jetcityimage/iStock Editorial via Getty Images

The Kroger Co. (NYSE:KR) rallied strongly as expected from the pullback around $42-ish. As of today, KR struggles to break through its March high, and in my opinion, opens an opportunity to lock in some profits and wait patiently for its pullback. The company continues to enhance its digital ecosystem as mentioned in my last article on Kroger, however, due to temporary headwinds, I have updated my DCF model. My revised valuation still provides a 20% upside potential, however, the overall bearish sentiment outweighs current return and that is why I sold a portion of my total positions and I am looking for another entry point as discussed in this article.

Updates on Kroger

KR remains one of the largest food retailers globally with its revenue growing at 3.64% 5-year CAGR, which is still faster than its peer Walmart Inc. (WMT). Although the company is experiencing uncertainties from excessive inflation, it managed to produce positive results, especially on its operating margin of 2.7% recorded in fiscal 2021 compared to 2.4% in fiscal 2020. Additionally, KR’s gross margin decreased to 22.01% from 23.32% last fiscal year, owing to higher supermarket fuel sales, as will be discussed later in this article. Further investigation into where those cost savings came from reveals that a surprisingly large portion is due to declining OPEX, which is the result of numerous store closures, food production plant closures, and the layoff of over 40,000 employees.

Kroger currently has 420,000 employees (down from 465,000 last F2020) who work in the company’s 2,726 supermarkets (down from 2,742 supermarkets recorded last fiscal year), 33 food production plants (down from 35 food production plants in F2020) and 1,613 fuel centers. A decrease in its human resources is actually somehow wise as there is an ongoing labor issue in California that plans to strike for a salary increase. On the other hand, I find this immaterial from the company perspective as they are gearing towards automation and technological advancement, enhancing their digital ecosystem which can still support the company’s growing demand. In fact, the company reassured its investors that KR is still capable of delivering a total shareholder return of 8% to 11%.

As we look to 2022, we are confident in our ability to continue to differentiate ourselves, serve our customers in new and exciting ways and continue to change the definition of what it means to be a grocery retailer while never losing sight of what’s most important to our customers. And when we do this, we have a clear path to delivering on our commitment of 8% to 11% total shareholder returns over time for our shareholders. Source: Q4 Earnings Call 2021

Additionally, the management provided an outlook to increase their CAPEX budget to $3.8B-$4B in fiscal 2022 which is expected to accelerate the company’s long-term growth. We can then probably see more catalysts about the enhancement of its digital economy. In April 2022, KR launched a collaboration with Bed Bath & Beyond Inc. (BBBY) to improve its services online, promoting an overall enhanced customer experience.

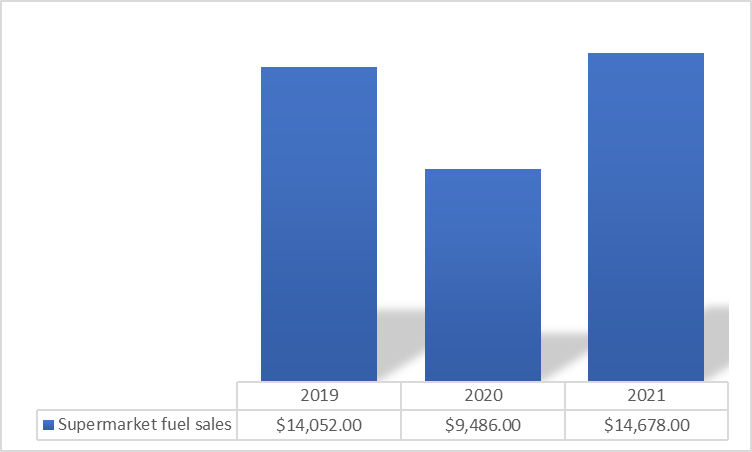

Looking at its digital sales on a yearly basis, it declined 3% compared to its last fiscal year, however, it still boasts an outstanding growth on a two-year stack basis of 113%. On the plus side, KR’s total sales without fuel of $122,293 million, up 0.1% year over year and a remarkable 13.76% on a two-year stack basis from $107,487 million in fiscal 2019, imply a strong seamless ecosystem. Another value-adding catalyst is its growing supermarket fuel as can be seen in the image below.

KR: Supermarket Fuel Sales (Source: Company Filing. Prepared by InvestOhTrader. Amounts in Million)

Although fuel prices have increased as a result of the Ukraine-Russia conflict, the company still produces a higher figure of $14,678 million this year than it did in 2019. This growth is attributed to an efficient fuel reward program in which points accumulated by customers are tied up with the company’s online store. Additionally, the management provided a strong outlook on its fuel sales growth as quoted below:

Customers that redeem fuel points spend, on average, 4x more at Kroger and visit 4x more frequently. Our investment in fuel rewards, which is reflected in our supermarket gross margin, also helps customers stretch their dollars further and allowed us to achieve gallon growth of 5% in the fourth quarter, outpacing market growth. Source: Q4 2021 Earnings Call

Valuation Revisit

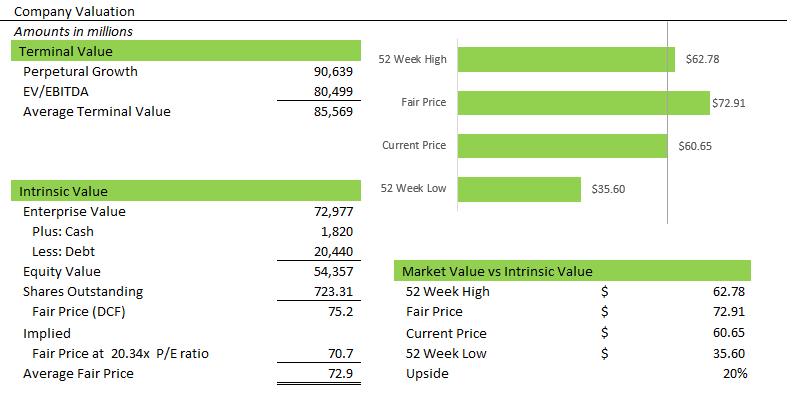

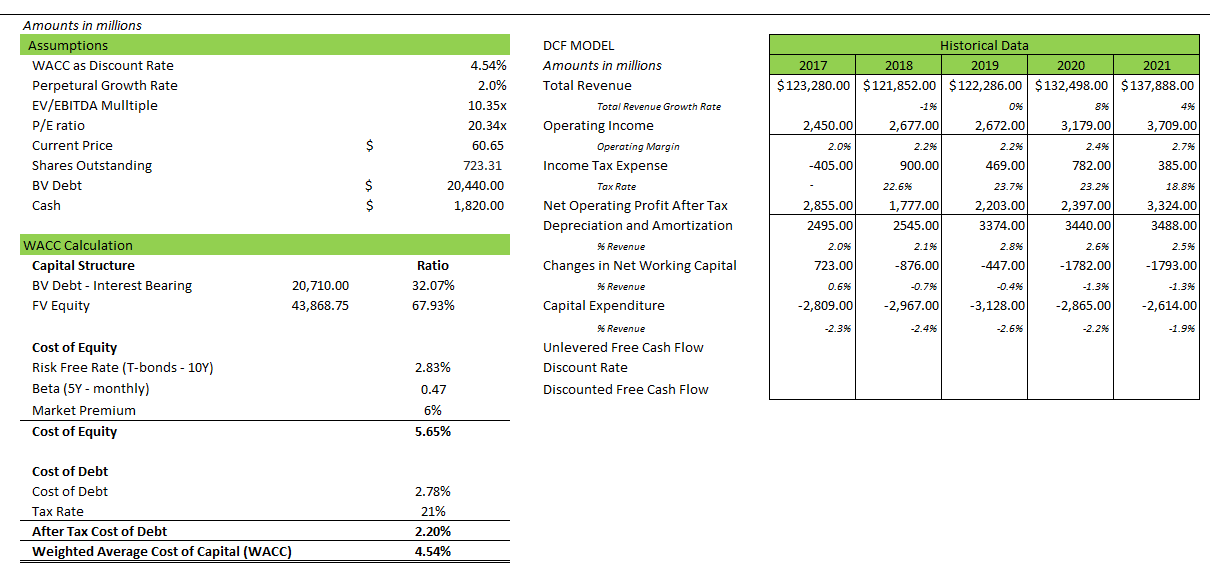

KR: Company Valuation (Source: Prepared by InvestOhTrader)

