AsiaVision/E+ via Getty Images

Investment Thesis

Kiniksa Pharmaceuticals (NASDAQ:KNSA) is a Massachusetts based biotech that IPO’d in April 2018, raising $152m at $19 per share – four and a half years later, the share price trades down 16% at a price of $16.30 (at the time of writing).

Given how bad the biotech sector’s bearish run has been over the last year, and the traditionally poor performance of biotech companies share prices post IPO, this can be considered a decent performance by the company. Shares did trade as low as $8 in May this year, but are up >100% across the past six months.

Kiniksa’s lead product is ARCALYST, a drug the company paid $5m upfront to acquire from the large Pharmaceutical Regeneron (REGN) back in 2017. ARCALYST was already approved to treat cryopyrin-associated periodic syndromes (“CAPS”) – back in 2008. Sales of the drug by Regeneron were recorded as $51.3m, $13.5m and $14.4m respectively in 2014, 2015 and 2016.

Kiniksa’s plan was to develop ARCALYST for other indications, and the biotech was able to do this when the FDA agreed to approve the drug – rilonacept – for recurrent pericarditis in March 2021, based on data from a Phase RHAPSODY trial which showed that patients given ARCALYST achieved a 96% reduction in risk of a recurrent pericarditis event, and that 92% of trial days for ARCALYST users were pain free or at most experiencing minimal pain, compared to 40% of days for those on the placebo.

Kiniksa has grown revenues from ARCALYST in every quarter since Q2’21 thanks to a growing prescriber base, with >650 healthcare payers having prescribed it as of Q3’22, with 22% having prescribed it to two or more patients. Guidance for FY22 is for net revenues of $115m-$130m. In the run up to the approval of the drug, analysts speculated that peak sales could reach $700m.

Based on this forecast, we can arguably justify Kiniksa’s current market cap valuation of $1.14bn, with the forward price to sales ratio being <2x. Kiniksa has other assets in its pipeline too. KPL-404 targets the costimulatory protein CD40 and is indicated for Rheumatoid Arthritis, with a Phase 2 clinical study in progress.

Mavrilimumab, targeting granulocyte-macrophage colony stimulating factor receptor alpha (“GM-CSFRα”) was licensed from MedImmune for an upfront payment of $8m, with potential development and commercial sales milestone payments of up to $157.5m. Kiniksa attempted to develop the drug as a COVID therapy, but changed tack after a late stage study failed to meet endpoints in December last year. The company is now looking for co-development partners to evaluate Mavrilimumab in cardiovascular diseases.

Finally, in September, Kiniksa announced a global license agreement with the Swiss Pharma giant Roche (OTCQX:OTCQX:RHHBY) for the rights to develop and commercialise Kiniksa’s pipeline asset vixarelimab, a fully human monoclonal antibody targeting oncostatin M receptor beta (“OSMRβ”).

Roche made a $100m upfront payment in exchange for the license, and there are $600m of clinical, regulatory, and sales-based milestones also available, although Kiniksa will continue to fund and complete a Phase 2b study of the drug in reducing pruritis in prurigo nodularis.

Kiniksa received another boost in Q322 – an income tax benefit of $175m – which together with $75m of the Roche money and $82.6m of ARCALYST revenues allowed the company to generate $332m of revenues and net income of $179m in the first 9m of 2022, and EPS of $2.58.

Divide that EPS figure by the current share price and you have a price to earnings ratio of 6.3x, which is attractively low even with one more quarter of EPS still to come. At this point however, the investment thesis in relation to Kiniksa becomes a little less positive.

Kiniksa is a loss making company – despite the ARCALYST revenues – in the last four quarters to Q2’21, operating losses were ($31m), ($36m), ($23m), and ($19.4m). Cash position as reported at Q3’22 was $201m, which management says will last the company until “at least 2025” (in its Q3’22 earnings presentation), but I also came across this statement in the Q3’22 10Q submission:

As a company we have limited experience obtaining marketing approval for product candidates, commercializing a therapeutic, supporting sales, marketing, and distribution activities and maintaining applicable infrastructure for these activities either directly and/or through agreements with third parties; as a result we may not be able to continue to commercialize ARCALYST or successfully commercialize any future approved product candidates, if any, thus potentially impairing the commercial potential of ARCALYST and our other product candidates.

