We Are

By Michael J. Fleisher

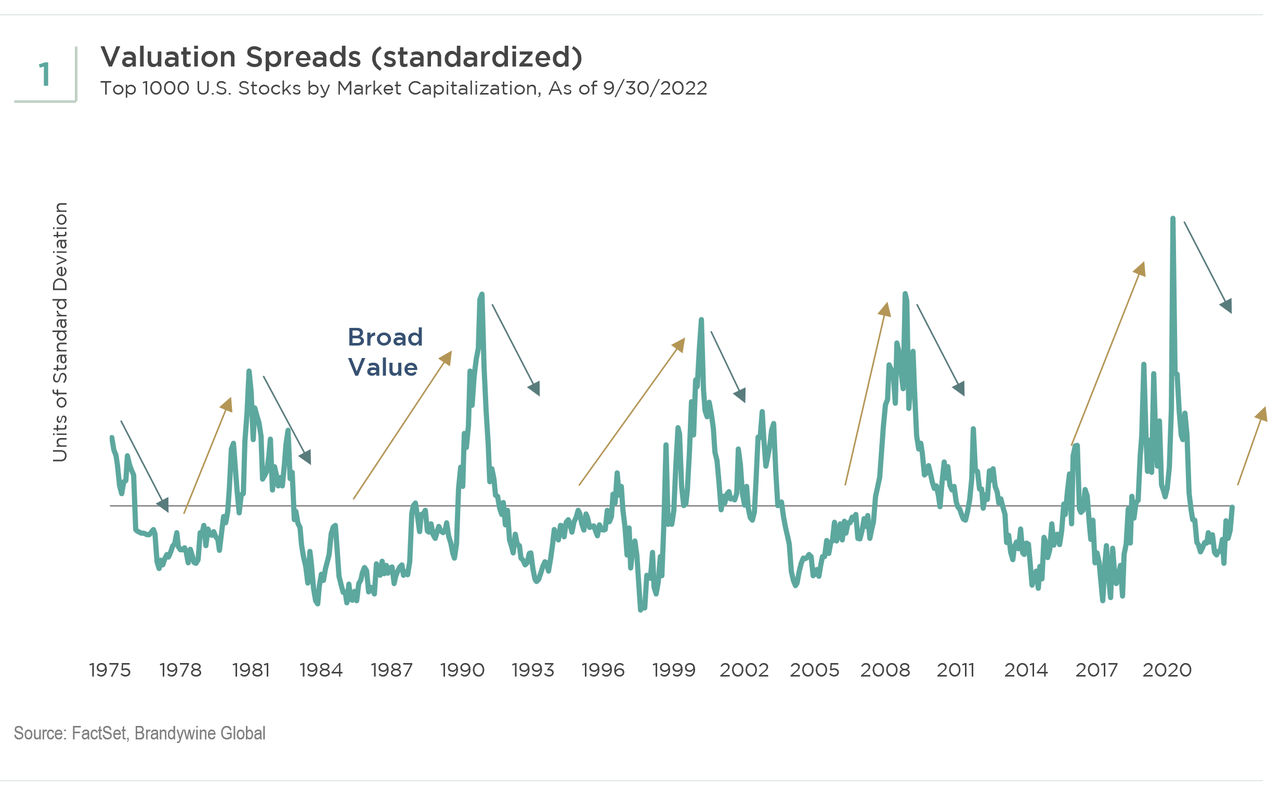

Earlier this year, the stock market signaled an important shift for value investing. Based on our proprietary research in value investing, we find that deeper-valued stocks tend to outperform when the valuation spread, meaning the difference between cheap and expensive stocks, peaks from a very wide level. Meanwhile, higher-quality value stocks generally outperform when the valuation spread troughs—or bottoms out—from a narrow level. This trough in the spread recently occurred in June of this year. As a result, our models are signaling for higher-quality value companies to outperform. Within our framework of quality factors, we find that profitable companies, represented by stocks with high return-on-equity ratios, significantly outperform when the standardized spread is widening from a very narrow level as indicated by the gold arrows in Figure 1.

Two Phases for Value Stocks

Our model-driven, large-cap value investment process accounts for the different phases of a market cycle and emphasizes the factors that are associated with outperformance during each phase. We identified two distinct value phases—Broad Value and Deep Value—by looking at valuation spreads between the cheapest quartile stocks and the median stocks out of the top 1000 U.S. stocks by market capitalization. We also discovered that some factors, which we group into value, sentiment, and quality categories, performed better in one environment—Broad or Deep Value—versus the other. Therefore, we found we could improve the consistency of excess returns and limit drawdowns relative to the benchmark by adjusting factor exposures to correspond with the prevailing market environment.

Valuation spreads narrowing and then starting to widen—as they began to do in June—signals the beginning of a Broad Value regime. Our research shows that a portfolio with an emphasis on value stocks with high-quality characteristics and relative price strength performs best in a Broad Value environment.

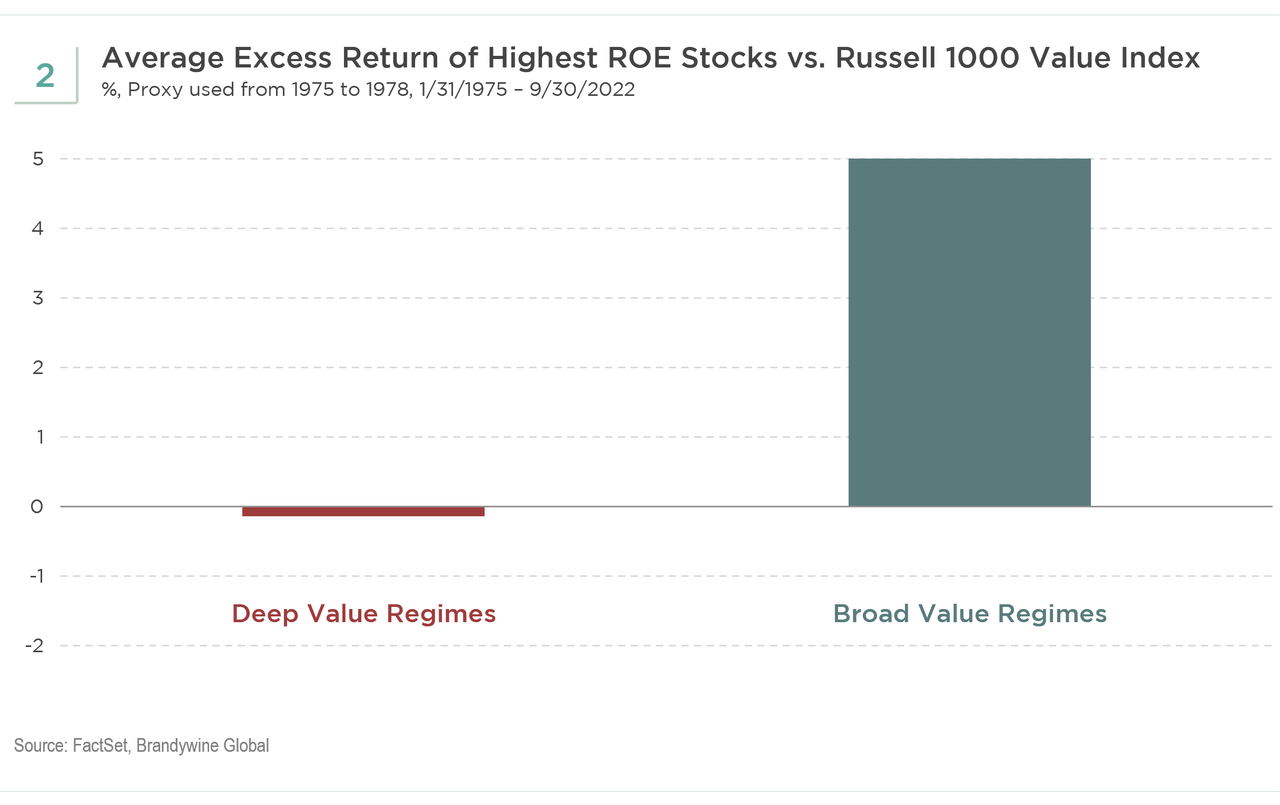

Benefit of Emphasizing Profitability in Broad Value Phases

The chart below (see Figure 2) depicts the benefit of adding profitability to value investing during Broad Value regimes. To demonstrate this enhanced return potential, we start the analysis with our value universe of stocks. This universe includes companies with low price-to-book or low price-to-earnings ratios ranked in the cheapest 35th percentile of large-cap stocks, defined as the largest 1000 companies in the U.S. by market capitalization. We then look at the behavior of only those value stocks that have a return-on-equity ratio ranked in the highest 25th percentile in this value universe. As you can see, value stocks with higher return-on-equity ratios (left-side bar) underperformed during Deep Value regimes but significantly outperformed during Broad Value regimes (right-side bar).

While deeper and distressed value stocks outperform early in the value cycle, they become more expensive and susceptible to underperformance as the cycle matures. At this point, fundamentals become more important to stock returns over the long term, and investors assign a premium to these higher-quality value stocks with more profitable businesses.

Signals Point to Broad Value

Since July 2022, the valuation spread has trended upward from a low level, which signals the early months of a Broad Value regime. Profitable companies should significantly outperform during this regime, although the occurrence is usually not as immediate as deep value companies’ outperformance when entering Deep Value regimes. Instead, the excess return generated by profitable value companies gains steam as the Broad Value regime matures. It is important to note that since 1974, the profitable value companies outperformed both the Russell 1000 Value and core Russell 1000 benchmarks, the latter representing the top 1000 companies by market capitalization, on average during Broad Value regimes. However, during the previous Broad Value regime from July 31, 2015, through July 31, 2020, the profitable value stocks outperformed the Russell 1000 Value Index by over 5% annualized and underperformed the core index by less than 1%, even with the parabolic outperformance of high-profile growth stocks not seen since the technology bubble of the late 1990s.

In summary, the valuation spread has widened recently from a low base, signaling the early stages of a Broad Value regime according to our models. As this trend continues, higher-quality value companies, such as those with high return-on-equity ratios, have the potential to significantly outperform.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment