GoodLifeStudio/iStock Unreleased via Getty Images

Between COVID and escalating recession worries, it does feel a bit “two steps forward, one step back” for Hyatt Hotels Corporation (NYSE:H) and the rest of the beleaguered lodging industry.

Granted, COVID is now becoming less and less of a concern after a very tough couple of years, but the impact of the ‘Omicron’ wave will weigh on FY22 financials. Meanwhile, slowing economic growth brought about by interest rate hikes and high energy and commodity prices might further delay what should be a relatively straightforward post-pandemic recovery story.

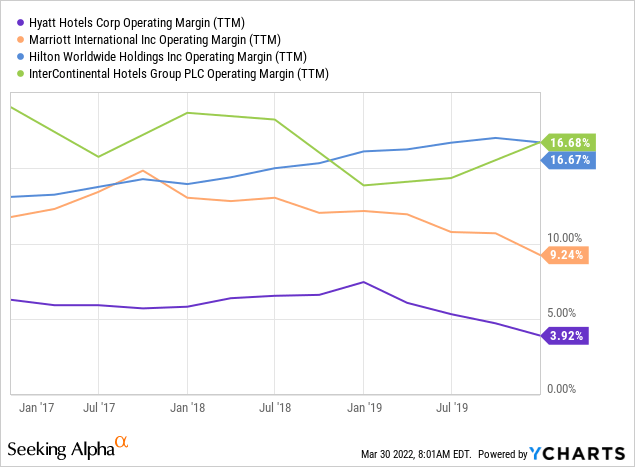

Setting those issues to one side for a moment, I do like the increasingly fee-based business model of industry leaders like Marriott International (MAR), Hilton (HLT), InterContinental Hotels (IHG) and Accor (OTCPK:ACRFF). Hyatt is a bit further back in that endeavor, although it is gradually getting there, while other aspects of its portfolio positioning, plus its growth prospects, look pretty attractive.

While the above amounts to one of the more interesting long-term investment cases in the industry, the pile-up of near-term headwinds potentially affecting the stock and Hyatt’s business is something to chew on. Given that a full earnings recovery here is a 2023 story at best, prospective investors can probably afford to wait a bit before committing.

Making The Right Moves

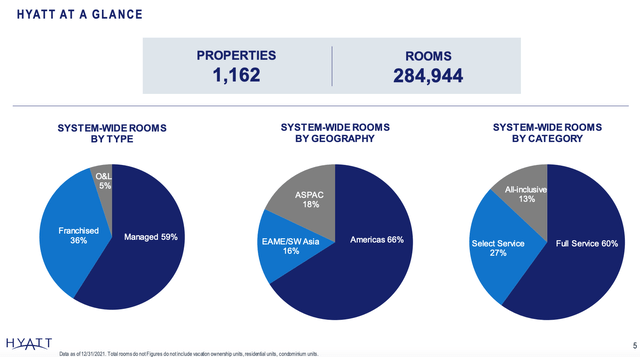

With 1,162 hotels and ~285k rooms globally, Hyatt is at the small end compared to peers Marriott (~1,500k rooms), Hilton (~1,100k rooms), IHG (~880k rooms) and Accor (~775k rooms).

It is also less further along in its transition to a fee-based business model, with around 5% of its rooms still attached to owned and leased (“O&L”) hotels as opposed to managed and franchised. Recently covered IHG, for instance, had just 0.5% of its room count in O&L hotels at the end of 2021.

Source: Hyatt Hotels March 2022 Investor Presentation

Although it might sound like I’m splitting hairs a bit here – 5% doesn’t usually sound like a big number – it shows up more on the revenue side, with 28% of the FY21 top line attributable to O&L hotels. Furthermore, because Hyatt also takes on the operating expenses associated with the day-to-day running of these hotels, its margins are lower than peers.

