xavierarnau/E+ via Getty Images

Introduction to View

View (NASDAQ:VIEW) offers a platform that is enticing at first. Smart window glass that dims using artificial intelligence, immersive displays that are also windows, and building analytics that include staff, visitor, and environmental monitoring. No, the windows aren’t the monitoring devices as it is a separate subsidiary. As you can see, the company leverages multiple high impact catch-phrases such as AI powered, sustainable and environmentally conscious, and even COVID management. This led to the company initiating an IPO in 2021 at a valuation of $2 billion, while the current market cap is $351 million. This 80% fall in less than a year is a record for purely valuation reasons I feel.

The main reason why the company has been so volatile is the lack of significant revenue growth, even as losses reach 5-10x yearly revenues. There is a single ray of light passing through View’s windows, and that is the opportunity to end their high investment phase, and shift to a more reasonable CAPEX profile. This shift may occur, and if it does, the current valuation may end up fair in time, but I would recommend waiting to see.

Poor 2021 Performance, Both Share Price and Financially

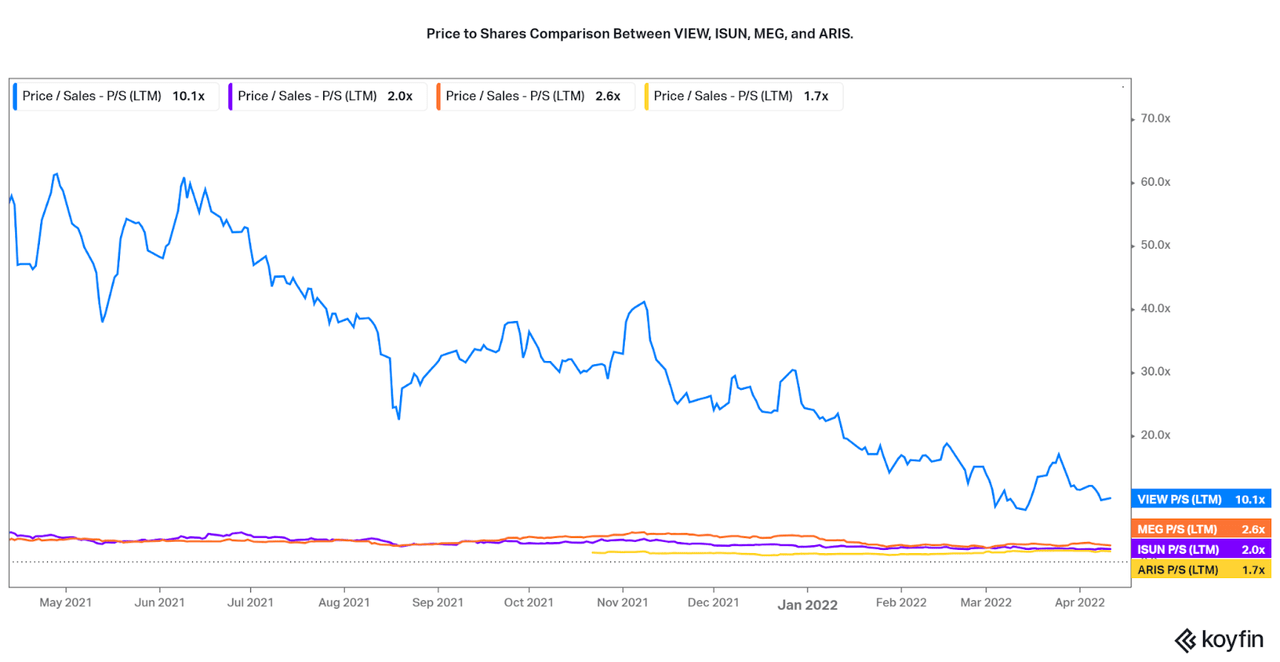

To put View’s performance in perspective, I will compare the company to three other speculative, high-growth companies that I do recommend: iSun (ISUN), Montrose Environmental (MEG), and Aris Water (ARIS). While the companies offer different services and are in entirely different industries, they highlight how View is in an even more precarious position.

