SergeyZavalnyuk

Thesis

Leading iron ore and base metals mining company Vale S.A. (NYSE:VALE) has seen its stock battered since its highs in 2022, as the market anticipated worsening global macroeconomic headwinds.

Therefore, we believe the battering is justified, even though the company highlighted it’s expected to benefit from secular drivers predicated on the world’s energy transition.

However, Vale’s operating metrics are expected to worsen further, with the Fed’s rate hikes causing mayhem in the currency markets. While commodity prices have already been pummeled, Vale could face the prospect of near-term demand destruction as we enter closer to a global recession.

Notwithstanding, China’s economy has shown green shoots of emerging from its economic malaise, as the central government aims to stabilize its property market. However, the recovery is expected to be tepid, as consumer spending remains weak. Furthermore, China’s monetary policy is facing significant challenges from easing further, given the Fed’s aggressive rate hikes.

Still, we postulate that VALE’s valuation has been de-risked adequately for investors to consider taking another look, as its margins are expected to remain steady.

Hence, we revise our rating on VALE from Hold to Buy, with a medium-term price target (PT) of $17, implying a potential upside of 28%.

VALE’s Valuation Has Been De-risked

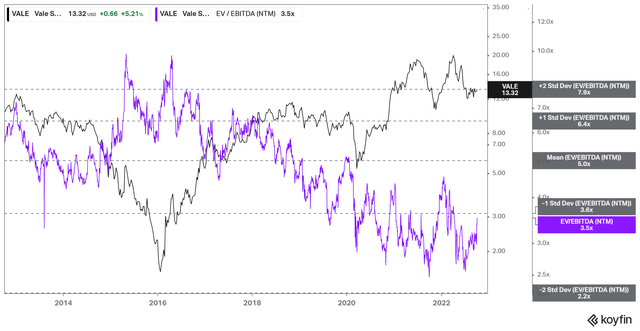

VALE NTM EBITDA multiples valuation trend (koyfin)

As seen above, the market had not re-rated VALE, although it recovered remarkably from its 2020 COVID lows. Therefore, we believe the market anticipated its rapid growth in 2020-21 was not sustainable.

With Vale’s forward EBITDA estimates expected to deteriorate further, we postulate that the market’s skepticism is justified. Notwithstanding, VALE appears to have found robust valuation support at its November 2021 lows, close to the two standard deviation zone under its 10Y mean.

Hence, we deduce that VALE’s reward-to-risk profile at the current levels seems attractive, even though neat-term headwinds may persist.

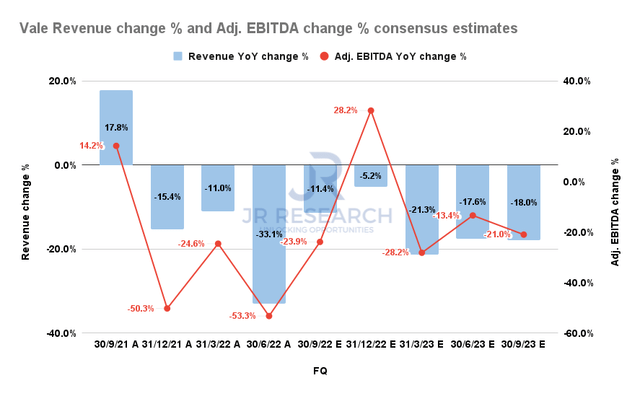

Vale Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

As seen above, Vale’s massive growth in FY21 proved unsustainable, as it couldn’t maintain its growth cadence.

Coupled with worsening macro headwinds, Vale’s revenue and profitability growth is expected to fall through FY23. Therefore, investors need to be prepared that while VALE may be near its long-term bottom, a material re-rating is unlikely in the near term, given worsening macro headwinds.

Nevertheless, there may be more positive news that could emerge from China through FY23. For example, Chinese Premier Li Keqiang highlighted in a recent meeting that China’s economy improved in Q3.

Therefore, the central government will focus on Q4’s recovery momentum to corroborate Q3’s uptick. Furthermore, China has been attempting to further bolster its property market. Several measures have been implemented, including lowering mortgage rates and urging its banks to ramp up property financing.

