Midnight Studio

Where should you invest your money in 2023? Where could you? It seems that investors need to be looking outside the stock and bond markets, but it’s not clear where the opportunities are. Real estate is interesting, but it is still quite correlated to the (falling) market. Private equity and hedge funds would be nice, but they are often uninvestable for the average retail investor. Even gold, the old-school flight to safety, is struggling as well.

Enter the KFA Mount Lucas Strategy ETF (NYSEARCA:KMLM). Unlike stock and bond ETFs, managed futures (hereafter, MF) funds like KMLM have been thriving in this torrid environment. KMLM in particular has boasted an impressive return of +42.60% YTD at time of writing.

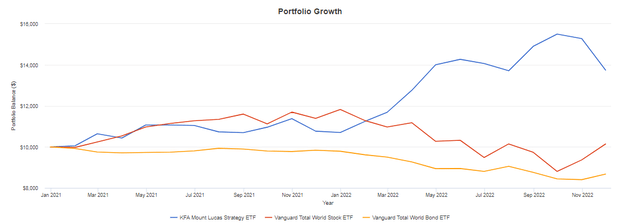

KMLM decimates global stock and bond indices since inception. (Portfolio Visualizer)

KMLM isn’t a day trader’s tool, even though it very well could be. It can be a part of a long-term investor’s broadly diversified portfolio. It’s an alternative investment, yes, but alternative investments are better than losing investments when you need them.

The Theory Behind KMLM

KMLM pursues a trend-following strategy using 11 commodity, 6 currency, and 5 global bond market futures (hereafter, I refer to these 22 futures as “commodity” futures). Trend-following is uncorrelated to both stocks and bonds, which makes it excellent for portfolio diversification. As we have seen so far in 2022, trend-following MF funds such as KMLM have left stock and bond indices in the dust. KMLM in particular has had a 40%+ return during this bear market.

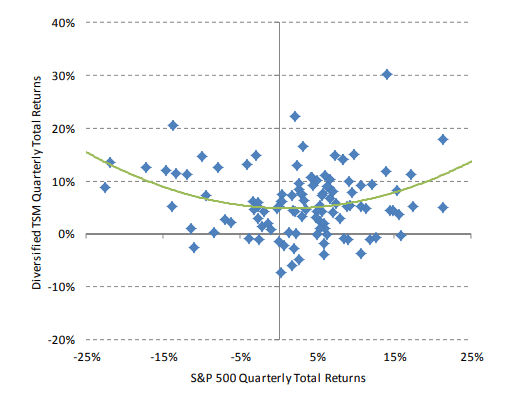

There are, of course, a number of reasons to want diversification. The empirical case is pretty clear. Trend-following has delivered positive premiums in both bull and bear capital markets for hundreds of years. It has only suffered in sideways markets where trends do not exist. Hurst, Ooi, and Pedersen (as well as other AQR colleagues) refer to this phenomenon as a “smile”. They illustrate it using historical S&P 500 returns against a time series momentum (or TSM) trading strategy.

Trend-following has positive returns in both bull and bear markets. (Lasse Heje Pedersen))

Investors who want to minimize drawdown risk should then be attracted to managed futures; trend-following trends to be profitable in bear markets (pun intended). Many investors argue that the traditional flight to safety, gold, is not an attractive drawdown hedge because gold in itself does not offer a premium. However, a trend-following strategy on gold futures might be a reasonable alternative. MF funds like KMLM pursue such proprietary strategies on gold and 21 other assets. In this sense, KMLM is preferable to its rival, the iM DBi Managed Futures Strategy ETF (DBMF). DBMF has some exposure to equities futures, which we don’t necessarily want.

It is important to remember that we aren’t looking for skilled managers to beat the market. Instead, we’re looking for asset classes that are uncorrelated with (and likely to outperform) equities. Ideally, we choose a systematic MF fund, such as one where a 180-day SMA indicator governs trading decisions. Unfortunately, there is no such thing as a passive MF fund, but systematic is the closest we can get to truly passive.

This is where KMLM comes in. KMLM is a systematic MF fund that offers its services in a convenient ETF package for a relatively low cost. You don’t need to be a hedge fund or a client of a special broker to access these strategies anymore, and KMLM has proven themselves to be very good at implementing them.