Revenue Growth

View has averaged 26% revenue growth per year over the last two years, and trailing twelve-month revenues are now $34.9 million. This growth rate is faster than iSun’s 15% rate and is also a larger magnitude. However, high growth is seen in the larger MEG and ARIS, who both offer high growth with a significant amount of revenues. This goes against the typical theory of larger companies growing slower and allows some potential for long-term growth for View from current levels. However, the growth rate is quite slow even compared to iSun, and my evaluations of the profitability of the company will show why.

|

View |

iSun |

Montrose Environmental |

Aris Water Solutions |

|

|

2Y Revenue Growth Rate (%) |

26.5 |

14.8 |

52.8 |

38.9 |

|

Total Revenue 2021 (million USD) |

32.3 |

21.1 |

546 |

229 |

EBITDA

To try to compare fairly the companies in terms of profitability, we can look at EBITDA. This separates cost of revenues and operating expenses from factors that vary significantly from industry to industry. However, you can begin to see the large disparity between View and the other companies. All other companies have been able to maintain a positive average EBITDA over the past 3 full year earnings reports. It is not a good look for View to have such high expenses at such an early stage for the company, and complex issues with pricing, contracts, and supply chains must be resolved. As the company does not show a pattern of reducing these issues, I cannot predict when EBITDA will become positive, and will not assume.

|

View |

iSun |

Montrose Environmental |

Aris Water Solutions |

|

|

Average EBITDA (million USD) |

(237) |

0.70 |

39.0 |

65.2 |

Net Income

As three of the companies offer positive EBITDA on average over the past 3 full years of reporting, I looked at the differences in Net Income as well. I assumed View had other forms of income that were added to the bottom line, but this is not the case as well. As you can see, all three alternative companies have significantly higher losses than View. While Montrose has negative net income as well, I find it hard to find any positive benefits for View since their growth rate remains sub-30%. Also, the most profitable company, Aris, has positive net income and a growth rate close to 40%.

|

View |

iSun |

Montrose Environmental |

Aris Water Solutions |

|

|

Average Net Income (million USD) |

(329.5) |

0.77 |

(35.6) |

2.03 |

What Potential Is There for View?

I find it incredible that the company has been able to draw over a billion dollars’ worth of funding to support their losses over the past few years. Thankfully, their IPO was timed perfectly when valuations were incredibly high. Also, the company has negligible debt, with most of it being paid off thanks to the large IPO funding. Now, the company has over $500 million in cash to support operations, although it won’t last long at current losses. As such, I find that 1-2 years of coverage will not be enough, and either further debt or dilution will be necessary. Considering the company will be earning less than $100 million for 2022, then I find the risk comes with little reward.

In fact, the financial state is quite a mess, and has led to the warning of being delisted from NASDAQ due to the delay of multiple earnings reports. In addition, the lack of transparency – the most recent presentation available is from 2022 – adds to the risk. While I have never shorted a stock, perhaps I have found a potential target. At current valuations, there is still plenty of downward momentum allowable. The chart below truly highlights the risk that awaits for those who invest in the asset. Other hindrances include:

-

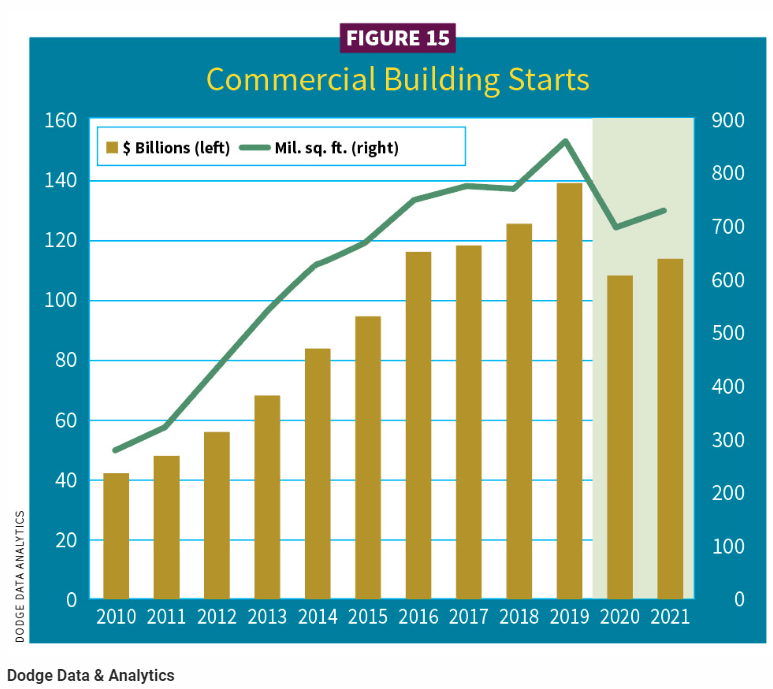

Reduced commercial real estate construction starts, thanks to work-from-home. End is in sight, but continual demand decreases. While one can say that less, more high-tech projects may survive and allow growth for View, this is unclear.

