JHVEPhoto

Introduction

As a dividend growth investor, I continuously seek opportunities to acquire income-producing assets for an attractive price. The current market volatility has the chance to find attractive dividend growth companies at a reasonable valuation. Sometimes I add shares to my existing positions while I start new positions on other occasions to further diversify my holding into new industries.

One of my rules within my dividend growth portfolio is selling shares in a company that slashed its dividend. However, I am forgiving and don’t mind buying again into that company once I see an improvement. The improvement should include a fix to what led to the dividend cut and renewed dividend growth. In this article, I will look into Kinder Morgan, Inc. (NYSE:KMI), a company that slashed its dividend and has been back to growth since then.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

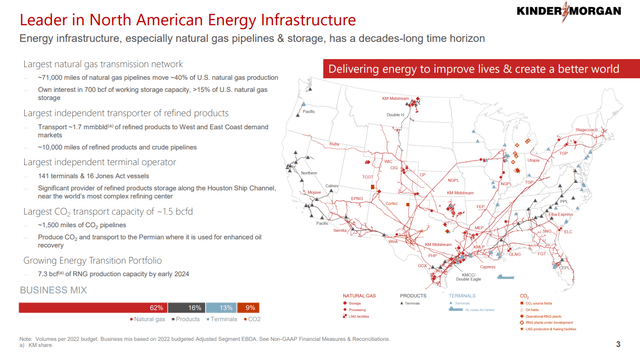

Kinder Morgan operates as an energy infrastructure company in North America. The company operates through four segments: Natural Gas Pipelines, Products Pipelines, Terminals, and CO2. It owns and runs approximately 83,000 miles of pipelines and 143 terminals. It was founded in 1936 and is headquartered in Houston, Texas.

Fundamentals

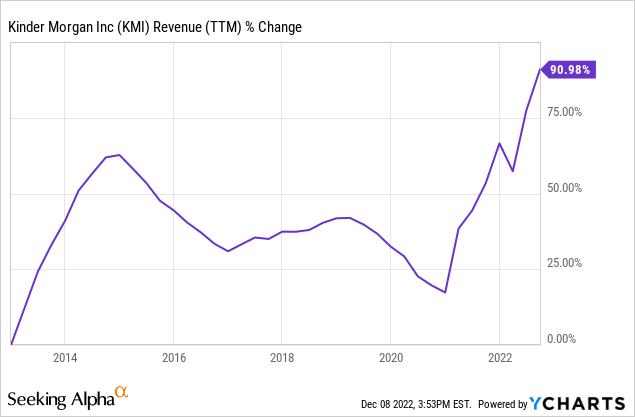

Sales of Kinder Morgan have almost doubled over the last decade. An increase of 91% over ten years equates to nearly 7% annually. Kinder Morgan achieved this growth organically by building more pipes and enjoying higher prices and inorganically as it merged with some of its peers. In the future, the analyst consensus, as seen on Seeking Alpha, expects Kinder Morgan to keep growing sales at an annual rate of ~5% in the medium term.

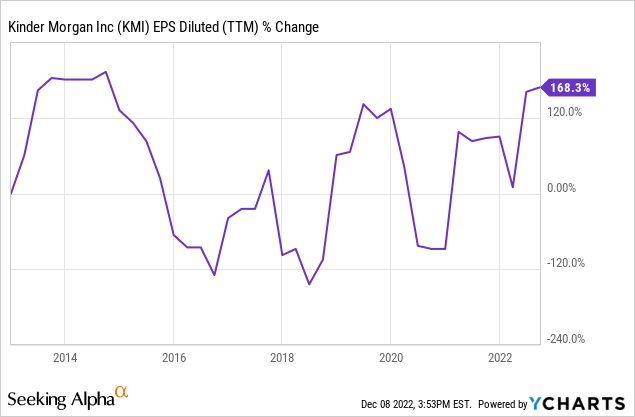

The company’s EPS (earnings per share) has grown much faster despite the number of shares almost doubling. The 168% increase in the EPS is due to a combination of higher sales and much higher margins, as the company is much more efficient and enjoys higher energy prices. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Kinder Morgan to maintain a flat EPS in the medium term, as the current forecast for 2024 is similar to the 2022 forecast.

