irin717/iStock via Getty Images

From A Dull Cocoon Comes a Butterfly

Ashland Inc. (NYSE:ASH), formerly Ashland Global Holdings, was an old, tired specialty chemicals company that has gained a second wind of late thanks to a fairly significant restructuring of the business. Many struggling aspects of the group have been sold off, including the large Valvoline (VVV) group in 2016 (who recently had assets acquired by Saudi Aramco (ARMCO)). From a long-term perspective, ASH’s finances look poor, as revenues have fallen over the past 20 years and earnings are volatile and relatively flat. However, some positive trends are emerging, and I believe the restructuring may be paying off at long last. This article will highlight the positives, and also the metrics that still need work, in order to assess whether the company is worth a shot.

Ashland Investor Presentation July 2022 Seeking Alpha

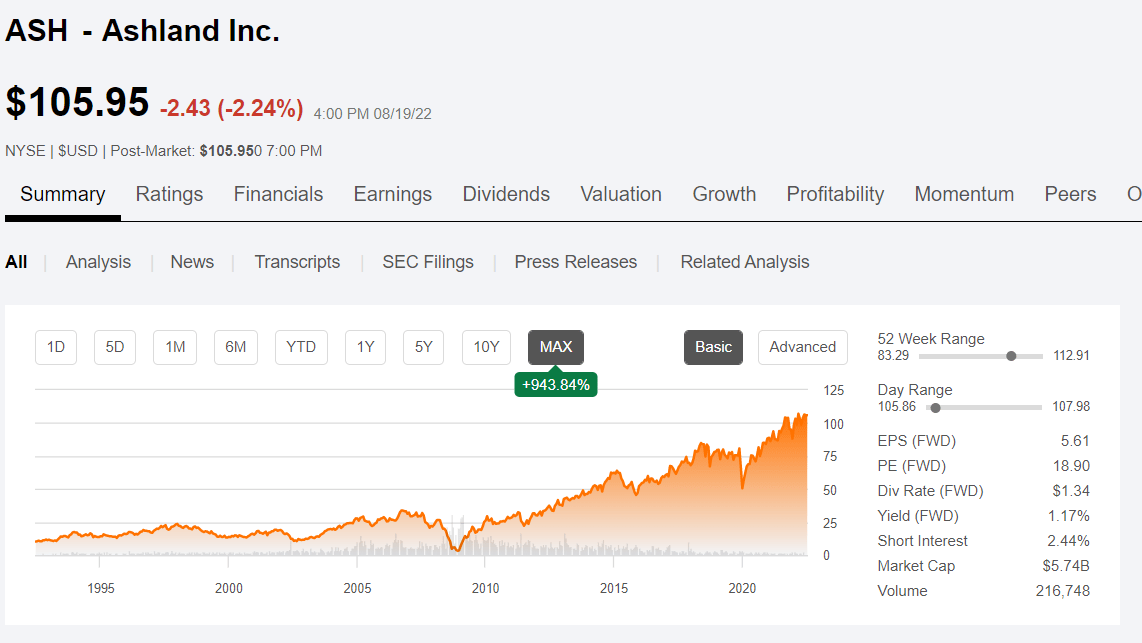

On the surface, Ashland’s performance over the past decade or so hides the significant shifts within the company. With fairly solid returns over the past 10 years thanks to a slow rate of change and conservative management, ASH is trading around all-time highs. Also, strength over the past year has allowed for the company to remain elevated even as the market has fallen. This is partially due to the strong main product segments that drive forward momentum no matter what. Also, there is some weakness under the surface that has led to valuation issues, and I will address these as well. First, however, let’s look at three primary revenue segments.

Ashland is a diversified specialty chemicals company, a quintessential Buffett or Lynch-style “boring” company with leadership in three unique areas. First, the life sciences thanks to solutions in contract manufacture and formulation of retail nutraceuticals or wellness products, medical products such as radiology films and analysis systems, and pharmaceutical feedstock, particularly polymers for controlled release. Also, the company has significant exposure to personal care and cosmetics, with the provision of a wide range of base products to manufacturers. Lastly, the rest of the vast range of products in nearly every industry are also lumped together, and range from agricultural products to paint to even the energy industry.

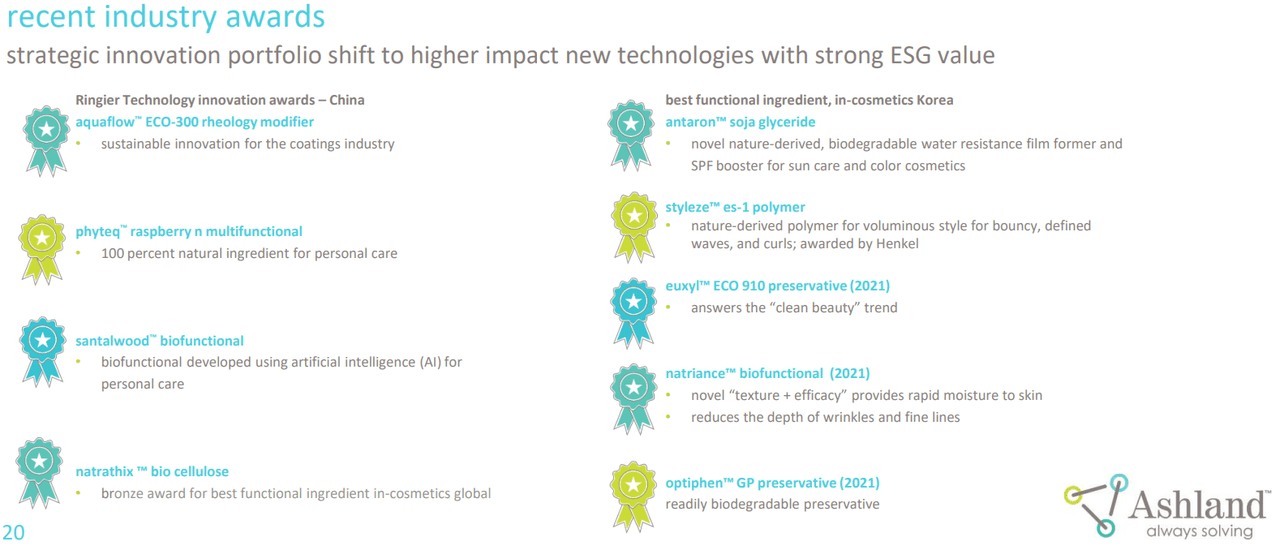

The range of high-quality products allows for safe growth, even if the client industries may not be of the highest quality, particularly in medicine and cosmetics. Instead, these industries provide growth due to the fact that each ASH customer will be looking to out-compete each other, and ASH is agnostic as to whether one particular company succeeds. Also, Ashland puts a focus on R&D and continues to try to find new growth paths thanks to new chemicals or processes. In particular, the company is looking to find new sustainable offerings that will allow clients to reduce their impact. Out with the old industries like low margin Valvoline, and in with the new premium goods.