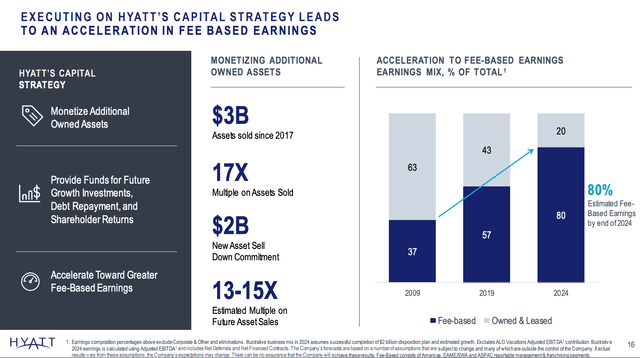

While that remains the case currently, the company is taking measures to boost the share of income generated by franchise and management fees. Indeed, the fee-based earnings mix has increased from sub-40% in 2009 to well over 50% currently, and management aims for it to hit 80% by 2024.

Source: Hyatt Hotels March 2022 Investor Presentation

Given that this should both boost profitability and lower capital intensity – reducing cyclicality in the business and making growth easier to fund – management is definitely making the right moves here.

Portfolio Positioning Otherwise A Positive

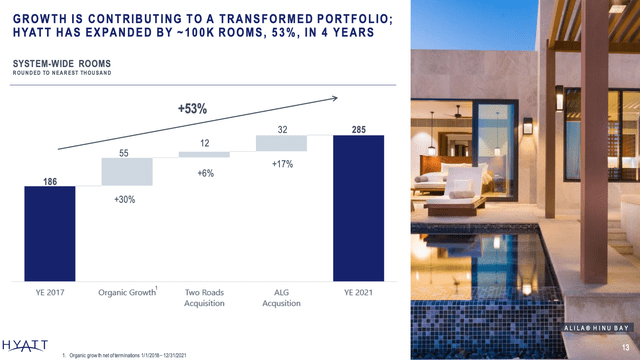

Although the above is still a work in progress, Hyatt does have a couple of things going for it in the here and now. For one, I like its portfolio positioning, with virtually all of the company’s brands positioned in the upscale category and above. The $2.7bn acquisition of Apple Leisure Group last year, which added around 100 resorts to Hyatt’s system, further positions the company toward high-end travelers.

With that, it’s worth noting that a number of the company’s peers are beefing up their higher-end exposure. For instance, 42% of IHG’s pipeline consists of hotels in the upscale and luxury segments (versus around 32% of its current system), while at Accor, 35% of the pipeline was in luxury & upscale at the end of 2020 (versus a sub-30% share of its then system).

These higher-end segments are potentially more profitable, based on higher revenue per available room (“RevPAR”). Furthermore, this end of the market is especially fragmented, with many independent luxury hoteliers keen to expand into branded partnerships due to the perceived benefits of associating with global players (access to global-level marketing, loyalty programs driving higher occupancy rates, and so on).

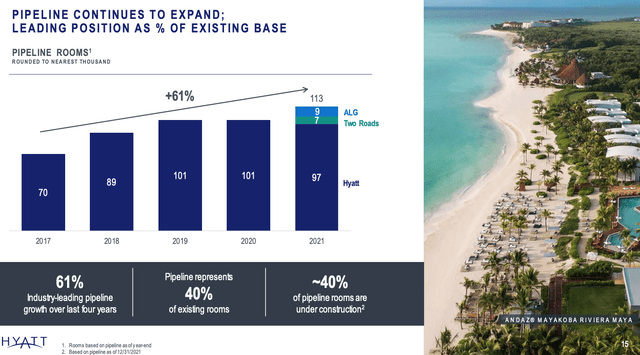

Source: Hyatt Hotels March 2022 Investor Presentation

All said, these dynamics can support higher organic unit growth at Hyatt, which averaged 6.7% annualized between 2017 and 2021.

Slowly Emerging From COVID

The events of the past two years have clearly been a big drag on Hyatt’s business. The company was arguably more sensitive to begin with for reasons set out above, though its higher geographic exposure to the Americas was probably a mitigating factor. Still, there’s only so much you can gloss over, and the company remained loss making last year even as most of its peers returned to posting modest profits.

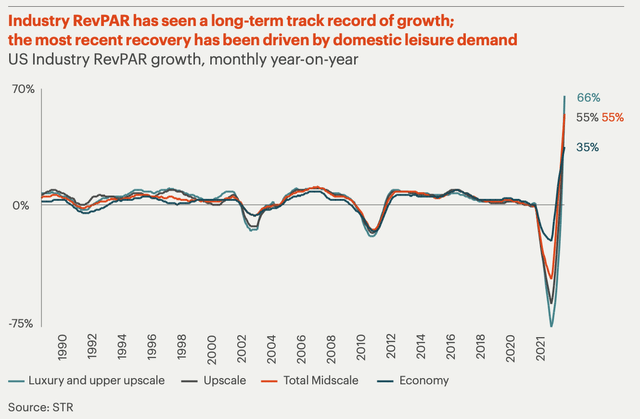

The recovery has thus far been uneven. Leisure demand has been robust, with Q4 2021 system-wide revenues actually eclipsing 2019 levels for comparable hotels, while revenues attributable to Business and Group remained much more subdued, albeit tentatively improving. All said, comparable system-wide RevPAR was $77.80 in FY21, improving to $96.75 in Q4, with those figures representing ~43% and ~26% falls on FY19 and Q4 2019 respectively.

The “Omicron” wave will have an impact on FY22 figures. By December, comparable system-wide RevPAR had reached 84% of 2019 levels, but this had weakened to just 63% in January 2022. On the plus side, management noted in its Q4 earnings call Q&A session that resurgent COVID-related headwinds have proved transient, and should therefore be limited to the first quarter:

I’ll tell you — I’ll just give you a real-time data point as we sit here right now. Presidents’ Day weekend, which is just ahead of us, up double digits relative to 2019 in our legacy Hyatt portfolio. So I would just tell you that Omicron considerations have dissipated as quickly as they rose at the inception.

Mark Hoplamazian – President & CEO of Hyatt Hotels Corporation.

Investors Can Probably Afford To Wait

Hyatt’s long-term growth prospects are attractive, with its current pipeline size (~40% of the current system) comparing favorably to Marriott (~32%), Hilton (~38%), IHG (~30%) and Accor (~28%). Management expects 6% net rooms growth in 2022, a rate which it can easily maintain in the medium-to-long run. Combined with long-term low single-digit annualized RevPar growth, Hyatt has one of the most attractive long-term growth outlooks in its peer group.

Source: Hyatt Hotels March 2022 Investor Presentation

While I’m bullish on the company’s long-term growth prospects, near-term headwinds are growing stronger. Firstly, recession worries are increasing, and that historically means downward pressure on RevPAR, especially given business travel is still fragile:

Source: IHG 2021 Annual Report And Form 20-F

Furthermore, interest rates are also on the up, potentially putting pressure on equity valuations, particularly at the ‘growth’ end of the market.

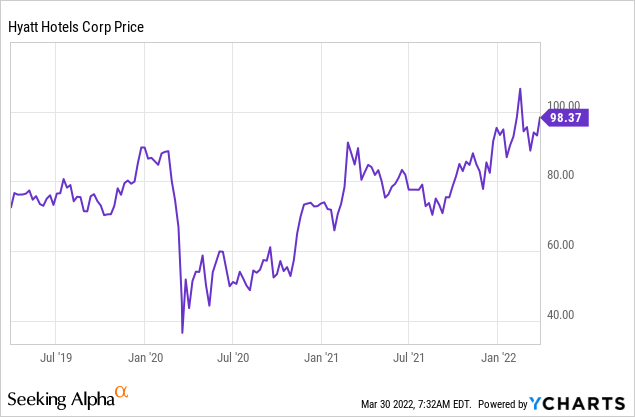

Hyatt stock has had a great run, recovering all of its COVID losses and re-approaching the $100 mark, but that leaves it trading at a lofty looking 60x FY23 EPS estimates as per Seeking Alpha. With headwinds mounting in the near-term and profits not set to recover to pre-COVID levels for at least another year, prospective investors can afford to wait. Hold.

Be the first to comment