Alan Staats

Kinder Morgan (NYSE:KMI) may not have the cheapest valuation among energy infrastructure heavyweights, but its execution has been flawless. Many investors have taken Warren Buffett’s words to heart regarding investing in companies with large moats around their business. When the barriers to entry are minimal, the probability of increased competition occurs. Unlike other industries, such as clothing, where it seems as if there are more boutique firms grabbing market share than at any point in the past, the oil and gas industry has arguably the largest barriers to entry surrounding the entire industry. You can’t just start an exploration and production company and drill for oil, and you certainly can’t just start an energy infrastructure company and build a pipeline.

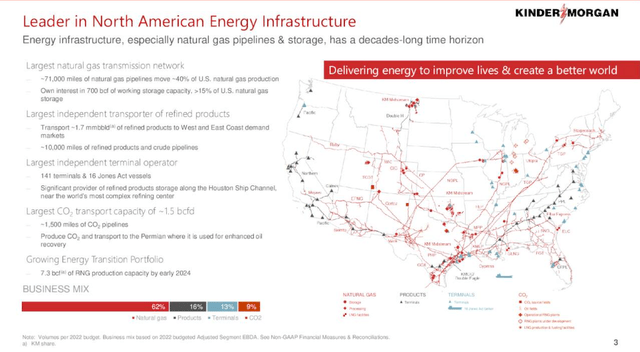

At the beginning of the summer, KMI broke through the $20 level, then declined -20.14%, declining from $20.14 to $16.05 over a 10-day period as the markets reached their June lows. At the end of August, KMI climbed back to $19.26, only to fall -16.46% to $16.09 at the end of September. KMI is currently trading at around $17.25 per share, and I am taking this opportunity to add shares of KMI as I believe it will climb back to its early summer levels of around $20 while collecting a 6.44% dividend. Oil & Gas aren’t disappearing, and the global economy is dependent on these commodities. There is an extremely low probability that new energy infrastructure companies will emerge, and the more likely scenario is that consolidation will occur across the sector. KMI has over 71,000 miles of natural gas pipelines and continues to strengthen its business operations as the reality of the future energy mix sets in.

Kinder Morgan

Kinder Morgan’s management team is executing their strategy and building value for its investors

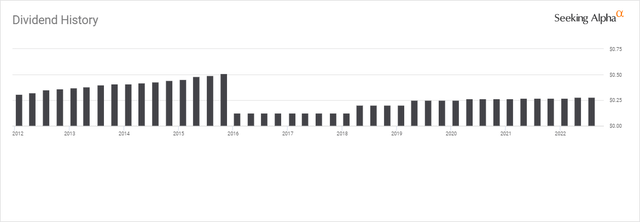

KMI isn’t the same debt-ridden company that it was at the end of 2015. Executive leadership came out and discussed the importance of financial discipline, and made an unpopular decision to reduce its quarterly dividend. In Q1 of 2016, the quarterly dividend was reduced by -74.51% ($0.38) from $0.51 to $0.13. This decision was made to strengthen KMI’s balance sheet, and allocate more capital from their distributable cash flow [DCF] to strategic growth projects.

Seeking Alpha

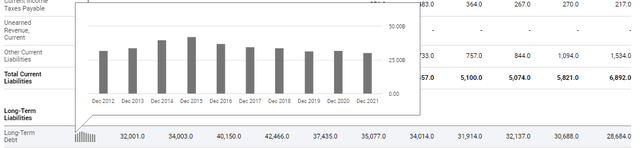

At the close of 2015, KMI finished its fiscal year with $42.47 billion of long-term debt. Since making the decision to focus on financial discipline and not growth at all costs, KMI has drastically reduced its debt load. Since the close of 2015, KMI has reduced its long-term debt by $13.78 billion (-32.45%), as it declined from $42.47 billion to $28.68 billion. The reduction in long-term debt has helped strengthen its balance sheet in addition to reducing its leverage ratio. KMI’s long-term goal was to have a 4.5x leverage ratio, as this was highlighted on the most recent earnings call. KMI has reduced its net debt by -26.62% since the close of 2015 from $42.96 billion to $31.53 billion. At the close of Q2, KMI had $31.53 billion of net debt on its balance sheet and generated $7.25 billion of Adjusted EBITDA placing its most recent leverage ratio at 4.35x. KMI expects to finish 2022 with a 4.3x leverage ratio and maintain its 4.5x long-term goal. KMI’s disciplined approach to capital allocation has allowed them to reduce their long-term debt by over $13 billion, their net debt by over $12 billion, and reach their long-term leverage target.