Due to rising inflation and yield rates, I lowered my expectation for the company, however, it still produces a 20% upside potential at today’s price. I still used an EV/EBITDA multiple of 10.35x which is still below its peer, WMT, who generated a 13.26x EV/EBITDA ratio. I also updated my WACC calculation which is now at 4.54% and used it as my discount rate to complete my DCF model.

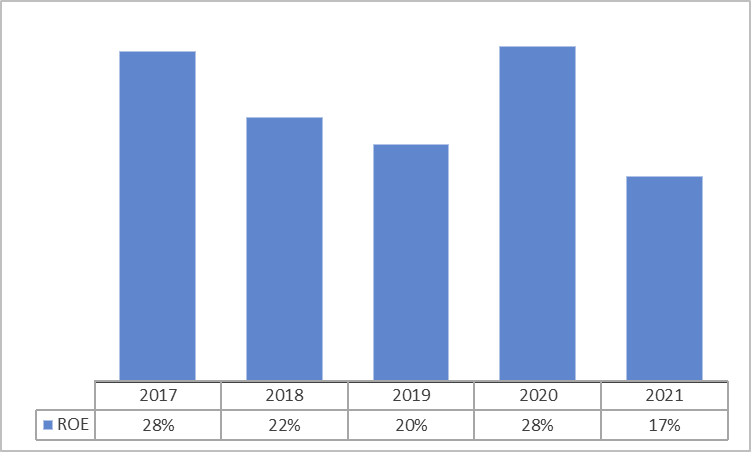

KH: Slowing ROE Trend (Source: Data from Seeking Alpha. Prepared by InvestOhTrader)

In my opinion, KR remains a solid investment, however, due to its deteriorating ROE trend as shown in the image above, I believe there is no reason to aggressively enter in at today’s sentiment.

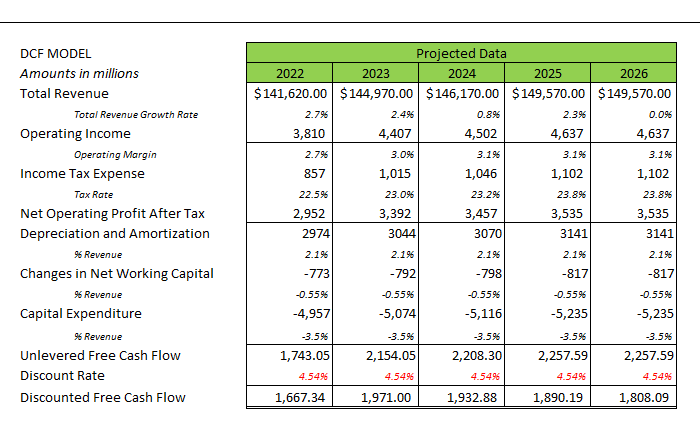

KR: DCF Model (Source: Prepared by InvestOhTrader)

I completed my DCF model using the top line forecast of experts. However, contrary to its current fiscal 2026 consensus estimate of $141.17 billion, which is expected to decline by 1.60% on a year-over-year basis, I projected a flat growth rate due to strong guidance from the management. We can also see a solid upward revision to its total annual revenue estimates despite the current headwinds. I projected its operating income to grow to 3.1% at the end of the model; this is aligned with the company’s long-term cost savings strategy. In fact, the management is aiming for an additional $150 million increment in its future operating income. Additionally, I projected a growing CAPEX spending as shown in the image above.

The image below includes my assumptions and updated WACC calculation that I used as my reference to complete my DCF model.

