JHVEPhoto/iStock Editorial via Getty Images

Dear readers/followers

In this article, I want to give you the opportunity to learn about the updated valuation of an insurance business – Chubb (NYSE:CB). As you may know from my articles, I’m big on investing in financials and insurance businesses specifically, because they come with such conservative and excellent overall trends, as well as long-term upsides if bought at the right price.

Chubb is no different. My investment in the company has outperformed the market. Unfortunately, it’s not that big – not as big as I would like.

Why investors don’t follow Chubb as much is understandable – but there is plenty to like here.

Let’s review and clarify.

Chubb – Revisiting this 20%+ annual upside.

So, unfortunately, Chubb is very underappreciated and underfollowed when compared to other insurance companies. This is a shame because it’s an absolutely superb business.

The company is found in beautiful Switzerland and focuses on the following businesses:

- Casualty

- Accident

- Health

- Reinsurance

- Life

- Property

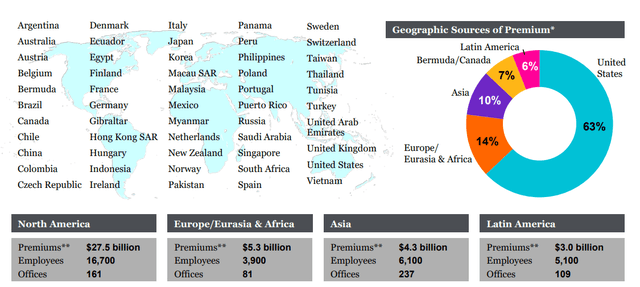

With clients across 55 nations in Europe, in Lloyd’s insurance in London, the company has some fundamentals that are hard to beat – by any insurance business in the market.

The company’s trajectory and track record for the past 2 years since I first started writing really confirms something that even I, an experienced investor and analyst that I am, still need to learn again and again.

Quality wins – always.

Oh, there are higher-yielding insurance businesses. Almost all of them. There are those even with a longer history. But in terms of fundamental quality, very few businesses can hold a candle to Chubb.

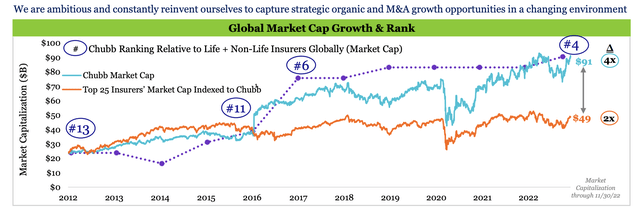

When the company merged with ACE Limited back in -16, it created the sixth-largest US P&C insurer by premiums and brought together two extremely beneficial business lines.

Chubb’s legacy focus was middle-market companies and personal line businesses, while ACE focused on the international market.

The combined company strength now provides both.

