piranka

For those who aren’t familiar with the intricacies of the audio space, audio technology may seem simplistic and rather old-school compared to many other technologies that are out today. But this way of thinking is mistaken. The fact of the matter is that audio technology is still improving and one of the companies dedicated to taking it to the next level is a firm called Knowles Corporation (NYSE:KN). Over the past few years, this enterprise has done a pretty good job of growing its top line. But bottom line performance has always been a bit mixed. Add on top of this the fact that revenue and profits are both struggling in the current fiscal year, and there isn’t much about the company that warrants serious consideration. Having said that, one positive aspect to the business is that shares do look to be trading at rather affordable levels. Some of this low price is probably warranted because the market is likely assuming that further weakness will continue based on current economic conditions. But for those who have a longer-term investment horizon, now might not be a bad time to consider a stake in the company.

Listen to this

According to the management team at Knowles, the company operates as a global provider of advanced micro-acoustic microphones and balanced armature speakers, audio solutions, high-performance capacitors and RF products. These technologies can be used by a variety of industries, ranging from consumer electronics, to medtech, to defense, to electric vehicles, to the industrial space, to the communications industry, and beyond. The core of the company’s technologies seems to be aimed at what management calls microelectromechanical systems microphones. In addition to this, and also boasts strong capabilities in the audio processing technology market in the sense that the company seeks to optimize audio systems and improve user experiences when it comes to consumer applications.

To best understand the enterprise, we should break it down into its two core operating segments. The first of these is the Audio segment, which designs and produces innovative audio products like microphones, speakers, audio processors used in applications that serve the mobile, hearing health, IoT, and other markets, and so much more. During the company’s 2021 fiscal year, this particular segment accounted for 76.8% of the company’s revenue and for 75.8% of its profits. The other segment is called the Precision Devices segment. It is through this that the company provides high-performance capacitor products and RF solutions for technically demanding applications such as power supplies, medical implants, defense activities, and more. This is a considerably smaller portion of the company, accounting for only 23.2% of its revenue and for 24.2% of its profits.

Although this is how things have been in recent years, that picture is rapidly changing. On November 16th, for instance, management announced that they were changing the segment names and reporting structure of the enterprise. This will begin with data announced by the company during the fourth quarter of 2022. On the one hand, we will still have the Precision Devices segment, with all of its operations seemingly unchanged. But then, we will see the company’s other operations broken up into two different segments. Audio will be broken up into a Medtech & Specialty Audio segment that would design and produce microphones and balanced armature speakers used in applications that serve the hearing health and premium audio markets. And second, we will have the Consumer MEMS Microphones segment that will produce microelectromechanical systems microphones and audio solutions used across the IoT, computing, and smartphone markets. At this time, we don’t really know what the picture will look like for this reorganized enterprise. But we do know that on November 29th, management will offer up a presentation on the new structure and discuss growth strategies for each individual unit moving forward.

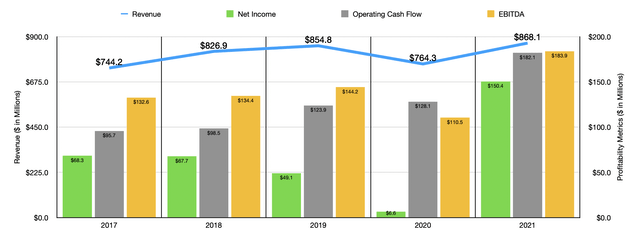

Over the past few years, the general trajectory seen by Knowles has been rather positive. Revenue went from $744.2 million in 2017 to $854.8 million in 2019. Because of the COVID-19 pandemic, sales dropped to $764.3 million in 2020. Having said that, this decline was short-lived, with sales rebounding and hitting $868.1 million in 2021. This surge in sales from 2020 to 2021 which is driven by $75.8 million in additional Audio revenues that benefited from higher shipping volumes thanks to improving market conditions. In fact, shipments even surpassed pre-pandemic levels according to management. Strong organic growth and an acquisition the company completed of a firm called IMC also helped to push sales up under the Precision Devices segment.

You might think that a fairly steady trend of increased revenue might help the company’s bottom line as well. But that was sadly not the case. Between 2017 and 2020, the company’s net profit actually dropped year after year, declining from $68.3 million to $6.6 million. Fortunately for investors, net income rebounded in 2021, hitting $150.4 million. According to management, the company especially benefited from 2020 to 2021 from its gross profit margin jumping from 35.5% to 41.4%. This was driven by higher shipping volumes, product cost reductions, higher factory capacity utilization, a favorable product mix, and a net favorable inventory reserve adjustment. Other profitability metrics followed this kind of trajectory. After declining from $144.2 million in 2019 to $110.5 million in 2020, EBITDA popped up to $183.9 million last year. The only metric to not show any downside in recent years was operating cash flow. It ultimately grew year after year, climbing from $95.7 million in 2017 to $182.1 million last year.

