Vladimir Zakharov

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 21.

The WisdomTree Emerging Markets SmallCap Dividend Fund (NYSEARCA:DGS) is a multi-factor emerging markets small-cap dividend ETF. DGS invests in small emerging market companies with high dividend yields, and with strong fundamentals across various quantitative metrics.

DGS’s 6.6% dividend yield, strong dividend growth track-record, and cheap valuation, make the fund a buy. The fund’s small-cap, emerging market holdings are significantly riskier than average, and so the fund seems mostly appropriate for more risk-seeking investors, in my opinion at least.

DGS – Basics

- Investment Manager: WisdomTree

- Underlying Index: WisdomTree Emerging Markets SmallCap Dividend Index,

- Expense Ratio: 0.60%

- Dividend Yield: 6.64%

- Total Returns CAGR 10Y: 2.18%

DGS – Overview

DGS is an equity index ETF investing in small-cap emerging market equities with strong high dividend yields and strong fundamentals. The fund tracks the WisdomTree Emerging Markets SmallCap Dividend Index, an index of these same securities. It is a relatively complicated index, perhaps excessively so.

The index first selects applicable securities meeting a basic set of inclusion criteria, centered on size, liquidity, location, etc. Companies are then ranked on their quality and momentum, and low-quality companies with negative momentum are excluded from the index. Applicable companies ranking in the top 30% dividend yield are then included in the index.

It is a dividend-weighted index: companies with higher dividend payments in total have greater weights. Larger companies tend to have higher total dividend payments than smaller ones, and higher-yielding companies tend to have higher total dividend payments than lower-yielding companies. As such, the index’s weighting scheme ends up being a cross between market-cap weighting and yield-weighting.

As with most indexes, there are several other exclusion and inclusion criteria, as well as weight caps and floors meant to ensure diversification. In general terms, I find DGS’s underlying index to be adequate, if perhaps a bit complicated.

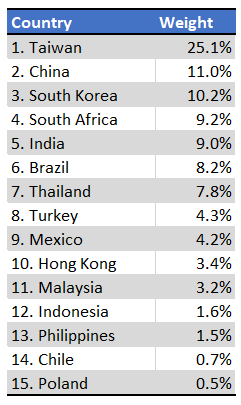

DGS provides investors with diversified exposure to emerging markets, with investments in 15 different such countries.

DGS

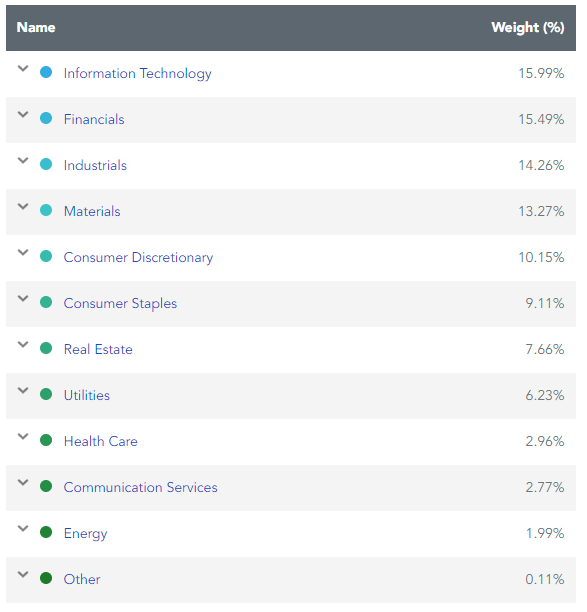

DGS’s industry diversification is quite strong too, with exposure to most relevant industry segments. Importantly, the fund is not significantly underweight tech, unlike most dividend equity ETFs.