Ashland

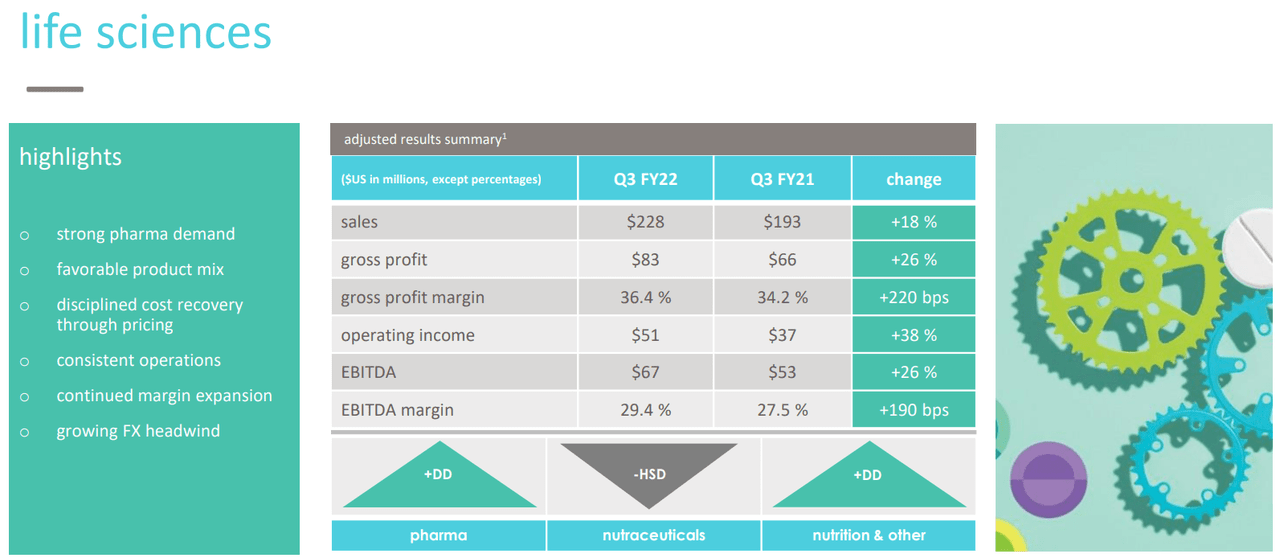

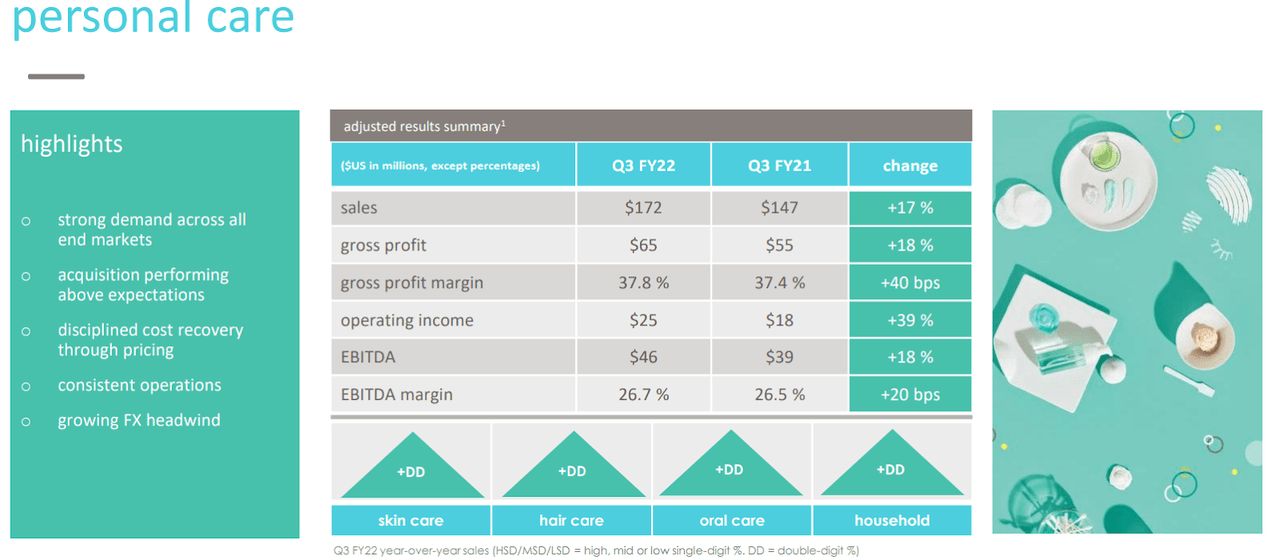

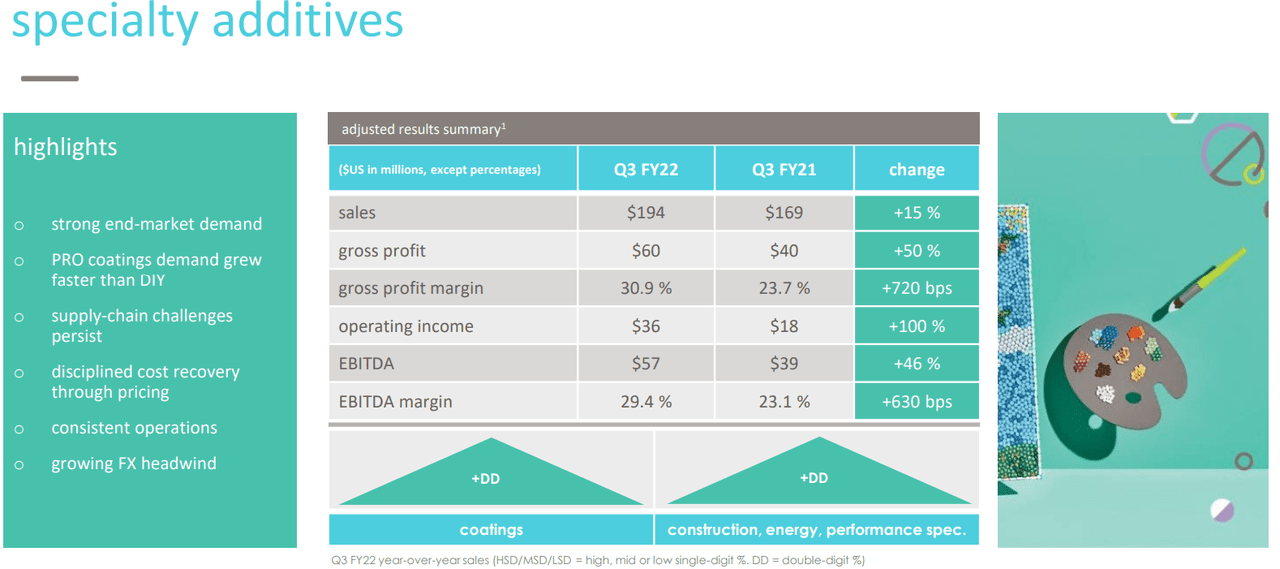

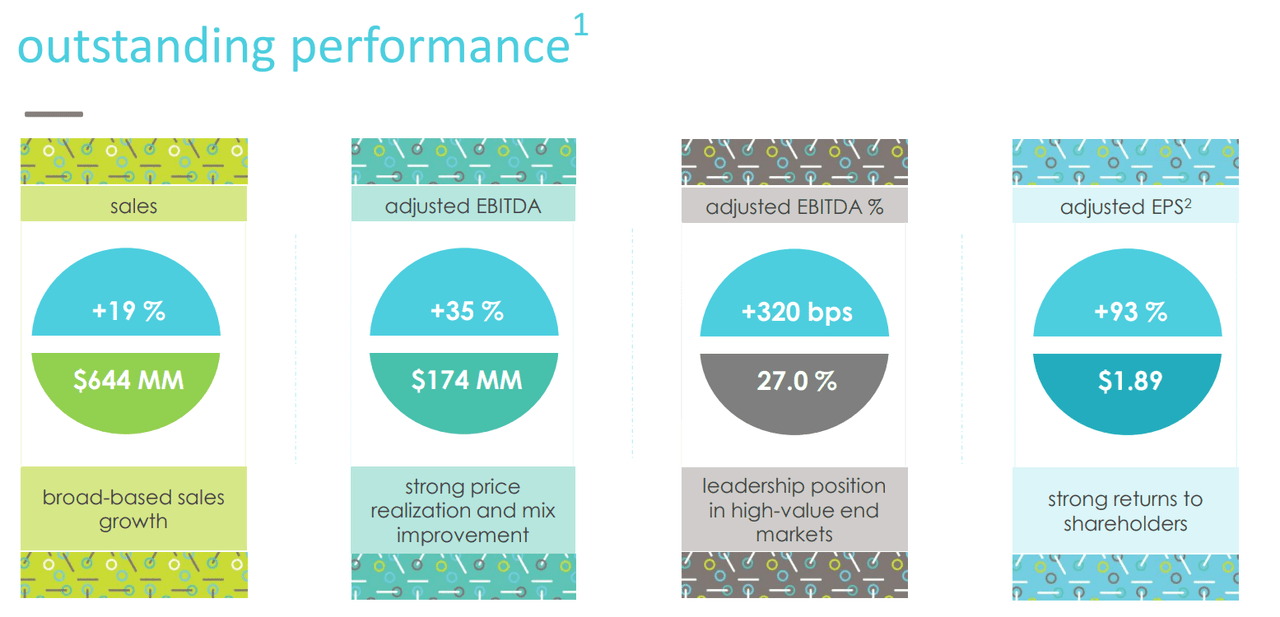

Recent performance has been solid in most revenue segments, with the only weakness in the now frowned-upon nutraceutical market. Instead, most segments are seeing double-digit growth between 15-20% YoY, and profit margins are increasing even more. The cycle of creating new high-margin, fast-growth products, and the unlocking of value through the sale of legacy assets is now the favored business style and is beginning to pay dividends (literally and figuratively). In fact, I also believe the company may be less cyclical than a typical specialty chemical company due to the sheer diversity of offerings, and so I believe Ashland is a solid long-term hold company rather than one to trade around. However, let’s take a step back and look at the fundamentals first to determine whether the company is worth taking a position.

Ashland Ashland Ashland

Financial Details

As we can see, recent performance has been driven mostly by improvements in profitability, although revenues are rebounding after pandemic weakness. The company also thinks carefully about shareholders and takes multiple measures to drive strong returns. In fact, most of the returns over the past decade have not been the result of revenue growth but rather increased profitability, reduced shares outstanding, and a general rise in average market valuation. As the share price is close to all-time highs based on the positives, it will be important to assess whether the financial performance reflects this, or there is risk in the shares falling moving forward.

Ashland

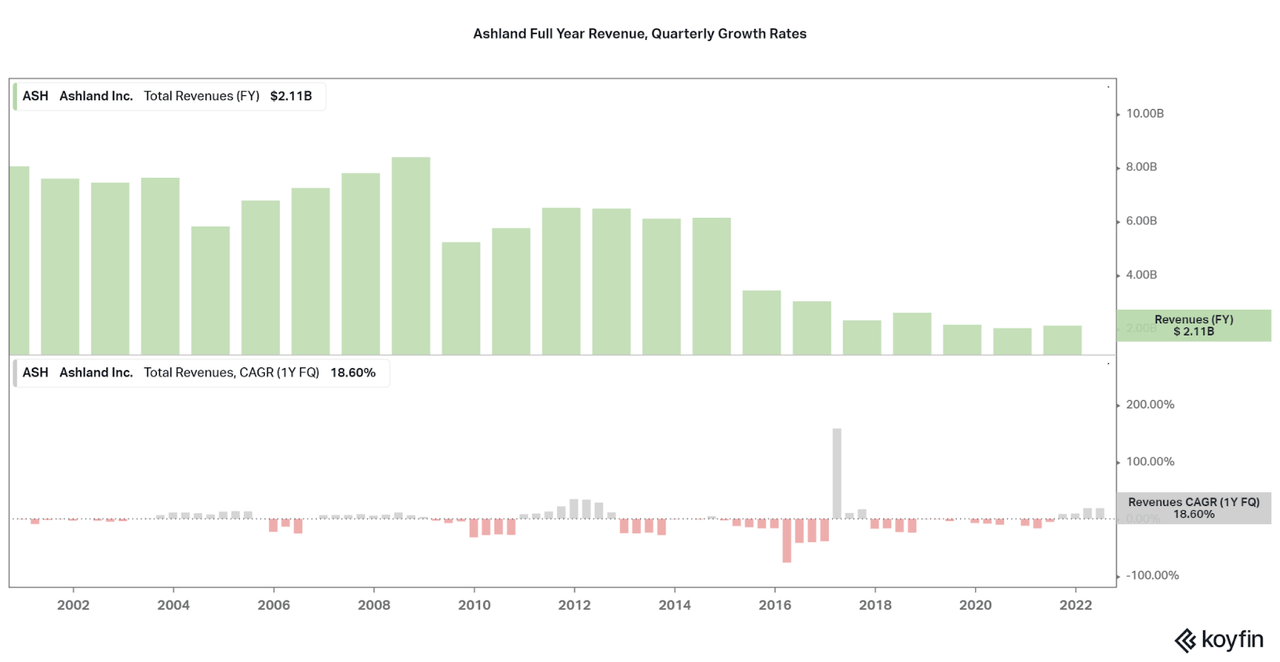

As discussed above, returns over the past decade or more have no relation to increases in revenues. In fact, the chart below highlights how revenues have fallen from over $8 billion per year to less than $2.2 billion in 2021. This pattern highlights the slow change within the company as legacy assets such as Valvoline were sold off. However, it seems like the restructuring is ending and management is happy with the results. Therefore, I am not worried by falling revenues over the years and will look at the sliver of hope of increasing quarterly revenues over the past few quarters as the signal of forward momentum returning. As of the Q3 earnings call, they had the following to say:

Over the last decade, Ashland’s journey of transformation has sharpened our focus as an additives and specialty ingredients company. As we have systematically identified and tackled the thorniest problems, we concentrate on areas rich in opportunities to innovate and drive value for customers, where innovation and expertise is one business unit can be leveraged in others.

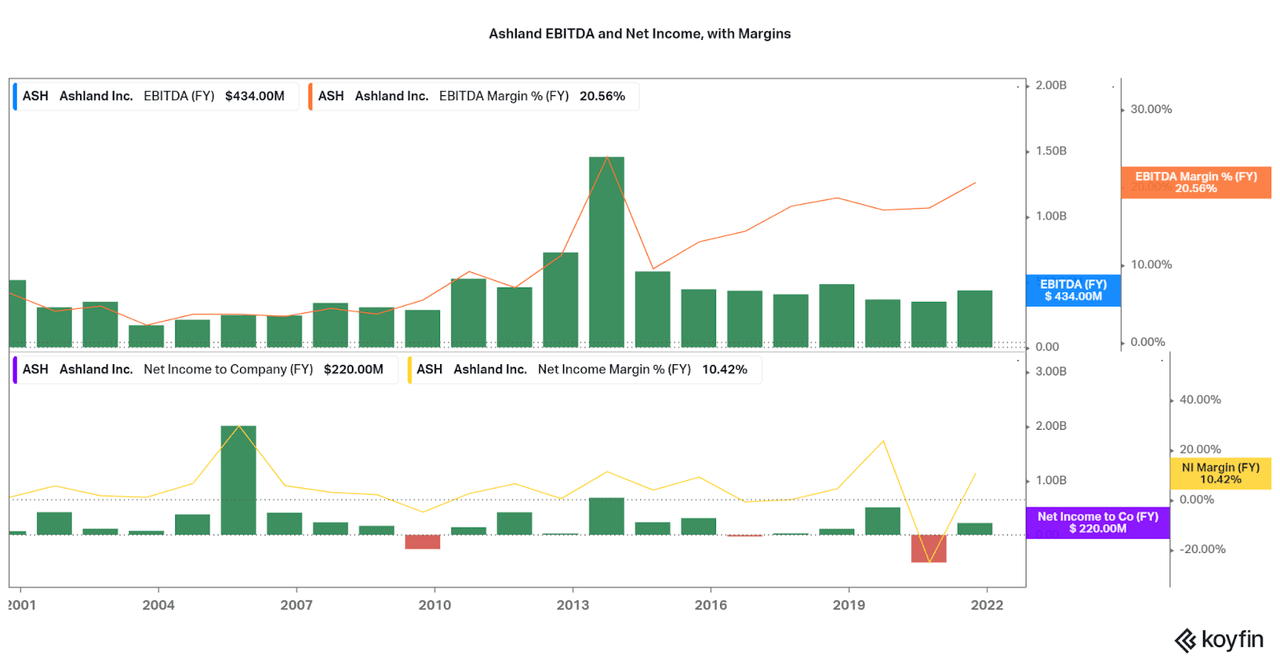

Koyfin

Want to see where all the improvements have gone? Straight to EBITDA margins. As shown in the chart below, EBITDA margins have shown incredible improvements over the past 20 years as high-quality products have been the focus. Unfortunately, net income is not seeing the same pattern. Naysayers will certainly be pointing to low net income as a bad sign, I find that the most important value is EBITDA. Low net income can signal continued investments into innovation and operational improvement and should be considered with other factors. Management continues to invest significantly in both improvements and shareholder returns, and the balance sheet also shows the progress.

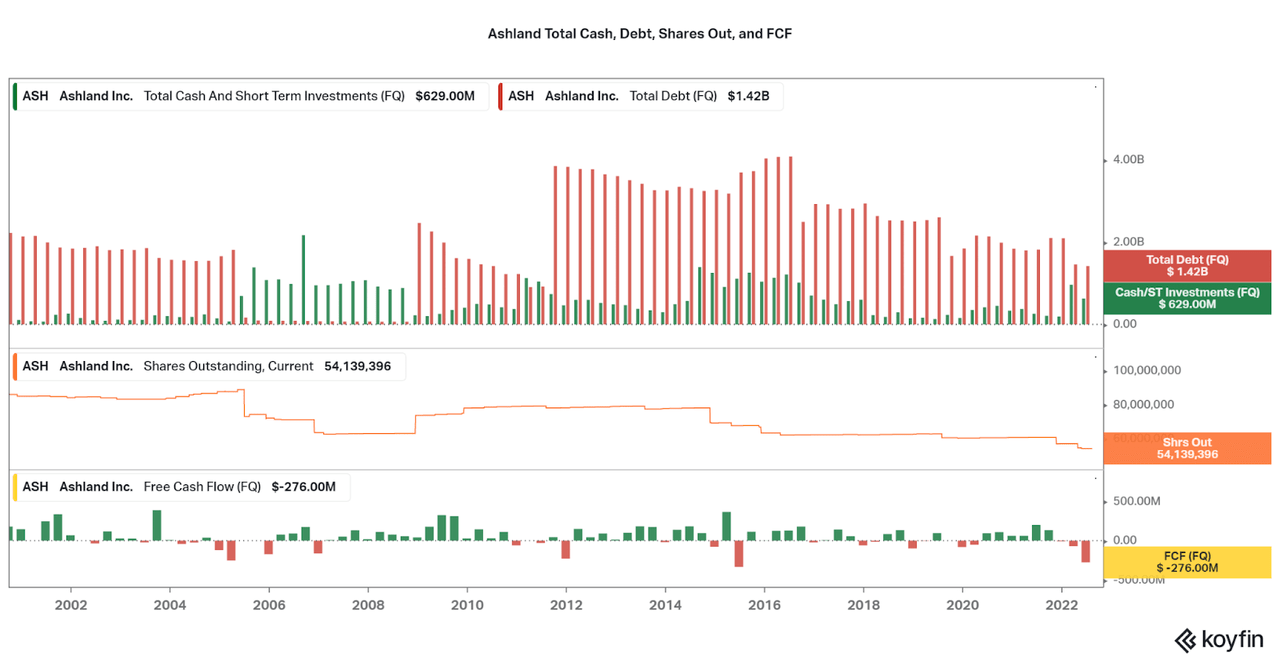

Koyfin

Bad assets lead to debt, and Ashland was heavily laden starting in 2012. However, most of this debt has been paid off over the past 10 years and leverage is now at a manageable level. The current net debt over EBITDA ratio is now 1.8x, a fairly safe level. At the same time, dilution has not been used to acquire funding, and instead, shares outstanding have fallen from 80 million to 54 million. As performance normalizes from this current strong position, look for steady free cash flow (“FCF”) growth moving forward. If Ashland maintains this form, I believe they are a very solid company with stable fundamentals and innovative, moat-like product segments. Therefore, a high valuation may be supported if this trend continues.