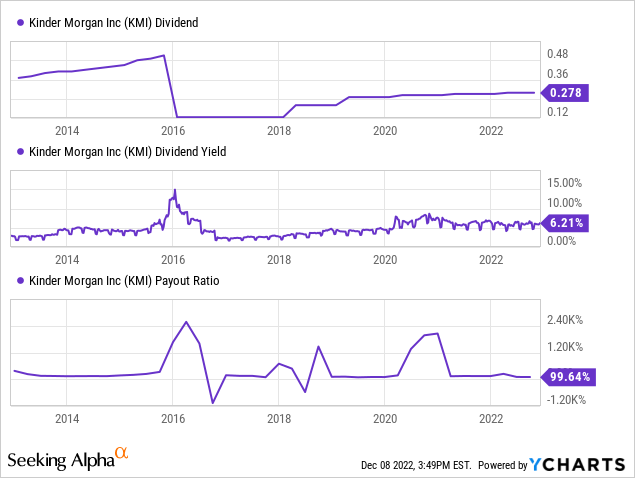

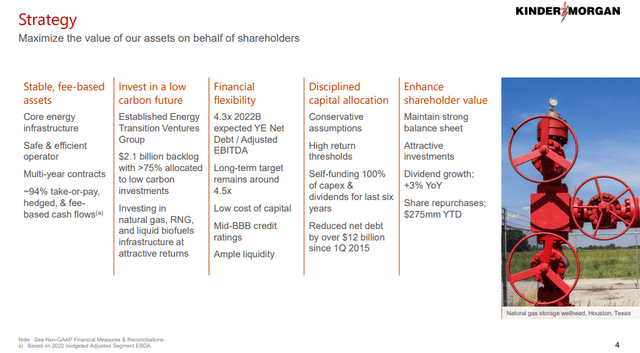

Kinder Morgan has been increasing its dividend in the last four years. Since the dividend cut, the company has had to deleverage and bring its balance sheet to a safer position. Following that, the dividend is growing again. While the dividend grew at a CAGR of 17% over the last five years, investors should expect limited increases due to the slower EPS growth. The dividend yield is attractive at 6.2%, and the payout ratio may look intimidating, but when using DCF (distributable cash flow), it doesn’t seem at risk with a payout ratio below 50%.

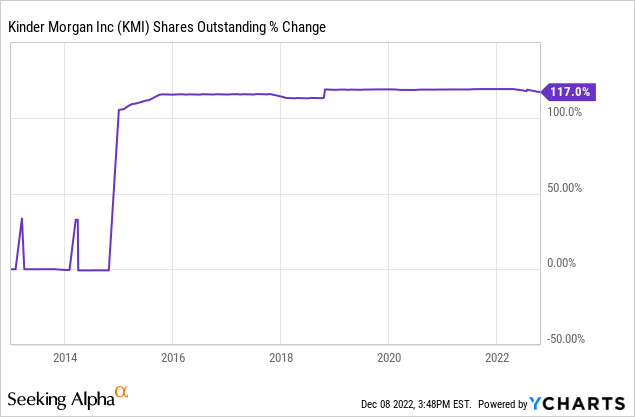

Another method companies use to return capital to shareholders is share repurchase programs. Buybacks support EPS growth and DCF per share for Kinder Morgan. The company’s disciplined approach leaves it with enough room for buybacks. Over the last decade, the company saw a significant share increase due to acquisitions and the need to fund projects with capital. However, in the past twelve months, buybacks have reduced the number of shares by 1%, which is a good sign.

Valuation

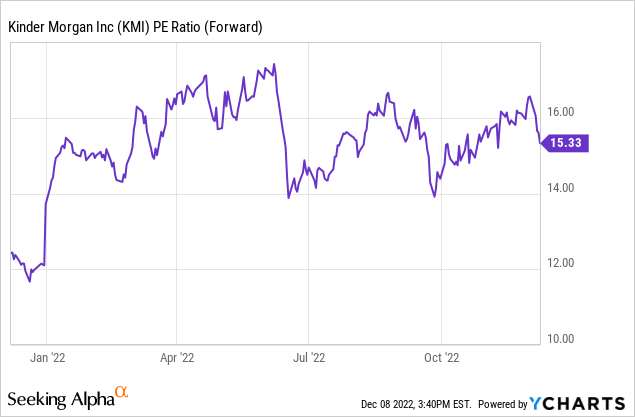

The P/E (price to earnings) ratio of Kinder Morgan stands at 15 when considering the 2022 EPS forecast. The valuation is higher than it was just twelve months ago. It makes sense, as 2022 was a good year for energy companies, and investors flocked toward them. In my opinion, the current valuation is still attractive despite the increase, especially when the company has a path for growth and an attractive dividend.

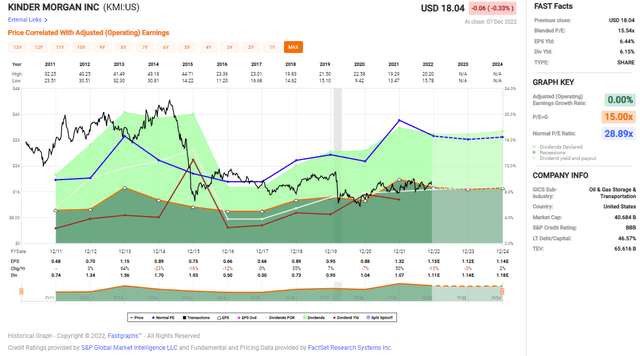

The graph below from Fastgraphs.com also implies that the shares of Kinder Morgan are attractive. Since 2011, the shares have been trading for almost 29 times EPS. Therefore, the current valuation seems extremely attractive. Still, investors should remember that lower leverage means slower growth. Consequently, it makes sense for the company to be less expensive than it used to be. Still, at the current valuation, there is some needed margin of safety.