Hence, we postulate that China could potentially offer some upside surprises through 2023 if its zero COVID restrictions could be eased after its pivotal 20th CPC National Congress in mid-October.

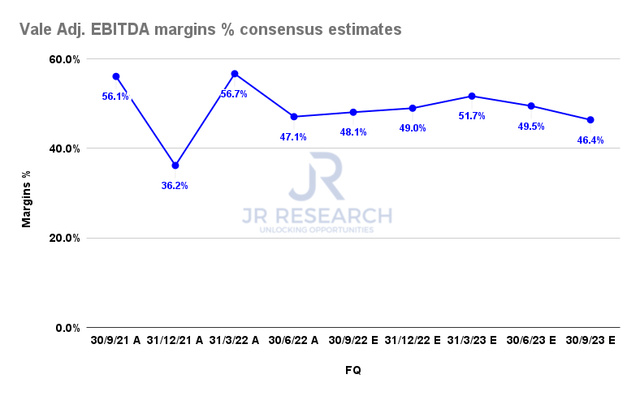

Vale Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Furthermore, Vale’s adjusted EBITDA margins are expected to remain robust through the cycle. Therefore, we believe it should provide security for investors in that its dividend payouts can be sustained, which should help undergird VALE’s valuation at the current levels.

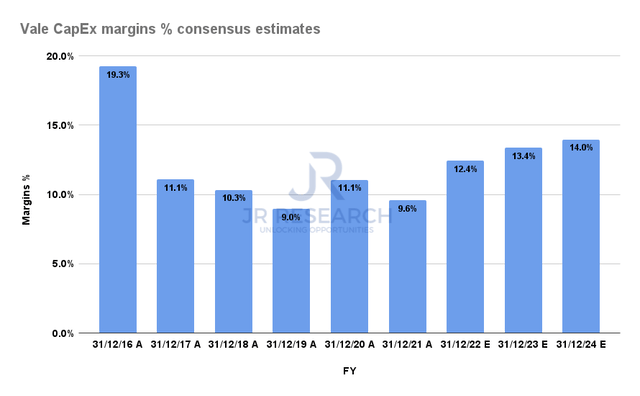

Vale CapEx margins % consensus estimates (S&P Cap IQ)

Moreover, the company is expected to continue investing through the cycle, leveraging its secular opportunities in its base metals segment. Hence, we believe Vale’s CapEx commitments accentuate its confidence in its medium-term growth opportunities in the global energy transition.

Given its robust profitability, the company would be able to capitalize on these accretive opportunities through the downcycle.

Is VALE Stock A Buy, Sell, Or Hold?

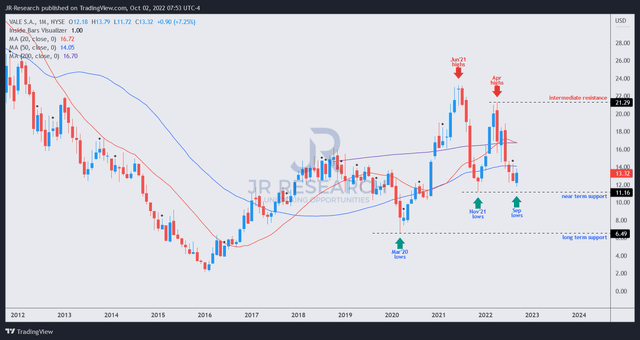

VALE price chart (weekly) (TradingView)

We gleaned that VALE has collapsed to its long-term support, close to the lows last seen in November 2021. Also, we observed that VALE last traded close to the 50-month moving average (blue line), which has supported its recovery since March 2020.

We believe that VALE’s long-term trend has reversed decisively to the upside since the lows in 2016. Moreover, the robust bear trap (indicating the market denied further selling downside decisively) at its March 2020 COVID lows corroborated its long-term uptrend continuation thesis.

Hence, as discussed earlier, we are confident that VALE should find strong buying momentum at the current levels, coupled with an attractive valuation.

We see constructive buying opportunities at the current levels with an NTM dividend yield of 12.3%, secured by a reasonable payout ratio (56% of EPS).

Accordingly, we revise our rating on VALE from Hold to Buy, with a medium-term PT of $17.

Be the first to comment