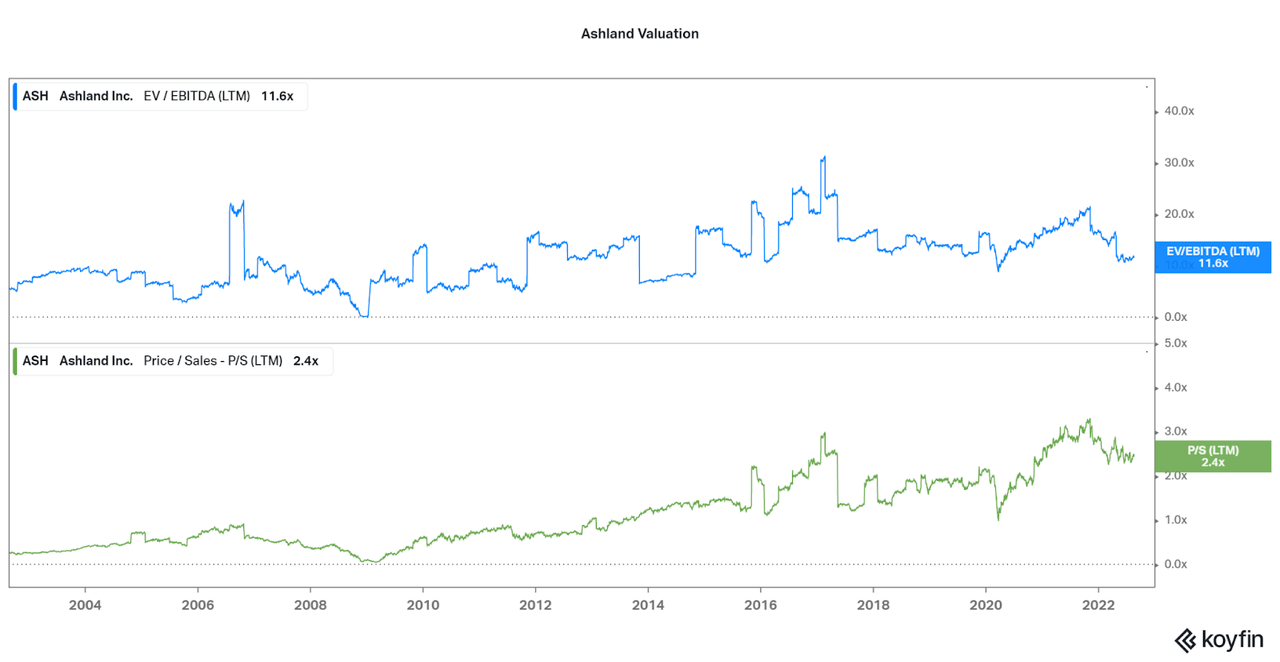

Koyfin

Valuation

It is necessary to consider the improving financial conditions when analyzing the valuation of Ashland. Particularly when we are betting on a long-term investment in a linear growth story. Also, few other companies offer decent comparisons, so I will look at the valuation on its own. There are two patterns to consider. First, the valuation is quite high compared to prior years, although down significantly over the past year. Second, we can see a clear pattern of increasing valuation since the GFC in 2008, even through times of volatility when major assets were being sold. These two patterns suggest that investors are approving operational improvements and allowing for the valuation to rise. The fundamentals support this, primarily with the reduced debt and increased EBITDA.

Koyfin

Conclusion

The data on Ashland suggests two things: investor approval and operational excellence. It takes a skilled management team to perform the changes that Ashland has seen over the past few years, and it should be taken as a case study for other conglomerates looking to thrive (such as the issues seen with Toshiba I discussed). As such, I find ASH is worthy of further consideration, and I believe it would hold a welcome spot within many portfolio types. While earnings growth and growth investments will drive capital gains indefinitely, a small, but growing dividend is also enticing for dividend growth investors.

The key moving forward will be sentient of the price, but invest periodically to reduce the risk. As per the recent earnings call, improvements continue to come and management looks forward to continued success. So will I.

Be the first to comment