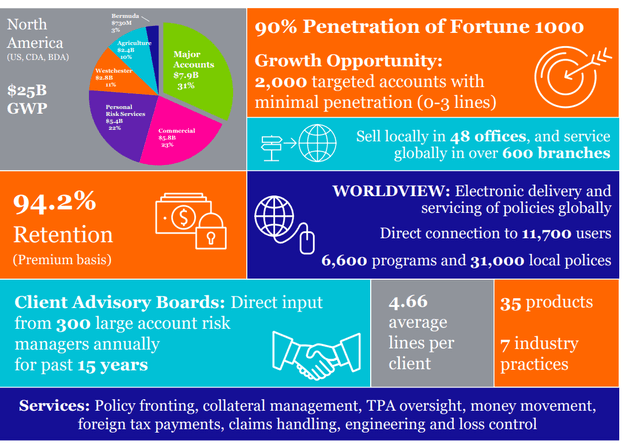

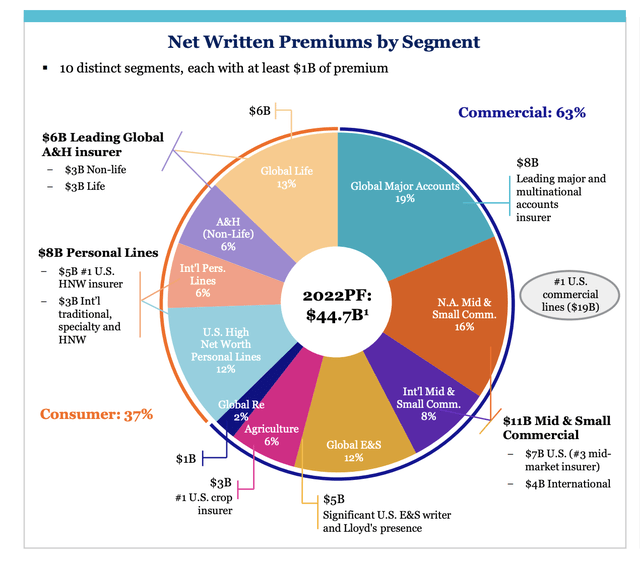

Gross premiums amount to over $30B on an annual basis, most of which (65%) comes from the commercial property and casualty lines, and the remaining 35% comes from consumer lines. Chubb’s products are distributed primarily through the company’s agents, combined with distributions for certain types of insurance through brokers.

Despite being an international operation, the majority of the company’s massive portfolio is found in the US, which generates around 63% of net premiums.

Aside from this, 13% are generated in Europe, 11% in Asia, and 8% in LATAM with the remaining 5% in Bermuda and Canada – so that’s how the company’s mix more or less looks today.

A portion of the company’s income and the mix is Personal lines. What are “personal lines”? Personal lines include things like traditional automobiles, homeowners, recreational marine/aviation, valuables, and specialty coverage, even for things as small as cell phones – so it’s a bit of a mixed bag, but Chubb is big in this as well.

The simple size of the company’s business itself is a competitive advantage. By being a larger size, Chubb can compete in pricing in ways that smaller businesses cannot. Chubb is also the no. 1 provider of personal lines coverage and services for what the company (and the market) calls “affluent customers”.

Chubb is actually the leading writer of crop insurance for farmers in the US, which should not in any way be underestimated here. A lot to like about such operations – how they work and the importance of the underlying business.

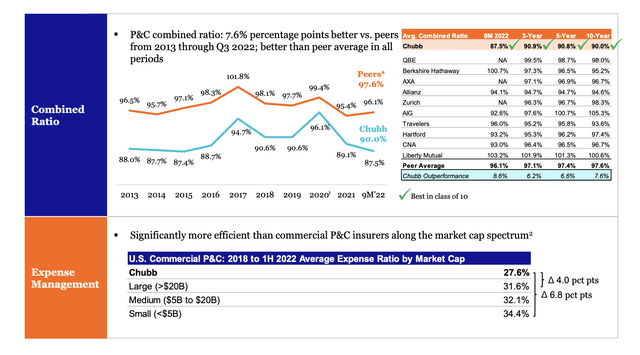

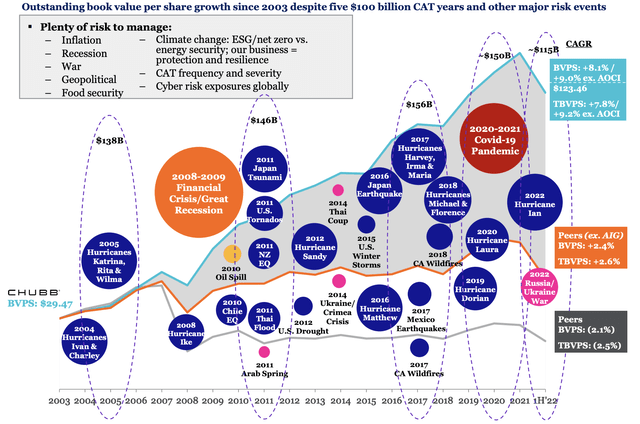

Chubb has consistently, for at least 8 years, outperformed not only the North American but also the global peer average over the past few years. In some ways, it makes excellent companies like Sampo (OTCPK:SAXPF), in which I’ve traditionally invested plenty of money in, look downright average.

