sankai/iStock via Getty Images

What does the future hold for the dividends of the S&P 500 (SPX)?

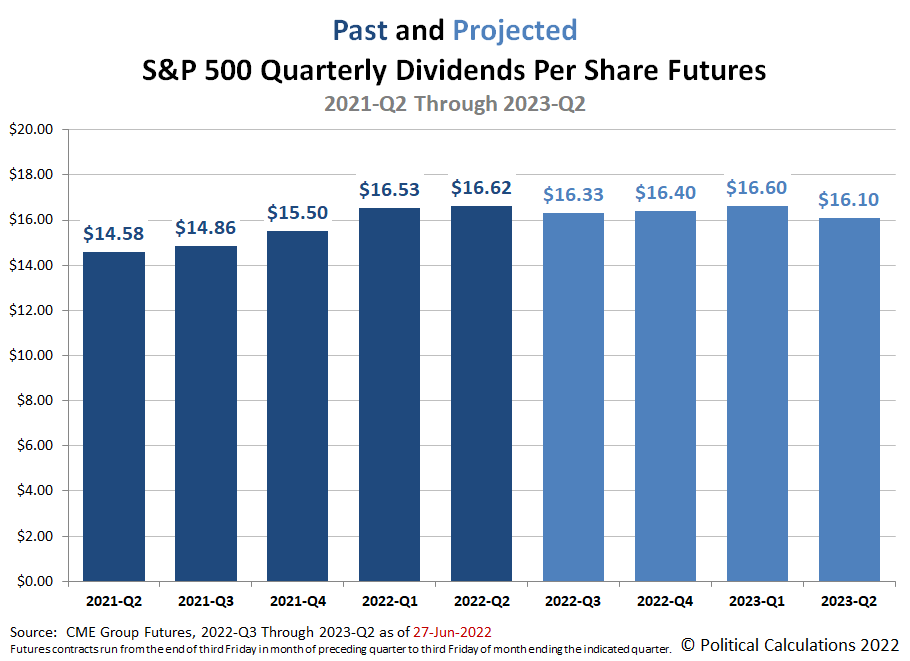

We’re now in the gap between when the index’s dividend futures contracts for 2022-Q2 have expired and the actual end of the calendar quarter, which makes it a good time to see what investors expect for the rest of the year. The good news is the outlook for the quarterly dividends per share of the S&P 500 has continued improving since we last checked them at the midpoint of 2022-Q2. Better yet, the futures data extends through 2023-Q2 so we can peer into the first half of 2023.

The following chart reveals those expectations as of Monday, 27 June 2022:

Here’s how the dividend futures have changed since our previous snapshot:

- 2022-Q2: Up $0.07 per share.

- 2022-Q3: Up $0.35 per share.

- 2022-Q4: Up $0.50 per share.

These increases indicate an improved outlook for the S&P 500’s dividends has developed over the last six weeks, which you would think would have boosted stock prices during this time. If you’ve been watching the stock market, you know they’ve fallen significantly instead and if you’ve been following our S&P 500 chaos series, you already know why the index has behaved as it has despite its improving outlook.

But this improving outlook may be in jeopardy. With recessionary risks now rising in the U.S., expectations for future dividends will take a greater role in shaping how stock prices behave. That’s why we’re increasing the cadence for presenting and analyzing future dividend data, which we’ll now do at roughly six week intervals. Our next update will arrive in mid-August 2022 and will present the Summer 2022 snapshot of the future for S&P 500 dividends.

About Dividend Futures

Dividend futures indicate the amount of dividends per share to be paid out over the period covered by each quarter’s dividend futures contracts, which start on the day after the preceding quarter’s dividend futures contracts expire and end on the third Friday of the month ending the indicated quarter. So for example, as determined by dividend futures contracts, the “current” quarter of 2022-Q3 began on Saturday, 18 March 2022 and will end on Friday, 16 September 2022.

That makes these figures different from the quarterly dividends per share figures reported by Standard & Poor’s, who reports the amount of dividends per share paid out during regular calendar quarters after the end of each quarter. This term mismatch accounts for the differences in dividends reported by both sources, with the biggest differences between the two typically seen in the first and fourth quarters of each year.

Reference

The past and projected data shown in this chart is from the CME Group’s S&P 500 quarterly dividend index futures. The past data reflects the values reported by CME Group on the date the associated dividend futures contract expired, while the projected data reflects the values reported on 27 June 2022.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment