D-Keine/iStock via Getty Images

Introduction

The last decade was certainly not favorable for AT&T (NYSE:T), who sees their share price back to the same depths as during late 2008 and early 2009 at the bottom of the global financial crisis. Even though this largely stems from their questionable WarnerMedia spin-off, which saw their once rock-solid dividends reduced, the recent drop came as their second quarter of 2022 results saw the prospects of a recession knocking at the door, proverbially speaking. Now the dust has settled from the initial sell-off one week ago, it appears that their shares are already priced for a depression, which is even worse and thus actually creates very desirable prospects to generate significant alpha.

Background

Since the story behind their acquisitions, subsequent spinoffs and their resulting dividend reduction has already been heavily discussed over the years, the more important news was their results for the second quarter of 2022 flagging that customers are taking longer to pay their bills, likely as a result of inflation and cost of living pressures. Despite their otherwise strong subscriber numbers, they were overshadowed by this bill payment headwind that saw their free cash flow guidance for 2022 being slashed by $2b, as the slide included below displays.

AT&T Second Quarter Of 2022 Results Presentation

This unexpected news comes as concerns grow over the outlook for the economy with fears that a recession may be on the horizon, which gets further credence from customers delaying paying their bills. Thankfully, their now reduced $14b of free cash flow guidance for 2022 still provides very strong coverage of around 175% to their circa $8b per annum of dividend payments and thus their dividends remain safe even if their financial performance further weakens on the back of a recession. Whilst positive, if they see lower earnings, it nevertheless would still hurt via slowing down their net debt repayments, which is an important topic given their triple-digit billion dollar net debt.

If they face further financial impacts from a recession, it would not only delay their deleveraging but could actually see leverage increase because it is a construct of both net debt and earnings, which means that if the latter falls, their leverage increases and vice-a-versa. When the second quarter of 2022 ended, their net debt of $131.9b was already pushing their leverage towards the high territory with a net debt-to-adjusted EBITDA was 3.23 that sits very close the threshold of 3.51 for what I consider the high territory, as per their second quarter of 2022 results announcement. Whilst they are not likely to face any solvency issues even if this eventuates, if their deleveraging ceases or reverses, would very likely reduce the confidence of management to return more cash to shareholders via either dividend growth or share buybacks.

Discounted Cash Flow Valuations

Since they are a very mature company already dominating their industry, recession or not, they are not going to see a decade of astounding growth and considering the frequent coverage here on Seeking Alpha regarding their dividends, it should not be the least controversial to say that their shares are almost exclusively sought by income investors. This means that their intrinsic value is heavily dependent upon the future income they can provide their shareholders and thus can be estimated by utilizing discounted cash flow valuations that replace their free cash flow with their dividend payments. If interested, further details regarding the inputs utilized for these valuations can be found in the relevant subsequent section.

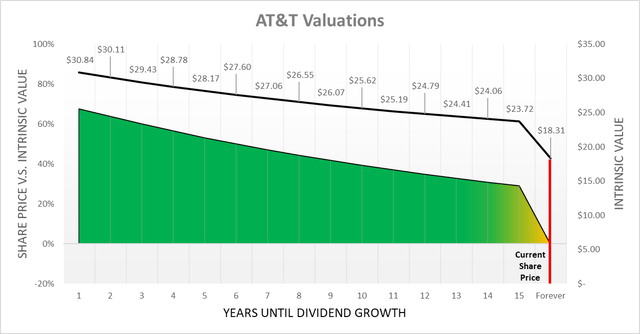

There are numerous ways to approach these valuations but given their ample free cash flow but uncertain economic outlook, it seems reasonable to structure these around the number of years until their dividend growth returns. In my view, the most bullish scenario would see no recession or at least, it does not last long nor is too severe, which means that their earnings are not further impacted and thus as a result, their leverage starts trending lower and management feels confident to increase their dividends after only one year. Due to their low growth outlook and mountain of net debt, it was assumed that their current quarterly dividends of $0.2775 per share would only see growth of 2.50% per annum perpetually into the future. Conversely, I see the most bearish scenario whereby their current dividends remain unchanged perpetually into the future, which would be very disappointing given their ample free cash flow and in my eyes, would be like seeing a severe depression whereby they struggle immensely with prolonged financial impacts that leave them falling behind and losing ground to competitors. Meanwhile, the remaining scenarios in between this range see the wait until dividend growth returns ranging from 2 years to 15 years with one-year intervals, after which, their dividends carry the same growth rate of 2.50% per annum perpetually into the future.

When reviewing the results, it was very exciting to see that their current share price of $18.39 aligns almost perfectly with the intrinsic value for the bearish scenario of $18.31 because this means that the market appears to have already priced their shares for a depression or at best, it does not have any faith in their ability to deleverage and thus grow their dividends. This is not to say that their share price can never drop lower in the short-term, which is always a risk given the inherent volatility in markets, especially if negative sentiment increases but rather, this actually means that in the medium to long-term, investors should see minimal downside risk.

I feel this creates a very desirable investment proposition, as notwithstanding any further short-term volatility, the outlook is very favorably skewed to the upside, especially with the bullish scenario producing an intrinsic value of $30.84 that is a massive 68% above their current share price. The various in between scenarios still see intrinsic values considerably higher than their current share price, which means that investors still have very strong prospects to generate significant alpha even if there is a long 10-year wait until dividend growth returns, as the resulting intrinsic value of $25.62 is a very impressive 39% above their current share price. By providing a variety of results, readers can cross-reference their own views with these valuations as they may vary from my own.

Valuation Inputs

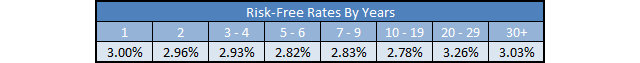

When conducting these discounted cash flow valuations, they utilized a cost of equity as determined by the Capital Asset Pricing Model. The inputs were a Beta of 0.68 (as per Barron’s), an expected market return of 7.50% and risk-free rates per year that track the United States Treasury yield curve on July 27th 2022, as the table included below displays.

Author

Conclusion

Whenever it comes to economic conditions, no one can ever see the future with complete certainty but thankfully in this situation, even if there is a recession, it should pass. More importantly, their shares are seemingly already priced for a far worse scenario whereby their dividends never see any growth, which would be like a depression and thus as a result, the medium to long-term downside risk is minimal but since such a bearish outlook is unlikely, the potential to generate significant alpha remains. Since this creates a very favorably skewed set of results, I believe that a strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from AT&T’s SEC filings, all calculated figures were performed by the author.

Be the first to comment