While strengthening its balance sheet, KMI has also made good on its promise of slowly increasing its dividend. After 9 consecutive quarters of a reduced dividend, KMI started providing annual increases. Since 2018, KMI has provided investors with 5 annual dividend increases, taking the quarterly dividend from $0.13 to $0.28. Over a 5 year period, KMI was able to increase its annual dividend by 115.38% ($0.60) per share.

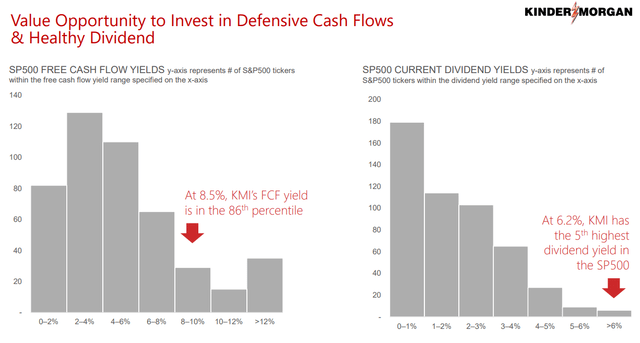

In the TTM, KMI has generated $7.25 billion in Adjusted EBITDA and $4.74 billion of DCF. Management has remained committed to maintaining a strong investment-grade balance sheet, fund expansion, and acquisition opportunities, pay a strong and growing dividend while generating additional value by repurchasing shares when opportunities present themselves. I think there is a disconnect between market pricing and the fundamentals of the midstream energy business, which is creating a value opportunity across the sector. KMI is generating lots of cash, strengthening its business, and rewarding shareholders through a growing dividend and potential buybacks, while having a giant moat around its business, yet the market is discounting KMI’s value. Managements strategic plan is paying off, and I think investors need to be patient while the market recognizes the opportunity in the midstream sector.

Seeking Alpha

KMI’s business operations are flourishing, and its contracted cash flow is protected

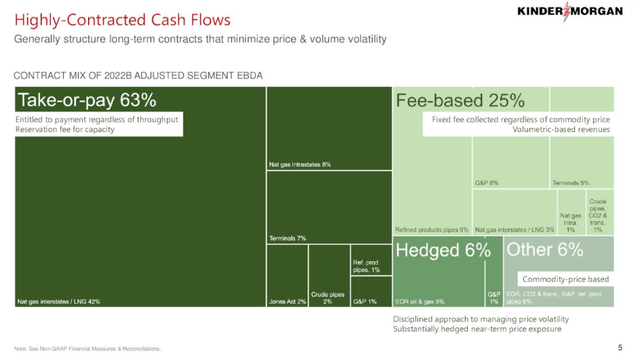

KMI’s business model is primarily comprised of take-or-pay and fee-based services. These types of contracts help mitigate risk on the transporter side to offset the possibility of declining commodity prices and the correlating effects throughout the energy industry. 63% of KMI’s cash flow is backed by take-or-pay contracts, which ensure that KMI is paid the negotiated rate regardless of the amount of fuels that pass through its system. Companies electing to enter into a take or pay contract with KMI are reserving future capacity based on their projections. Fee-based services represent 25% of KMI’s cash flow. This is where a fixed rate is negotiated upfront between KMI and its customers. The revenue which is generated from fee-based contracts is based on volume, which passes through the system as the fee has already been set. Fee-based contracts are also a mitigation method to an uncertain commodity market as fees are agreed upon upfront, so whether commodity prices increase or decrease, KMI is generating a revenue amount that is attractive to their overall business.

Kinder Morgan

KMI has $2.1 billion committed to projects within its pipeline, of which 30% will be in service by the end of 2022, while the remaining 50% will come online in 2023, and 20% in 2024. Once its backlog of projects is clear, KMI expects to allocate $1-$2 billion to capital projects going forward. KMI has updated its 2022 guidance to include an additional 5% in net income, 5% in Adjusted EBITDA, 5%, and 5% in DCF. As the domestic and global energy demand increases, KMI will be allocating capital to fulfill the demand. The U.S is producing 82 bcfd of natural gas and is projected to increase 26.83% to 104 bcfd by 2030. The Permian is one of the largest basins for natural gas and is expected to grow by 10 bcfd per day. KMI currently has 7 bcfd of takeaway capacity in the Permian and is projected to increase its takeaway capacity to 10+ bcfd by 2030.

KMI should have several opportunities to expand its contracted services as more natural gas is utilized domestically and exported to our allies overseas. KMI currently has 7 contracted LNG export terminals, with an additional terminal in 2025. From 2025 – 2030 KMI has an additional 2 contracted terminals subject to final investment decision, and there are an additional 11 opportunities that KMI could pursue. KMI has an extensive pipeline system throughout the Houston Ship Channel where many of the U.S export capacity for LNG resides and over 700 bcf of gas storage. This make KMI a prime choice for LNG facilities due to KMI’s network connectivity.

Kinder Morgan

Why I continue to believe in the midstream sector and Kinder Morgan

National security doesn’t just come from economic stability or military power, it has as much to do with energy security as well. The situation in Europe has proved how vital to a national economy energy security really is. Energy infrastructure companies have large moats around them for several reasons. First, you can’t just go build 70,000 miles of pipelines and all the storage and processing facilities needed to go along with them. You need to map out what facilities the pipelines will need to connect, get permits, purchase land, build the infrastructure, and sell contracted services. Starting an energy infrastructure company isn’t as easy as hiring a group of engineers and starting a SaaS company. It could be one of the hardest companies to grow from the ground up. This is why Berkshire Hathaway (BRK.A) purchased Dominion’s (D) natural gas pipelines instead of building them several years ago.

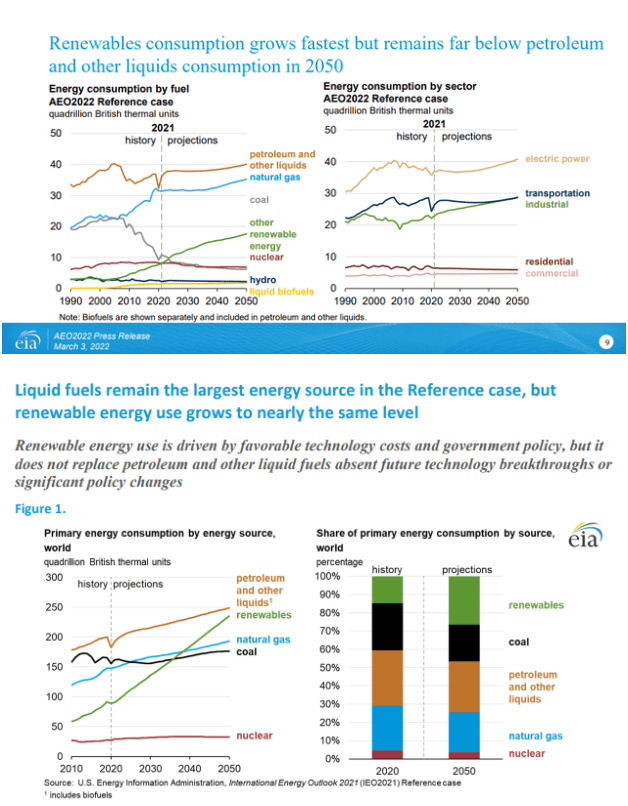

On 3/3/22, the EIA released its 2022 Annual Energy Outlook and concluded that petroleum and natural gas remain the most consumed sources of energy in the United States through 2050 (1st slide below). The EIA publishes its international energy outlook every 2 years, and the last one was published prior to the war in Ukraine. In 2021, on a global scale, the natural gas consumption rate will increase by roughly 18% by 2050 per the EIA’s projections (2nd slide below). Their next report is slated for 2023, and it will be interesting to see how things have changed due to the growing demand for natural gas overseas.

EIA

The global demand for energy is increasing, and while renewables will see the largest amount of growth, the combination of oil & gas will still play a dominant role in the domestic and global energy mix. As demand increases, so will the need for transportation and midstream operations. KMI is one of the largest midstream operators, and with demand increasing for decades to come, it should have no problem turning additional demand into profits. It’s more likely that the largest energy infrastructure companies will acquire permits to support the additional capacity rather than new companies trying to break into the sector. I believe that there was too much noise around replacing oil & gas with renewables, and as we are seeing in Europe, it’s not realistic over the next several decades. The likely scenario is that renewables will increase their position in the global energy mix, and the common goal will shift to eradicating coal as a consumable energy source.

Conclusion

I believe KMI offers capital appreciation and an income-generating opportunity for investors. KMI has made significant progress since the close of 2015, and the future sets up well for midstream operators. KMI repurchased $275 million worth of shares in 2022 and provided shareholders with a 3% YoY dividend increase. Management has been able to allocate capital to growth opportunities while increasing the amount of Adjusted EBITDA, an DCF that KMI produces, lowering its long-term debt and net debt while improving its leverage ratio. This isn’t the KMI of old, and I think there is a long-term opportunity in shares of KMI. I plan on adding to my position and collecting the dividends as I wait for shares to appreciate.

Be the first to comment