Guillaume

I used to be a franchisee – someone who owned his own business… yet didn’t at the same time.

It’s a very interesting model with some distinctive benefits and drawbacks alike.

In the definite pros category is brand recognition and the established customer base that comes with it. That’s something most entrepreneurs and new small business owners don’t get to enjoy.

Not only do they have to worry about running their business including staffing, payroll, taxes, and the like… they also have to handle excessive amounts of advertising that often leave them in the red for months, if not years.

When it comes to how frustratingly slow it can be to grow a business when you’re a relative nobody, take it from someone who started out very small here on Seeking Alpha 12 years ago. I didn’t have advertising options at the time. And so it took me a decade to build up the sizable following I have today.

I can’t tell you how much work, long nights and early mornings it took to make a success story here.

Not that I’m complaining, mind you. In fact, I’m very proud of how far I’ve come on Seeking Alpha. The struggles taught me just as much, if not more, than the achievements.

I’d even venture to say that the process may have taught me more than the “easy way” I chose before when I operated stores for both Athlete’s Foot and Papa John’s (PZZA).

Franchisee Perks I Once Knew and Enjoyed

Before anyone gets mad at me, I put “easy way” in parentheses for a reason. For all of you running your own franchises for McDonald’s (MCD), Chick-fil-A, 7-Eleven, etc., believe me when I say…

I know it’s not easy. Honestly, I felt I was parenting entire broods of teenagers while running my stores – on top of actually parenting teenagers.

All the same, I did have customers automatically coming to me, knowing what I sold and where I sold it. To quote Rush Cycle:

“The marketing, business plan, and franchise operations (are) already in place for (franchisees). You won’t need to develop a business strategy, collect market research, determine what product(s) and service(s) you are offering, test whether or not the public wants and responds to those offerings, and scale your finding to maintain profitability.”

It also adds you have:

- Established logistics and supplier relationships

- Training programs (for employees)

- Assistance opening the business

- Easier access to financing

- A franchisee network and support from your franchisor.

All true. And in my case, I didn’t have to worry about landlord issues either.

Because I was my own landlord (for several locations).

You see, I became a franchisee in the first place because I had some open spots at some of the strip malls I’d built and owned. Like every other landlord, I wanted full occupancy. So when the mountain wouldn’t come to Mohammad, Mohammad went to the mountain instead.

Ultimately, it didn’t work out for me, and not just because of those “teenager” issues. As my regular readers know, I bit off more than I could chew as both a landlord and a tenant.

But there are others out there in much better positions to make it work.

The REIT Way of Looking at It

This brings me to equity real estate investment trusts (REITs), which are landlords by their very nature. They own portfolios full of anything from office buildings to apartment complexes to hotels to hospitals to retail centers and beyond…

Then rent them out to tenants.

They’re in the business of collecting rent checks. In fact, by law, 75% of their owned (or leased) assets’ total value must come from real estate holdings.

But some of them have been exploring that 25% over the last few years. They’re investing in their own tenants – and sometimes buying them up altogether.

This is typically happening when the tenants are struggling. If they’re renting out a significant enough portion of the REITs’ space… losing them could be a big financial hardship. So these corporate landlords are stepping in to save their own days.

At least that’s the intent.

As I (kind of sort of) knew when I first set out to build shopping centers – and then own them and then rent to myself – there are no guarantees involved in any business venture. And as I learned firsthand when the 2008 crash killed my entire operations, that means sometimes business ventures crash spectacularly.

Sometimes that’s management’s fault, as it was in my case to a large degree. Simply put, I was going overboard with everything from taking on too much to spending too much.

Other times, life happens in ways we don’t want or expect, which I can also relate to. After all, I didn’t plan on the housing market crashing.

But either way, there’s money to be made and lost in the process. So let’s explore a few examples and one failure…

Kimco is its Name-O

Kimco Realty (KIM) is the largest shopping center REITs with a national portfolio of 526 properties, including mixed-use assets, that are predominately grocery anchored.

Over the years, KIM has enjoyed a history of investing in real estate rich retailers such as Albertsons, Montgomery Ward, Franks Nursery & Crafts, and Woolco.

So, KIM has decades of retail property experience, financial acumen, and strong retailer relationships that have resulted in unlocking real estate value for both retailers and property owners.

More recently KIM announced that based on the value of the total consideration per share paid to shareholders in the Kroger-Albertsons merger (Merger Announcement), its existing stake in Albertsons Companies (ACI) has an implied valued of $34.10 per share representing a significant premium of over 37% to the closing share price on Sept. 30, 2022.

