gchapel/iStock via Getty Images

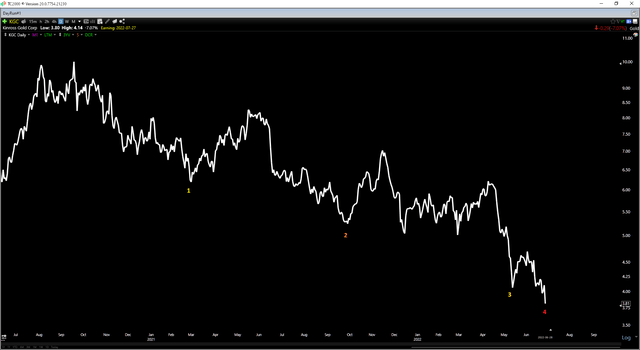

Few sectors have held up as well as the Gold Miners Index (GDX) this year, with majors like Newmont (NEM) being a sanctuary among the storm. Kinross (NYSE:KGC) has been an exception. In fact, it’s suffered a fourth leg down since its Q3 2020 peak, which often marks the capitulation selling phase, with underwater investors finally throwing in the towel and exiting their positions into weakness. In the present case, I am the dumb money, long from $4.50 and brutally early. However, with sentiment nearing despondency, I see reasons to be optimistic. Based on the stock trading at less than 4.0x cash flow, investors appear to be getting its world-class Dixie Project for free.

All figures and shares prices are in United States Dollars unless otherwise noted.

Just over six weeks ago, I wrote on Kinross, noting that the stock was too cheap to ignore at a massive discount to its net asset value. Clearly, I was brutally early on my bullish rating, with the stock shedding another 12%. While it’s easy to get caught in the short-term noise, the long-term picture continues to look bright, and investors look to be getting a rare entry point into the name with limited downside risk. This is especially true if Kinross can execute successfully on its mammoth-sized opportunity in the Red Lake Camp, which looks to have 480,000+ ounce per annum potential beginning in 2029. Let’s take a closer look below:

Q1 Results

The gold miners had a decent setup heading into Q1, coming up against easier comps due to the gold price shellacking in Q1 2021 and softer production as some COVID-19 restrictions remained in place. Unfortunately, this favorable setup was pulled out from under them with the emergence of Omicron and its effects on workforce availability, combined with what’s already been a tight labor market in several jurisdictions. For Kinross, it was dealt an additional blow, pushed into selling its Russian operations (Kupol) and a phenomenal development project that underpinned its planned growth, Udinsk.

Kinross Gold – April Article (Seeking Alpha Premium)

Given this unfortunate setup, it made zero sense to be long the stock above $6.00, let alone $5.00, with more than $1.0 billion in value shaved off its Project NPV (5%). Adding insult to injury, the sale came in at a figure well below expectations ($340 million vs. $680 million), doing little to bandage up the gaping hole left in its net asset value. However, the valuation is becoming a little ridiculous, with the stock now sitting at $3.80 and sporting a market cap of ~4.9 billion. Before digging into the valuation, it’s worth highlighting the long-term opportunities not reflected in FY2022/FY2023 cash flow estimates.

Long-Term Outlook

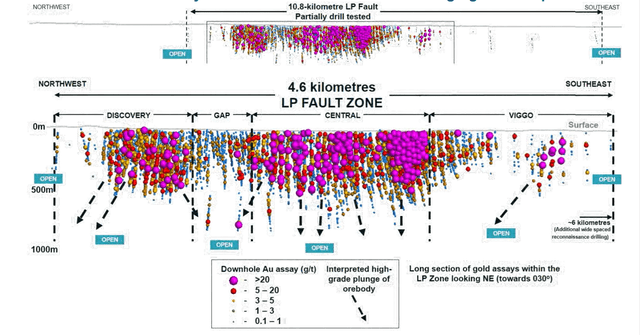

Beginning with the star of the portfolio, Dixie, the potential here is near unrivaled in North America for a development project. This is because Kinross’ Dixie Project looks to have 8.5+ million-ounce resource potential between the Central Zone and Hinge/Limb, with significant upside to this figure from a near-mine (Arrow, Viggo, Discovery zones), regional, and at-depth standpoint. Notably, the grades at Dixie are well above that of the average open-pit amenable project, rivaling Fortuna’s (FSM) Seguela but dwarfing it in scale, and coming in just behind Skeena’s (SKE) Eskay Creek deposit, which is a freak of nature by open-pit standards.

