Justin Sullivan

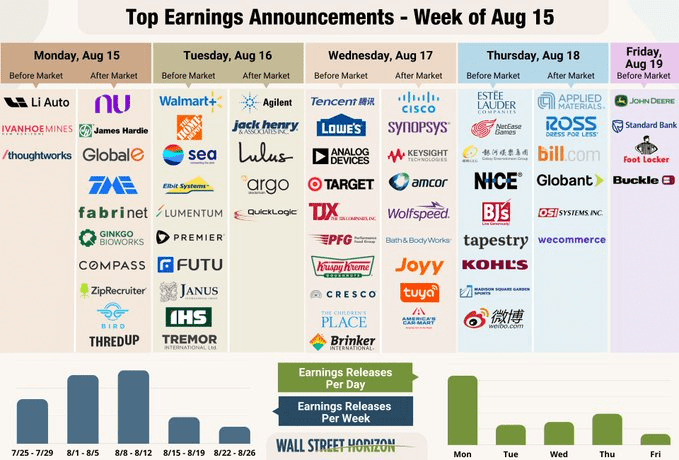

Meme stock mania continues. While U.S. microcap stocks catch a tailwind, as many high short interest companies see massive squeezes lately, a handful of retailers have been caught up in a buying frenzy. As that kind of market action is fascinating to watch unfold from a speculative point of view, there’s crucial fundamental information being released this week. Retail earnings season is of course already underway. Walmart (WMT) and Home Depot (HD) reassured investors that the consumer is still in decent shape and, at the company level, execution in big Consumer Staples and Consumer Discretionary areas seems to have improved.

The Q2 earnings season rolls on. We will hear from Target (TGT) and Lowe’s (LOW) on Wednesday and Ross Stores (ROST) the following day. Also on Thursday is one regional retailer: Kohl’s (NYSE:KSS).

This Week’s Earnings: Retail Rings The Register

Wall Street Horizon

The $4.25 billion market cap stock in the Multiline Retail industry within the Consumer Discretionary sector trades at a very low 5.6 trailing 12-month price-to-earnings ratio and pays a hefty (perhaps suspiciously high) 5.5% yield, according to The Wall Street Journal. The stock was in the news earlier this summer when buyout hopes sparked volatility. In early July, however, those talks were scrapped. Shares cratered on July 1 – falling from the mid-$30s to the mid-$20s in short order.

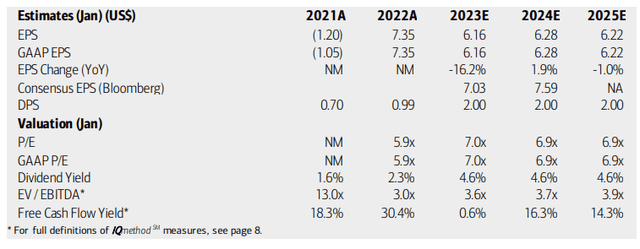

BofA analysts see earnings normalizing this year, but then falling in 2023. EPS growth is then seen as tepid through 2025. The consensus forecast is a bit more optimistic. The company’s dividend is seen as hovering around $2 per share in the years ahead. KSS trades at a low EV/EBITDA multiple and it actually has decent forecasted free cash flow looking out to 2024-25. The stock could be a value here considering that BofA values Kohl’s real estate holdings at $5.5 billion.

Kohls: Earnings, Valuation, Dividend Forecasts

BofA Global Research

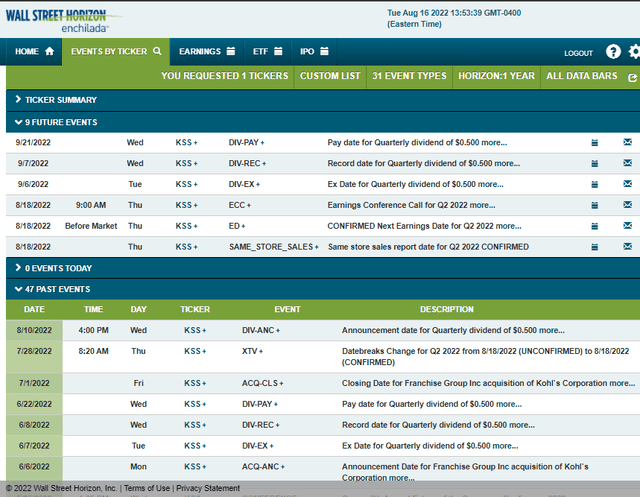

Looking ahead, the retailer has a confirmed earnings date of Thursday morning with a conference call immediately following the results. Investors also look forward to an ex-dividend date of Tuesday, Sept. 6, according to data from Wall Street Horizon.

