24K-Production

Introduction

In June, I wrote a bearish SA article about autonomous security robot (“ASR”) company Knightscope (NASDAQ:KSCP) in which I said that it had an order backlog which represented an aggregate annual subscription value of just $1.6 million and that it could run out of cash by early 2023.

Well, Knightscope’s Q2 2022 financial report showed that the order backlog has improved only slightly as it represented an aggregate annual subscription value of $1.9 million as of August 10. In addition, the loss from operations jumped to $7.2 million in Q2 2022 and the company had just $15.6 million in cash as of June. In my view, the bear case is stronger now and opening a small short position seems less risky compared to June as the short borrow fee rate has declined from 48% to less than 12%. Let’s review.

Overview of the Q2 2022 financials

In case you haven’t read any of my previous articles about Knightscope, here’s a short description of the business. The company specializes in the design of ASRs for indoor and outdoor surveillance use and it has amassed over a million hours of field experience. It currently offers three models of robots under a machine-as-a-service (MaaS) business model, and it has a multi-terrain ASR under development under the K7 brand. The latter has been in the prototype stage for about 5 years now.

Knightscope

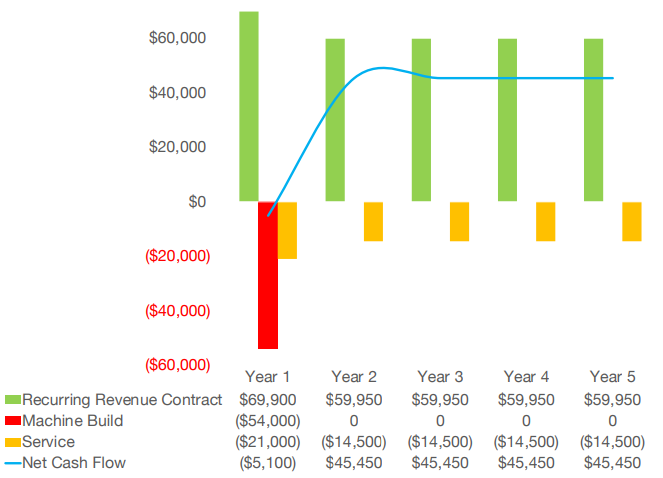

So, what is MaaS in this case? Well, Knightscope offers subscriptions for ASRs at an effective price of about $3 to $9 per hour and this service includes deployment, maintenance, support, and software and hardware updates among others. The standard subscription term is one year and according to management estimates, each robot can bring about $60,000 of revenue per year. The net cash flow margin was estimated at just above 75% from year two.

Knightscope

The margins look great at first glance and the potential near-term annual recurring revenue opportunity is estimated to be about $4.1 billion according to the company’s latest corporate presentation (slide 6 here).

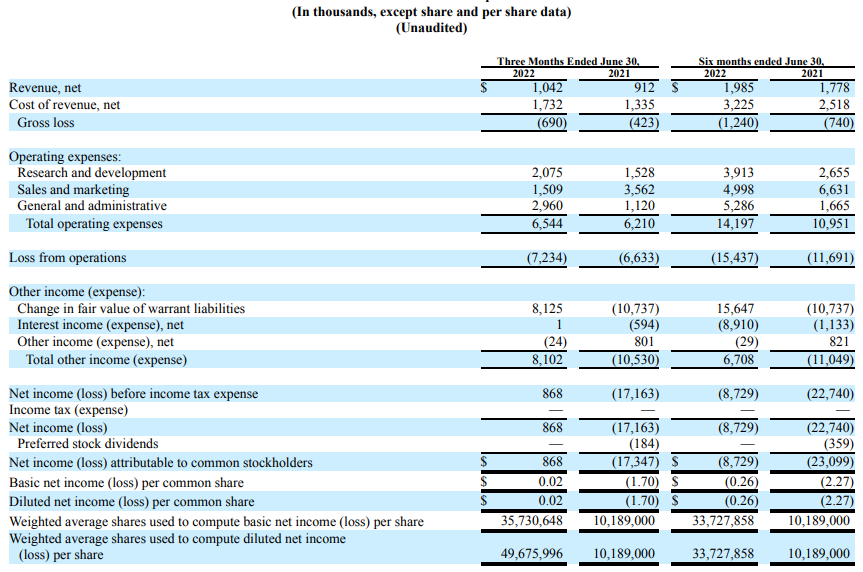

So, where are the red flags here? Well, one of the main red flags is that the gross profit margin remains negative due to the high cost of revenue, which is mainly comprised of the depreciation and service costs for the ASRs. Another major red flag is that the order backlog is nowhere near that $4.1 billion figure, and this means that Knightscope is far from reaching profitability as sales and marketing expenses alone are still higher than revenues at the moment. In addition, quarterly general and administrative expenses have more than doubled since the company’s $22.36 million IPO on Nasdaq in January 2022 due to higher personnel related costs and higher investor relations, and professional services costs. As you can see from the table below, net revenues have been barely growing and this is unlikely to change in the coming months as the backlog of orders included just 35 ASR as of August 10, which represented an aggregate annual subscription value of only $1.9 million.

Knightscope

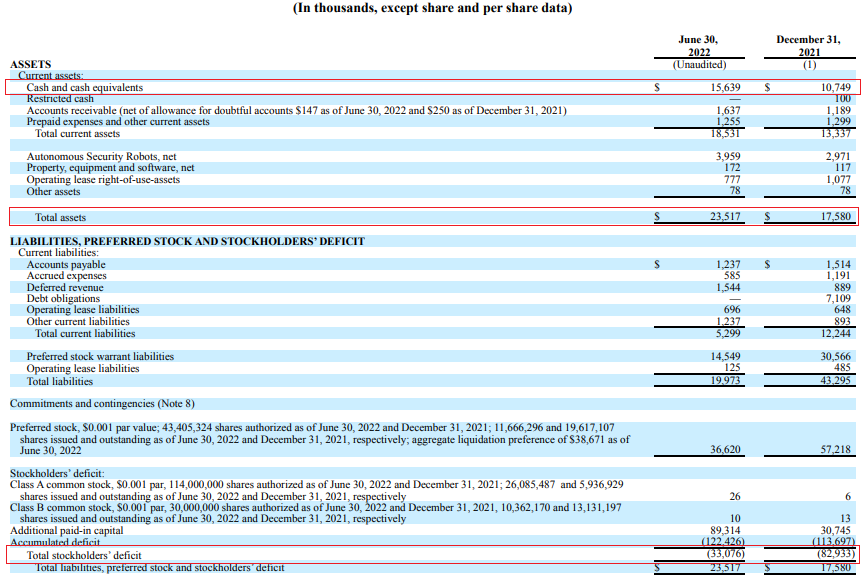

For comparison, the backlog of orders included 24 ASRs as of September 28, 2021, which represented an aggregate annual subscription value of some $1.3 million. At this growth rate, it could take several years for Knightscope to reach breakeven. With net cash used in operating activities at $5.3 million in Q2 2022 alone, cash and cash equivalents were down to $ 15.6 million at the end of June. Considering asset sale and borrowing opportunities are likely limited due to an asset-light business model and negative shareholders’ equity, I think that significant stock dilution could be coming in the near future in order to fund operations.

Knightscope

Overall, I think the bear case is strong here and this could be a good time to open a small short position as data from Fintel shows that the short borrow fee rate is 11.37% as of the time of writing. This level is still somewhat high but is much better than the 47.95% when I wrote my previous article about Knightscope.

So, why only a small position? Well, because there are no call options available yet and I think there are at least three major risks for the bull case. First, I could be wrong that the order book won’t improve significantly over the coming months. Second, Knightscope seems to be a major player in the ASR market, and this could make it a takeover target if a major tech company decides to enter this industry. Third, the share prices of microcap companies can increase for spurious and unknown reasons, and we’ve seen this happen with Knightscope’s stock in the past. On January 31, the share price of the company briefly surpassed $27 before crashing below $13 on the next day.

Investor takeaway

In my view, Knightscope has an interesting business, but it seems that the company has vastly overstimulated the near term annual recurring revenue opportunity as the size of its order backlog remains insignificant. Quarterly revenues are barely above $1 million and net cash used in operating activities is above $5 million per quarter. I think that the situation is unlikely to improve in the near future.

The gross margins of the business are negative and I think the company could be close to worthless at the moment due to the high operating expenses. In addition, the balance sheet situation looked bleak as of the end of Q2 2022. With cash and cash equivalents down to $15.6 million at the end of June, there could be significant stock dilution soon.

Overall, I think that Knightscope is a speculative sell as there are some major risks and there are no call options available to hedge against them. Risk-averse investors could be better off staying away from this stock.

Be the first to comment