Sergey Shulgin/iStock via Getty Images

As with most SPAC transactions, Super Group Limited (NYSE:SGHC) has collapsed following the closing of the deal. The online gambling company is actually profitable, questioning whether the stock has dropped 60% from the SPAC deal for any logical reason. My investment thesis is far more Bullish on the gambling stock here at $4 after the major discount has finally arrived.

Diversified Growth

Unlike a lot of the other online gambling stocks going public via SPACs during the boom last year, Super Group already had a strong business outside the U.S. The company operates the Betway, online sports book, and Spin, online casino, brands with nearly 50% net gaming revenue from both units.

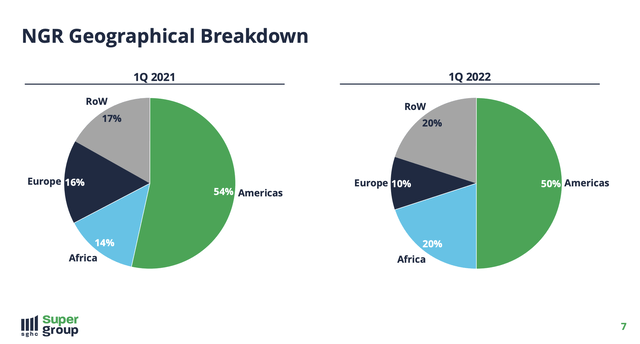

The company has about 50% of revenues from the Americas, but unlike other online gambling players entering the U.S. half of revenue comes from areas such as Africa and RoW. The recent regulatory issues in Germany and The Netherlands have shifted business away from Europe and more into areas such as Africa.

Source: Super Group Q1’22 presentation

The company is still a play on online gambling growth in the U.S., but the deal with Digital Gaming Corporation won’t close until later this year. DGC will offer access to operations in 6 U.S. states with market access to another 6 states providing the next major growth avenue for Super Group. In addition, the company recently entered Bulgaria.

While the Q1’22 results provided over 7% revenue growth to reach ~$350 million, the numbers are below where Super Group hoped to be when doing the SPAC deal. The company discussed a tough hold during March and pulled guidance for the year in part due to tough currency conversions with the Euro.

Super Bargain

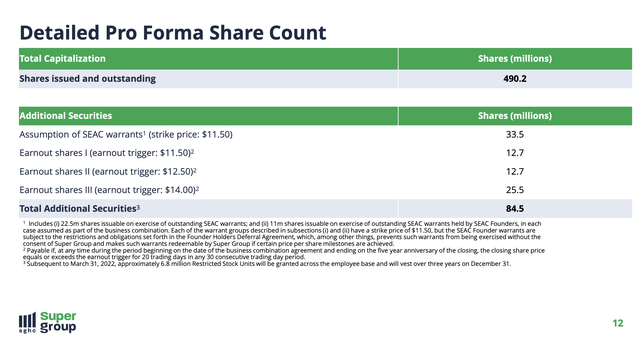

With the dip to $4, the stock only has a market cap of ~$2 billion with 490 million shares outstanding. Similar to other SPACs, Super Group has a substantial amount of additional securities outstanding that may or may not be executed with the stock at $4. All of the warrants and earnout shares require a price of at least $11.50 to trigger the exercise of those shares.

Source: Super Group Q1’22 presentation

In a fully diluted case, Super Group would have ~575 million shares outstanding for a market cap of $2.3 billion. Of course, the stock would have to hit $14 for 20 trading days for the last 25.5 million shares to be paid out. The stock valuation would top $8 billion in such a scenario, but Super Group would obtain nearly $350 million in cash for the warrants.

The company generated $1.5 billion in NGR in 2021 and is on pace to top this figure. Super Group is cheap considering the company generated $358 million in adjusted EBITDA and strong free cash flow last year.

The company had forecast some aggressive growth in 2022 with adjusted EBITDA growth of 14% to reach €345 million, but the online gaming market has hit a soft patch and the DGC deal hasn’t closed yet. The stock only trades at ~5.5x trailing EBITDA (based on the lower Euro price), though the stock does get tough to value knowing the share count will quickly rise.

The original guidance for the year had adjusted EBITDA converts to $360 million now, which would be substantially cheap. Unfortunately, Super Group pulled guidance and the actual number could be far lower with Q1’22 EBITDA of €61.5. Yes, the number was up 14% YoY, but the annualized number is far below the original target for 2022.

Takeaway

The key investor takeaway is that Super Group has hit a rough patch like the rest of the online gambling market as consumers spend more time out and about. Ultimately though, the company plays in an attractive market with long-term growth opportunities in the U.S. and the RoW online gambling markets not apparent in the stock valuation.

Investors should use the weakness to build a position in Super Group before the market turns around and the DGC deal closes in the 2H providing the gateway to the attractive U.S. markets.

Be the first to comment