KR: DCF Model (Source: Data from Seeking Alpha and Yahoo! Finance. Prepared by InvestOhTrader)

Chart Revisit

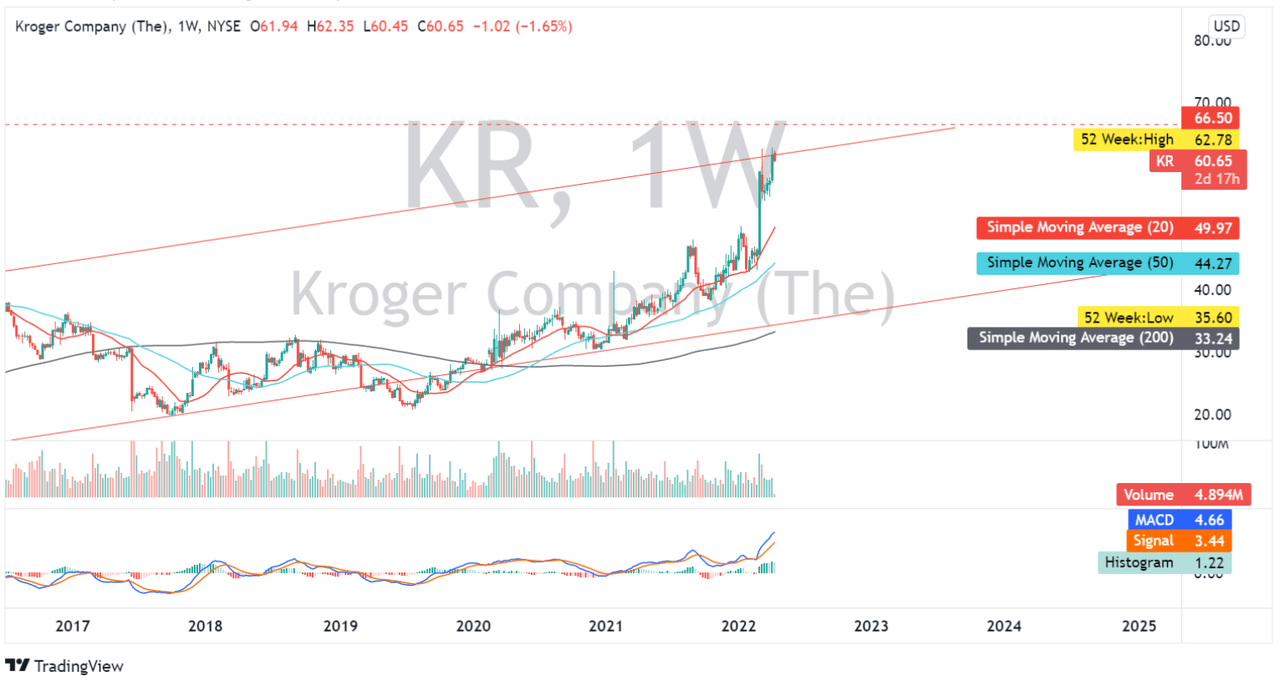

KR: Weekly Chart (Source: TradingView)

Currently, KR is showing some price action weakness and may print a potential double top. With its declining efficiency and macro headwinds, it is just logical for KR to experience a pullback which will open an opportunity to get it at a better price. Investigating its 50-day simple moving average, we can see a huge price imbalance suggesting KR to revert to its 50-day simple moving average. Looking closely at its daily timeframe, we can see a huge gap from March 2, 2022, that we can use as a confluence for our support or buy zone target, if ever there will be a correction. Lastly, its MACD indicator tells investors and traders that KR is still in a strong bullish trend, which serves as a good catalyst for a pullback opportunity. If KR is truly strong, I anticipate a 10% pullback; if not, it is likely to experience a deeper pullback.

Final Key Takeaways

Kroger’s margin and efficiency may be impacted by today’s temporary headwinds, but when combined with the management’s guidance of continued buybacks and dividend payments aligned with the company’s long-term total shareholder return, I believe it still provides positive upside for investors. However, on a short-term perspective, I believe the risk involved outweighs its potential return. KR is trading at a logical resistance and taking some profit at today’s price, leaving some to ride another wave if it continues to outperform the market, and in my opinion, is the safest plan at today’s market sentiment.

Thank you for reading!

Be the first to comment