Lim Weixiang – Zeitgeist Photos

Investment Thesis

Cleveland-Cliffs Inc. (NYSE:CLF) reported Q3 results that left much to be desired. This is a widely respected company, that should perform better than most during the downturn.

Well, that’s the theory. And yet… Reality turned out to be very different.

The one bullish aspect here is that CLF is not that expensive at less than 5x next year’s EBITDA.

One serious concern is what will CLF be able to realistically do to return capital to shareholders, while it holds a $4.4 billion net debt position.

There’s a lot to discuss, so let’s press ahead.

Low Bar Going Into Earnings

Anyone seriously following the steel market would have expected that the bar going into the earnings report was already low, and that it wouldn’t take a whole lot to deliver a positive surprise.

But as soon as you open the press release you know things are not going well when CLF decides to make the highlight of the quarter, not its revenues or its profitability, but instead its balance sheet. Something that is obviously important, as we’ll soon discuss.

But before that, keep in mind that Steel Dynamics, Inc. (STLD) already reported its results last week and that stock has jumped nearly 20% in a week.

Consequently, given that Steel Dynamics, a company that I had previously called The New Growth Stock, had succeeded in reporting 11% topline growth rates in Q3, there was the expectation that CLF would positively impress investors.

Alas, it was not to be. In fact, not only did CLF not report any growth whatsoever, it actually missed revenue estimates and reported negative 6% y/y revenue growth rates.

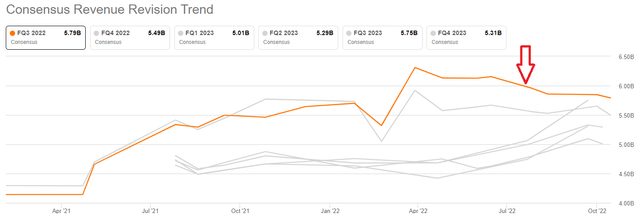

Let me put this another way, going into earnings, analysts had already been busy downwards-revising CLF revenue estimates.

And despite those lowered estimates, CLF still misses on the top line.

Balance Sheet Looks Too Leveraged

As noted already, CLF improved its balance sheet by reducing $1.8 billion reduction in net pension/OPEB liabilities (employee benefits). But that was largely done by remeasurements given higher interest rates leading to a change in the discount rate.

This is not the most pressing consideration when CLF’s balance sheet has a net debt position of $4.4 billion.

When a company reports more than $1 billion of EBITDA, as CLF did in Q2, bullish investors, such as myself, can be willing to turn a blind eye to a significant amount of leverage.

But when that EBITDA ends up as less than $0.5 billion in a quarter, all of a sudden, what was not an issue, rapidly becomes a very pesky issue!

Capital Returns Brought Into Question

Recall, back in Q2 2022, with the share price at an average price of $20.92, CLF was very open to repurchasing shares, deploying $157 million back to shareholders. And now? When its share price moved lower, CLF repurchased $34 million worth of shares during the quarter. A fraction of the previous capital return.

This is an extremely vexing capital allocation strategy. Either repurchase shares throughout the cycle, or don’t repurchase shares at all.

Because this half-hearted attempt at market timing is not done with long-term shareholders in mind.

CLF Stock Valuation — Less Than 5x Next Year’s EBITDA?

I believe that in 2022, CLF will make around $3.3 billion of EBITDA. For a stock with a $7 billion market cap, that’s clearly really attractive, at approximately 2x EBITDA.

The problem here is that if over the coming several quarters, CLF ends up making around $300 to $500 million of EBITDA per quarter, that would mean its run-rate forward would be around $1.5 billion.

That’s still clearly very much acceptable, at less than 5x EBITDA.

But not exactly as cheap as the headline figure would have you believe. Hence, it’s very much a middle of the road valuation for a steel company.

The Bottom Line

The one-line takeaway is this, this is a mixed quarter for investors. It is not a thesis-breaking quarter, as investors would up to a certain extent know that the quarter was going to be tough.

The single biggest overhang is that investors interested in steel need to think about at what point will steel prices stop coming down?

For that, by far, the biggest uncertainty is, at what point will China’s real estate market return to strength, as this is arguably the biggest sector consuming steel.

On yet the other hand, few investors invested in CLF because they expected positive news in the current macro environment. Investors are mostly looking out to 2023 and expecting steel prices to stabilize by then.

And on this note, CLF CEO Lourenco Goncalves states that maintenance activities were partially responsible for some of this quarter’s underperformance and that this should be less of a headwind in Q4 and beyond.

In short, CLF is cheap, but its cost structure may be too high for these low steel prices.

Be the first to comment