bymuratdeniz

Based on current strip prices, I estimate that Civitas Resources (NYSE:CIVI) could pay out $6.69 per share in dividends (base plus variable) based on 2023 results. This is based on its current goal of paying 50% of free cash flow after its base dividend. Since Civitas also has a net cash position, there is room to increase this percentage as well.

I previously noted (in February) that Civitas could generate over $1 billion in positive cash flow in 2022 at current strip, and it appears capable of generating close to $1 billion in 2023 despite starting to pay cash income taxes now.

2H 2022 Outlook

Civitas may average around 167,000 BOEPD (45% oil, 70% liquids) in production during the second half of 2022. This would put it in the upper half of its full-year guidance for total production.

At current 2H 2022 strip of around $92 WTI oil and $7.35 Henry Hub natural gas, Civitas would generate $1.858 billion in oil and gas revenues before hedges.

Civitas’s 2H 2022 hedges have an estimated value of negative $205 million at those commodity prices.

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 13,800,000 | $87.00 | $1,201 |

| NGLs (Barrels) | 7,709,600 | $36.00 | $278 |

| Natural Gas [MCF] | 55,310,400 | $6.85 | $379 |

| Hedge Value | -$205 | ||

| Total Revenue | $1,653 |

Civitas is expected to have approximately $535 million in 2H 2022 capex based on its full-year guidance.

| Expenses | $ Million |

| Lease Operating Expense | $85 |

| Gathering, Transportation, Processing and Midstream | $161 |

| Production Taxes | $158 |

| Cash G&A | $45 |

| Cash Interest | $10 |

| CapEx | $535 |

| Cash Taxes | $70 |

| Total Expenses | $1,064 |

Thus I expect Civitas to generate $589 million in positive cash flow in the second half of 2022. This includes the impact of cash taxes and is before Civitas’s dividends.

Potential 2023 Outlook

I have modeled a potential 2023 scenario where Civitas keeps production at around 167,000 BOEPD. At current strip of approximately $81 WTI oil and $5.50 Henry Hub gas, Civitas would generate $3.078 billion in revenues after hedges. Civitas’s hedges would have much less of a negative effect in 2023 and those hedges have an estimated value of negative $64 million at $81 WTI oil and $5.50 Henry Hub gas.

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 27,429,750 |

$76.50 |

$2,098 |

| NGLs (Barrels) | 15,238,750 | $32.50 | $495 |

| Natural Gas [MCF] | 109,719,000 | $5.00 | $549 |

| Hedge Value | -$64 | ||

| Total Revenue | $3,078 |

If we assume that Civitas’s 2023 capex budget is $1.05 billion (slightly higher than its 2022 capex budget), then it could generate $983 million in positive cash flow before dividends. I’ve also allocated $200 million for cash income taxes in 2023, although that’s an area of uncertainty to me.

| Expenses | $ Million |

| Lease Operating Expense | $168 |

| Gathering, Transportation, Processing and Midstream | $305 |

| Production Taxes | $267 |

| Cash G&A | $85 |

| Cash Interest | $20 |

| CapEx | $1,050 |

| Cash Taxes | $200 |

| Total Expenses | $2,095 |

Notes On Dividends

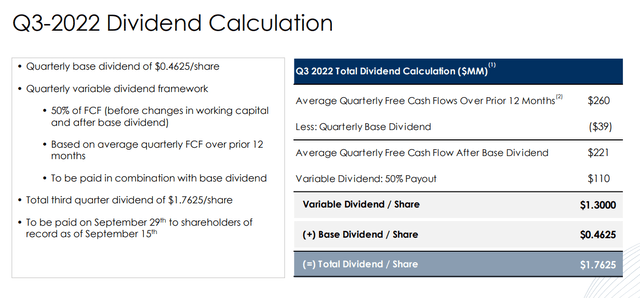

Civitas is paying a $0.4625 quarterly base fixed dividend currently, which adds up to around $39 million per quarter in base dividends. It also declared a $1.30 per share variable dividend for Q3 2022, which was a $110 million payout for that quarter.

Civitas Dividend Calculation (civitasresources.com)

Based on Civitas’s current dividend calculation formula, it may be able to pay a variable dividend of approximately $1.21 per quarter based on 2023 results. This would result in total dividends of $6.69 per share based on 2023 results.

Civitas also has room to increase its variable dividend payout percentage since it already has a slight net cash position.

Notes On Valuation

If one values Civitas at a 3.0x EV/EBITDAX multiple at long-term (after 2023) $70 WTI oil and $4.00 Henry Hub gas, this would result in an estimated value of approximately $72 per share for it. This also includes the value of additional cash flow in 2H 2022 and 2023 due to current strip being above $70 WTI oil and $4.00 Henry Hub natural gas during that period.

Conclusion

Civitas is on track to generate over $1.5 billion in positive cash flow between 2H 2022 and the end of 2023 despite starting to pay cash income taxes. It also currently has no net debt, and can pay out around $6.69 per share in total dividends based on 2023 results (at current strip) with its current dividend payout policy. This would be a yield of over 10% at its current share price, while it also has the potential to increase its dividend payout ratio.

Be the first to comment