KSS: Corporate Event Calendar

Wall Street Horizon

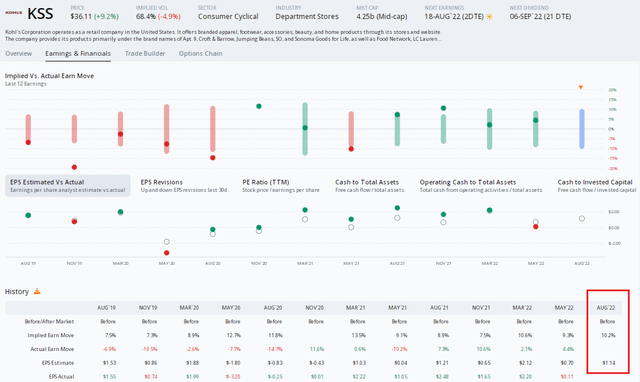

Digging deeper into the earnings expectations, data from Option Research and Technology Services (ORATS) show a big implied share price move post earnings. The at-the-money straddle using the nearest-dated expiration date shows a 10.2% expected stock price change. The EPS estimate is $1.14 and there has been one analyst downgrade of the stock in the last few months. KSS has a solid EPS beat-rate history, topping analyst estimates in seven of the past eight announcements.

Kohl’s Q2 Earning Preview: A Big Implied Move

ORATS

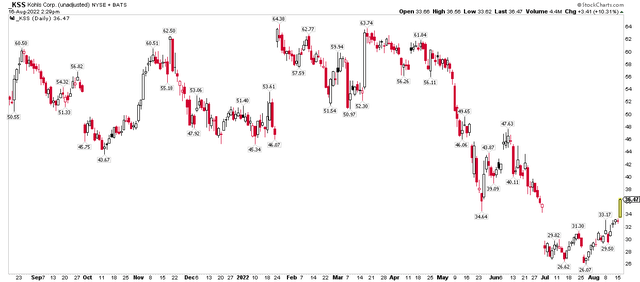

The Technical Take

On the one-year chart of KSS, you can see today’s jump on the heels of strong numbers from Walmart and Home Depot (and the retail meme stock craze led by Bed Bath & Beyond (BBBY)). The stock has filled the downside gap from Friday, July 1. This would be a natural spot for the bulls to take some profits. The next resistance area is in the mid-$40s. Finally, the 2021 to early 2022 highs at $63, while out of reach, is the final stopping point. The more immediate $43 resistance price dates back to late 2019, too.

KSS: 1-Year Chart: Gap Filled

Stockcharts.com

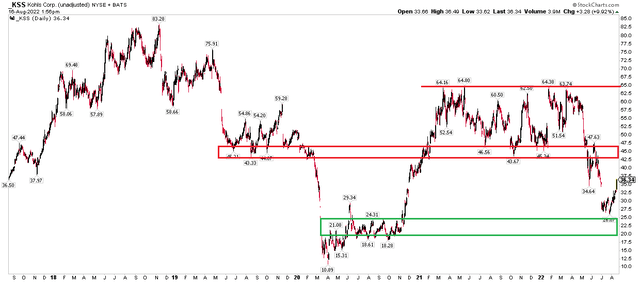

5-Year Chart: Resistance Is Seen At the 2021-2022 Range Lows

Stockcharts.com

The Bottom Line

Kohl’s trades a cheap valuation after a 2022 chock full of corporate events and headline risk. The stock is now caught up in a short-covering rally as about 10% of the float is short. I see resistance at current levels, and another layer of supply starts at $43. Based on the implied move post-earnings, swing traders should take profits if shares indeed climb to the low $40s. Long-term investors can be long here based on a low valuation and a potential turnaround in the years ahead.

Be the first to comment