MR1805/iStock via Getty Images

I have long held a bearish stance on the British-American entertainment cruise giant, Carnival Corporation (NYSE:CCL)(NYSE:CUK), and have first outlined my thoughts on the matter in an article written in December last year titled: “Simply Running Out Of Time“. The reasoning behind this has largely stayed the same. The cornerstone of the bear thesis could be summed up as the company taking out a tremendous amount of debt in order to finance its pandemic operations, shareholders being diluted out of the company ownership due to the effect of equity financing, and in the end, the ability of management turning the boat around being proven much more difficult than many have initially foreseen.

The company reported its long-awaited third-quarter earnings results last Friday, once again disappointing investors and opening room for more than a 20% price drop in a single day which left the share price close to the 30-year low. While I believe that Monday’s opening bell will allow for some optimism in the company to be restored, there is no doubt that Carnival Corporation has been going on a clear path from bad to worse since the onset of the pandemic, as shareholders take yet another painful punch to the gut. Still, not everything is that bad this time around.

Carnival Q3 2022 earnings report

News headlines over the weekend were less than favorable for the British-American cruise operator, which reported its third quarter results on Friday, the 30th of September. In fact, shares of Carnival fell by 23% and are once again trading below their pandemic lows after the stock market struggled to process the earnings results. However, for the first time in a while, we have several positives to discuss concerning the CCL earnings release. Revenues for the quarter came at $4.3 billion, more than the $4.0 billion in revenues for the combined first two-quarters of the year. However, the company still posted a quarterly loss of $279 million, which takes the tally to slightly more than a billion this year.

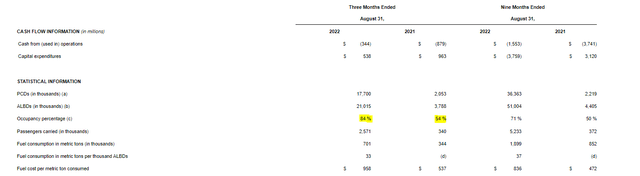

To start on a more positive note, operational results for the quarter were an extraordinary improvement when compared to the last quarter and even came close to record-breaking quarters of late 2019. The company served more passengers as PCDs rose to 17.7 million, which represents an increase of almost 54.8% from the second quarter and only slightly falls behind the record-breaking Q3 of ’19 by 28.24%. Additionally, total customer deposits were $4.8 billion in the third quarter of 2022, even approaching the record third quarter of $4.9 billion in 2019. New bookings for the quarter even offset most of the historical seasonal decline in customer deposits, suggesting there is still significant demand cruises in the quarters to follow.

Occupancy rates at the time were 113%, with current third-quarter rates being set at 84%. However, it is important to note that management pointed out August rates were as high as 90%. This came as cruise companies largely began dropping most vaccine mandates and pandemic protocols in early August. This means there is still a lot of room for improvement operational-wise, which CCL will likely capitalize on over the next couple of quarters. Interestingly enough, we can observe the impact of soaring fuel prices as the company spent $487 on fuel per metric ton back in 2019, and more than $869 on fuel per metric ton back in the same period of this year.

Statistical Information (CCL Q3 2022 Business Update)

Our business continues on a positive trajectory. We’ve been closing the gap to 2019 as we put a stake in the ground internally and shifted from return to service to a relentless focus on return to strong profitability. The occupancy gap to 2019 has reduced from over 50 points in Q1 to less than 30 points in Q3. At the same time, our capacity in service has gone from approximately 60% in Q1 to over 90% in Q3. In fact, in the month of August, we achieved almost 90% occupancy at higher constant dollar revenue per diem despite the impact of future cruise credits. And the differential in adjusted cruise costs, excluding fuel per ALBD, has reduced from over $25 in Q1 down to $10 in Q3. As a result, we were able to generate over $300 million of adjusted EBITDA in the third quarter, overcoming a near doubling in fuel prices.

Josh Weinstein, President, CEO – Q3 ’22 Earnings Release

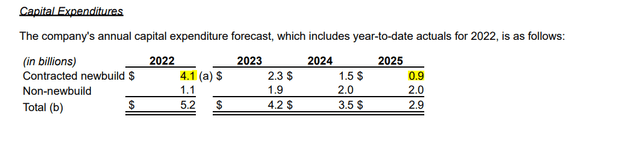

Another positive that is worth pointing out is that management has doubled down on attempting to limit capital expenditures, with spending on shipbuilding expected to decrease at roughly 30% per year until 2025. This would see some desperately needed free cash flow finally freed up.

Capital Expenditure Forecast (CCL Q3 2022 Business Update)

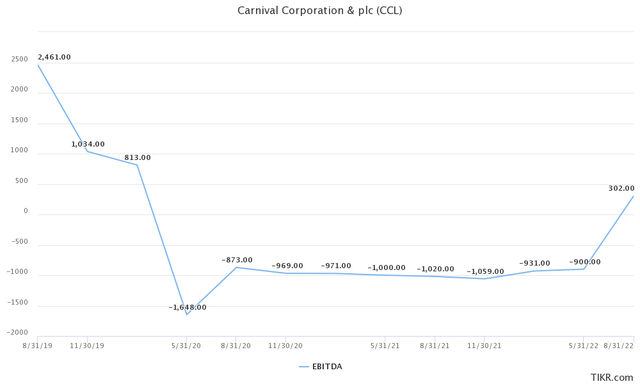

This in fact means that we had the first quarter of positive EBITDA in a little over 4 years. The company ended the third quarter with $7.4 billion of liquidity, which involves their current cash and some $2.4 billion in a revolving credit facility. It effectively sums up most of the positive financial updates for the quarter, the rest is much less impressive.

Quarterly EBITDA (TIKR Terminal)

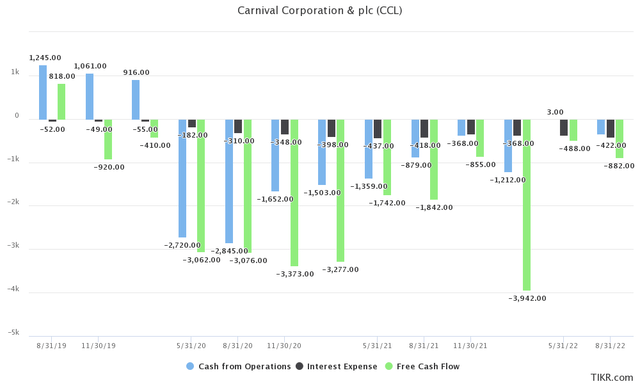

Ultimately, the main issue remains the same. Carnival is still burning through significantly more cash than it generates. The positive here is that it no longer burns approximately $2 billion per quarter, as was the case during the pandemic, but there is still nowhere near enough generated cash to be able to turn the boat around for the company. As of the third quarter, CCL generated a negative $344 million in cash from operations and a negative $822 million in free cash flow. The quarterly interest expense alone is parked at $422.00 million. How bad things actually look can be seen when we compare the numbers to pre-pandemic Q3 of 2019, when the company generated $1.24 billion in cash from operations and $818 million in free cash flow. Pre-pandemic quarterly interest expenses were only $52 million.

CFO, FCF, and Interest Expense (TIKR Terminal)

The guidance for the full year and 2023 remains bleak at best. Management made it clear they expect another tough quarter given the seasonality of their business. Henceforth, Carnival is expected to post another net loss next quarter. Fourth-quarter EBITDA is expected to be negative as well, however, management noted that overall the second half of the year should have a positive EBITDA. This would in theory limit negative EBITDA to up $200 million in the fourth quarter. They didn’t feel comfortable providing guidance for 2023 other than to note that the company anticipated continued improvement in adjusted EBITDA and occupancy throughout the following year.

Decay of CCL’s balance sheet

It is not really possible to discuss Carnival Corporation without addressing the two main issues the company faces, debt and dilution. CCL is simply not the same company it was in early 2019, with the balance sheet having significantly deteriorated due to the amount of debt and equity financing the company was forced to take on to stay afloat.

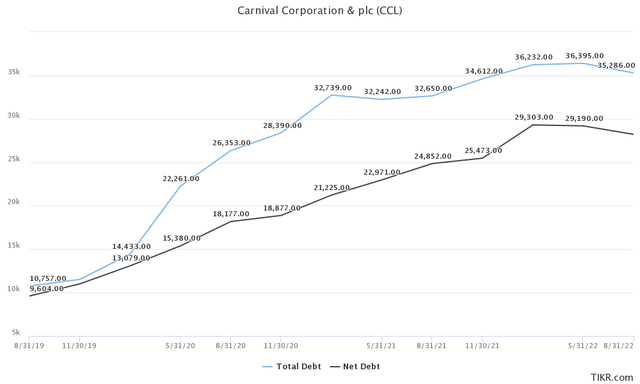

The main issue at hand is one concerning the outstanding debt the company has incurred in the period over the last three years. As per the latest quarterly filing, the company had $35.28 billion in total debt and $28.21 billion in net debt. In the third quarter of 2019, prior to the pandemic, the company reported $35.28 billion in total debt and $28.21 billion in net debt

Total Debt and Net Debt (TIKR Terminal)

If we annualized the positive third-quarter EBITDA, the company would generate $1.2 billion in EBITDA. That would land the Net Debt/EBITDA ratio at 24.3x, while the Total Debt/EBITDA ratio would be 29.4x. It is worth keeping in mind that this figure is with management already telling us that fourth-quarter EBITDA is likely to be negative.

Even if CCL could generate between $5-6 billion in EBITDA next year, which seems quite optimistic from where we stand today, that would still place the company at Net Debt/EBITDA at 4.70-5.64x and a Total Debt/EBITDA at 5.88-7.05x. Carnival was able to generate between $4.5-5.5 billion in EBITDA during the best years leading up to the pandemic outbreak.

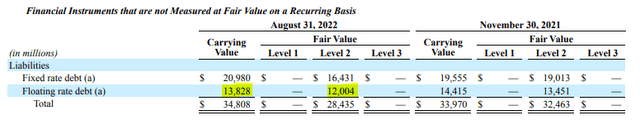

Another issue in this aspect is the structure of the debt. Close to 40% or $13.82 billion of debt was taken out at a floating rate, which is going to cause additional issues for the cruise operator down the road given the current macroeconomic environment.

Structure of Debt (CCL Q3 2022 10-Q)

Management once again doubled down on its efforts in kicking as much of the debt as possible down the road, which helps the company stay afloat, for now at least. Instead of having $2.89 billion of debt maturing next year, due to refinancing efforts during this quarter, that principal has been lowered by $520 million to $2.37 billion. From that point on, management will have to scrape the barrel in order to find $4.93 billion in 2024, $4.25 billion in 2025, and $4.38 billion in 2026.

Debt Maturity Schedule (CCL Q3 2022 10-Q)

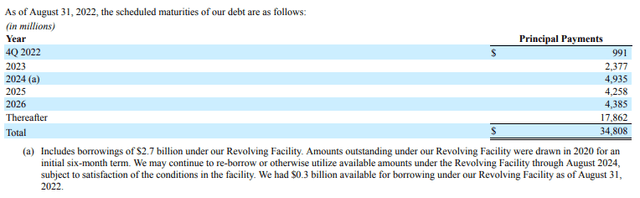

As previously noted, the company placed a lot of dependency on equity financing in order to raise capital during the lockdowns. This practice was placed on hold for a little more than a year, prompting me at one point to even praise management efforts to no longer dilute the shareholder base at these price levels. Unfortunately for common stockholders, July saw another expensive public offering from Carnival.

The latest public offering saw CCL sell 102.13 million shares of common stock at a public offering price of $9.95 per share, further increasing the share count to 1.29 billion. This rather difficult, but arguably necessary course of action came at a huge cost to shareholders, with the average shareholder being diluted by almost 89% since the offset of the pandemic. Shareholders in the two major rivals, Norwegian Cruise Line (NCLH) and Royal Caribbean (RCL) have largely suffered the same fate. Given the current company’s trajectory, it is highly likely this will not be the last offering we have a chance to see.

Shareholder Dilution (TIKR Terminal)

Still lacking confidence

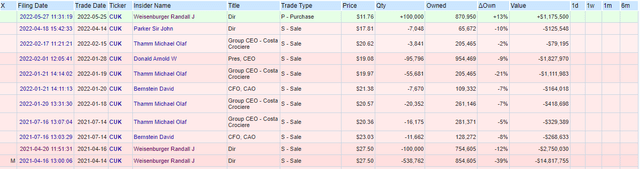

I have already dedicated some time to discuss what I have described at an earlier point as a “very loud and noticeable lack of insider purchases” by corporate insiders during the course of the past year. However, only weeks prior to my last article, Randall J. Weisenburger, a long-time serving member of the board, purchased 100,000 shares of CCL in the open market at around $11.76 per share. This led me to believe that it might be the beginning of a broader across-the-board purchasing spree by insiders, finally restoring some senior management confidence in the turnaround potential of the company.

However, that has not been the case since, with Randall’s purchase seemingly proving to be an isolated vote of confidence. It is said that insiders tend to supply the market with high-quality investment information every time they decide to trade their own company’s shares in the open market. But in times like this, an argument can be made that they can supply the market with quality grade information whenever they decide not to engage in trading of their own stock.

Insider Activity (OpenInsider)

Final thoughts and closing arguments

We can conclude that the operational results during the third quarter were relatively impressive given the situation the company finds itself in, but they didn’t necessarily translate all that well over to the financial results. Carnival is still burning through cash and even at 84% capacity barely fails to cover the interest expenses on the tremendous amount of debt it has accumulated during the last three years. Given the bleak guidance management provided, I am not sure if any good financial results are to be expected prior to the second-quarter results of the next year. Overall, the situation seems to be slowly deteriorating for the common stockholder. In our last article titled: “On Board The Titanic And Set On Collision Course“, we pointed out that we deem it realistic to see the company at a $6-7 per share level, at which point we would re-evaluate the risk-reward profile which at that point might prove too enticing. Given the latest results and the somewhat weak guidance, we would have to conclude that even with Carnival selling at $7.03 we are seeing the opportunity as increasingly less favorable to the average investor. In the end, we would still have to argue that most investors are better off jumping ship and cutting their losses, as Carnival Corporation appears to be committed to a collision course with time slowly running out.

Be the first to comment