Even by 10Q risk statement standards it is a downbeat assessment of Kiniksa’s chances of even being able to continue marketing and selling ARCALYST, let alone guiding its pipeline assets through to the approval stage. Accumulated deficit was reported as ($496.5m) as of Q3’22, so there is no question that management is under some pressure, and without any boost from tax benefits, or collaboration revenues, Kiniksa may be loss-making again in 2023.

Although it’s hard to make a bull case for a loss-making biotech, it is encouraging at least to see operating losses are narrowing whilst ARCALYST sales are growing. But can they grow enough in 2023 and beyond to support or even list Kiniksa’s >$1bn market cap? Let’s look at some of the decisive factors.

Growth In Recurrent Pericarditis

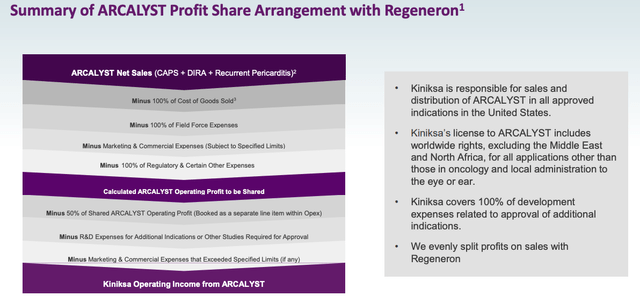

Kiniksa management acknowledges that the recurrent pericarditis market is ARCALYST’s “primary growth lever”, which makes sense given the shrinking revenues of the drug when it was owned by Regeneron – presumably the reason the Pharma let the drug go at such a knockdown price – that and the fact they are still eligible half of all net profits on sales of the drug.

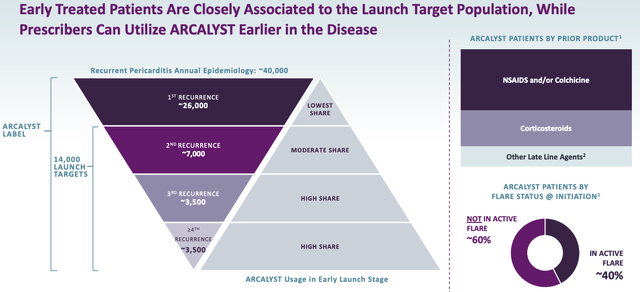

ARCALYST has the advantage of being the only FDA approved therapy for recurrent pericarditis, and there is a reasonably large patient pool of up to $40k, according to management’s research.

ARCALYST patient population (Kiniksa corporate presentation)

That works out – using the quoted list price of ARCALYST of $20,700, at a market opportunity of ~$828k, although due to reimbursement deals and Kiniksa’s OneConnect program, which is a treatment support program for patients prescribed ARCALYST, that figure is probably significantly lower – I would be tempted to use the lower end of analysts’ former peak sales guidance of ~$600m.

Kiniksa has started out by claiming the low hanging fruit – those patients whose pericarditis – a condition characterised by swelling and irritation of the thin, saclike tissue surrounding the heart (pericardium) which causes sharp chest pain – has recurred multiple times. Management says the payer mix for ARCALYST is comprised of commercial – ~70%, Medicare – ~20%, and Medicaid – ~10%.

Kiniksa says it plans to grow its sales force from ~30 specialty cardiology reps to ~50 reps, which it believes will give it access to ~70% of recurrent pericarditis (“RP”) patients – a market opportunity of ~621k. Recent growth – sales were up 24% sequentially to $33.4m last quarter – certainly suggest that this is a potential target for the company, but ultimately I would drop my peak sales projection by another $100m, to $500m.

“Recurrent” Treatment of Recurrent Pericarditis

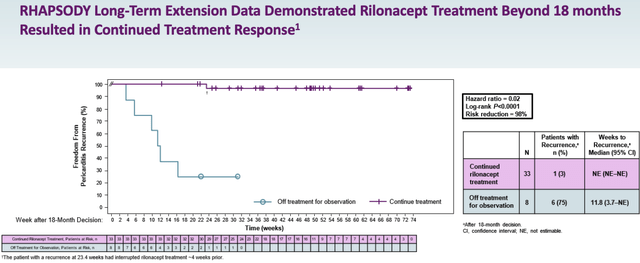

Management has been touting the results of the extension part of the pivotal RHAPSODY study – as Chief Medical Officer (“CMO”) John Paolini explained on the Q3’22 earnings call:

The primary outcome of the study is that patients who remained on continuous rilonacept therapy after the 18-month treatment milestone experienced a 98.2% reduction in the risk of recurrent pericarditis events compared to those who suspended therapy at the 18-month milestone. The hazard ratio was 0.018 with a p-value of less than 0.0001.