The Merger Announcement further specifies that part of the cash consideration will be paid in the form of a $6.85 per share special cash dividend on Nov. 7, 2022.

Subsequent to the Merger Announcement, KIM monetized 11.5 million of its 39.8 million shares in Albertsons, generating net proceeds of approximately $301.1 million. KIM still retains 28.3 million shares of Albertsons.

“The proposed merger of Kroger and Albertsons implies a significant increase in the value of our stake and is further validation of our long term and profitable investment in Albertsons,” said Conor Flynn, KIM’s CEO.

In connection with the proposed transaction, KIM agreed not to sell 28 million of its shares in Albertsons for a period of up to seven months. Upon the expiration of this lock-up, KIM will have full flexibility over its Albertsons holdings including its ability to further monetize shares at its discretion subject to REIT compliance requirements.

KIM’s common stock dividends paid in 2022 to date were based on projected REIT taxable income and did not include any potential gains from the sale or special dividend distributions from its Albertsons investment. As a result, the company anticipates it will make a special dividend to maintain its compliance with REIT distribution requirements.

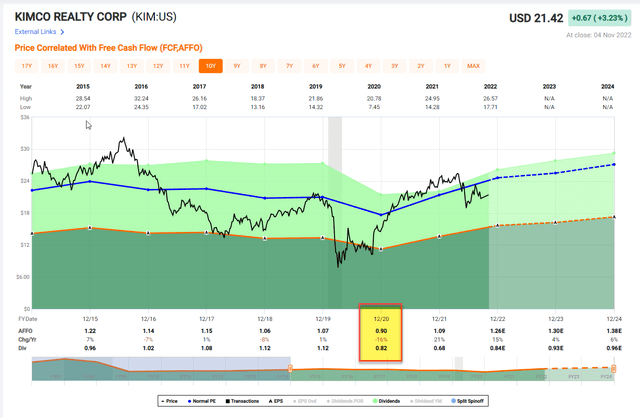

As viewed below. KIM did cut the dividend in 2020, and has since clawed back its earnings power to pre-COVID levels. Analysts estimate AFFO per share of $1.26 in 2022 (highest ever) and 4% growth in 2023 and 6% growth in 2024.

Shares are now trading at 17.4x vs. 19.0x – the average multiple over the last six years. The dividend yield is 4.3% and now covered better than ever. KIM has proven it can be a world-class landlord, while also making tactical investments that deliver enhanced shareholder returns.

FAST Graphs

Simon Says…

Simon Property Group (SPG) is a mail REIT with retail operations investments include SPARC Group and JCPenney. SPARC includes seven brands— Aéropostale, Brooks Brothers, Eddie Bauer, Forever 21, Lucky Brand, Nautica and the most recent addition, Reebok.

SPG entered a joint venture (partners include Brookfield Asset Management, Inc. and Authentic Brands Group) to acquire JCPenney out of bankruptcy in December 2020.

In just one year, SPG stabilized the JCP business, significantly improved financial results, de-levered the balance sheet, added private and exclusive national brands, and established a new leadership team focused on the future growth of this storied retailer.

The retail operations produced terrific results in 2021, outperforming on gross margin and EBITDA.

SPG has an approximate 10% ownership interest in ABG, a world-class intellectual property, brand development, marketing, and entertainment company.

The ABG licensing platform includes more than 30 brands and generates approximately $10 billion in gross merchandise value through its network of over 700 partners globally.

SPG recognized a significant gain in ABG due to their recapitalization that happened at the end of 2021. The market value of ABG when SPG first invested was a little over $1 billion and now it’s over $13 billion.

In addition to SPG’s successful investments in traditional operating retailers and licensing ventures, the mall giant continues to advance the digitization of its business through an investment in Rue Gilt Groupe, a leading premium and luxury offprice e-commerce portfolio company, consisting of three brands—Gilt, Rue La La and Shop Premium Outlets.

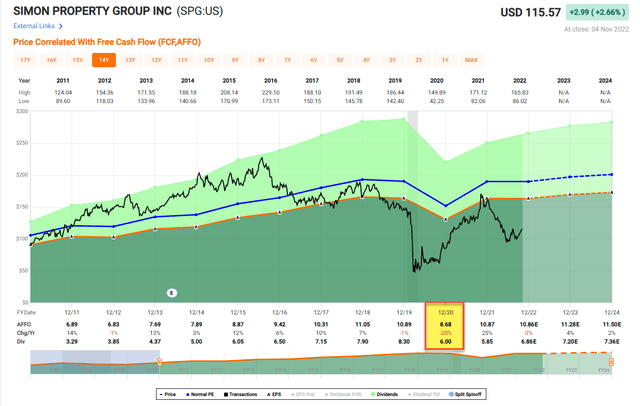

Of course, Mr. Market sees no value in Simon, the tenant. As viewed below, shares are trading significantly below normal valuating ranges. Also, the company cut its dividend in 2020 from $8.30 per share to $6.00 per share.

