jetcityimage

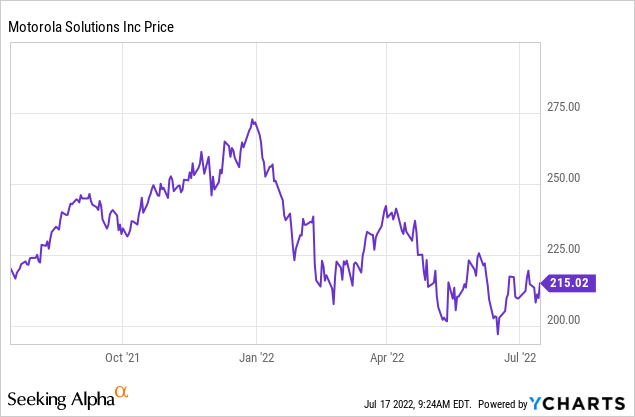

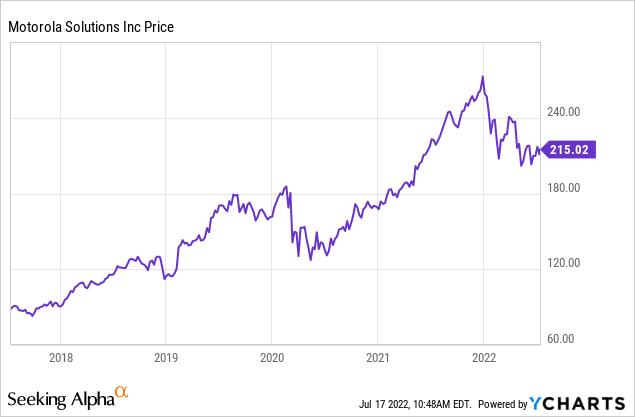

Like many companies this year, the stock of Motorola Solutions (NYSE:MSI) is down significantly YTD (~20%, see graphic below). However, the company’s Q1 EPS report was a strong beat and – perhaps even better – the company posted a record backlog as pent-up demand for its products is driving growth going forward. Meantime, while MSI’s land mobile radio (“LMR”) continues to be its largest source of revenue, the company’s niche acquisitions over the past few years has opened a huge TAM opportunity for its Video Security & Access Control (“VS&A”) business. As a result, I am upgrading my rating on MSI from HOLD to BUY.

Earnings

Despite a challenging macro-environment, Motorola Solutions released a strong Q1 EPS report that was a beat on both the top- and bottom-lines. Revenue of $1.9 billion was up 7% yoy while the company enjoyed record first-quarter orders, sales, and ending backlog ($13.4 billion, +19% yoy). GAAP EPS of $1.54/share was up 9% as compared to Q1 of last year.

The strong backlog was driven by a 26% increase in the Products & Systems Integration Segment as orders for LMR and Video Surveillance systems were strong. However, the largest increase in the backlog ($1.3 billion) came from the Software & Services Segment due to the extension of the Airwave contract in Q4 of last year as well as an increase in multi-year software & services contracts in North America.

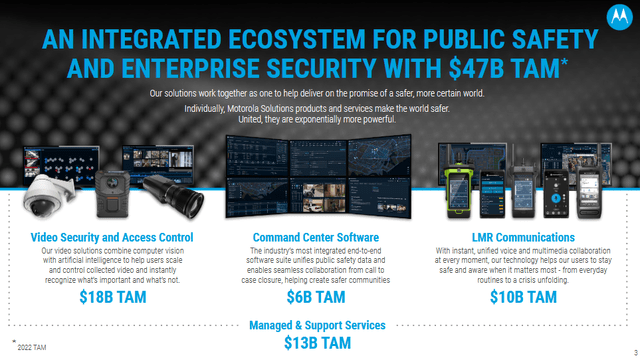

As I reported in my previous Seeking Alpha article on MSI, the company has been using its excellent free-cash-flow generation to make niche acquisitions in video surveillance over the past few years (see MSI Uses M&A To Bolster Growth Profile). This strategy has opened up a huge new market opportunity for the company. Indeed, in the company’s June “MSI Monitor” IR newsletter, CFO Jason Winkler pointed out that video security is an oft-overlooked and underappreciated market for MSI:

Our journey in Video Security & Access Control (VS&A) started just over four years ago with our acquisition of Avigilon. This strategic investment decision reflected our belief that video was a strong fit with our communications technologies enabling public safety and enterprise security. Since then, through a number of additional acquisitions, we’ve significantly expanded our portfolio of fixed, body-worn and in-car cameras, and extended our capabilities in both cloud and AI which have brought us into adjacent areas such as access control, weapons detection, loss prevention and license plate recognition. Today video security and access control represents our largest addressable market at over $18B.

MSI’s Market Opportunities (Motorola Solutions)

Indeed, during Q1 VS&A software grew 28% and Motorola continues to invest in the sector. In addition to acquiring TETRA Ireland during Q1, MSI also bought Ava Security and, after the quarter’s end, acquired cloud-based video analytics expert Calipsa for $40 million and announced plans to buy Videotec – a maker of ruggedized video solutions (explosion proof cameras) for use in harsh industrial environments. Clearly MSI is taking dead-aim at the large $18 billion video security and access control TAM and this effort will likely drive growth for years to come.

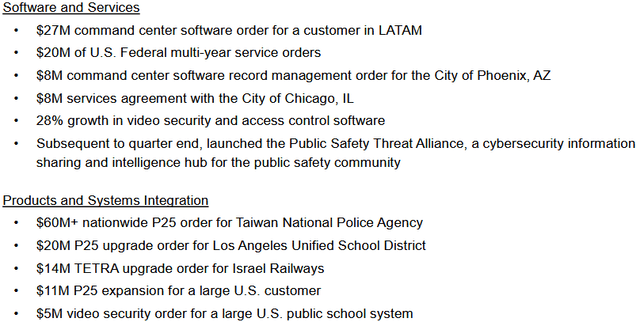

Notable Contracts & Developments

As can be seen in the graphic below, Motorola Solutions continues to demonstrate order strength across a wide variety of governmental agencies and has a broad geographic footprint:

Shareholder Returns & Capital Allocation

During Q1, MSI bought-back $493 million of shares while only paying $134 million in dividends and $54 million in cap-ex. My followers know I am not a big fan of such an over-emphasis on buybacks as compared to the dividend. However, MSI raised the dividend 11.3% last year (from $0.71 to $0.79/share) and I suspect the company’s continued strong financial performance is likely to lead to another double-digit increase this year.

Meantime, the company continues to invest in the future: the TETRA Ireland and Ava Security acquisitions cost a combined $507 million.

Challenges

In the short- to mid-term, MSI faces significant operating challenges. Supply-chain disruptions, inflation, and the strong US dollar crimped margins in Q1. Indeed, MSI raised forward guidance on foreign exchange headwinds for FY2022 from $110 million to $170 million. In addition, note that Q1 free-cash-flow declined from $318 million in Q1 of last year to only $98 million. However, this was due primarily to an increase in inventory and is likely a one-off as shipments will likely be robust in Q2.

MSI’s combined FY2021 sales in Russia and Belarus amounted to less than $25 million. That being the case, the company does not anticipate that the Russia-Ukraine conflict will materially or adversely affect it. However, the conflict is obviously still ongoing and any escalation could disrupt the global economy or global supply chains and could materially and adversely affect the company’s operations going forward.

Upside risks include growth in MSI’s recurring revenue base due to increasing sales in software, services, and video surveillance products. Meantime, the company’s LMR business is a stable generator of free-cash-flow because customers are entrenched in Motorola’s solutions as a result of relatively high switching costs and risks of changing suppliers for these mission critical systems.

Summary & Conclusion

MSI’s stock is down ~20% YTD and currently trades at a relatively attractive 21.8x forward earnings. Yet the Q1 report was strong, the Q1 backlog was an all-time record, and the company is guiding for 7% revenue growth this year. Indeed, Goldman Sachs believes Motorola Solutions is one of the least vulnerable companies when it comes to recession margin pressure. Note the companies $13.4 billion backlog at the end of Q1 equates to 1.5x FY22 expected revenue of $8.7 billion.

While the $3.16/share annual dividend (1.43% yield) is likely not overly attractive to income investors, MSI’s dividend growth outlook remains excellent. Meantime, video surveillance is a very large ($18 billion) market opportunity for the company and MSI is superbly positioned to grab a significant slice of that market.

Add it all up and I am raising my rating on MSI from HOLD to BUY. Given expectations for non-GAPP earnings of ~$10/share for FY22, MSI could easily trade back up to $250 from the current $215, or 15%+. Note from the 5-year chart below that MSI was trading ~$270 at the beginning of the year.

Be the first to comment