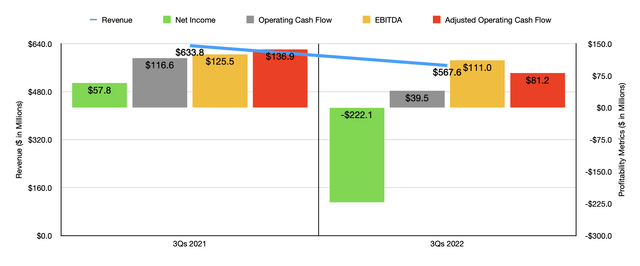

Unfortunately, 2022 is looking to be a bit painful for shareholders. During the first nine months of the 2022 fiscal year, the company reported revenue of $567.6 million. That’s actually down from the $633.8 million reported the same time last year. This plunge, management said, was driven by a significant decline in Audio revenues of $102.6 million, largely because of lower demand for MEMS microphones in mobile, computing, and IoT markets. This weakness, in turn, can be chalked up to weak global demand for consumer electronics, largely affected by COVID-19-related shutdowns in China and by excess inventory in the company’s supply chain. Naturally, profits followed suit. The company went from generating a net profit of $57.8 million to generating a loss of $222.1 million. Operating cash flow dropped from $116.6 million to $39.5 million. Even if we adjust for changes in working capital, it would have taken a beating, declining from $136.9 million to $81.2 million. And over that same window of time, we also would have seen EBITDA decline, dropping from $125.5 million to $111 million.

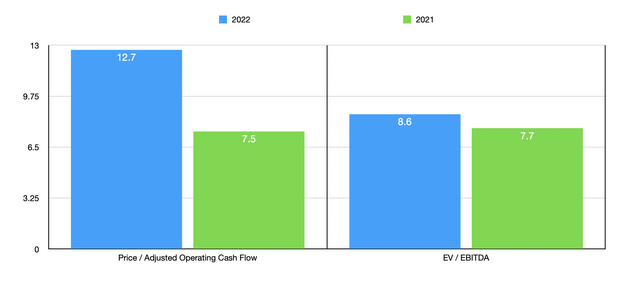

When it comes to the 2022 fiscal year in its entirety, management is forecasting revenue of between $200 million and $220 million for the fourth quarter. This should translate to earnings per share of between $0.20 and $0.24, with adjusted earnings of between $0.31 per share and $0.35 per share. Given the volatility of earnings, I don’t believe that they would be particularly useful when valuing the company. Instead, I estimated adjusted operating cash flow for the year of $108 million and EBITDA of approximately $162.7 million. If these numbers come to fruition, the company would be trading at a forward price to adjusted operating cash flow multiple of 12.7 and at a forward EV to EBITDA multiple of 8.6. By comparison, if we were to rely on the data from 2021, shares would be considerably cheaper at 7.5 and 7.7, respectively. Also as part of my analysis, I compared the company to five similar firms. On a price to operating cash flow basis, four of the companies had positive results, with multiples ranging between 13.7 and 25.8. In this case, our prospect was the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range was from 4.6 to 17.6, with two of the five companies being cheaper than Knowles.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Knowles Corporation | 12.7 | 8.6 |

| Alps Alpine Co. (OTCPK:APELY) | N/A | 4.6 |

| Bel Fuse Inc. (BELFA) | 14.7 | 6.9 |

| Belden (BDC) | 14.4 | 11.9 |

| Amphenol (APH) | 25.8 | 17.6 |

| Littelfuse (LFUS) | 13.7 | 12.3 |

Takeaway

With what data we have at our disposal now, I do believe that Knowles might be in for some continued pain. Given the current economic conditions we are dealing with, this is not much of a surprise. Ultimately though, even with the financial data we have, shares don’t look unreasonably priced at all. Of course, it is always possible that the deterioration could worsen. But seeing how the company weathered the COVID-19 pandemic, I believe a good case could be made that it should weather this economic storm as well. So although investors in the company should anticipate continued volatility moving forward, I do think that it may make for a soft ‘buy’ prospect for long-term investors who really like this space.

Be the first to comment