To conclude, Kinder Morgan offers solid fundamentals. Sales are growing, and so are the EPS and DCF. While we might see some stagnation in the medium term due to a possible recession, the company still offers a much-needed infrastructure. The dividend yield is attractive, and so is the valuation at roughly 15 times earnings.

Opportunities

The most prominent opportunity for Kinder Morgan is that it is well-positioned to capitalize on the growing demand for energy infrastructure. The company is one of the largest operators of pipelines, terminals, and other energy infrastructure assets in North America. It is well-positioned to benefit from the region’s continued oil and gas production growth. It provides the company with a strong and stable revenue stream, which can help to drive its future growth and profitability. When we see the challenges in Europe due to the war in Ukraine, it emphasizes how critical it is to have domestic energy assets.

Kinder Morgan Investors Presentation

Moreover, Kinder Morgan has a solid balance sheet and is committed to disciplined financial management. The company has a decent BBB credit rating and is committed to maintaining a conservative financial profile after the dividend cut. It can give investors confidence that the company is well-positioned to weather potential economic downturns or market volatility due to the probable recession. The slide below shows that the company’s more prudent approach to debt is part of its strategy.

Kinder Morgan Investors Presentation

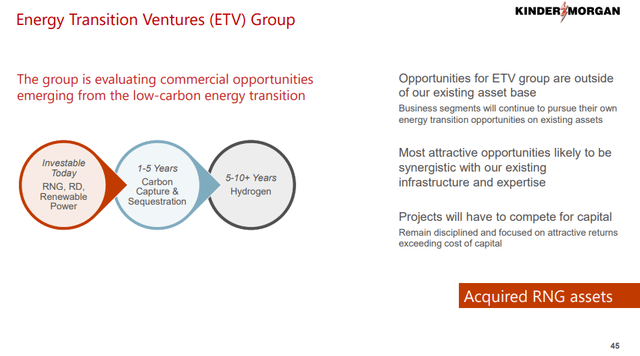

Another growth opportunity in the long term is Kinder Morgan Energy Transition Ventures. It focuses on identifying and investing in early-stage clean energy technologies that have the potential to disrupt the energy industry. It is how Kinder Morgan aligns for a future with less demand for fossil fuels. They work with entrepreneurs, scientists, and other innovators to help develop and commercialize cleaner, more sustainable energy solutions such as hydrogen.

Kinder Morgan Investors Presentation

Risks

The most considerable risk is the volatility in the energy market. The energy market is subject to significant fluctuations and volatility, which can impact the performance of companies like Kinder Morgan. For example, changes in global demand or supply, as well as geopolitical events or natural disasters, can all affect the price of oil and gas and, in turn, the revenues and profitability of the company. While the current environment is positive for the company, a recession may pose a risk as it may lower the energy demand. Peace between Russia and Ukraine may also pressure energy prices lower.

Another risk for the company is its dependence on government approvals. Many of Kinder Morgan’s projects, such as pipeline expansions or new terminals, require regulatory approvals from government agencies. It can be lengthy and uncertain, and there is always the risk that a project may not be approved, which could impact the company’s future growth and profitability. We had seen how the Biden administration hindered TC Energy’s (TRP) growth prospects when it halted the Keystone XL project.

The third risk is many times overlooked, and it is the competition. The energy infrastructure sector is highly competitive, and Kinder Morgan faces competition from other large companies in the industry. This competition can put pressure on the company’s pricing and margins and could impact its ability to grow and generate profits. Competition indeed requires significant capital-intensive investments, but today there are already different pipeline networks. Kinder Morgan’s scale makes it harder to replace due to its scale.

Conclusions

Kinder Morgan is a very decent company, in my opinion. The company has solid fundamentals, with growing sales and distributable cash flow. Therefore, the company is slowly expanding its dividend and even buying back some shares. It does it all without increasing its debt load while maintaining what I believe to be a fair valuation.

Moreover, Kinder Morgan, Inc. has several significant growth opportunities. These opportunities have to do with the current fossil fuels business and more “green” prospects such as hydrogen and carbon capture. Therefore, the future looks promising despite the risks that the company has to deal with. I believe that Kinder Morgan is a BUY at the current price for investors who seek income. Growth investors should be more cautious here and may prefer to wait for a better opportunity in Kinder Morgan, Inc.

Be the first to comment