TU IS

Kingsoft Cloud (NASDAQ:KC) is a pretty vertically integrated cloud player that focuses on the Chinese market. They offer infrastructural services, but also plenty of software products to go on top of that to various industries. With the recent acquisition of Camelot, they focus more on the financial sector as well with a new suite of software that can be deployed with Kingsoft cloud services. The sales have grown substantially on the acquisition, but there has been meaningful organic pressure from the scaling down of the CDN business and general focus on securing higher margin contracts.

The shares have slumped since earnings, but have also been volatile as it becomes seemingly more of a battleground, short interest now almost 7%. We don’t think concerns are that much to do with business results, which will likely increment into improvement. We think investors are taking politics more into account with their investments, and KC is suffering for it. We agree with the recent market moves – there are good reasons to avoid this stock.

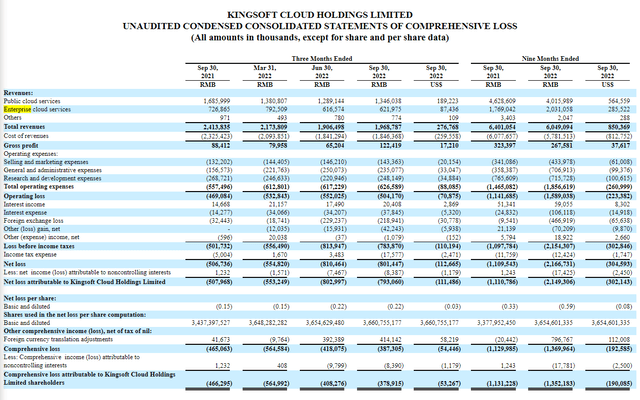

Kingsoft Cloud Q3 Earnings Results

The Q3 results were a little confusing at first, but become clearer when considering the Camelot acquisition and important strategic shifts by the company. Camelot provides software for financial institutions to deal with data and conduct the sort of controls that banks are concerned with. Revenues were down about 20% YoY, and based on information in previous disclosures, the Camelot revenues are probably about 7% of Kingsoft’s total revenues now on a run-rate basis with 5 years duration of backlog. Kingsoft’s public cloud business saw 14-20% declines. CDN, or content delivery networks, which is edge infrastructure to do things like deliver streamed video to devices, saw very significant declines that drove this whole segment. Camelot acquisition was responsible for the overall growth in the enterprise cloud segment it seems, which otherwise saw slower growth as Kingsoft became more selective in its customer acquisition. This is consistent with the company’s plan to shed these parts of businesses because apparently they are structurally unprofitable in a significant number of cases and to improve gross margin.

The growth of enterprise cloud in the revenue mix has grown gross profits YoY by about 50%, so the efficiency plan is working, but apparently the ability to up and cross sell has been impacted by the decision to eschew the provision of CDN infrastructure, which usually needs to be integrated with software to deliver an effective final product.

Management is guiding towards more improvement as the HK listing becomes completed, which is currently generating some unwanted SG&A, as well as some other restructuring that will result in severance pay and other line items that should drag on operating income. With further mix improvements and continued discipline on customer acquisition, we should see improving operating performance as China also slowly makes a recovery some of its self-inflicted lockdown wounds.

Risks

It’s a cloud company, and it can grow. Currently it is dealing with difficulties in closing engagements due to lockdowns. Restrictions would also reduce the scope to generate new business. There are good reasons why the company is losing revenue YoY beyond idiosyncratic downsizing. They should reinitiate organic growth over the next year, and margins should grow.

Despite the possibility of growth, and the secularity of markets, there are a lot of risks to Kingsoft. The first is simple, and it’s the revenue concentration. A lot of its market is Bytedance, the company responsible for TikTok. There is political risk here, as the Chinese government has an explicit stake in parts of Bytedance’s businesses. There are security risks here. Even without those dramatic risks, there’s the problem that revenue concentration is usually not a good thing, especially for a company that is struggling to bargain profitable contracts.

There are more alarming political risks. Kingsoft is not properly audited, and therefore is at risk of delisting. The diplomacy between the US and China will continue to matter a lot for whether or not Chinese companies can stay on US exchanges. That is why KC is in the process of listing on HK exchanges as a backup. But there’s also pressure from the Chinese side, which is cracking down on its own companies who may be using offshore companies to do things deemed illegal. These laws are very opaque, and legal action could come down on a company like KC which operates a corporate structure in the Cayman Islands and works in China through subsidiaries. With China still being a restricted market, especially in telecoms, there are reasons to be concerned.

There are also the new data protection laws that have just come into force. GDPR seems to be somewhat of a template for these regulations. What we’ve seen from GDPR is very punitive fine threats and still developing framework and ongoing adoption of the laws. They required substantial reconfiguration of infrastructure by a lot of players, and have restricted activity in some cases, where GDPR threatens fines if negligence can be shown in how the data is kept and otherwise managed. Kingsoft will be dealing with this a lot, and many of its clients are dealing with some of the most sensitive possible data, especially in the financial world, and the risks around non-compliance with these important regulations cannot be understated as companies in the past have failed to respond to the opaque and very new regulations coming into force in China all the time, especially when dealing with critical industries or vulnerable parties. Just look at Qudian (QD) and regulation around effective usury.

The valuation isn’t that great either. The company trades at 0.5x revenue. They are very in the red, and even massive overhead cuts are a problem. They need scale, and are doing a lot to limit it themselves with CDN scale-downs, on top of economic trouble in China. Then there’s the growing execution risks mentioned above. Revenue isn’t growing much, and is needed to also deliver profitability. Already profitable and cheap companies like Kyndryl (KD) can be bought in the cloud space from the US, with none of this China risk. While Kingsoft has more current software exposure, lots of its business is infrastructure like Kyndryl. Kyndryl is also going through somewhat of a transition, but has lower hanging fruit and less existential, legal unknowns. Lots could go wrong here with Kingsoft, and we understand the short interest. We don’t see this as an easy battleground. Best to avoid.

Be the first to comment