PhonlamaiPhoto

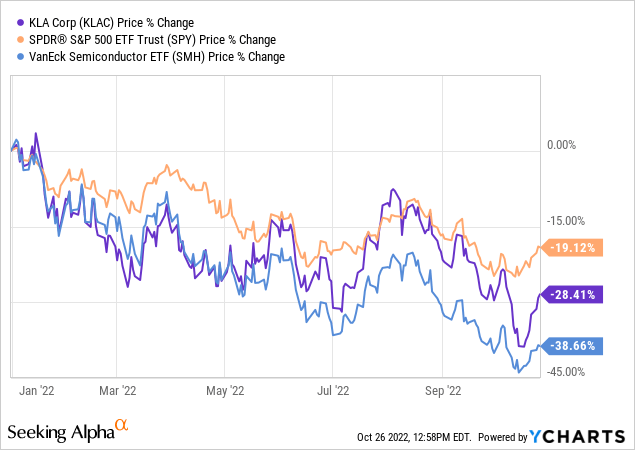

The stock of semiconductor equipment maker KLA Corp (NASDAQ:KLAC) is down 10.3% this year. Yet that is significantly better than the S&P500 and less than half the drop of the broad semiconductor sector (as measured by the (SPY) and VanEck Semiconductor (SMH) ETFs – see graphic below). Meantime, the company still trades as though it was dead money. I say that because at a 14x TTM P/E ratio, KLA is trading at roughly a 30% valuation discount to the S&P500 (TTM P/E of 20x). Well, KLA is not dead money – the company generated $3 billion in FCF during FY22 (which ended in June) while EPS was +31.7% yoy. Total revenue of $9.2 billion was +33% as compared to FY21. KLA released its Q1 FY23 report after the market closed today (Wednesday, October 26th) and it was a continuation of full-year FY22’s strong performance.

Bottom line here: despite the on-going trade tension, and specific technology trade restrictions on the semiconductor equipment makers, global semiconductor demand will be met one way or that other – whether the semi-equipment goes to China, or to Vietnam, Korea, Japan, or, hopefully, right here in the good ol’ USA.

Investment Thesis

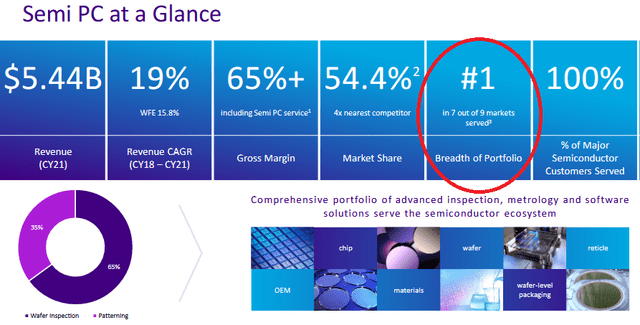

Global Newswire reports that the global semiconductor equipment market is expected to reach $142.5 billion by 2027 and between now and then, grow at an estimated CAGR of 4.1%. While that is certainly not eye-popping growth, there are sub-segments of the semi-equip sector that are growing at a much healthier pace. For instance, the process control, inspection, and HVM (“High-Volume Manufacturing”) areas have exhibited strong growth. As shown from the following slide summarizing the performance of its Semiconductor Process Control (“PC”) segment in calendar year 2021, this fits in well with KLA’s focus and expertise:

As you can see by the graphic, KLA’s process control segment grew at a 19% CAGR over the past three years, and, more importantly, the company has a commanding 54.4% market share (4x the nearest competitor) and is #1 in breadth of portfolio in 7 out of 9 markets served.

Earnings

Indeed, KLA’s full-year FY22 earnings report back in June was quite bullish in my opinion. The company generated $3 billion in FCF in FY22 (which ended in June) while EPS was up 31.7% yoy. Total revenue of $9.2 billion was +33% yoy. For that it is given a 14x multiple?

The company kicked-off FY23 with its Q1 report was issued after the market closed today (Wednesday, October 26th). It was a very bullish report that was a strong beat on the top- and bottom-lines as the numbers came in above guidance. Highlights included:

- Total revenue was $2.72 billion (+30.7% yoy).

- EPS was $7.20/share (+52.2% yoy and a $0.83/share beat).

- Free-cash-flow was $927.2 million.

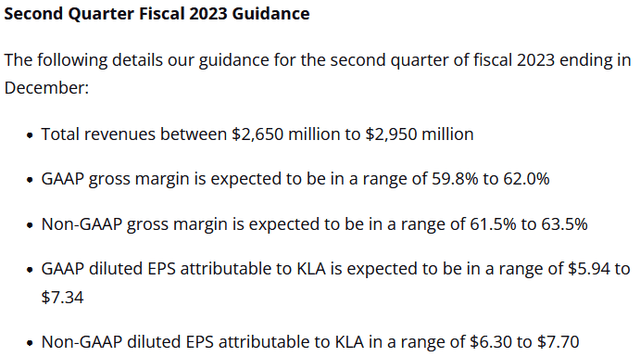

Q2 guidance is shown in the graphic below, taken from the report:

The mid-point of Q3 revenue guidance ($2.8 billion) is relatively flat with Q1 and the gross margin estimate remains strong and in the 60%+ range, comparable with FY22. EPS guidance remains solid despite the macro-environment.

Going Forward

I expect KLA to continue to focus on, and dominate, the high-margin (65%+ gross margins) process control & inspection sub-segment of the semi-equip world. KLA’s customers need to increase yield & reliability and to adopt high-volume manufacturing in order to improve margin. For instance, the memory industry will encounter yield and defect challenges as it moves toward next-generation devices (160+ layer 3-D NAND for instance). KLA is likely to be a primary beneficiary of this trend because these smaller dimension devices will require more precise manufacturing specifications and therefore more precise measurement during the inspection process. That being the case, KLA is very well-positioned for strong growth going forward because its equipment will be required to enable chip makers to improve margin of these smaller dimension devices.

Also, a short-term catalyst may be that KLA’s service revenue continues to expand as its customer base grows in combination with high machine utilization rates. Indeed, on the Q4 FY22 conference call, KLA CEO Rick Wallace said:

Often what we’ve seen historically in downturn is customers still want to get productivity. And one of the ways they do that as they focus heavily on yield improvement or process stability. So we actually see utilization stay high on the services in order to keep the tools capable. And sometimes they will actually deploy some of their limited budget toward upgrading the installed base.

Risks

The U.S./China technology trade-war is in full-bloom and certainly KLA’s leading edge equipment sales have been negatively impacted. Indeed, just a few weeks ago Reuters reported that:

… KLA shall stop sales and service to “advanced fabs” in China for technology of NAND chips with 128 layers or more, and DRAM chips 18nm and below, and advanced logic chips. The U.S. chip toolmaker would also cease supply to China-based chip facilities owned by Intel (INTC) and South Korea’s SK Hynix, the source added.

That will certainly be a drag on what otherwise would have been a fertile Chinese market for KLA. Yet as I said earlier, global semiconductor demand will be met – one way or the other. If not via China, then through Vietnam, Korea, Japan – and, hopefully and eventually, from the United States.

High-level risks also include a weaker global economy pushing down industry-wide sales as well as potential competitive pressure considering KLA’s big market share in process control – particularly from a company like Applied Materials (AMAT). AMAT has been working for years to take market share away from KLA’s position in passive data collection (“PDC”) and inspection. Netherlands-based ASML Holding (ASML) is another company to keep an eye on in this regard.

Up-side risks include Biden’s signing of the U.S. CHIPS & Science Act of 2022 back in August. This act will enable $50 billion in manufacturing and R&D funds available through the Department of Commerce to strengthen the domestic semiconductor industry and related supply-chains. I consider this to be a mid- to longer-term bullish catalyst for KLA.

Summary & Conclusions

KLA has a very strong position in the global semiconductor equipment sub-segments of process control, inspection, and HVM – where it commands a dominant market share and, as a result, strong margin. I expect that trend will continue this year. I also believe the significant valuation discount of KLA stock to the overall S&P500 is irrational. I expect KLA will earn close to $22/share in FY23 and that the valuation level will move-up to be much closer to a market multiple (say 18x) as the company continues to prove it can deliver strong free-cash-flow despite the macro-headwinds. That being the case, my 12-month PT on KLA is $396, or roughly 30% above its current level of $306.

NOTE: On the strength of the Q1 report, KLA is currently trading strong in the post-market: $311.99 +$5.59 (+1.82%) @5:50 PM (quote from Seeking Alpha). That being the case, be careful with market orders early in tomorrow’s session and I would caution against buying during the pre-market when volume is typically low and price extremes can easily cost you a few dollars per share. That said, in light of my $396 price target, $310/share is still a bargain.

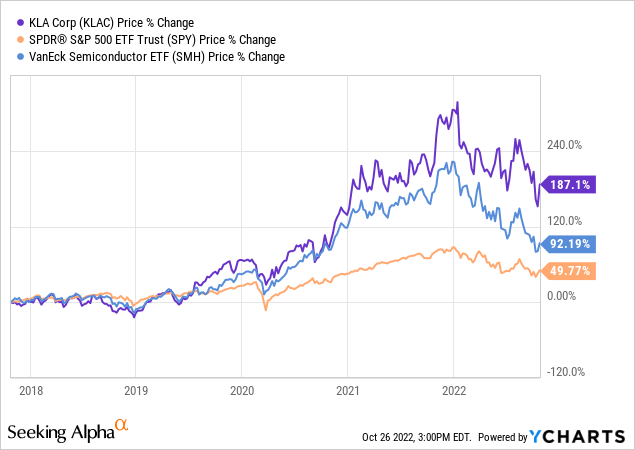

I’ll end with a 5-year price comparison of KLA versus the S&P500 and the Van Eck Semiconductor ETF and note that its performance track record is very impressive:

Be the first to comment