-

The underlying construction industry growth rate will probably never support significant revenue growth. Especially considering the current valuation would assume that the company products are deployed in the majority of new starts.

-

Inflation, recession, and supply chain difficulties all are steep and incalculable headwinds that are major concerns for the construction industry. Less cheap money, the inability to spend, and paying too much for supplies will all impact View significantly.

Koyfin Dodge Data & Analytics

Are there any good points to consider? Well, first is the fact that revenues are growing, regardless of the rate. Second, View seems to be shifting away from their high cost, low demand smart window solutions towards building system management. The company announced the acquisition of IoTium to support this growth. However, while diversification is commendable, it is important for the company to realize that their available market is extremely slow moving, and requires profitability. SaaS services should increase margins and growth, but I believe the company should pull back on spending. Further, the company must increase the prices of their products as costs outweigh the revenues brought in. Finding contracts with boutique firms for slow, stable growth would be far more sustainable in the end.

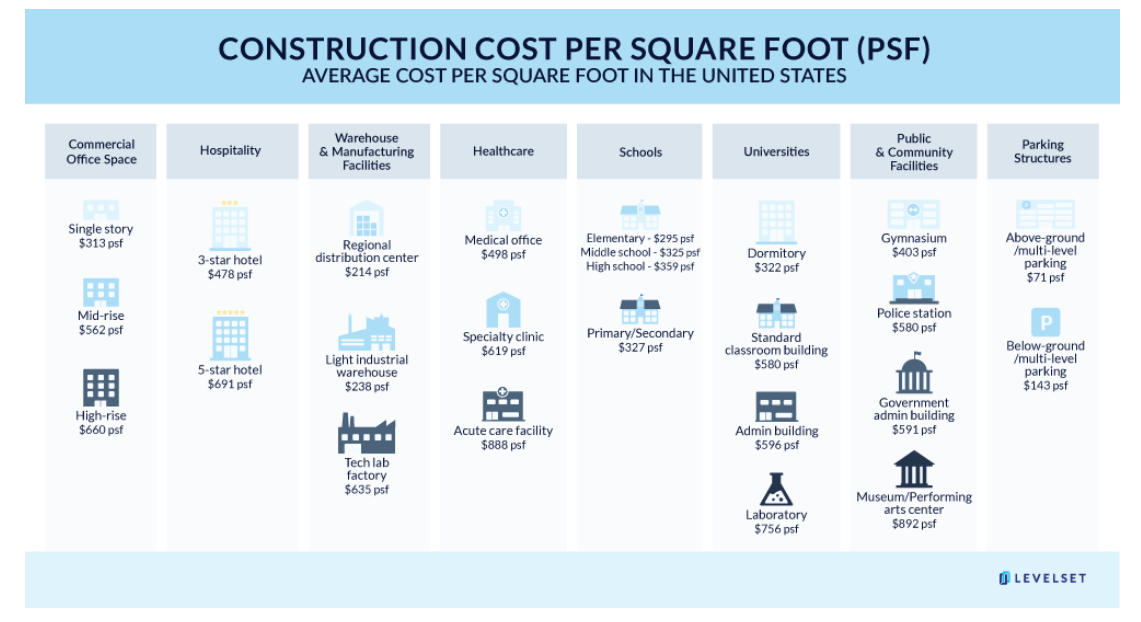

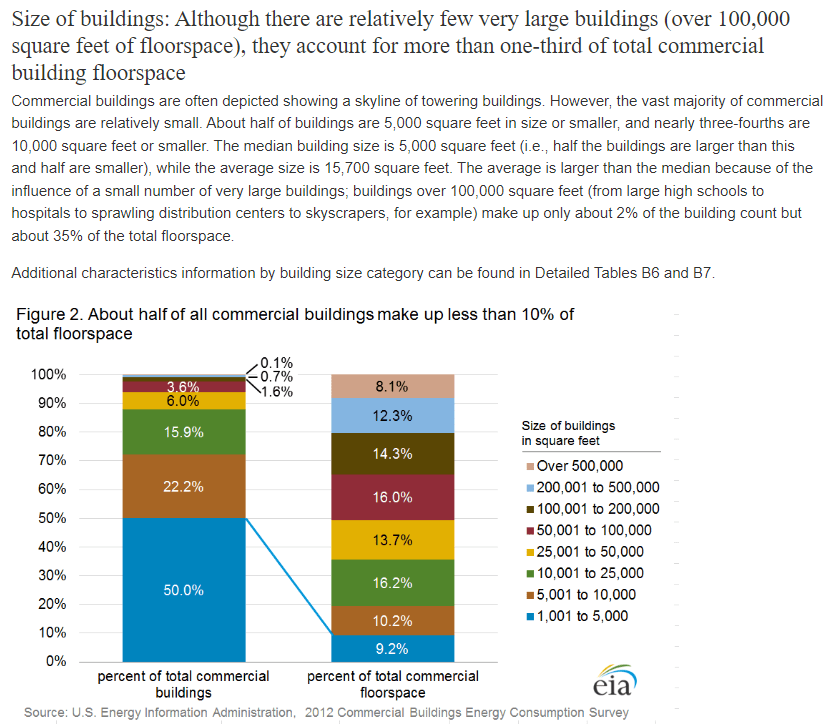

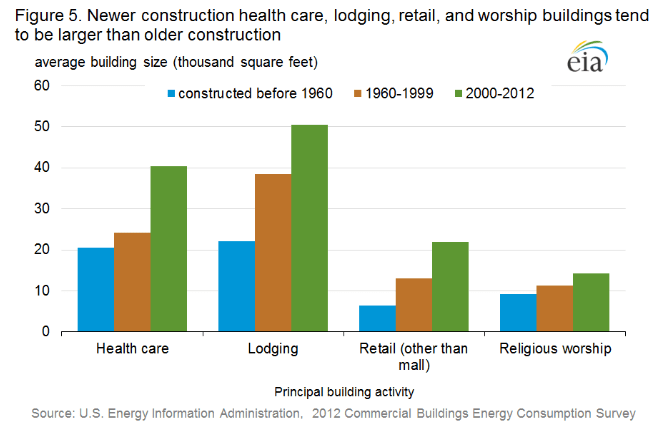

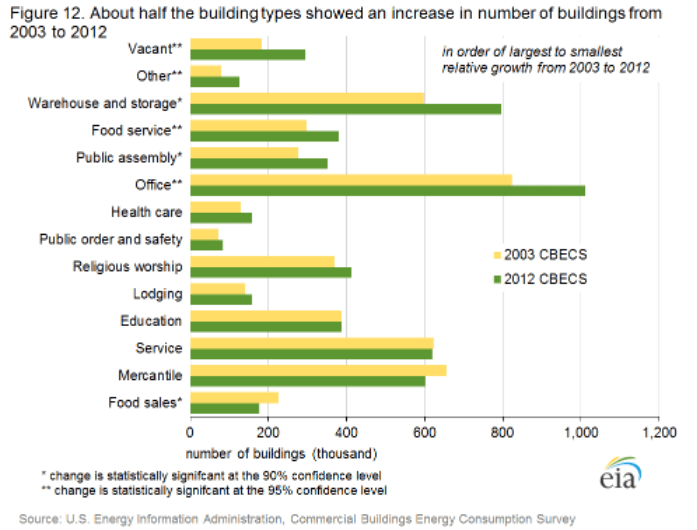

To understand the potential market that View can/should take advantage of, we can look at proportional construction costs. All data can be seen in the figures below, or the entire report by the EIA can be read here. In 2012, the average square footage of commercial buildings was 15,000 square feet and