Valuation and Risks

Commodities are not cash flow-generating assets, and thus it’s difficult to put a valuation number on them. However, MF funds, as well as the beta they seek, are subject to mean reversion. We can guess expected returns (proxy for valuation) using past performance.

Over the last (just about) 100 years, the long-run real return of global bonds over cash has been just south of 2% according to Antti Ilmanen’s book “Investing Amid Low Expected Returns”. The long-term real return of commodity futures, on the other hand, exceeds 3%. For trend-following as a strategy, it’s over 4%. In exchange for the higher return, you are taking on obviously higher risk. Unlike bonds, commodity futures are not promising to pay you a coupon. Thanks to the magic of futures, you can lose a lot of money very quickly. Turnover costs can also be debilitating. As John Bogle tirelessly lectured us, turnover costs matter.

Bonds, especially US Treasuries, have one big advantage going for them: they’re safe. They have a rate of return. They’re basically risk-free assets, even compared to government bonds from other countries. Managed futures, on the other hand, are supremely risky. Commodities and currencies have an expected real return of zero, if even that. And, certainly, trend-following is not a risk-free source of return at all. You’re relying on an algorithm to make you money.

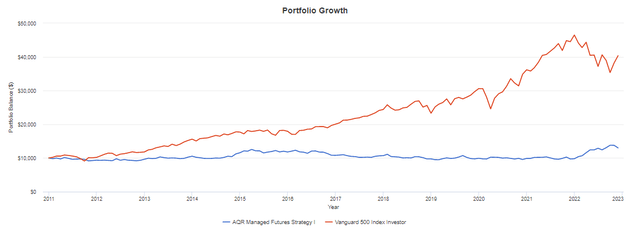

These risks have even shown up recently. Funds like KMLM have not performed well over the last decade, and in fact have lost to bonds. For the sake of data availability, the figure below illustrates this with the AQR Managed Futures Strategy Fund Class I (AQMIX), which has been around for nearly 12 years. AQMIX only really began to outperform the S&P 500 in the current drawdown. Since inception, however, it has returned a measly 2.24% nominal return. This is far below the half-millennium average.

Managed futures funds have not performed well over the last decade. (Portfolio Visualizer)

This is discouraging to investors who need short-term validation of their strategies. As with many strategy funds, MF funds have their best years, like this year, following a period of extended underperformance. As with many investments, assets mean-revert; profits are only made after all the paper hands have sold out. Moreover, we can expect mean reversion to occur in the near future. The S&P 500 sits at a P/E ratio of 20, which is still higher than the historical average. Given the S&P 500 itself still has scope to mean-revert for the worse, and the Fed having no intention to stop hiking interest rates, it’s probably not the worst idea to own assets that have nothing to do with the market. Maybe, it’s even a good idea to hold assets that do well when trends are apparent.

One of the big advantages of KMLM is also one of its big downsides. It does not benefit from the equity risk premium. Having zero exposure to the stock market makes KMLM a fine diversification tool, but it also cuts its expected returns. KMLM is unattractive for investors who want to take on a lot of risk and maintain that risk for a long time. Some momentum-focused alternatives for risk-tolerant investors exist, such as the iShares Edge MSCI USA Momentum Factor ETF (MTUM), which pursues momentum strategies within the US stock market. It should be noted, however, that MTUM is not better than KMLM; KMLM simply has a different niche.

Should You Buy KMLM?

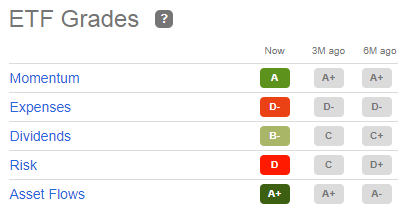

Seeking Alpha’s Quant gives KMLM a Strong Buy rating with 4.67/5 as of the time of writing. The fact that Quant thinks KMLM has good momentum is silly in a trivial way, but it’s absolutely right. Notably, asset flows are also high. This means that investors have already taken notice of KMLM – if you want to get in, you need to get in now. It will be a shame if asset flows drop when KMLM slumps for a few years, but it’s inevitable.

Quant is bullish on KMLM. (Seeking Alpha)

Overall, yes. I would recommend KMLM to buy-and-hold investors who want to reduce risk via diversification rather than simply taking less risk. KMLM is also interesting for investors who want commodity/currency exposure for insurance reasons but want to expect some return. KMLM is especially interesting to investors who want to gamble on MF beta with a small part of their portfolio.

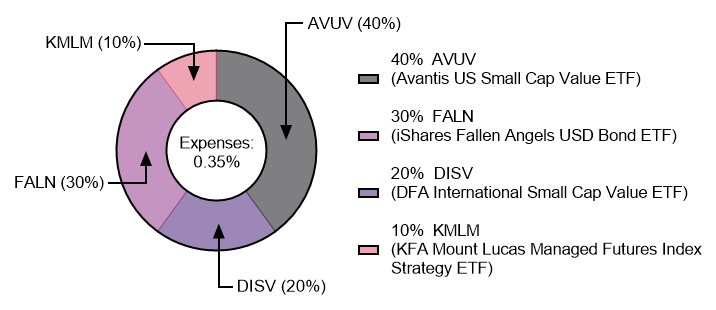

Below is a model portfolio where I think KMLM would be useful. The overall expense ratio, at 0.35%, runs a bit high, but for all the factor diversification we are getting it is probably worth it.

Factor-oriented model portfolio including KMLM. (FM Research)

KMLM is not a stock alternative (if anything, I would consider it a bond alternative). Therefore, we still need stocks. Here we take a global factor-diversified approach, reducing risk in barbell-style by piling on multiple highly risky assets with low correlations to each other. My reasoning for using the Avantis U.S. Small Cap Value ETF (AVUV) for US equity exposure can be seen here. The Dimensional International Small Cap Value ETF (DISV) has similar goals to AVUV but for international markets. The exact allocation between AVUV, DISV, or any other factor fund is up to personal preference (the Avantis All Equity Markets ETF (AVGE) is interesting), but I overweight AVUV because of its lower expense ratio. Stocks are 60% of the portfolio here, but of course, the percentage can adjust to personal tastes.

If using bonds for an asset class-diversified portfolio, my choice would be the iShares Fallen Angels USD Bond ETF (FALN). My reasoning can be found in this article. Junk bonds are more attractive from an income perspective because they provide more income than treasuries – moreover, if we are buying bonds for income, then we don’t care so much about their price stability. FALN has an average duration of ~8 years, which is admittedly inappropriate for a long-term investor, but it’s tricky to find longer duration bonds within the junk bond universe. Long-term corporate bonds a la the Vanguard Long-Term Corporate Bond Index ETF (VCLT), for example, would be a reasonable substitute. If credit risk bothers you, consider long-term Treasuries – I recommended the Vanguard Long-Term Treasury ETF (VGLT) here.

Finally, KMLM is included as a hedge against catastrophe (which is what already happened in 2022, and may continue to happen in 2023). If we are in a dire bear market, then it doesn’t matter a whole lot whether you’re in stocks or bonds. Trend-following, however, could make a difference. The 10% is enough to make me feel like I did my due diligence, but it is not enough to change the course of my overall portfolio. Of course, one can allocate more than 10% as desired.

Verdict: KMLM Is A Well-Designed Product

I trust the academic research, which shows us time and time again that trend-following is a pervasive market phenomenon. But, it’s very sensitive to your inputs. Small perturbations in your definitions greatly change your results. It would be nice if there were a fund that simply accepted MF beta, but that’s not what happens. All of these MF funds are letting their algorithms fight against each other, and at some point we’re just picking managers. If we go by assets under management, picking KMLM seems like a pretty good bet, and it’s also nice that they employ a rules-based strategy. There are reasons to think that MF funds will do well in 2023, and that includes KMLM.

KMLM is certainly not something to bet the farm on, however. Its market-timing, leveraged, actively managed, and independently non-diversified nature make concentrating KMLM in a portfolio completely inadvisable unless you’re a hedge fund or are privy to actionable information. That being said, KMLM has had a stellar 2022, and with inflation concerns not quite over and the S&P 500 still overvalued relative to pre-pandemic levels, it seems likely that KMLM will keep up its tempo for a good stretch in 2023.

Even if you’re a retail investor with a boring and unpretentious 60/40 portfolio: if you’re willing to make any changes at all in 2023, you might talk yourself into 60/30/10.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment