Fritz Jorgensen/iStock Editorial via Getty Images

Meta Platforms, Inc (NASDAQ:FB) is showing rapid improvement in its digital payments segment within important regions like India and Brazil. The company has recently received permission to double its payments user base to 40 million within India. This should allow the company to expand its services in all the major metros where digital payment usage is higher. Facebook has linked the digital payments feature with WhatsApp which should allow the company to reach a user base of 500 million users in India and over 2 billion users worldwide. Rapid growth of digital payments by social media platforms in China has already shown the potential for Facebook.

The combined valuation of new fintech services in India has crossed $50 billion and could rapidly increase as the transaction level increases. Facebook’s user base on WhatsApp and other social media platforms give it a significant edge over other competitors in the long run. We could see very high standalone valuation of the digital payments segment within Facebook as the company expands its services to other developing and developed markets. This segment has the capacity to move the needle for the valuation of the Facebook stock and is going to be a key pillar in the future trajectory of the stock.

Rapid expansion

Facebook is seeing lower regulatory hurdles for its payments platform within India and Brazil. These are the two main regions where Facebook has focused in the initial launch of its digital payments services. The recent approval to expand payments to 40 million users in India should allow Facebook to reach the entire user base within major metros where digital payments usage is higher. The company had requested permission to expand the services to all users within India. However, regulators are probably more careful due to the massive reach of WhatsApp and other social media platforms of Facebook.