Shares are trading at 10.6x compared with the longer-term average of 17.5x. Similar to KIM, SPG’s is earning more per share ($10.6 per share in AFFO) than it has in its entire history. Also, analysts are forecasting 4% growth in 2023.

Bottom line – there’s a lot to like about SPG right now!

FAST Graphs

A Hospital Sharp Shooter

Medical Properties Trust (MPW) is a hospital REIT that has been in the media a lot these days. For example, you can read my recent articles here and here. MPW delivered solid Q3-22 results and in Sunday’s edition of the Wall Street Journal

“Many of the trends associated with pandemic finally are starting to unwind, allowing hospitals to look more like their old selves. On the positive side ate a return of non-COVID patients and a stabilizing labor environment as most hospitals hire new medical staff.”

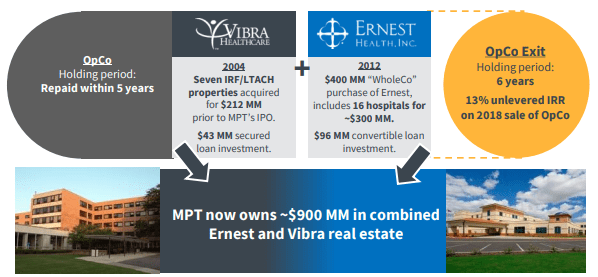

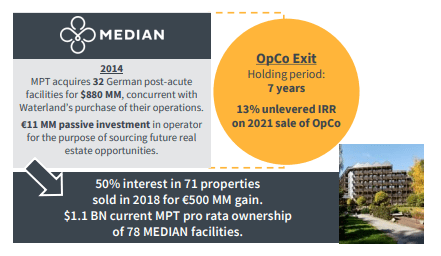

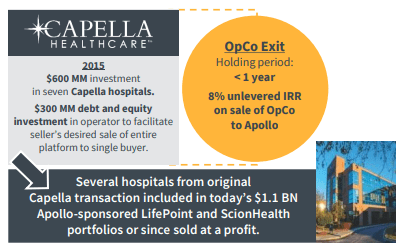

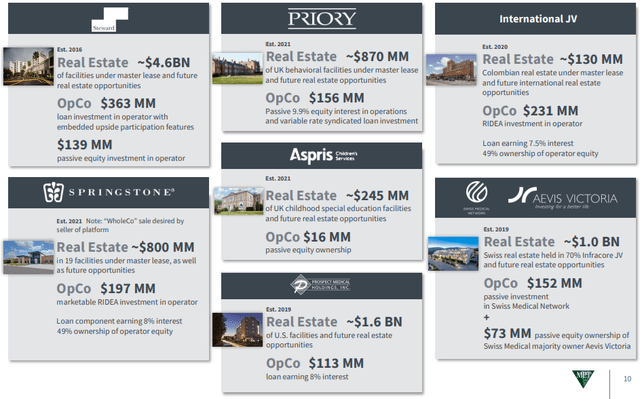

Over the years MPW has been successful investing in OpCos – a highly profitable competitive advantage for the Birmingham-based REIT. MPW’s scale and expertise are of great benefit when a seller mandates a “WholeCo” exit (i.e. Ernest, Capella, Springstone).

OpCo investments become independently marketable for profitable exit, often quickly, and cash consideration was paid from MPW to the seller and not retained by the operator in materially all cases listed below:

MPW Investor Deck

MPW Investor Deck

MPW Investor Deck

MPW Investor Deck

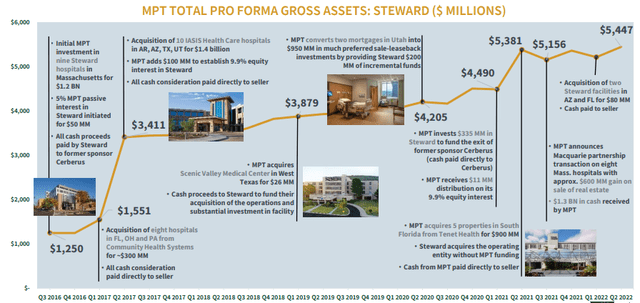

One of the biggest risks for MPW is the company’s concentration with Steward hospital system where the company has made several investments with the OpCo.

