martin-dm/E+ via Getty Images

We recently wrote an article talking about how cheap European Shopping mall owner Klépierre (OTCPK:KLPEF) had gotten, and why we viewed its high dividend yield as very attractive. The company just reported its first half 2022 results, which we see as very positive, so this article will mainly complement the previous one by focusing on the recent results and our view of their future.

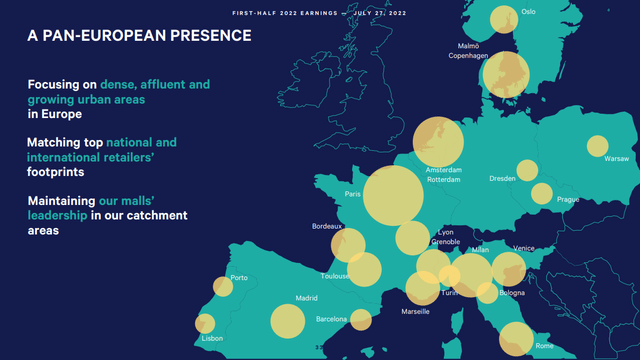

As a reminder, Klépierre owns and operates high-quality shopping malls in some of the most attractive European cities, including Paris, Madrid, Barcelona, and Rome. The map below shoes where Klépierre has a presence, and as can be seen it is focused on some of the most dense, affluent, and growing urban areas in Europe.

Klépierre Investor Presentation

First half 2022 Results

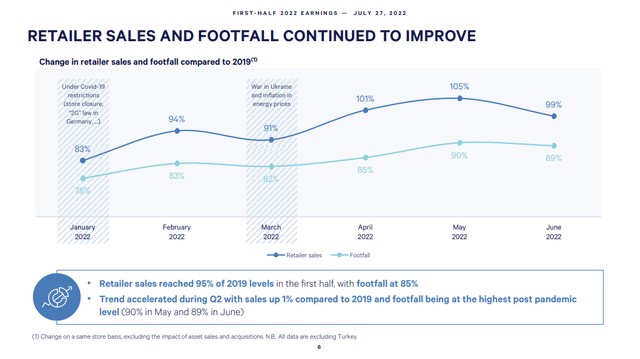

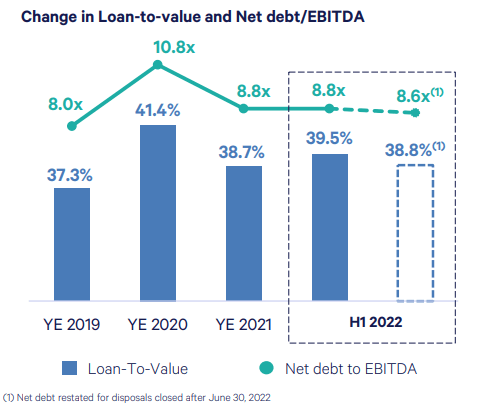

H1 2022 operating performance improved from Q1 to Q2, and is back to the normal course of business. H1 2022 net current cash flow per share was €1.32. Steady leasing activity delivered a 2.7% positive reversion, and occupancy rate improved to 94.7%. Net debt fell below €8bn, with €431m disposals closed to date, resulting in an Loan-to-Value of 38.8% and a Net debt/EBITDA of 8.6x. Particularly impressive was that guidance was revised upwards to at least €2.45 per share.

Klépierre Investor Presentation

The critical segment of fashion reached 102% of 2019 levels in the second quarter. Household equipment posted a sustainable outperformance, while Food & Beverage solidly rose, close to pre-COVID levels.

Operational performance

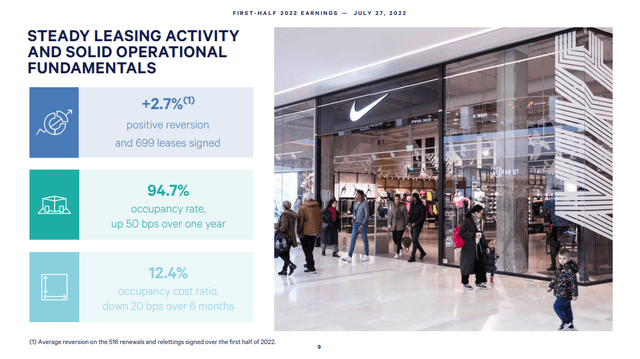

Critically, leasing performance was excellent, delivering a +2.7% positive reversion and 699 total leases signed. This helped improve the occupancy rate to 94.7%. The occupancy cost ratio remains very healthy at only 12.4%, which should help retailers absorb future rent increases without too much issues when the time comes to renew.

Klépierre Investor Presentation

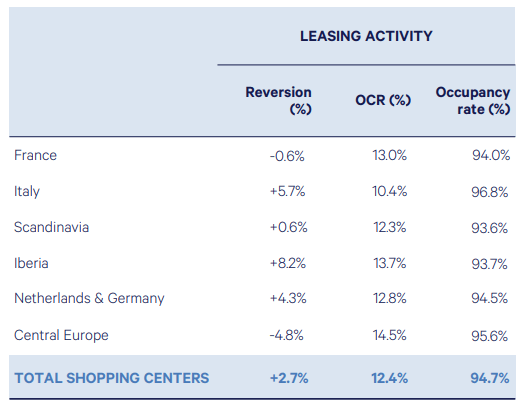

Not everything is perfect, though. Reversion was slightly negative in France, and very negative in Central Europe. Also the occupancy rate in some markets has room to improve. Still, the occupancy rates reflect the high-quality of the assets, with all the markets above 90%.

Klépierre Investor Presentation

Mall expansions

One of the news communicated during the earnings update is that the Gran Reno Mall in Bologna, Italy has opened its extension at the start of July this year. This should add €9.7 million in annual rents. It was 98% let at opening. This is one more sign that there continues to be significant demand for class A malls in good locations.

Klépierre Investor Presentation

Balance Sheet

The balance sheet remains quite strong, with debt at €7,867 million, down €139 million vs. December 2021. Approximately 88% of net debt was hedged at fixed rates in 2022, reducing the risk that increasing interest rates presents.

Liquidity position is solid at €2.3 billion, down €500 million compared to December 31, 2021, after €400 million of debt repayment. Net debt / EBITDA at 8.6x is quite healthy, and the Interest Coverage Ratio at 10.0x shows the financial strength of the company. Following the May 20, 2022 ratings review, S&P confirmed Klépierre’s current rating BBB+ with a stable outlook.

Klépierre Investor Presentation

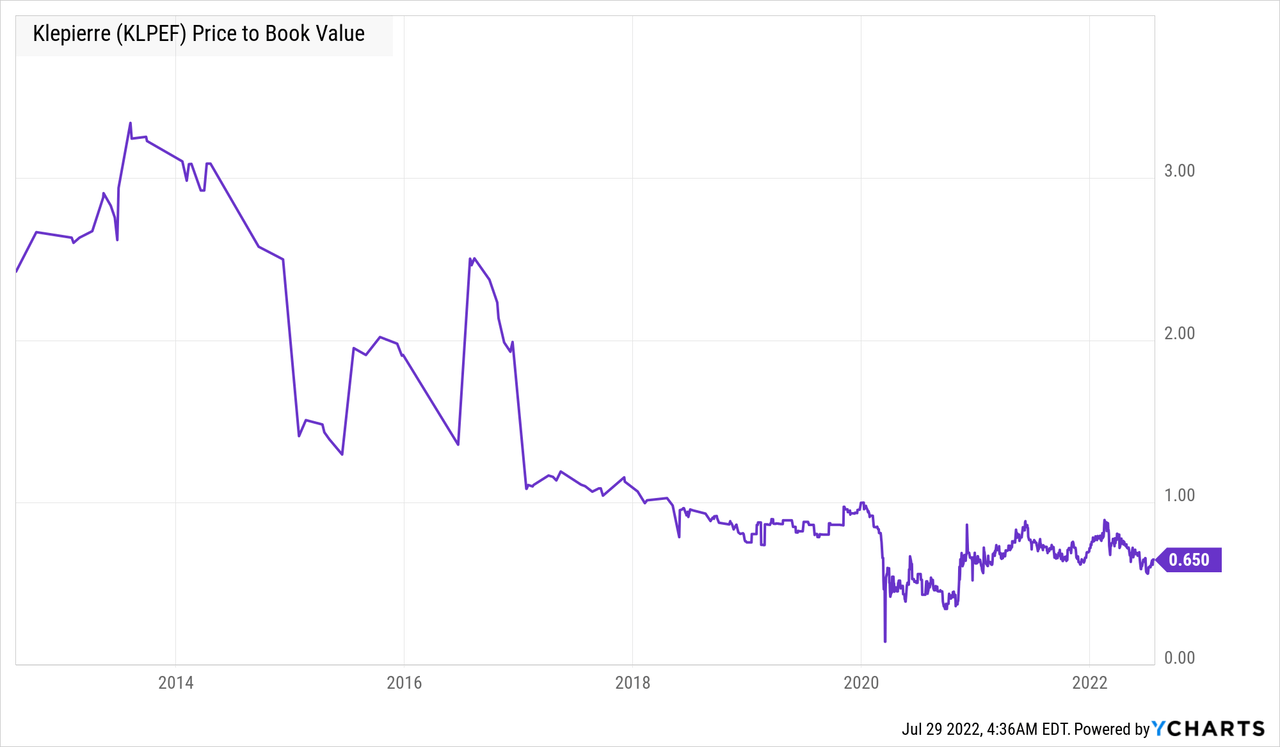

Over the past 18 months Klépierre has completed €1.3bn of asset disposals at 0.3% below book value. This shows the estimated book value for the company is reliable and a good valuation measure. By the way, EPRA NTA per share, which is a proxy for book value amounted to €30.60 as of June 2022. Shares are trading with about a third discount to this book value, reaffirming our belief that shares are significantly undervalued.

Valuation

Klépierre is a company that used to trade at a significant premium to book value, and is now trading at only ~0.65x its book value. We believe this is too cheap, and expect the company to eventually return to trading above book value, which would mean returns of more than 50% from current prices.

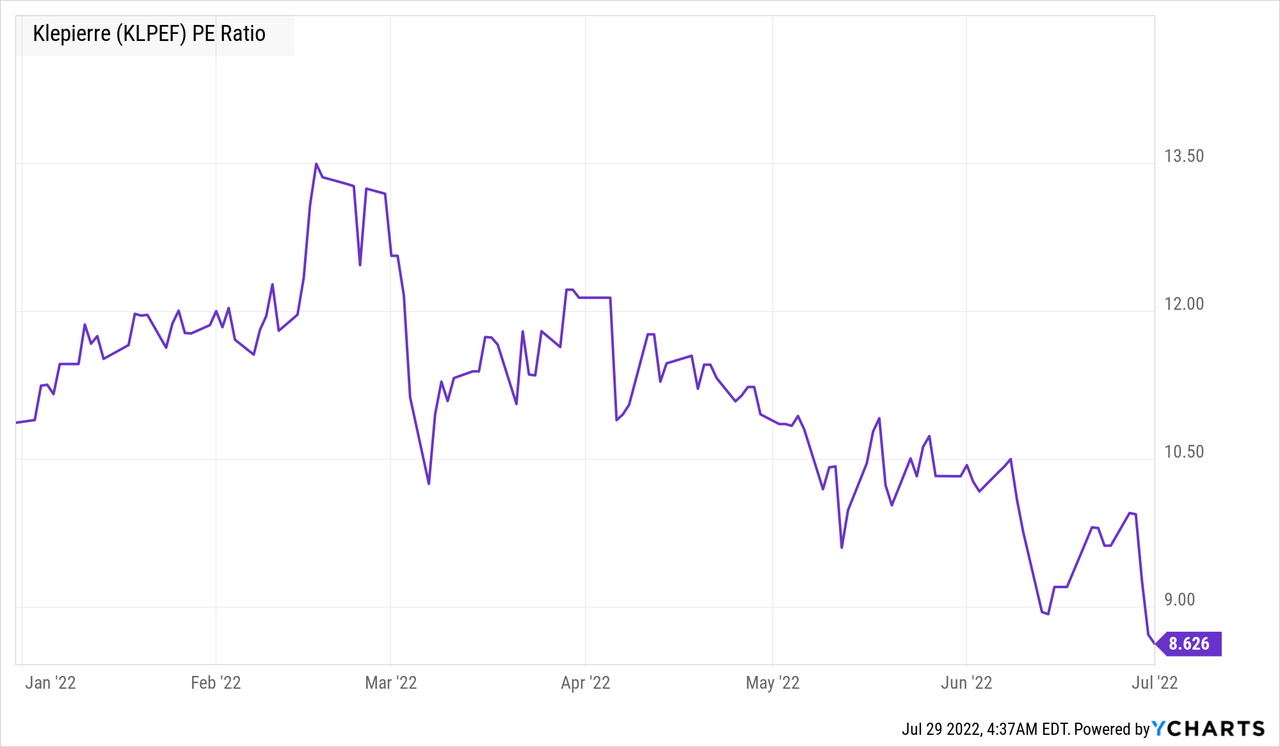

Similarly, its price/earnings ratio shows just how cheap shares are, with a p/e of ~8.6x, and a dividend yield above 8%. All these metrics point to severe undervaluation.

Risks

In the short to medium term the biggest risk that we see is another round of forced closures by the government should COVID become a major health crisis again. Longer term there is risk of e-commerce taking market share from physical retail, although so far it seems that many retailers are opting for an omni-channel strategy where they concentrate their stores in the highest-quality physical spaces like Class A malls to complement their digital strategies. We therefore believe Class B and Class C malls we’ll be the most affected by the rise of e-commerce, while flagship destination malls should continue to do well. So far Klépierre has shown that quality malls have staying power with the quick recovery it has delivered after the pandemic.

Conclusion

We were very impressed that Klépierre increased its 2022 earnings guidance upward by a significant amount. For 2022, the company expects net current cash flow to reach at least €2.45 per share, a 5.4% increase compared to the midpoint of the initial guidance. It is also very encouraging to see that retailer sales in its malls are now close to pre-COVID levels, even exceeding pre-COVID levels in April and May this year. Another positive sign is that the company was able to complete several asset disposals at prices very close to book value. All of this reaffirms our thesis that Klépierre is trading at a very attractive valuation, and that the company has almost completely recovered from the COVID crisis.

Be the first to comment