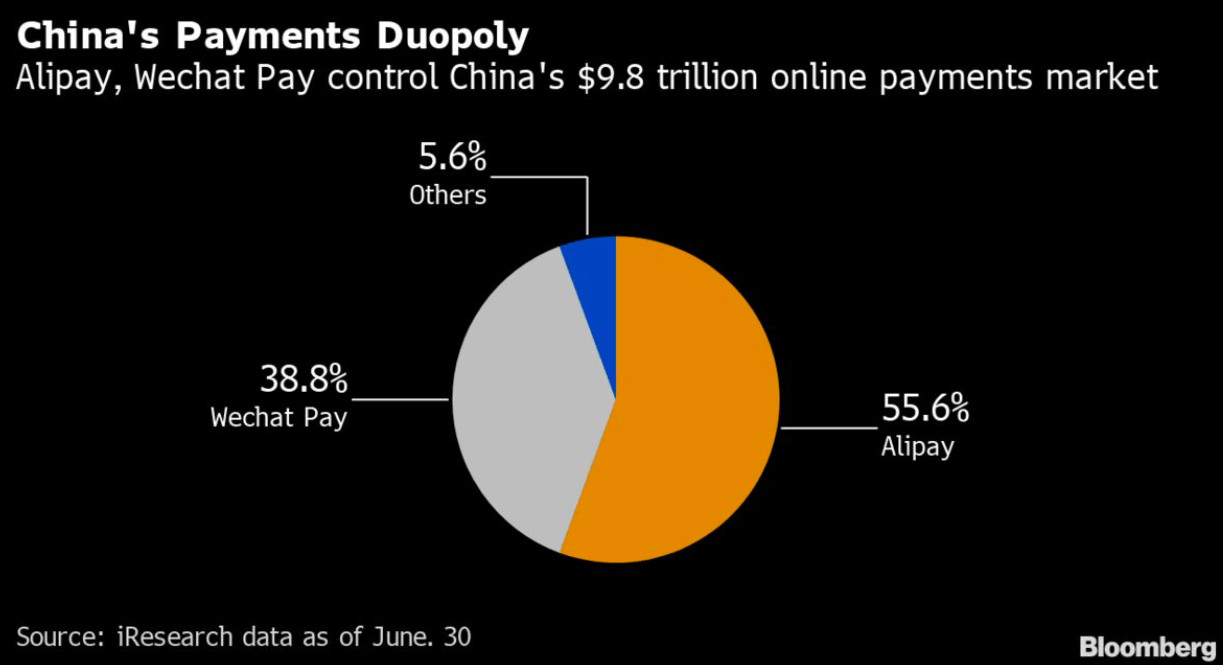

Regulators in Brazil are also becoming less stringent on Facebook which has allowed the company to expand the payments feature to over 100 million users in this region. It is very important for Facebook to increase market share in these regions because it will pave the way for its launch in other developing regions. The penetration of credit and debit cards is a lot lower in developing regions which make them an ideal market for digital payments. We have seen this in China in the last decade. There was an explosive growth of Alibaba’s (BABA) Alipay and Tencent’s (OTCPK:TCEHY) WeChat Pay. This allowed Alipay to reach a valuation of over $200 billion before its public listing was postponed.

Goldmine for Facebook

Digital payments are a small fraction of the larger fintech services. In early stages, digital payments are promoted to encourage users to shift their transactions to online apps. Eventually, new fintech services are offered including insurance, loans, buy now pay later options, and more. Again, this trend was clearly visible in China. Facebook could replicate the success of Tencent’s WeChat Pay because of its social media platform.

We have already seen a rapid growth of fintech services in many developing regions like India, Southeast Asia, Latin America and others.

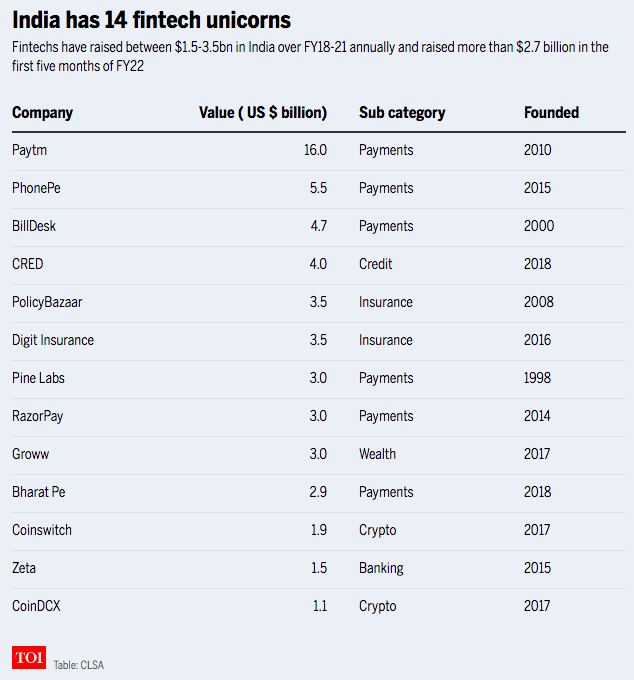

Times of India

Figure 1: There are 14 fintech unicorns in India with combined valuation of over $50 billion. Source: Times of India, CLSA

A number of new fintech companies have already reached unicorn status in India. Besides these unicorns, there is a strong presence of tech giants like Google Pay (GOOG), Amazon Pay (AMZN), Walmart’s PhonePe (WMT) and others. While Facebook has been a latecomer in this field, it has a number of advantages that should allow the company to grab a big chunk of the market over the long run.

Facebook’s advantages

The digital payments and fintech segment should reach maturity over the next few years. Saturation in this segment leads to market share getting divided among three to four major companies. This was clearly visible in China where most of the market share was divided between Alipay and WeChat Pay. Another major feature of this segment is that it heavily favors social media platforms and ecommerce platforms.

The reason is that most of the users have to use their social media apps a couple of times a day which makes it easier for them to use them for digital payments. The ecommerce companies can also gain market share because customers are using their platform for purchases and it is easier to add online payments options to provide a seamless experience.

Bloomberg

Figure 2: Duopoly within China’s payments industry. Source: Bloomberg, iResearch

We can see from the above image that online payments market has effectively become a duopoly in China. This is likely to be replicated in most of the other developing regions where usage of credit cards is limited. As the market matures, Facebook would be in a good position to leverage its social media platform to increase transactions.

Impact on Facebook’s stock

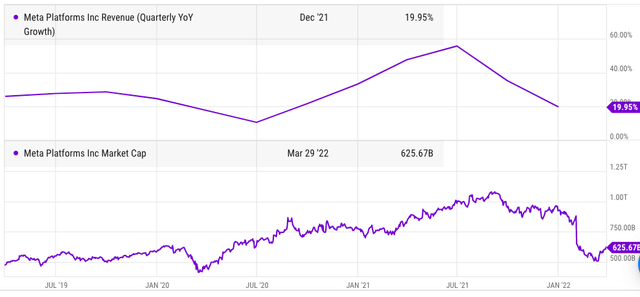

Facebook has shown one of the biggest corrections in recent history. One of the main reasons for Wall Street becoming bearish toward Facebook stock has been the lack of future growth potential. If Facebook can show rapid progress in digital payments and fintech segment, it would provide a strong growth runway for the company and also move the needle in terms of the valuation of the stock.

Alipay had a standalone valuation of over $200 billion at its peak. Rapid growth of fintech segment in India will also lead to a better valuation of major players in this segment. If Facebook’s online payments platform succeeds in India or Brazil, it will show Wall Street that the management can still launch valuable services despite being a latecomer and also increase the chances of expansion of these services across other regions.

The first task of Facebook is to increase the transaction volume in India and Brazil. Once this is achieved, the company can expand to other regions and also bring out more lucrative fintech services like insurance, wealth management, credit and more. Facebook has a bigger addressable market compared to Tencent’s WeChat Pay or Alipay. This should allow the company to gain better standalone valuation compared to these two giants in China.

Figure 3: Facebook’s market cap and revenue growth. Source: Ycharts

We can see that Facebook’s potential in fintech segment is quite significant compared to its current market cap. Becoming one of the top three or four global digital payments and fintech companies in important regions of the globe should significantly improve the sentiment toward Facebook stock. This segment is also big enough to move the needle for the stock making it one of the most important initiatives of the company. Investors should gauge the progress made by the company in this segment and the impact of future growth trajectory on the stock.

Standalone valuation

The possible standalone valuation of Facebook’s future fintech service will depend on its market share and the addressable market size. As mentioned above, the cumulative valuation of new unicorns in India’s fintech industry is already over $50 billion. This does not include important players like Google Pay and Amazon Pay. There is a lot of scope for rapid growth in the next few years as new fintech services are launched and customers become more comfortable.

A report by Boston Consulting Group has estimated that the total fintech industry valuation in India would grow to $150 billion by 2025. Facebook should be able to corner at least 20% of this market due to its 500 million strong user base on WhatsApp in this region. This would equate to an incremental valuation of $30 billion from a single region. Similar progress in other developing economies of South Asia, Southeast Asia and Latin America should add over $100 billion in incremental value for Facebook.

It is also possible that we see better acceptance of digital payments and fintech services in the domestic US market and European Union. A strong performance in a single region should significantly improve the ability of the management to replicate the services in other regions. A lot will depend on future regulations and evolution of fintech industry. It is highly likely that Facebook will be a key player in this industry and replicate Tencent’s success in China because of its social media platform. This should allow the company to add a major growth runway and boost the sentiment toward the stock.

Investor Takeaway

Facebook is rapidly expanding its digital payments services in India and Brazil. It has received permission to expand user base to 40 million in India and could increase this customer base to cover the entire 500 million WhatsApp users in India. Regulators are also becoming less stringent in Brazil where the company has over 100 million user base. The digital payments and fintech segment has already given several unicorns. Services like Alipay had achieved valuation of $200 billion.

Facebook’s social media platforms and WhatsApp give it the perfect tool to rapidly expand its payments services in many regions across the globe. Rapid progress in this segment should help in changing the sentiment of Wall Street towards the company and deliver one of the biggest growth runways for the company.

Be the first to comment