Chubb remains rated “A” – this is one of the hallmarks of excellent insurance companies I invest in, and recent results pretty much confirm how great things are going for Chubb.

3Q22 is what we have here, and the annualized written premiums here are up to above $51B on a gross basis. This is growth between 2019 and 2022 of almost 30%, with net up almost 30% and a combined ratio that’s trending down below 88%.

From this revenue/premiums, the company gets around $3.4B of net underwriting, and close to $3B of net investment income – with investment income around 5% up in 3 years, and underwriting up over 50% – superb results. EPS has grown 43% in the same timeframe.

Chubb has managed the rare feat of margin outperformance, due to excellent underwriting and superb efficiency. The company’s expense ratio is down to 27.6%, which can be compared to a peer average of closer to 32%. 1% might be a momentary fluke – close to 5% is a company-conscious strategy and pattern of outperformance.

Chubb grows slowly – but it grows steadily – and it does so better than many of its peers.

We also currently have a significantly different premium sales mix than we had over a year ago – take a look at the improved and more diversified mix that Chubb currently offers.

This sort of mix comes with a sort of stability that often can be considered to be market-beating – and Chubb has proven this by not needing to re-evaluate or re-assess any of its current financials, reserves or other parts of the business. Pandemic headwinds have been there, but Chubb has managed this well.

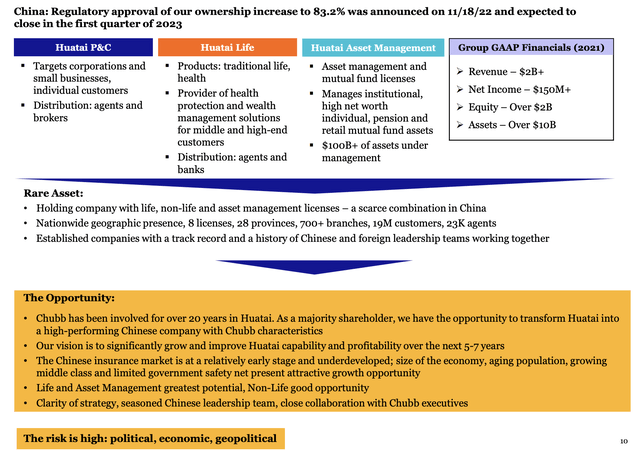

The company is also growing in Asia – one of the typical growth markets, but one that many companies have issues with, and it’s one of the few insurance companies with a majority stake in a native insurer – Huatai.

As the company itself says – the risk is high, and we’ll discount it – but the upside is massive here.

Chubb is driven by industry-leading margin development. The company’s combined ratio is best-in-class in its international peer group. Take a look here.

In fact, if there is one insurance company I would say has previously been able to create value while remaining conservative and diversified, my answer wouldn’t be Sampo, it wouldn’t be a European business, and it wouldn’t be any of the businesses that I currently have heavy insurance investment capital in (even though these are massively undervalued, and that’s why I invest in them).

My answer to you would be Chubb. Because Chubb outperforms. Continually, and usually with a de minimis sort of risk profile. Chubb remains conservative. The closest comparison I can make to how safe I think Chubb is Allianz (OTCPK:ALIZY) and Munich RE (OTCPK:MURGY), two of the largest players that I also invest heavily in, and that are a bit “closer to home”.

You don’t need to take my word for it either – Chubb outperforms. That’s what they do.

When the world is in chaos, and we don’t really know how things are going to go – because I don’t believe that risk will grow less, going forward. When we want to protect our capital while beating the market, we should focus on investing in the best of the best.

Economic growth, inflation, and central bank policies will continue to dictate trends, and Chubb expects to capitalize on globally unfavorable underwriting conditions for its P&C operations on a global basis. I’m not worried here about the company. I expect consumer product lines will continue to recover, and as interest rates start to rise, the company’s investment income will rise in lockstep along with this. The company’s M&A of Cigna, as well as Huatai, will also provide growth opportunities.

In short, there’s a lot to like about the company here.

That is what Chubb is.

Let’s make sure we invest at the right price.

Chubb Valuation

Chubb’s valuation has seen an interesting development for the past few years. While it was possible to “BUY” Chubb a lot cheaper than we see at this time, and I did buy a couple of shares as it dropped really low, the fact is I didn’t react enough for what Chubb offers and what price it offers it at.

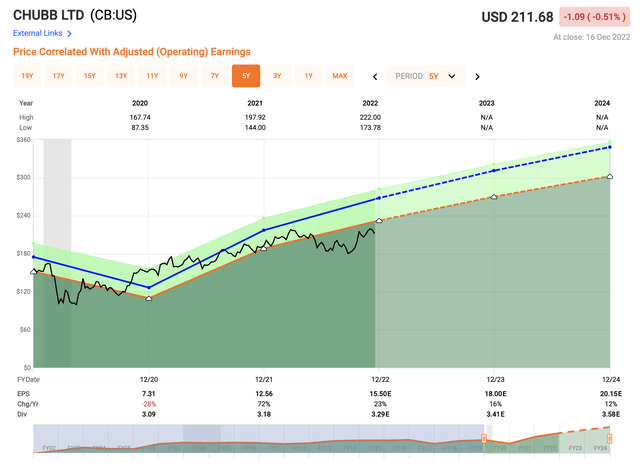

Chubb currently trades at a blended P/E of 13.77x, compared to a 5-year average of 17.28x, implying some undervaluation. The biggest argument here next to that valuation one, is the way that earnings are expected to flow going forward. Take a look here.

Chubb Valuation (F.A.S.T Graphs)

The market is applying. a significant discount to the company, not seen since COVID-19. I personally view this discount as being much too excessive in comparison to what’s actually happening to the company – which is nothing negative. There are some risk considerations in China, but these are comparatively small when looking at the company’s business base.

I believe reversal and outperformance is the only logical end result for the medium term here – and while forecast accuracy isn’t perfect, it’s good enough to be over 80% on a 2-year basis (Source: F.A.S.T graphs).

The ranges we may get from Chubb in terms of annualized RoR are as follows. First of all, we assume the next 2 years of growth estimates at 16 and 12% are relatively locked in, and that 2022E comes in according to plan. Based on such estimates, even a flat, 13-14x P/E RoR would be at least 17% annually, or close to 40% RoR in less than 3 years from an A-rated class leading insurer.

The upper range of that estimate, if we allow for 16-17x P/E goes close to 28% annualized, or close to 60% total RoR until 2024E.

And I don’t consider those numbers to be in any way unrealistic, given what Chubb is and what it offers.

The one major drawback here is the dividend. It’s not that impressive. The current yield is 1.57%, which in terms of peers is the bottom of the barrel. Investing in Chubb means foregoing higher yields for safe capital appreciation – but in today’s market, I believe this to be a relatively fair deal. That’s why I push for investing more in Chubb.

18 analysts follow Chubb as an investment. out of those analysts, 14 currently consider the company to be a “BUY”, from price ranges starting at $175 and going as high as $270/share. The average PT for this stock is currently around $236, which implies an upside of over 11% from the current share price.

I would view this PT as a fair one – and even very conservative, in terms of where things are going. For my own PT, I moderate it somewhat more, giving the company a near-term target of $235 – and this includes a heavy, 10-15% discount for the Chinese investment. Even with that baked in, there is a lot to like here.

Chubb does the rare thing of combining a market-beating upside with what I consider to be rock-solid value. The company cannot be called “cheap” to my conservative PT, but it’s certainly undervalued.

Here is my current and updated thesis on Chubb.

Thesis

- Chubb is among the class leaders in P&C and other insurance lines, such a personal ones. The company has a history of solid outperformance over time, comes with superb fundamentals, and has an upside in the double digits over the coming few years. It combines attractive fundamentals with a market-beating upside, and this is very rare in any sector.

- Chubb is an easy “BUY” at any sort of attractive valuation – and that’s what we have here.

- I adjust my PT for Chubb to $235/share for the near and medium term, and give the company a “BUY” here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I only call companies with a 15% upside to my conservative PT cheap, but other than that, this company has “everything” you might want – except a higher dividend.

Be the first to comment