Iryna Imago/iStock via Getty Images

Investment Thesis

Amneal Pharmaceuticals (NYSE:AMRX), a “a pharmaceutical company specializing in developing, manufacturing, marketing and distributing high-value generic pharmaceutical products across a broad array of dosage forms and therapeutic areas, as well as branded products” (source: company Q321 10Q submission) had a reasonably strong year in 2021, while management’s guidance for 2022 implies similar performance this year.

The company delivered net revenues of $2.1bn in FY21 – up ~5% year-on-year – adjusted EBITDA of $538m, and adjusted non-GAAP EPS of $0.85, reflecting a price to earnings ratio of ~5x, which is significantly lower than e.g. the average for US Pharmaceutical giants of ~23x.

Looking ahead, the guidance for FY22 is for $2.15bn – $2.25bn, adjusted EBITDA of $540 – $560m, and adjusted EPS of $0.8 – $0.85 – broadly the same as in 2021.

Granted, the lack of meaningful top line growth could be a concern, and if we look at GAAP rather than non-GAAP figures, EPS in 2021 was just $0.07, compared to $0.62 in FY20, and the FY21 PE ratio increases to 60x whilst there is no GAAP FY22 EPS forecast available.

Amneal isn’t a dividend payer either, so investors looking less risky exposure to the generic drugs markets might prefer to look at e.g. Viatris (VTRS), whose dividend currently yields >4%, or possibly Dr Reddy’s Laboratories (RDY), although the yield here is currently <$0.5%.

Nonetheless, I still find Amneal to be an interesting investment opportunity for several reasons: Namely, the fact that Amneal’s original co-founder brothers, Chirag and Chintu Patel, are back at the helm, the emerging new biosimilar business, the recent acquisitions of AvKARE – a company that provides pharmaceuticals, medical and surgical products, and services primarily to governmental agencies – and Kashiv Specialty Pharmaceuticals, Amneal’s demonstrable commitment to innovation, and M&A, and finally, its depressed market cap valuation.

Amneal’s market cap currently stands at $1.3bn, which is nearly 0.5x forecast FY22 sales. Generics is an unusual business in which P/S ratios tend to be exceptionally low – Viatris’ is ~0.7 – but even when taking into account Amneal’s substantial debt of ~$2.5bn, and net debt to adjusted EBITDA of ~4.6x, when we consider Amneal shares traded at a value of $24 in July 2018, $14 in April 2019, and >$7 one year ago, and that Amneal is profitable again after losses of $201 and $603m in 2018 and 2019, I believe there’s a strong chance of a reversal in the fortunes of the share price.

Amneal may not deliver strong share price upside in 2022 due to a lack of top and bottom line growth, although a recovery to $7 again and >60% upside would not seem to be out of the question. But there are enough reasons to be positive that the growth will eventually come, in my view, as the underlying business strikes me as fundamentally strong, well managed, with clear opportunities to grow. In the rest of this post I will examine the above mentioned reasons to be cheerful in more detail.

Founders Back On Board After Post-Merger Misadventure

The company’s 2 original co-founders – brothers Chirag and Chintu Patel – have in fact been back at the helm since August 2019, but it takes time to orchestrate a turnaround and Amneal now is a much larger business than the one they diligently built between 2002 and 2017.

Amid a competitive generics landscape, in 2017 California-based Impax Laboratories, seeking either a sale, acquisition or merger, and led by M&A specialist Paul Bisaro, apparently found what they were looking for in Amneal.

Amneal, then a private company, agreed to merge with Impax Laboratories in October 2017, borrowing ~$2.7bn to complete the transaction, and creating a top 5 generics giant valued at ~$6.4bn, and forecasting EBITDA of $700 – $750m in its first year, and $200m of cost savings.

Former Allergan CEO Rob Stewart was appointed CEO, as the Patel brothers stepped away from the day-to-day running of the business, becoming Co-Chairmen of the combined company’s Board of Directors, and Bisaro Executive Chairman.

Initially the combined company’s share price performed reasonably well, peaking at $24 in September 2018, but the promised EBITDA did not materialize, and the company announced losses of ~$200m and ~$600m in 2018 and 2019 dragging the share price to a low of $4.

Clearly, the merger was not working out as planned as Amneal announced job cuts, plant closures in the US, and a restructuring plan, as well as the return of the Patel brothers as joint CEOs, and the resignations of Stewart and Bisaro.