Central Zone vs. 10.8 Kilometer Strike LP Fault – Dixie Project (Company Presentation)

In addition to impressive grades that could contribute to an average feed grade of 2.8 to 3.0 grams per tonne of gold for the first eight years (open-pit phase), the project also benefits from infrastructure. This is because a provincial powerline and paved highway run parallel to the project, providing easy access to a skilled workforce in an established mining jurisdiction/ample access to lower-carbon energy. Suppose materials inflation doesn’t continue its runaway pace. In that case, this should limit upfront capex to $1.15 billion or less, a very attractive capex figure for a project that could ultimately boast a 30+ year mine life. The attractiveness of the project is further reinforced by the company’s Canadian tax pools, with its headquarters being in Canada.

Dixie Project – Red Lake (Company Presentation)

Based on preliminary discussions, Kinross appears to be targeting a 15,000 tonne per day operation at Dixie, and I believe it’s fair to assume an average head grade of 2.90 grams per tonne of gold. These metrics would make Dixie one of the largest gold mines in Canada, capable of producing ~485,000 ounces per annum on average over its first eight years. In a 3.0 gram per tonne scenario with 96% gold recovery rates, annual production would climb to ~507,000 ounces per annum, placing Dixie ahead of Cote and well ahead of Meadowbank, Meliadine, and LaRonde. Just as importantly, an open-pit project with this scale and grades should enjoy sub $775/oz all-in sustaining costs, making it one of the lowest-cost mines globally.

Moving south to the United States, Kinross appears to have another decent (albeit much smaller scale) opportunity brewing in Washington. This new opportunity is Curlew Basin, a low-sulphidation epithermal gold deposit, which produced 550,000 ounces between 1997-2007 at an average grade of 7.5 grams per tonne of gold. While Kinross is targeting a much smaller resource of 1.0 million ounces here, this is feasible due to the existing infrastructure in the area, with Kinross’ Kettle River Mill and tailings storage facility just 35 kilometers away and much closer than the proximity of the mine/mill when it was operating at Buckhorn.

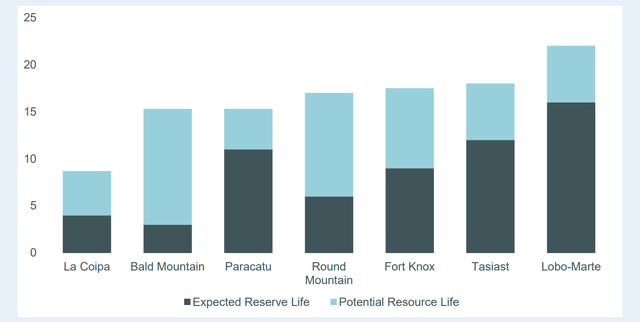

Assuming a grade of 6.0 grams per tonne and a throughput rate of 2,000 tonnes per day, this could be a ~130,000 ounce per annum opportunity with a relatively low upfront capex bill. Obviously, this is not a significant needle-mover like Dixie could be once in production. Still, it would fortify Kinross’ position as an America’s focused gold producer, with the potential for ~1.80 million GEOs from its Americas portfolio once Dixie comes online, with additional contribution from Tasiast (Mauritania). Of course, the key will be mine-life extensions, which look likely given Kinross’ conservative $1,200/oz gold price assumption for reserves.

Kinross Gold – Reserves & Life of Mine Extension Opportunity (Existing Assets) (Company Presentation)

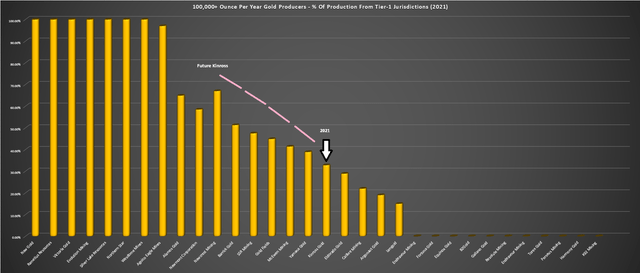

Putting this all together, Kinross should have a clear path to multiple expansion, having divested its worst asset from a jurisdiction standpoint (Kupol) and having paved a path to more than offsetting it with high-margin Tier-1 jurisdictions ounces at Dixie. In my view, Kinross should be able to command a P/NAV multiple of 1.20x with a path to 75% or more of production coming from Tier-1 jurisdictions, combined with significantly less production from Tier-3 jurisdictions. This would place the company more in line with its peers but still at a discount, given Kinross’ slightly higher operating costs.

