DarrelCamden-Smith/iStock via Getty Images

We’re weeks away from the start of the Q1 Earnings Season for the Gold Miners Index (GDX), and while many companies are set up for another year of earnings growth, Kinross’ (NYSE:KGC) earnings trend is going in the wrong direction. This is based on it being one of the few miners to see a 40%+ decline in EPS last year, and FY2022 isn’t looking any better following the sale of a cash cow: Kupol. Given the updated no-growth outlook, which was previously a key differentiator, I struggle to see more than 12% upside from current levels at a current share price of US$6.21. Hence, I continue to see more attractive opportunities elsewhere.

Dixie Drill Core (Company Website)

The higher gold price has lit a fire under many million-ounce gold producers, and despite the turbulence in global markets, the Gold Miners Index has steadily trended higher since December, up more than 20% for the year. Unfortunately, one producer has had a very difficult past 18 months, which has led to underperformance, and 2022 hasn’t been much easier for the company. This is due to the recent Russia/Ukraine developments, which led to Kinross suspending its Russian operations before divesting them this month. Let’s take a closer look at the impact this has had on its portfolio:

Kinross Gold Operations (Company Presentation)

For those unfamiliar with Kinross, the company has two key assets in Russia. This includes an operating mine (Kupol), a cash cow, and a very attractive development asset with margins that were expected to be industry-leading: Udinsk. In the case of Kupol, the asset (combined with Dvoinoye) generated ~$1.13 billion in operating earnings over the past three years and a significant portion of last year’s cash flow. Some investors might argue that it’s unfair to measure Kupol’s contribution against FY2021 levels due to the mill fire that hurt Tasiast’s performance last year, which is a fair point.

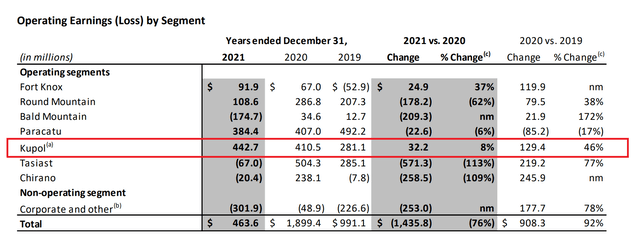

Operating Earnings by Segment – Kinross (Company Filings)

However, even on a three-year average basis, Kupol generated more than one-third of operating earnings for Kinross, making it a key asset for the company in addition to its massive Paracatu Mine in Brazil. The sale of this asset to Highland Gold is set to put a significant dent in operating cash flow this year and going forward, with this mine contributing ~481,000 GEOs in FY2021 at industry-leading costs cash costs below $700/oz on a by-product basis. Obviously, while it impacts 2022, it also puts a meaningful dent in the medium-term outlook from a consolidated production/margin standpoint.

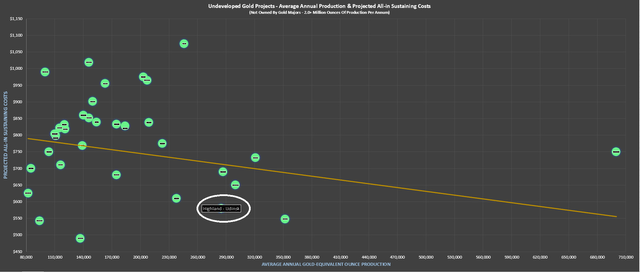

Undeveloped Gold Projects – Estimated Annual Production/Costs vs. Udinsk (Company Filings, Author’s Chart)

While the loss of Kupol is certainly a disappointment, the loss of Udinsk should not be underrated. As the chart above shows, this was going to be another cash cow for Kinross, with a recent PFS outlining a 7-year mine life with total gold production of ~2.0 million ounces. The production profile was impressive, but the costs made Udinsk special, with this open-pit heap-leach project having projected all-in sustaining costs of $580/oz. These figures are 50% below industry-wide estimated all-in sustaining costs of ~$1,170/oz and would have helped to pull down Kinross’ consolidated costs.

The above chart shows Udinsk was one of the largest and lowest-cost undeveloped assets globally, with only a few projects rivaling it from a margin standpoint (Skouries, Hod Maden).

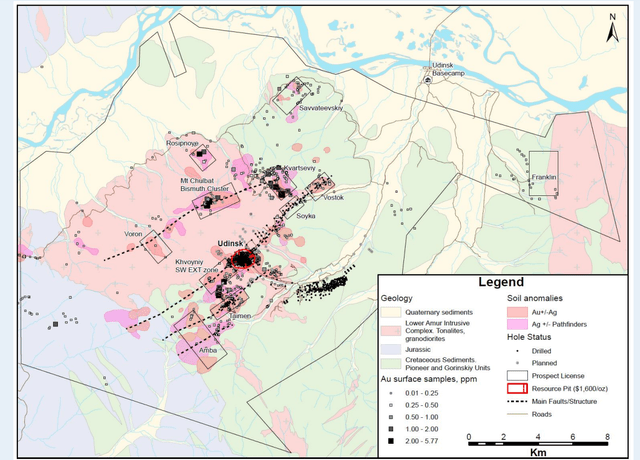

Notably, Udinsk was the first project on its large Chulbatkan license acquired from N-Mining in 2019, with an After-Tax NPV (5%) at $1,800/oz gold of $930 million. This is a painful loss for Kinross, especially considering that this resource represented just a speck of the large land package surrounding Udinsk, as the map below shows. While it’s purely speculation at this point, I would not have ruled out a second asset or a significant mine life extension given the attractiveness of Udinsk and how little of this land package had been explored.

Prospect License – Udinsk (Company Presentation)

Medium-Term Outlook

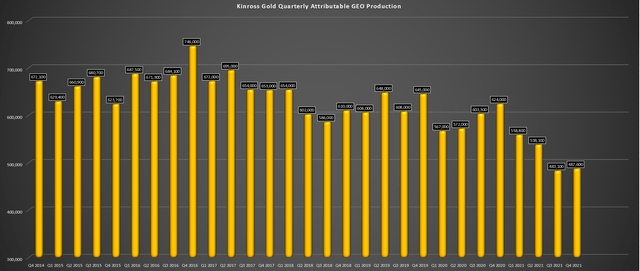

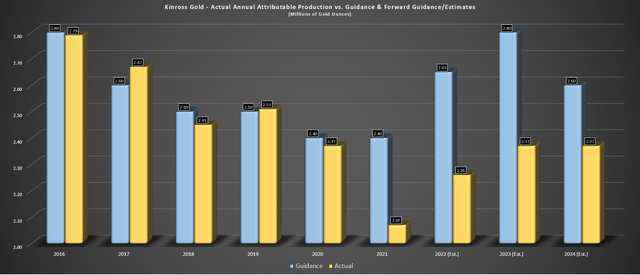

As the chart below shows, Kinross has seen a steep decline in annual attributable gold-equivalent ounce [GEO] production since 2016, but the company had outlined a path for growth going forward. This was based on the Tasiast 24k Project, which continues to move towards production by Q4 next year, increased production from La Coipa, and steady production at its key assets. However, with the sale of Kupol, Kinross has shedded more than 350,000 GEOs in production in FY2022 and FY2023 and ~200,000 GEOs in FY2024.

Kinross Quarterly Attributable GEO Production (Company Filings, Author’s Chart)

Based on this new outlook, there’s now a significant dent in Kinross’ production outlook, which was previously targeting ~2.65 million GEOs in FY2022, ~2.80 million GEOs in FY2023, and ~2.60 million GEOs in FY2024 (blue bars). Under the updated outlook, and assuming Kinross doesn’t sell Chirano as well, which is up in the air, production is now expected to average just ~2.33 million GEOs over the next three years (2022, 2023, 2024). This is well below pre-COVID-19 levels despite the significant ramp-up at Tasiast.

Kinross Gold – Actual Annual Attributable GEO Production vs. Guidance + Forward Guidance/Estimates (Company Filings, Author’s Chart & Estimates)

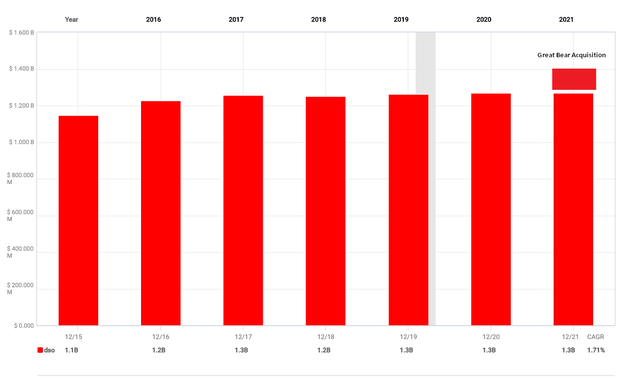

If we look at the longer-term production profile (2016-2024) and assume Chirano is divested, Kinross’ production would actually be down 20% from FY2016 levels (2.80 million GEOs) compared to estimates of ~2.30 million GEOs in FY2024. This is based on Chirano contributing roughly ~140,000 GEOs per annum. Meanwhile, even if Chirano isn’t divested, this is still more than 15% lower production than FY2016 levels, while Kinross has seen a rising share count (FY2015: ~1.15 billion shares vs. ~1.31 billion shares currently). If we compare this production growth per share to sector leaders like Agnico Eagle (AEM), it is inferior by a wide margin.

Kinross Gold – Shares Outstanding (FASTGraphs.com)

Long-Term Outlook

Fortunately, Kinross’s long-term outlook has some promise, with three high-margin assets in the wings. These include Manh Choh, Dixie (Great Bear acquisition), and Lobo-Marte. At Lobo Marte, Kinross is expected to see annual production just shy of 300,000 GEOs at projected all-in sustaining cost below $700/oz. Meanwhile, Manh Choh could add 150,000 GEOs per annum at sub $800/oz costs. Finally, Dixie is a wild card but has the possibility of adding 400,000 GEOs per annum at sub $800/oz costs as well.

Having said that, arguably the 2nd best asset of these four (before the divestment) was Udinsk, and it will no longer contribute in late 2025. This has stolen from the 2026 production profile and hurt the margin outlook. Meanwhile, Manh Choh now looks like an H2 2025 opportunity vs. 2024 previously, and while it is a very solid asset, it doesn’t mean the needle much for Kinross (~150,000 GEOs per annum). Elsewhere, while Dixie is a game-changer and could be one of Canada’s largest mines, I would be surprised to see commercial production before H2 2028.

Kinross Gold Operations (Company Presentation)

Given this upgraded outlook, it’s clear that while Kinross will see much lower production than pre-COVID-19 levels over the next three years (2022, 2023, 2024), 2025 won’t be much better. This is because Udinsk is off the table, Kupol won’t be contributing, Chirano may not be contributing, and Manh Choh is unlikely to see a full year of production either. Hence, investors will need to wait until at least 2026 to see a return to the ~2.50 million GEO mark (2019) under current assumptions, especially if Chirano is divested. Worse, they can no longer look forward to the margin expansion from Udinsk (12% of production profile at sub $600/oz costs).

With Kinross down more than 35% from its highs, some investors will argue that these assumptions are priced into the stock. This is a more than reasonable point, and I would agree that the stock has likely found its lows at $5.00 per share. However, with one of the weakest earnings trends sector-wide, and a much weaker free cash flow yield (ex-Kupol), Kinross is only slightly undervalued, in my view.

At the same time, other million-ounce producers have seen an improvement in their growth profiles and trade at very attractive free cash flow yields. So, while Kinross is undoubtedly cheap if one has a 6+ year view for Dixie, it’s no longer a growth story unless it plans to make another major acquisition of a producing asset or near-producing asset. Although this would help the production outlook, it might place the stock back in the penalty box short-term, similar to the Great Bear acquisition. Let’s take a closer look at the valuation below:

Valuation

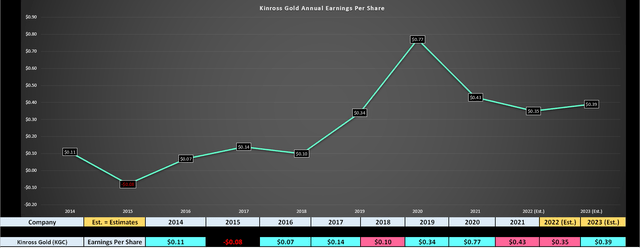

Looking at Kinross’ earnings trend below, we can see that the company was one of the few gold producers that not only saw a decline in annual EPS, but a massive decline. This was based on annual EPS sliding from $0.77 to $0.43, a 44% drop year-over-year. As noted earlier, this was partially related to inflationary pressures that impacted costs and the much lower production and higher costs related to the fire at Tasiast. Unfortunately, while most gold producers will see new highs in annual EPS this year, like Agnico Eagle, Kinross will not follow suit.

Kinross Annual Earnings Per Share (Factset.com, Author’s Chart)

As the chart above shows, annual EPS is forecasted to decline further this year to $0.35, driven by the much lower production with the divestment of Kupol, possible divestment of Chirano, and a higher average share count (Great Bear acquisition). This leaves Kinross trading at ~17.7x FY2022 earnings estimates, which I would not call a cheap valuation. The reason is that under its new outlook, its growth outlook has been stripped while other million-ounce producers have much more attractive growth profiles and margin profiles, like Agnico Eagle.

Dixie Project – Red Lake (Company Website)

From a P/NAV standpoint, it’s also hard to argue that Kinross offers a margin of safety, given that it recently shed more than $2.0 billion in NPV (5%) from the sale of Udinsk and Kupol. Given that the company could also look at divesting Chirano, this would translate to a decline of more than $2.2 billion in NPV (5%) vs. February levels. While this was partially offset by cash consideration ($680 million Russian assets) and what I would estimate to be up to $150 million for Chirano, this still doesn’t nearly patch up the decline in NPV (5%) from the sale of these two (possibly three) assets.

Based on my updated estimate of ~$8.6 billion in NPV (5%) at its operating assets (including Dixie), Kinross might appear cheap, trading at a slight discount to its current market cap of ~$8.13 billion at US$6.21. However, if we subtract ~$2.90 billion in net debt and corporate G&A, this leaves Kinross trading at a healthy premium to its net asset value. I would argue that Kinross can easily command a P/NAV multiple of 1.15-1.20x, but anything more is a stretch. Hence, I don’t see a ton of upside from a P/NAV standpoint either for the stock.

Kinross Gold Operations (Company Presentation)

Kinross Gold has made some needed adjustments this year to its portfolio, with the risk of operating in Russia clearly much higher than the company previously envisioned. This is especially true considering its decision to add Russian exposure in 2019. Fortunately, the company got some value from exiting Russia, but this has put a major dent in its growth outlook and its cash flow generation. The good news is that this updated portfolio should be able to command a slightly higher multiple after shedding the Russian exposure. However, this was offset because it didn’t get anywhere near fair value for its Russian assets.

Following the recent changes to the portfolio, Kinross remains a solid producer with an improved jurisdictional profile. Still, with a no-growth outlook looking out to 2025 and two low-cost assets out of the portfolio, I see barely 12% upside from current levels to conservative fair value. This doesn’t mean that the stock can’t go higher, but I continue to prefer great growth stories at more attractive valuations like Alamos Gold (AGI).

Be the first to comment