DGS

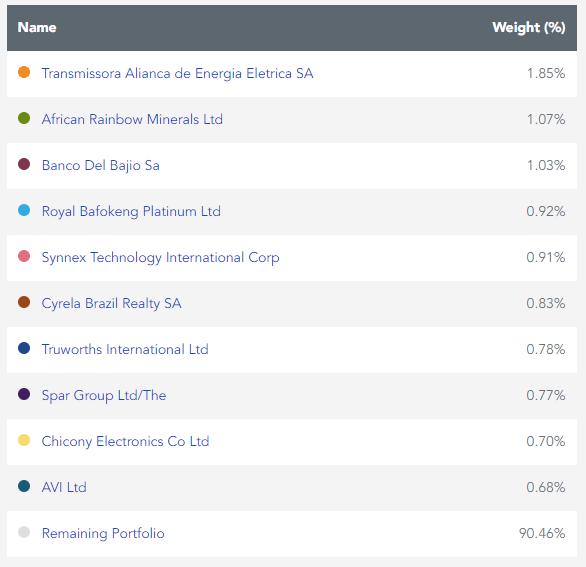

Concentration is quite low as well, with the fund’s top ten holdings accounting for slightly under 10% of its value.

DGS

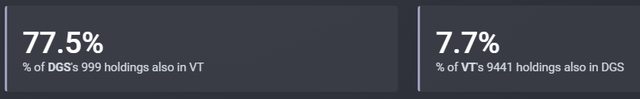

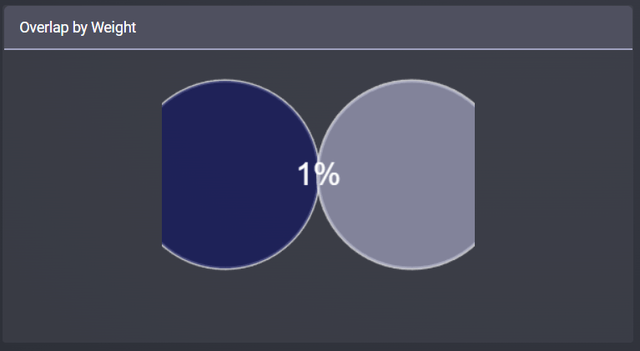

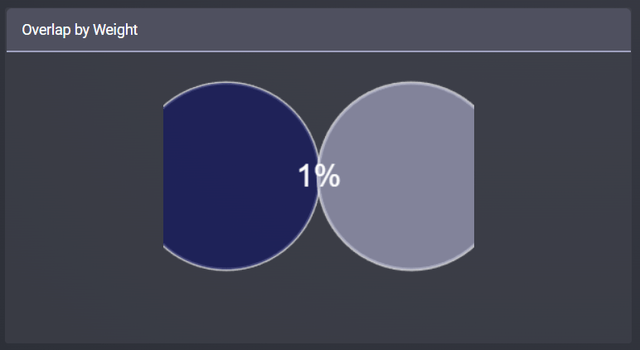

DGS focuses on an incredibly narrow, niche set of holdings: high-yield emerging market equities. Although there are many of these, DGS invests in around 1000 different securities, they are not representative of the broader equity investment universe, and so do not provide investors with diversified exposure to the same. As an example, DGS only invests in 7.7% of the holdings of the Vanguard Total World Stock ETF (VT), a global equity index fund.

DGS focuses on small-cap equities, so the overlap is even lower by weight.

The situation does not materially change comparing DGS to the iShares MSCI Emerging Markets ETF (EEM), an emerging markets equity index ETF.

Point being, DGS’s holdings are not representative of the equity investment universe, broadly or narrowly defined. As such, the fund’s performance could significantly differ from that of its benchmark at any given moment in time, increasing risk, volatility, and the potential for significant underperformance. DGS only invests in a tiny sliver of global / emerging market equities, so it is possible for said sliver to underperform even as broader indexes perform quite well. DGS’s performance has been reasonably correlated to that of its benchmark in the past, so this hasn’t been a significant issue so far, although conditions could always change moving forward.