Gold Producers – 2021 Percentage of Production from Tier-1 Jurisdictions (Company Filings, Author’s Chart)

Valuation

Based on an estimated year-end share count of ~1.28 billion shares (assuming share buybacks) and a share price of US$3.81, Kinross trades at a market cap of ~$4.87 billion. This is a very reasonable valuation for a company on track to produce ~2.28 million gold-equivalent ounces [GEOs] in 2023, translating to ~$4.21 billion in revenue at a $1,850/oz gold price, or an AISC margin of ~$1.70 billion. From a cash-flow per share standpoint, and assuming Kinross can meet more conservative estimates of $1.10 in FY2023, this would leave the company trading at just 3.45x forward cash flow, a massive discount to its historical cash flow multiple of ~5.3 (12-year average).

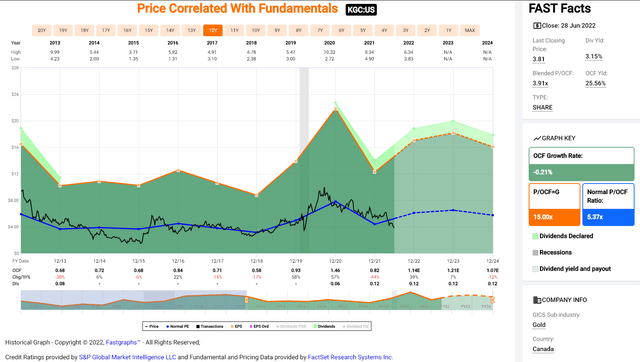

Kinross – Historical Cash Flow Multiple (FASTGraphs.com)

Given that this historical cash flow multiple highlights the stock’s average multiple with a considerable period of time spent in a secular bear market for gold, I would argue that it’s a fair multiple to use to derive fair value, and even on the conservative side. So, assuming the company meets more conservative FY2023 cash flow per share estimates ($1.10), Kinross’ fair value would come in at $5.95. However, its FY2023 cash flow does not factor in the value of the Dixie Project, which looks like it could boast an After-Tax NPV (5%) of $1.80+ billion without factoring in new discoveries from a regional standpoint.

If we apply a 0.60x multiple to the Dixie Project, given its early stage, this translates to an additional value of $1.08 billion or $0.84 per share. Hence, there looks to be a clear upside to my conservative fair value of $5.95 after factoring in the upside for Dixie, which investors are arguably getting for free here. Finally, if we go by a more conservative P/NAV basis, with an estimated net asset value of ~$6.67 billion for Kinross and a 1.20x multiple, Kinross’ fair value comes in at $6.25. In summary, no matter how we value Kinross, the stock looks to be trading at a massive discount to fair value here.

So, what are the risks?

With Kinross shedding its highest-risk asset (Kupol), I see the main risks as out of the way, with the only major risk being the gold price. While opinions differ on the gold price, and we could certainly see further weakness, I would argue that Kinross is already priced for much lower gold prices, given that I am using sub $1,725/oz gold prices to calculate the fair value of its projects. For this reason, and given that gold tends to perform quite well in periods of negative real rates, the risk finally looks to be to the upside for Kinross.

This is especially true from a discovery standpoint medium-term, given that Kinross is dedicated all of its drills to proving up a resource at Dixie, with what should be a shift to more regional exploration and near-mine targets post-resource (2023). Assuming Kinross could make an additional major discovery at Dixie, or its positive exploration results continue at Curlew Basin, we could see the market begin to give these assets more credit and provide a further boost to net asset value. So, while it’s easy to be pessimistic here, and there’s no question that there are safer ways to play the sector, this is about as attractive as it gets from a valuation standpoint for a 2.0+ million-ounce producer with a revamped operating portfolio (Russia exit).

Tasiast Mine (Company Presentation)

With Kinross in what appears its fourth leg down in what’s been a brutal bear market in the stock, it’s understandable that many investors have given up out of disgust. However, during these periods (capitulation phase), investors can get their best entries, and the miners are one of the most emotional sectors, swinging wildly in both directions. For this reason, there’s no reason that Kinross couldn’t trade well above its historical cash flow multiple when sanity returns to the market and gold prices firm up. Based on the stock appearing like it’s near capitulation and sentiment the worst I’ve seen in Kinross for years, I believe the stock has finally set up an extremely low-risk entry point at $3.80.

Be the first to comment