RHAPSODY extension study results (Kiniksa presentation)

In other words, patients who use ARCALYST for longer in RP are likely to see a substantial benefit, meaning patients may end up using the drug for e.g. two years rather than one, potentially doubling sales revenues each year. According to Kiniksa, nearly 7k new patients come into the pool of patients every year.

Regeneron’s Cut of Sales

If the longer use by patients results in a doubling of revenues you could arguably say that there is a $1bn peak sales opportunity rather than $500k, but, alas, Regeneron is still taking a 50% share of all operating profits derived from ARCALYST, as shown below:

Regeneron profit split (Kiniksa corporate presentation)

As such, I am sticking with a target peak sales figure for ARCALYST – in an optimistic scenario – of $500m, based on a combination of the above factors.

Likely Revenue Contribution From Other Assets

KPL-404 has a proven mechanism of action in targeting CD40 interaction and Rheumatoid Arthritis (“RA”) is a large and lucrative market, independently estimated to be worth >$60bn, although personally I would estimate it is worth half that figure since sales of Big Pharma drugs across all autoimmune indications are not much more than $100bn.

Unfortunately for Kiniksa it is a very crowded market – approved therapies include Pfizer’s (PFE) Xeljanz and Enbrel, Bristol Myers Squibb’s (BMY) Olumiant, AbbVie’s (ABBV) Rinvoq and Humira, Merck’s (MRK) Remicade and a host of others. Most of the above mentioned products sell in the multi-billions.

KPL-404 is at the early stages of a Phase 2 study and proof-of-concept data will not arrive until early 2024. When it does arrive, it may have to be exceptional to make a dent in this market, or more likely, if it is exceptional, it may encourage a Big Pharma to make a buyout offer for Kiniksa – an attractive scenario for investors as I would expect the deal price to be $2-$3bn at least. Pfizer recently paid $7bn to acquire Arena Pharmaceuticals and its Phase 3 stage autoimmune asset Etrasimod.

Turning to Mavrilimumab I think it is difficult to assess what management does next with this drug, which seems to have been developed primarily as a COVID therapy. It has been shelved at the present time, although given Kiniksa management’s deal making ability, I would not rule a deal similar to the Vixarelimab agreement with Roche – although I would expect such as deal to be worth only half as much.

Finally, Let’s be generous and say that Kiniksa earns $100m per annum from Vixarelimab over a 6-year period, as the drug hits all of its development and sales milestones.

Conclusion – Do The Market, Revenue and Profits Opportunities Add Up To A Buy?

Naturally there are plenty more variables affecting Kiniksa’s prospects going forward but I hope this article has been able to shine a light on some potential opportunities, and threats.

In terms of whether the stock is a buy or a sell at the present time, I think that Kiniksa may be able to make ARCALYST profitable despite the downbeat assessment in the latest 10Q statement. The fact that management has promised current funds will last until 2025 is an added bonus, although expect the company to raise if new clinical data or a strong sales quarter raises the share price.

My peak sales target for ARCALYST hovers around the $500m mark and that may be slightly generous given the work the sales team faces accessing the earlier stage patient pools when patients have had only one or two recurrences.

I think that justifies a market cap up to $1.5bn – when we include a triple-digit million annual contribution from Roche – which represents a premium of 25% to current traded price, and a theoretical price to sales ratio of 2.5 – probably fair for an early commercial stage Pharma – and assuming the company becomes marginally profitable.

Since these are demanding targets however I am not sure I would rate Kiniksa as a strong buy opportunity at the present time – the success or failure of KPL-404 is the likely difference maker.

Should that drug deliver strong PoC in its Phase 2, Kiniksa will likely become a strong buy opportunity in my view. Since that data won’t arrive until 2024, however, I will maintain a watching brief for the time being.

Be the first to comment