Approximately $1.6 billion in cash rent and interest was collected on real estate leased to Steward since Q4-16. In Q1-22 there was an approximate $600 million real estate gain on sale of eight Massachusetts hospitals

Secondarily, equity and structured debt investments position MPW to benefit from growth in the value of Steward, with limited downside. Steward’s Utah operations are highly profitable and generating ~$105 million of EBITDA run-rate.

MPW Investor Deck

On the Q3-22 earnings call, MPW’s CEO explained,

“When we reported to you three months ago Steward was in the middle of managing its cash flow to satisfy these cash requirements. Since then and again with some assistance from MPT, Steward has weathered this cash strain and is now on the flip side of these circumstances and expects to be strongly cash flow positive starting with the fourth quarter of 2022.

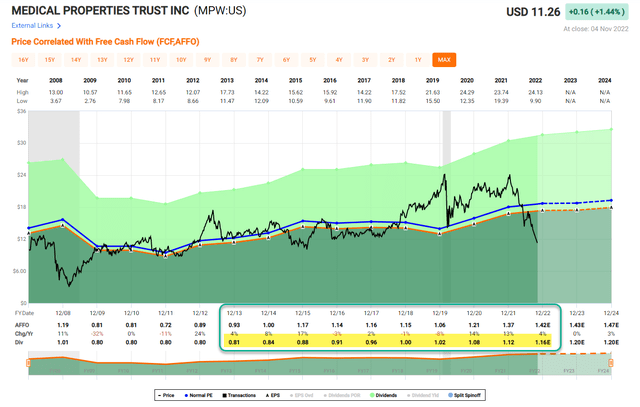

As viewed below, MPW has increased its dividend every year since 2013 and the dividend is well-covered. AFFO per share hit an all-time high in 2022 (analysts estimate $1.42 by YE) with modest growth of just 1% in 2023.

Some consider the OpCo deals shady, but our view is that MPW has a circle of competence in the sector and has proven that it can be successful investing on both sides – as a landlord and tenant.

FAST Graphs

In Closing…

There are examples in REIT-dom in which the landlord and tenant combination are destructive.

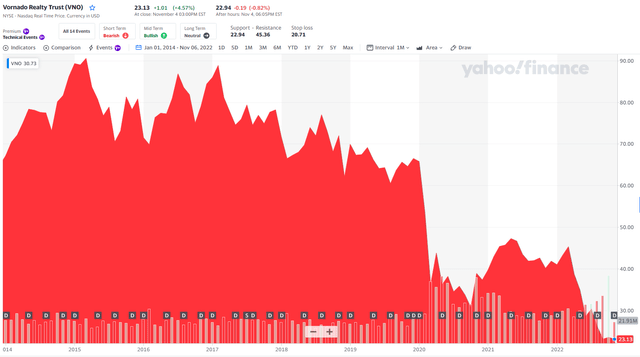

You may recall an article I wrote a few years back on Vornado Realty (VNO),

“Over the years Vornado has made frequent plays “outside its wheelhouse of prestige office and retail leasing,” which is unusual for a REIT. In doing so, Vornado has made debt and/or equity investments in numerous companies that the REIT does not control (or has sole control) including investments in Alexander’s Inc. (ALX), Toys ‘R’ Us, J.C. Penney Company (JCP), LNR Property Corporation, and other equity investments.

However, many of these bets haven’t paid off for Vornado and the company has been working to shed itself of the non-core assets. In September (2013) Vornado sold its remaining 13.4 million shares in J.C. Penney for $13 a share, ending a three-year investment in the struggling department store operator it had pushed to renew itself. Vornado owned 6.1 percent of shares, which it sold in a block trade to Citigroup.”

Yahoo Finance

The big difference here – with VNO and the other three REITs – is that VNO was investing outside of its circle of competence. Whereas, KIM, SPG, and MPW are investing in businesses they understand very well.

As I explained in that 2014 article,

“Vornado’s non-core approach to investing – liken to a mutual fund strategy – was originally structured to diversify its revenue. By investing in higher risk marketable equity securities or companies that have significant real estate assets, such as J.C. Penney and Toys ‘R’ Us, Vornado was hoping to become the first REIT to “crack the code” for conglomeration.”

Warren Buffett, who’s flagship Berkshire Hathaway (BRK.A) is also somewhat of a conglomerate, recognizes that

“What an investor needs is the ability to correctly evaluate selected businesses. Note that word “selected”: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”

fs.blog/circle-of-competence

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment