Anatoly Morozov

Thesis

Daqo New Energy Corp.’s (NYSE:DQ) Q3 earnings release in October corroborated our thesis that its growth could be slowing. We discussed in our previous article that Daqo could be operating at peak topline and profitability growth in FY22 before a significant normalization phase.

Management’s commentary had attempted to debunk those fears. Despite telegraphing a lower-than-expected production volume in Q4 (since December is usually seasonally strong), the company attributed the weakness to maintenance pushouts that it had intended to complete earlier in H1/early H2. While we could consider cutting the company some slack in that, we believe it’s essential for investors to consider whether China’s solar industry growth could see a healthy pullback in 2023 after a period of significant growth.

Moreover, Bloomberg recently reported that the momentum in Q4 has been relatively subdued, although analysts still expect a spectacular year. However, we believe DQ’s price action had already anticipated a record year for the company in 2022. As always, the market is forward-looking, trying to anticipate what Daqo’s operating metrics could look like in 2023/24, with a potential growth normalization phase in the works.

Despite that, we favor management’s recent corporate actions, as it attempted to bolster investors’ confidence in its execution. It telegraphed a new massive $700M stock repurchase (effective through December 21, 2023) to replace the $120M authorization it consummated in Q3. Its new authorization represents nearly 20% of its market cap. As such, it likely strengthened investors’ confidence in management’s outlook through 2024, as management sought to deploy its cash buffer of $4.62B (including bank notes receivable guaranteed by domestic Chinese banks) as at the end of Q3.

Notwithstanding, DQ’s price action suggests near-term caution. The market had rejected further advances above its November highs and is currently in a pullback phase. Hence, we prefer to assess the extent of the pullback and parse where it could find support to consolidate.

DQ’s valuation of 0.5x NTM EBITDA is unusually low in the context of its historical average of 5.1x (10Y average). Hence, we believe the market is likely positioning for a steeper fall in its profitability metrics moving ahead. In addition, its TTM tangible book value multiples (TBV) also suggest that DQ has been de-rated.

While we think DQ’s October lows (nearly 20% below) could hold, we need to assess buyers’ conviction in the recent pullback.

Revising from Buy to Hold for now.

Daqo: Don’t Understate A Potential Growth Normalization

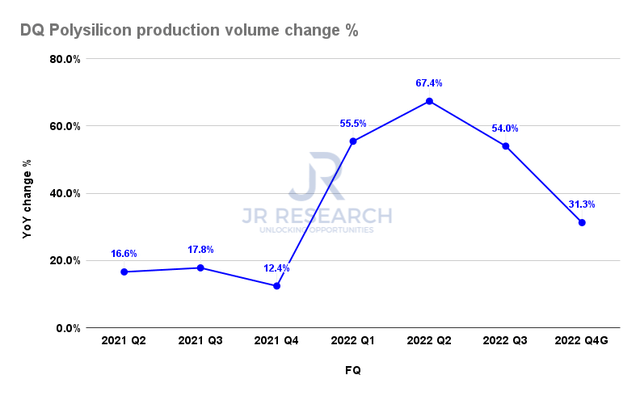

Daqo Polysilicon production volume change % (Company filings)

Daqo guided for a production volume of 31K MT (midpoint) for FQ4, up 31.3% YoY. However, it also represents a significant drop from FQ3’s 54% uptick, corroborating a moderation from Q2’s peak growth of 67.4%.

Notwithstanding, management attributed the “weakness” in a typically seasonally strong Q4 to maintenance pushouts, as CFO Ming Yang articulated:

So normally, we do our maintenance between March or April through, say, July. But this year, because of the strong demand in the first half, we actually delayed maintenance to the second half of this year. And so most of the maintenance was supposed to kick off starting in August. But because of the COVID restrictions, [it] gave us significant challenges to conduct maintenance schedule during this time frame. [So,] some maintenance has been pushed out to October or even November. So that’s why [the] slightly higher production in Q3 [is] offset by slightly lower production in Q4. (Daqo FQ3’22 earnings call)

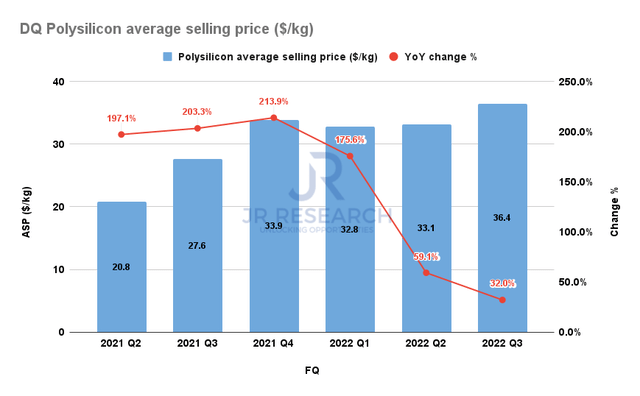

Daqo Polysilicon ASP (Company filings)

As seen above, the growth in Daqo’s average selling price (ASP) has also been moderating through Q3. Based on management’s commentary of about $36-$38 it saw in early Q4, it implies a YoY growth of under 10% in its ASP for Q4. Therefore, it puts significant pressure on Daqo to continue its record growth spurt through FY23, suggesting investors can no longer ignore a normalization phase.

Bloomberg also highlighted in a recent update that solar installations’ growth momentum in Q4 has been slower than expected. It underscored that “just 5.6 gigawatts of solar were added in October, leaving installations over the year so far at 58 gigawatts for solar.”

Therefore, it could put China’s National Energy Administration (NEA) previous forecast of 100 GWh under significant pressure.

Notwithstanding, Daqo had reiterated its confidence in a seasonally strong Q4. Bloomberg Intelligence also reiterated its projections of 90 GWh for 2022. It expects state-owned firms to meet targets as they “have a relatively higher tolerance when it comes to investment returns.”

Hence, we believe there could be some price pressure moving forward, which could further impact the momentum of Daqo’s ASP.

Is DQ Stock A Buy, Sell, Or Hold?

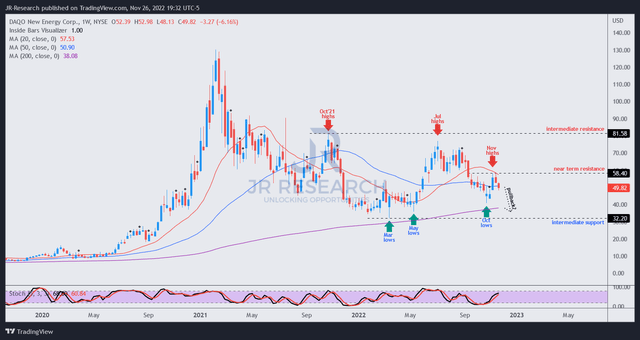

DQ price chart (weekly) (TradingView)

DQ has continued to come under pressure despite buyers attempting to force a surge after the company’s announcement of its new repurchase authorization. As a result, it prevented DQ from re-testing its previous July/August highs, a notable red flag in DQ’s weakening upward momentum.

Hence, we believe the market’s positioning suggests it could be expecting a significant normalization phase through FY23. Therefore, it’s likely that DQ remains in an extended consolidation zone undergirded by its March/May/October lows.

Hence, we believe it’s apt for investors to assess the re-test of those levels in the pullback before deciding whether to pull the buy trigger. Furthermore, DQ’s unusually low valuation suggests caution is warranted, as highlighted earlier.

Revising from Buy to Hold for now.

Be the first to comment