7.09 |

$5.78 |

22.66% |

|

(Non-GAAP) |

|||

|

Net income |

$455.6M |

$390.2M |

16.76% |

|

EPS |

$7.45 |

$6.14 |

21.36% |

Source: KLIC Form 10-K

However, while the numbers for the whole year look solid, a closer look at the underlying numbers shows something less encouraging. The year started out well with, for instance, record GAAP EPS of $2.11 in Q1 on revenue of $461M, but the numbers got worse as the quarters went by, especially in the last quarter of FY2022. Q4 revenue declined by 23.1% QoQ and 41% YoY to $286.3M. GAAP EPS declined by 44.7% QoQ and 47.6% YoY to $1.10 and non-GAAP EPS declined by 43.1% QoQ and 45.2% YoY to $1.19. The table below shows how KLIC ended FY2022 on a weak note.

|

(GAAP) |

Q4 FY2022 |

Q3 FY2022 |

Q4 FY2021 |

QoQ |

YoY |

|

Revenue |

$286.313M |

$372.137M |

$485.326M |

(23.1%) |

(41.0%) |

|

Gross margin |

46.3% |

51.2% |

47.7% |

(490bps) |

(140bps) |

|

Operating margin |

23.6% |

32.8% |

31.9% |

(920bps) |

(830bps) |

|

Income from operations |

$67.544M |

$122.077M |

$154.836M |

(44.7%) |

(56.4%) |

|

Net income |

$64.904M |

$119.034M |

$133.711M |

(45.5%) |

(51.5%) |

|

EPS |

$1.10 |

$1.99 |

$2.10 |

(44.7%) |

(47.6%) |

|

(Non-GAAP) |

|||||

|

Operating margin |

25.7% |

34.7% |

33.0% |

(900bps) |

(730bps) |

|

Income from operations |

$73.569M |

$128.997M |

$160.198M |

(42.9%) |

(54.1%) |

|

Net income |

$70.240M |

$125.089M |

$138.266M |

(43.9%) |

(49.2%) |

|

EPS |

$1.19 |

$2.09 |

$2.17 |

(43.1%) |

(45.2%) |

Source: KLIC

The top and the bottom line shrank in the latest quarterly report and this process is expected to accelerate in the following quarter. Guidance calls for Q1 FY2023 revenue of $155-195M, a decline of 62% YoY at the midpoint. The forecast expects non-GAAP EPS of $0.20, plus or minus 10%, a decline of 90.9% YoY at the midpoint.

Guidance was worse than expected. Consensus estimates expected revenue of $244M and non-GAAP EPS of $0.81 in the next earnings report. As a consequence, earnings expectations were revised downwards. Consensus estimates now project FY2023 non-GAAP EPS of $1.54-2.26 on revenue of $700-903M. The former represents a YoY decline of 70.7-79.3% and the latter represents a YoY decline of 39.9-53.4% at the midpoint.

|

(Non-GAAP) |

Q1 FY2023 (guidance) |

Q1 FY2022 |

YoY (midpoint) |

|

Revenue |

$155-195M |

$460.9M |

(62.03%) |

|

EPS |

$0.20, +/- 10% |

$2.19 |

(90.87%) |

Multiples are going higher

The earnings revisions have impacted valuations. Up until fairly recently, KLIC was trading in the low single digits, but the latest numbers from KLIC have caused multiples to jump higher in many instances. For instance, KLIC trades at 31 times forward GAAP earnings with a trailing P/E of 6.8, which shows how much earnings are expected to deteriorate in the next 12 months compared to the previous 12 months. The table below shows some of the multiples KLIC trades at.

|

KLIC |

|

|

Market cap |

$2.75B |

|

Enterprise value |

$2.02B |

|

Revenue (“ttm”) |

$1,503.6M |

|

EBIT |

$491.4M |

|

Trailing GAAP P/E |

6.81 |

|

Forward GAAP P/E |

30.97 |

|

PEG ratio |

0.30 |

|

P/S |

1.93 |

|

P/B |

2.31 |

|

EV/sales |

1.34 |

|

Trailing EV/EBITDA |

4.11 |

|

Forward EV/EBITDA |

14.20 |

Source: Seeking Alpha

A recovery will come, but the question is when

KLIC did attempt to soften the blow from its latest guidance by stating that while market conditions have deteriorated, it also expects demand to improve starting in the second half of FY2023. Management does not believe FY2023 revenue will be any less than that of FY2018, which suggests revenue of no less than $889M. From the Q4 earnings call:

“Over recent months, industry leaders and forecasters lowered WFE and semiconductor unit outlooks due to increased uncertainty related to interest rates, global trade tensions, and ongoing supply chain disruptions, which negatively impact both inventory and demand levels across the general semiconductor, LED and memory end markets.

Considering this dynamic environment, we recently conducted scenario planning across our individual business lines. Based on this detailed feedback, we currently expect fiscal 2023 revenue to meet or exceed our previous cyclical peak revenue in fiscal 2018. This outlook suggests a more typical seasonal pattern through fiscal 2023, with ongoing digestion in the first fiscal half followed by gradual demand improvements in the second fiscal half.”

A transcript of the Q4 FY2022 earnings call can be found here.

However, it’s worth pointing out that there are no guarantees KLIC won’t be forced to lower its outlook. A recovery could take longer to arrive. KLIC is expecting a recovery in the second half of next year, which is in line with what some other companies are expecting in say the memory market, which is currently in a deep slump.

Still, recall that management once predicted at the 2021 Investor Day last year that revenue in FY2022 and FY2023 would be similar to FY2021 at around $1.5B, but the latest outlook has lowered FY2023 revenue to more like around $900M, give or take, which is 40% less than before. KLIC has lowered its outlook before due to changing market conditions, so it can always happen again. So while the prospect of a second half recovery sounds comforting, it’s by no means a sure thing.

Investor takeaways

Part of the reason why I was and remain neutral on KLIC as stated in a previous article, even though it may not have looked warranted with multiples like P/E in the mid single digits, was because of concerns that earnings could deteriorate more than the market was pricing in at that time. The latest guidance and resulting revisions to consensus estimates show that the concerns raised in the article were absolutely warranted. Earnings expectations have gone down and multiples have been adjusted accordingly.

The latest guidance expects non-GAAP EPS of about $0.20 in Q1, a far cry from the $2+ KLIC was earning not that long ago. However, the stock did not sell off as much as one may have expected for a couple of reasons. Management held out the prospect of a recovery that is only a few quarters away, which likely negated the worse-than-expected guidance to a certain extent. A dividend increase and pending acquisitions may also have influenced sentiment.

More importantly, the stock has benefited from changes taking place, especially as it relates to macro conditions. There are increased expectations of a Fed pivot and many stocks, semis included, have rallied in anticipation of this happening. The prospect of a possible easing in Fed policy has neutralized any blowback KLIC might have received from its latest guidance.

However, the rally has paused in recent weeks with resistance putting downward pressure on the stock. While KLIC has certainly benefited from all the talk of a Fed pivot, whether or not there actually is one is not a given. The risk here is that the Fed does not ease as is expected and the market does not react well to the lack of easing.

Similarly, there is also the risk that KLIC is underestimating the severity of the downturn. Management is now calling for a relatively short downturn that will start to recover in the second half of FY2023, but this may be too optimistic, especially since downturns tend to last longer historically. Management already had to revise its earlier prediction of FY2023 revenue of $1.5B to something more like around $900M. It’s not out of the question that KLIC is forced to lower its outlook again in the coming quarters.

Bottom line, there are arguments to be made in favor of long KLIC, but there are just as valid arguments against it. The stock has done well in the last few months, but the sustainability of the rally looks iffy at best. The rally is built on assumptions that may turn out to be misplaced. While KLIC is expecting a quick recovery, the reality is that the quarterly numbers are getting worse in a hurry. The stock is priced at a premium with multiples where they are. The charts favor a move down in the stock. While some may have no issue with the above, others are unlikely to go along. If that is the case, standing on the sidelines looks to be the safest option.

Be the first to comment