Sometimes, a company can only be driven forward by the people who worked hard to build it from the ground up and have the requisite passion, and this seems to have been the case with Amneal.

Although the decision to appoint an experienced CEO for its first steps as a public company may have been the wisest move at the time, it’s the original founders who understand the business better than anybody else, and have the most motivation to make it succeed again, in my view. Since 2019 when the brothers took back day-to-day running of the company, as Chirag Patel remarked on the Q421 earnings call:

Since 2019, revenue is up $468 million or 29% and adjusted EBITDA is up $182 million or 51%.

Generics, M&A and Developing Biosimilars May Be Key To Unlocking Value

Amneal’s business has many moving parts but is essentially comprised of three different divisions – the Generics segment, which drove $1.37bn, or 65% of Amneal’s revenues in 2021, the Specialty segment, which drove $378m, or 18% of revenues, and AvKARE, which drove $349m, or 17% of revenues.

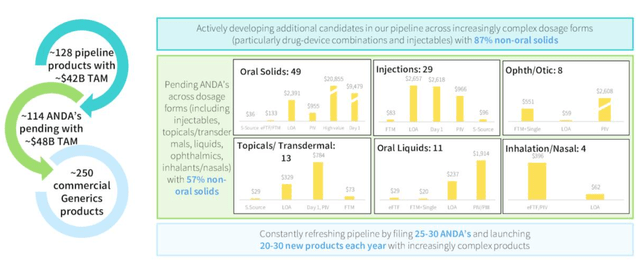

Within Generics, there are ~250 marketed products, 114 Abbreviated New Drug Applications (“ANDAs”) submitted to the FDA, with a total addressable market (“TAM”), management believes, of $48bn, and a further 128 pipeline products, with a TAM of $42bn (source: Q421 earnings presentation).

With so many products, it seems hardly surprising that Amneal’s business is challenging operationally – the average “big pharma” concern has nothing like that number of products – but this can also be seen as a competitive advantage, and management are attempting to introduce more complex generic drugs- non oral solids as opposed to oral solids for example – to offer a more sophisticated, and presumably lucrative product mix.

Amneal Generic division overview. (earnings presentation)

Amneal Generic division overview. Source: Q421/FY21 earnings presentation.

Generics is Amneal’s bread and butter – it’s 44 products launched in 2021 earned $176m, and it was first of second to be approved in 46% of its new product launches, which speaks to an in-depth knowledge of the industry.

Amneal has beefed up its injectable generics segment with the acquisitions of both India based Puniska Healthcare, in a ~$93m deal, and its 293k square foot manufacturing facility, and Saol Therapeutics’ antispasmodic baclofen franchise, which takes the injectables segment revenues beyond $150m, management says.

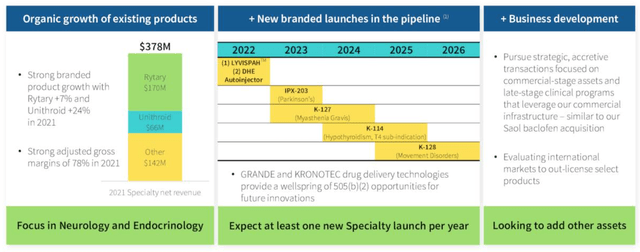

Within Specialty, which involves the “development, promotion, sale and distribution of proprietary branded pharmaceutical products, with a focus on products addressing central nervous system (“CNS”) disorders, including migraine and Parkinson’s disease,” management hopes to launch at least one new product per year, as shown below.

Specialty Division Overview. (earnings presentation)

Source: Q421/FY21 earnings presentation.

As we can see, management isn’t afraid to invest in new opportunities via M&A either, and although debt levels are high, there’s also >$1.5bn current assets that can potentially be deployed. Despite the difficult merger with Impax, it’s clear management hasn’t lost its ambition to grow inorganically as well as organically. Amongst the new product launches planned, there may be >$1bn in sales, management believes, while an added advantage is the presumably strong relationship Amneal must have with the FDA, having had so many generic products approved.

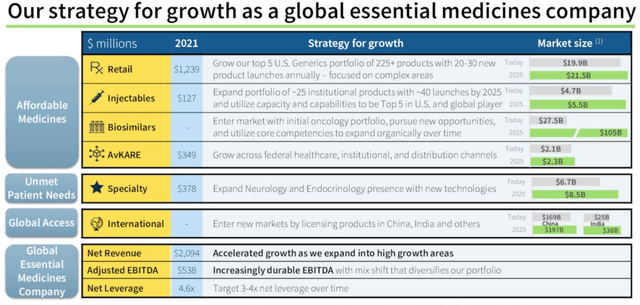

Although the AvKARE business offers limited growth prospects (but remains a good source of reliable, recurring revenues), when we review the company’s strategy, below, there is one opportunity that stands out, and this is biosimilars.

Amneal global growth strategy. (earnings presentation)

Source: Q421/FY21 earnings presentation.

Management believes this a $25bn market opportunity presently, rising to >$100bn by 2025. I discussed biosimilars in a recent note on Viatris and Organon (OGN) as follows:

Biosimilars – a “biological product that is very similar to a reference biologic and for which there are no clinically meaningful differences in terms of safety, purity, and potency” (source: Drugs.com) – is an important, growing and controversial part of the pharmaceutical landscape.

A biosimilar is very similar to a generic, but its biological profile is not identical to the drug it is trying to imitate – so long as the efficacy and safety match the drug, however, the biosimilar can get around some of the restrictions that apply to generic drugs.

With drug pricing a constantly recurring issue in Pharma, biosimilars – that are potentially cheaper to manufacture and can undercut established drugs on price – are considered to have massive growth potential.

Ironically, shortly after this post, Viatris offloaded its biologics division to India based Biocon in a $3.3bn deal, not necessarily a vote of confidence in the sector, although Viatris has taken a sizable equity stake in Biocon.

Amneal clearly views biosimilars as essential to its growth strategy however, with Chirag Patel opening the recent Q421 earnings call by discussing the recent approval of Releuko, a biosimilar version of filgrastim, used to treat low neutrophil count, describing it as “truly a watershed moment for Amneal,” and later commenting:

In biosimilars, we expect to enter the market in 2022 with our initial oncology portfolio of three products. The total addressable market for these products is $6.3 billion with $2.9 billion representing the biosimilar portion.

Beyond those, we’re also actively looking at additional partnership opportunities where we can be early to market, preferably first or second. The pipeline for the industry remains robust with approximately $148 billion in total biologics products revenue facing loss of exclusivity in the next decade.

Of course, that does not mean there is a $148bn market opportunity on the table since once a drug loses its patent exclusivity and generics / biosimilars enter the market, prices rapidly decline by as much as 90%, but it can certainly be a double-digit billion opportunity for Amneal, in my view. On the earnings call, Chirag Patel compared the Releuko approval to the company’s first folic acid approval in 2005 at Amneal, pointing out that “now today, we sit on 350 approvals.”

The next two biosimilars planned are pegfilgrastim, and bevacizumab – the latter is a version of Roche’s (OTCQX:OTCQX:RHHBY) Avastin, which earned >$5bn of revenues in FY20, and has a PDUFA date of 17th Aril (when the FDA will rule on whether to approve the drug), which is a potentially significant share price upside catalyst for investors to look forward to.

Biosimilars is already a competitive market, but so was generics when Amneal won its first approval in 2005, and the determination to succeed is palpable, while the company’s presence in emerging markets where demand for such products is likely to be high and manufacturing costs cheaper is another potential competitive advantage.

Conclusion – Amneal May Have Made A Mess Of Impax Merger, But Company Can Come Back Stronger

It seems to me that Amneal did what it had to do to find its way onto the public markets via its merger with Impax, and the Patel brothers may have played their cards right by stepping away from the company, distancing themselves from the difficulties the company faced, before taking back the reins when it became clear that the company was failing.

It hasn’t been a rewarding period for shareholders, but it was probably the right thing to do to install an experienced CEO of a public company. Now, however, the founders are back in charge of a $1.3bn market cap listed company, with sales nearly twice that figure, cash to deploy, and multiple new business opportunities.

The GAAP net income and EPS seems to imply that the turnaround is not yet complete, and there is a long way to go. Debt needs to be paid down, and new businesses integrated whilst existing ones need to be restored to profitability in competitive markets.

Personally, however, I find the generics business model – and as a consequence, the biosimilars model, fairly attractive, given its global nature, and reduced costs of product development, but in order to succeed, you need an excess of determination and ambition.

I could be reading this incorrectly, but I think that is what the twin-CEO’s bring to Amneal – their passion seems to be communicated more strongly than most biotech companies via earnings calls, presentations, and most importantly, performance, and that is why I don’t think the company’s share price will be depressed for much longer.

The only thing missing is a dividend or a share buyback program, but perhaps, after steadying the ship, management can consider adding these to the mix also.

Be the first to comment