jetcityimage/iStock Editorial via Getty Images

Avis Budget Group, Inc. (NASDAQ:CAR) is one of the world’s largest car rental companies operating in more than 180 countries through a brand portfolio that includes “Avis”, “Budget”, “Payless”, and “Apex” among others. The company also owns the “Zipcar” car sharing network platform that counts over one million members. This is an industry that got crushed during the pandemic but has been defined by an ongoing recovery as travel rebounds.

On the other hand, inflationary cost pressures and high gas prices along with broader macro concerns have represented some of the ongoing headwinds. Shares have been volatile and down around 20% this year. Still, we highlight what have been solid financial trends supporting a positive long-term outlook.

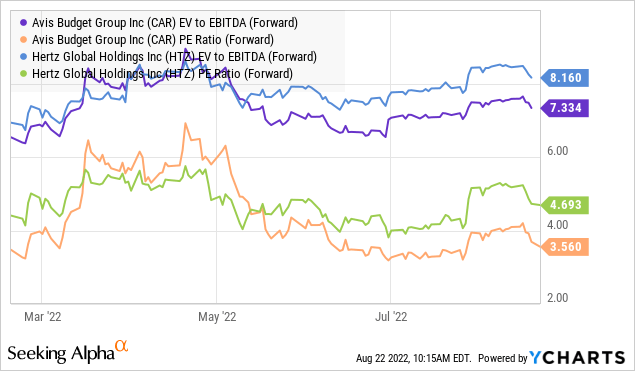

We like CAR at the current level and view the recent correction as a buying opportunity. The company is profitable with positive free cash flow while trading at a discount to its peer and competitor Hertz Global Holdings, Inc. (HTZ). The recent trend of declining gas prices can work as a tailwind supporting rental car demand into the current quarter.

CAR Q2 Earnings Recap

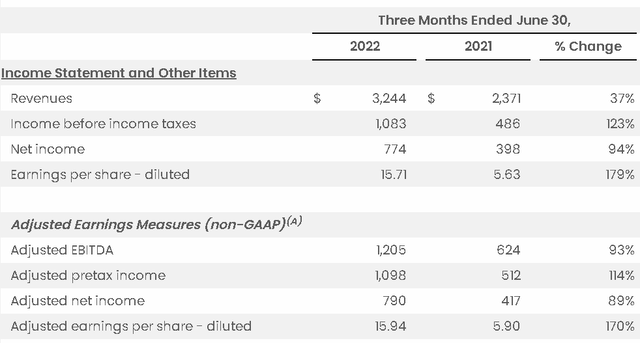

Avis reported its Q2 earnings on August 1st with non-GAAP EPS of $15.94 which beat the consensus by $4.11. Revenue of $3.2 billion, up 37% year-over-year was also ahead of estimates. Management noted this was a record quarter for the company in terms of sales and net income based on the strong demand for the summer travel season.

Total rental days globally were up 29% from Q2 2021 while higher rental pricing and strong vehicle utilization rates were key themes this quarter. For context, America’s region unit revenue per day (RPD) at $80.76 climbed 2% y/y but was also 44% higher than the Q2 2019 rate as a pre-pandemic benchmark.

While revenues in the Americas region climbed 30% y/y based on a larger fleet, the performance was even more impressive from the smaller international segment, where revenues increased by 71% from the period last year. Adjusted EBITDA at $1.2 billion nearly doubled from $624 in Q2 2021.

Another dynamic for the company has been its gain in fleet vehicle sales. Given constrained new car availability, used car prices have been elevated, which is reflected in a slower depreciation rate of its vehicle asset base. The result is a higher residual value at disposition as the company manages its global fleet for efficiency by extending the useful life for rental purposes. The implications are tricky, but one thought is that Avis Budget is in a good spot as it sells off its fully depreciated vehicles at an accounting gain while refreshing the fleet with newer models through next year.

Finally, we can bring up what has been a strong balance sheet. Avis Budget ended the quarter with $579 million in cash and equivalents against $4.7 billion in corporate debt, excluding vehicle financing. Considering the Q2 EBITDA run rate near $4.8 billion, the leverage rate is under 1x. The company has been active with share repurchases, buying back around $1.7 billion in stock this year. While nothing has been announced, we wouldn’t be surprised at the possibility of a dividend initiation down the line as there is financial flexibility for it.

In terms of guidance, while the company is not offering formal targets, the messaging from management was positive. The outlook is for rental car demand to remain elevated although the climb in RPD should moderate. From the earnings conference call:

The underlying demand environment is currently strong for both our Americas and international segments. International will continue to see recovery in both rental days and RPD. In the Americas, rental day growth will continue relative to 3Q21 and 3Q19, but with growth moderating from the levels we saw in the second quarter… We believe that the benefit we’re seeing in rental days, depreciation, and most importantly cost savings will more than offset an RPD decline.

The net result of all this is at this point, we believe that we’ll generate higher adjusted EBITDA in the third quarter of 2022 than we did in the third quarter of 2021, putting us on track to deliver the highest full year adjusted EBITDA in our company’s history in 2022.

CAR Stock Price Forecast

Going back a few months, there was some concern in the market that record high gas prices through June would keep drivers off the road and limit the demand for rental cars where customers are responsible for fuel. Looking through the Q2 numbers, it wouldn’t be a stretch to call this earnings report a blowout. In many ways, the industry has recovered even faster than expected during the depths of the pandemic.

That being said, car rental is a notoriously difficult business to both operate and invest in given the number of moving parts and forecasting challenges. Beyond simply the macro environment, the asset-heavy balance sheet with intensive required fleet investments means AVIS Budget Group faces exposure to trends in interest rates and car market pricing. All this is on top of intense competition from not only other large and small rental car companies but also ride-sharing alternatives.

All this helps explains the poor performance of CAR stock price, which is down nearly 50% from its April high above $325.00. The good news is that some of the headwinds have cleared up with the price of gasoline dropping sharply over the last two months, removing one layer of uncertainty. There is still the question of if economic conditions will deteriorate from here, but we argue that the outlook has improved with signs U.S. inflation is cooling off while the strong labor market indicates resiliency to consumer spending.

By this measure, CAR looks interesting on this latest pullback down about 20% just over the past week since shares briefly approached $200. From the chart below, we note that the level of around $165 down to $150 has represented an area of support all year. Keeping an optimistic outlook on economic conditions, we believe the current pullback represents a new buying opportunity ahead of the next leg higher.

We mentioned competitor and car rental peer Hertz Global. In this case, HTZ has attracted some speculative attention going back to the “meme stock” phenomenon of early last year. The result is that while both CAR and HTZ capture similar market dynamics, CAR trades at a significant discount in terms of its forward P/E ratio at 3.6x compared to HTZ at 4.7x. Similarly, CAR’s EV to forward EBITDA multiple at 7.3x compares to HTZ closer to 8.2x.

The financial and operating trends don’t justify these spreads in our opinion. For reference, CAR generated an adjusted EBITDA margin of 37.1% in Q2 compared to HTZ at 33% in Q2. Avis Budget also had stronger top-line growth against HTZ which grew revenue by 25% in Q2. CAR’s balance sheet is also significantly stronger with less debt. Again, this appears to be a case where CAR is under-appreciated while HTZ commands more of the industry headlines and stock market attention.

Final Thoughts

We rate CAR as a buy with a price target for the year ahead at $225 representing a 5x multiple on the current consensus 2022 EPS of $46.17 or an EV to forward EBITDA ratio around 8.5x. The call here is that the U.S. economy in particular will avert a deeper recession while the demand for car rentals remains strong, surprising expectations to the upside. The ability of CAR to continue generating financial efficiencies through fleet management can drive continued earnings momentum. Longer term, the return of business travel and higher margins can support an even higher share price.

The other side to risks would be a more concerning deterioration of the global economic outlook. Fuel prices are an important monitoring point along with interest rate volatility that could end up pressuring the stock. In the near term, it will be important for CAR to hold the $150 level of stock price support.

Be the first to comment