In my opinion, due to DGS’s niche, unrepresentative holdings, portfolio weights and position sizes should be kept relatively small. Going above a 5% allocation seems excessive, in my opinion at least.

DGS – Investment Thesis

DGS’s investment thesis is quite simple, and rests on the fund’s strong dividend yield and dividend growth track-record, and cheap valuation. These combine to create a fund with strong potential income and returns, albeit a risky one as well. Let’s have a quick look at each of these points.

Strong Dividend Yield

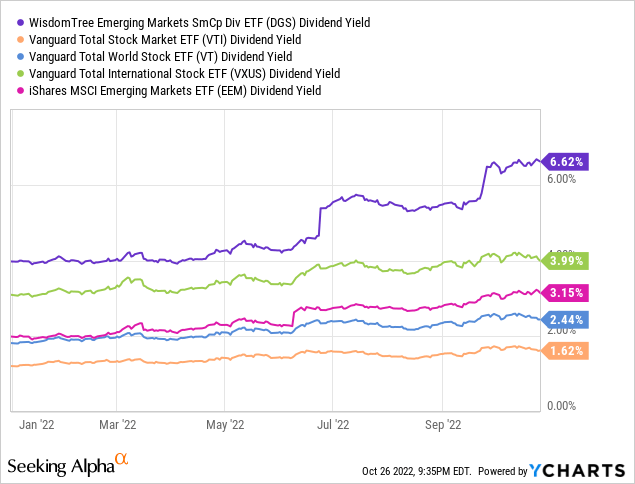

DGS currently offers investors a 6.6% dividend yield. It is a strong yield on an absolute basis, and quite a bit higher than that of most broad-based equity indexes.

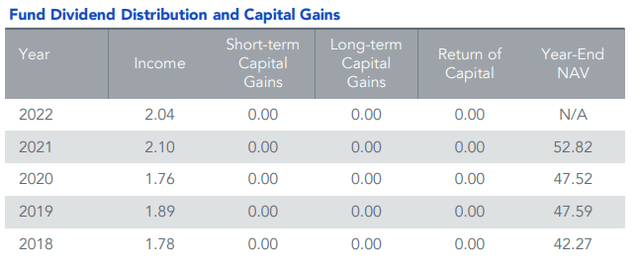

DGS’s dividends seem to be covered by underlying generation of income, but the situation is somewhat complicated. In general terms, ETFs distribute any and all income generated to shareholders and nothing else, for regulatory reasons. DGS’s past dividends have been exclusively income, as expected.

Although the above points towards fully-covered dividends, other metrics point otherwise. DGS currently sports an SEC yield, a standardized measure of short-term generation of income, of just 5.1%, quite a bit lower than the fund’s 6.6% dividend yield. On the other hand, SEC yields might not be entirely reliable measures for an emerging market ETF like DGS. Some emerging market equities have irregular dividend payments, so their short-term generation of income fluctuates wildly, and might not be indicative of their long-term generation of income.

In any case, it seems that DGS’s dividends are mostly covered by underlying generation of income. The fund’s strong, reasonably well-covered 6.6% dividend yield is a benefit for the fund and its shareholders.

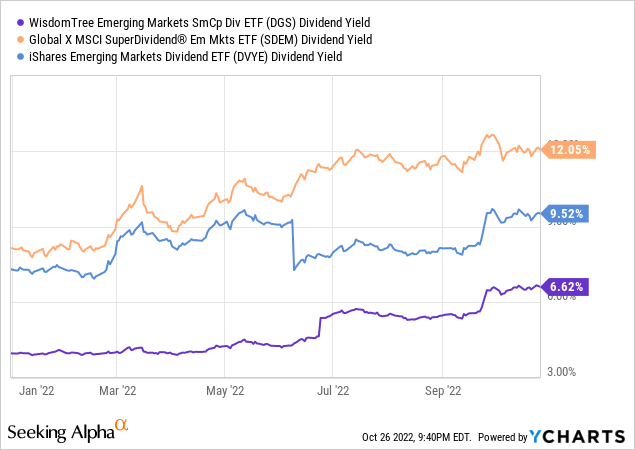

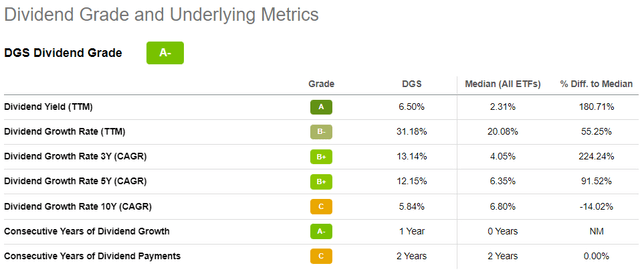

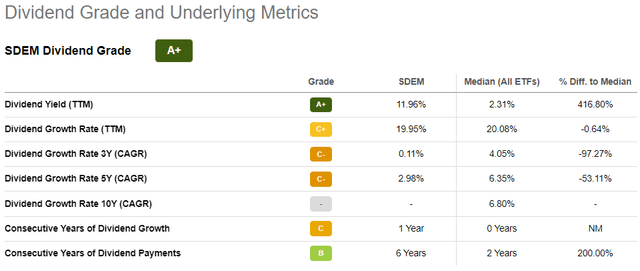

On the other hand, the yield is quite a bit lower than that of other high-yield emerging market equity ETFs.

DGS does provide investors with a key advantage relative to its peers: a solid dividend growth track-record. Let’s have a look.

Strong Dividend Growth Track-Record

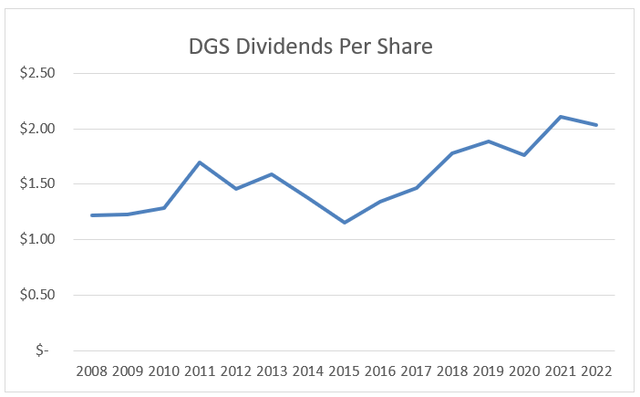

DGS’s dividends have seen solid growth since inception, growing at a 4.5% CAGR for the same. Growth is rapidly accelerating, growing at a 12.2% CAGR for the past five years, with even faster growth achieved YTD.

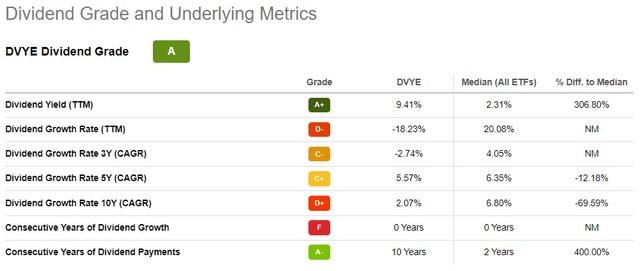

DGS’s dividend growth is significantly higher than that of its peers, for all relevant time periods.

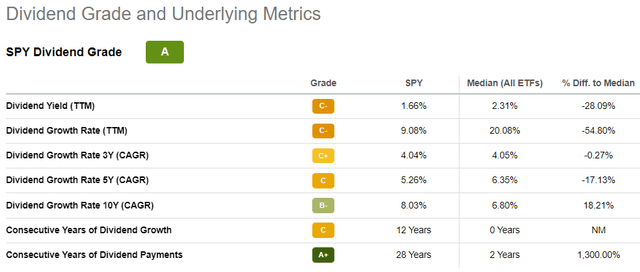

DGS’s dividend growth track-record seems slightly superior to that of the S&P 500 as well. DGS’s dividends have grown significantly faster than those of said index for the past five years but have seen moderately lower growth during the past decade. Advantage DGS, in my opinion at least.

DGS’s strong dividend growth track-record is a significant benefit for the fund and its shareholders, and particularly important for long-term dividend growth investors.

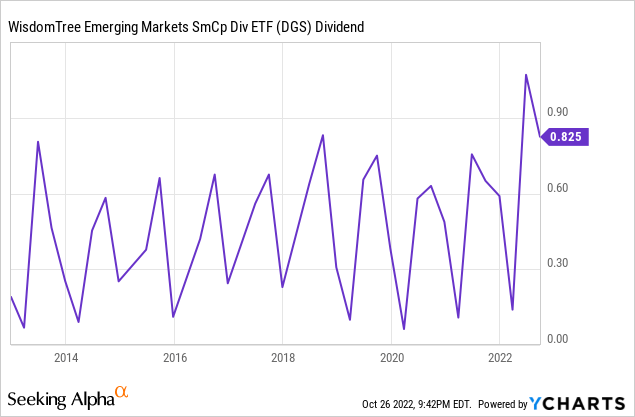

On a more negative note, DGS’s dividends are incredibly volatile, due to the volatility and irregularity of the dividends of its underlying holdings. Graphing the fund’s dividends is proof enough.

Volatile dividends are a negative, especially for income investors and retirees who rely on dividends for their spending or retirement needs.

Volatile dividends also make it difficult to analyze a fund’s dividend growth track-record. If dividends are volatile, it is sometimes difficult to tell if dividends are seeing sustainable growth, or a temporary spike. The figures clearly show that dividends have grown, the graph does not clearly show that. Looking at the fund’s annual dividends since inception might help matters, as doing so smooths out some of the quarterly dividend volatility. Growth seems abundantly clear looking at annual dividends, although some volatility / cuts remain.

Seeking Alpha – Chart by author

Cheap Valuation

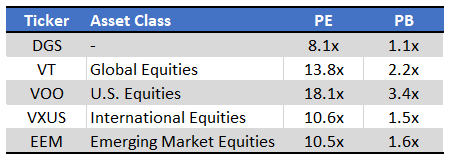

DGS sports an incredibly cheap valuation, with a PE ratio of 8.1x, and a PB ratio of 1.1x. Both are relatively low figures, significantly lower than U.S. equities, but only moderately lower than comparable international / emerging market equities.

Fund Filings – Chart by author

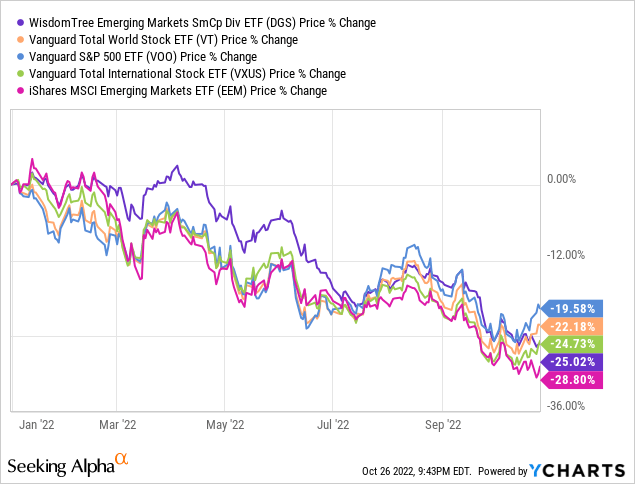

Cheap valuations could lead to strong capital gains, contingent on valuations normalizing, as a result of improved investor sentiment or fundamentals. Valuations have mostly not normalized, with DGS seeing average capital losses YTD.

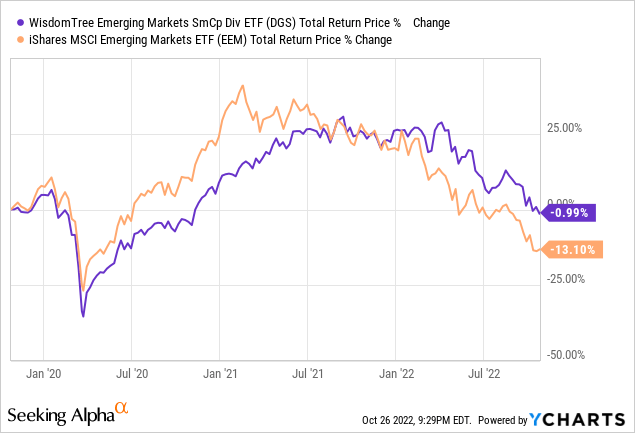

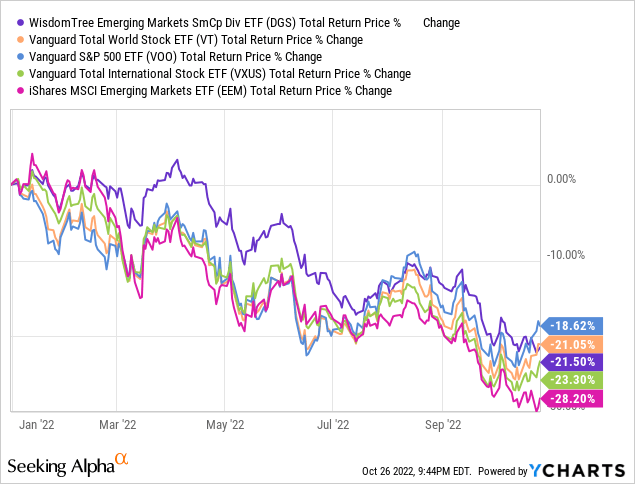

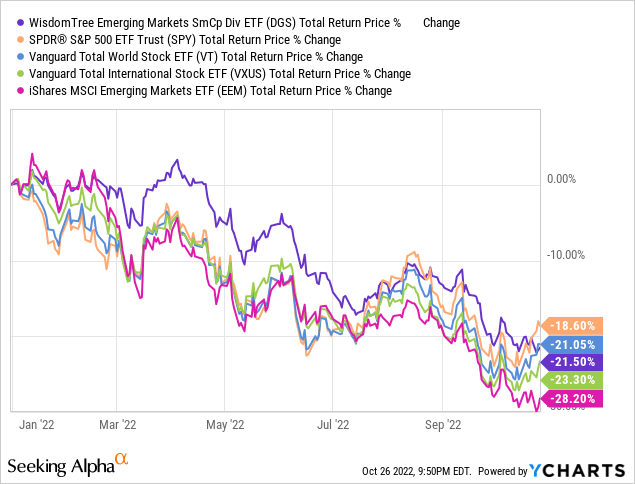

On a more slightly more positive note, DGS’s total returns have been a bit stronger, due to the fund’s dividends. DGS has moderately outperformed emerging market equity indexes on a total return basis YTD, but still slightly underperformed relative to global and U.S. equity indexes.

DGS’s cheap valuation provides investors with strong potential capital gains. If these fail to materialize, as has been the case YTD, investors receive strong dividends regardless.

DGS – Risks and Negatives

DGS is a strong fund and investment opportunity, but it is not one without risks and negatives. Three stand out.

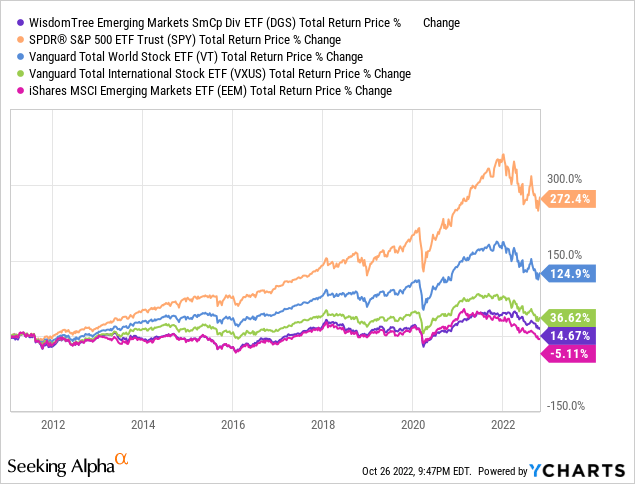

First, is the fund’s dreadful long-term performance track-record, with the fund significantly underperforming relative to U.S. and international equities since inception. Underperformance was entirely due to focusing on emerging market equities, which have underperformed for a bit more than a decade.

Importantly, DGS’s fundamentals and performance have both materially improved these past few months, so future performance will likely be stronger, in my opinion at least.

Second, is the fact that the fund’s emerging market, small-cap, high yield, holdings are significantly riskier than average. Emerging market securities are generally quite risky, due to the weak economic and market fundamentals of issuer countries. Emerging markets also sometimes suffer from corporate governance issues, with all the negatives that entails. Small-cap equities also tend to be relatively risky investments, as small-caps tend to have less diversified revenue streams, weaker balance sheets and financials, and less proven, resilient, business models. High yield equities also tend to be riskier than average: they wouldn’t have high yields otherwise.

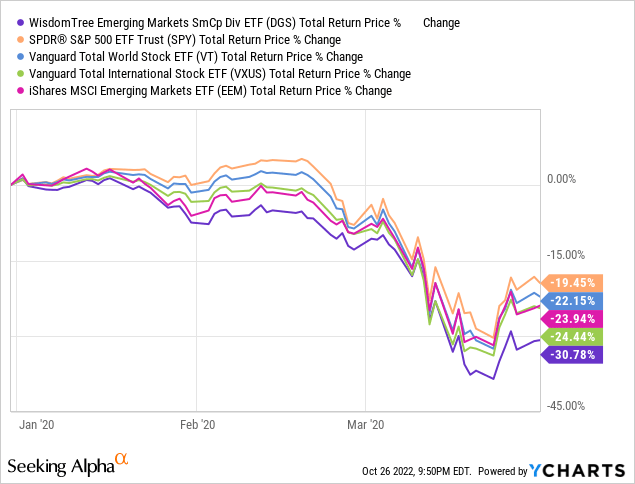

DGS focuses on emerging market, small-cap, high yield, equities, so risk, volatility, and potential losses during downturns are all significantly higher than average. In theory at least. In practice, the fund seems to be riskier than average, but only moderately, inconsistently, so. As an example, the fund underperformed during 1Q2020, a period of significant market losses, but only moderately so relative to international and emerging market equities.

On the other hand, DGS has performed above average for an equity fund YTD, another period of significant market losses.

DGS’s holdings seem to be riskier than average, but not significantly so.

Third important risk factor for the fund is its volatile, risky dividends. DGS’s investment thesis rests on the fund’s strong, growing dividends. Dividend volatility undercuts said investment thesis and means investors can’t really rely on said dividends for their short-term spending needs, which might be important to some retirees and income investors. DGS should provide investors with hefty dividends, as has been the case since inception, but these are very unreliable and volatile, an important negative.

In my opinion, DGS’s benefits and positives outweigh these risks and negatives. Other investors, especially more risk-averse retirees looking for stable dividends, might disagree.

Conclusion

DGS’s strong 6.6% dividend yield, dividend growth track-record, and cheap valuation, make the fund a buy. The fund’s small-cap, emerging market holdings are significantly riskier than average, and so the fund might not be an appropriate investment for more conservative investors and retirees.

Be the first to comment