rising. Therefore, we can assume new buildings are around 30,000 sq. ft. Additionally, View’s applications are typically mid or high-rise applications, leading to an average construction cost per square foot of $600. I also broadly assume smart windows are 5-10% of the total cost (this is a hard data point to estimate).

Therefore, View must be applied in at least 1,900 commercial construction projects per year to earn $1 billion in revenues. I recommend you fiddle around with the equation to determine different outcomes based on changing factors. Considering there are about 6 million commercial buildings, growing at ~1.2% rate since 1979 and slowing (EIA data), View needs to reach a significant market share of new building construction. Or, the company must be applied in high square footage and high cost projects to account for smaller volumes of projects.

Levelset EIA EIA EIA

Conclusion

While the opportunity is there, commercial construction is a huge market; View lacks the fundamentals to earn my confidence. While revenues may continue growing, huge losses will not allow shareholders to benefit. As such, I would not recommend investing in the company, and expect the share price to continue falling. Watch factors such as commercial property construction and the corresponding construction costs to determine the health of the market, but View really needs to gain profits first. I can’t imagine what the company must continue spending on, as just one or a few facilities to develop the window products should be necessary. Perhaps upon meaningful commercialization, the company would be an acquisition target by a firm such as Johnson Controls (JCI). That would be the best result for longs I believe.

Thanks for reading, let me know if you agree in the comments.

Be the first to comment