Avesun/iStock via Getty Images

U.K. insurer and financial services group Legal & General (OTCPK:LGGNF) remains a solid income pick in my view. The nature of the business has been covered in previous pieces here on Seeking Alpha. In this piece I simply want to look at why, now as before, I continue to see the company as a good long-term pick from an income perspective.

My last piece on the company (Legal & General: 6.3% Yield And Continued Dividend Growth In Sight) was a year ago and had a “buy” rating attached. The business continues to perform well with a long runway of strong potential ahead of it. Accordingly I maintain my “buy” rating.

Legal & General Continues to Grow its Business

There has been a long-term growth story at the firm and I expect this to continue. Its mix of businesses exposes Legal & General to long-term growth opportunities which it is well-positioned to capitalize on due to its well-known brand and strong market position.

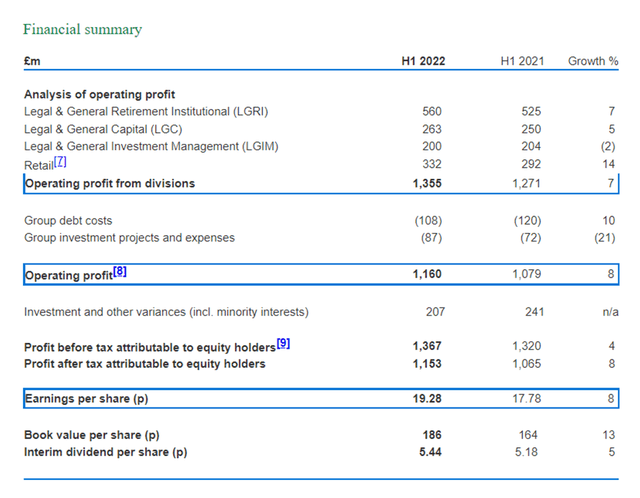

The most recent evidence of this is in the company’s interim results, published last month.

Source: company interim results (footnotes omitted)

The company itself noted its strong track record, with CAGR for the first half in the past 11 years of 11% in EPS, 11% in DPS and 8% in book value per share. That is an excellent performance and the business continues to show positive signs of growth as seen above.

The company struck an upbeat note in the results, saying, “Our strategy has delivered strong returns for our shareholders over time. It has demonstrated resilience through the pandemic and positions us well to navigate – and even benefit from – the prevailing market environment. We are confident we can continue to deliver profitable growth as we execute on our strategy.“ I concur with that assessment. The company is on track to achieve or beat the cumulative cash and capital ambitions it laid out in a five-year plan at the end of 2020. That includes a progressive dividend policy.

Ongoing Income Potential

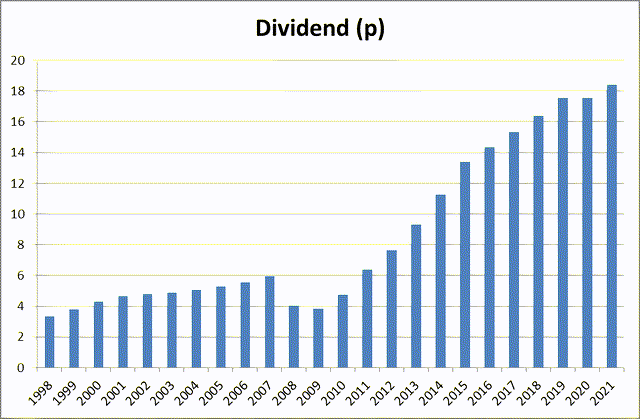

The main appeal of Legal & General to many investors is its dividend, which has an attractive history for the most part over the past two decades, with a couple of stutters when the economy turned bad.

Chart compiled by author using data from company website

The company has set out its dividend policy until 2024 here, which foresees annual dividend growth in the low to mid-single digits. I see no particular reason to expect significant change in 2024. If the company continues to do well and generate enough cash, I expect it to continue its broadly progressive dividend policy that has characterized the past quarter century.

The dividend remains well-covered, with coverage last year exceeding 1.8x earnings, as it has done for three of the past five years.

The reason I think Legal & General should be able to keep increasing its dividend is because I expect it to be able to continue growing earnings thanks to its entrenched market position and strong brand. This can be illustrated by looking back at the company’s performance over the past decade. While some of the metrics move about depending on exactly what time frame is used (notably revenue), double digit earnings growth is the standard and even when the dividend has been growing fast, earnings per share growth has not been far behind.

|

5-year CAGR |

10-year CAGR |

|

|

Revenue |

0.1% |

6.1% |

|

Profit |

10.1% |

11.0% |

|

Basic earnings per share |

10.1% |

10.6% |

|

Dividend per share |

5.2% |

11.2% |

Table compiled and calculated by author using data from company annual reports

Given that the current dividend policy foresees more modest dividend increases even than over the past five years, I expect earnings per share growth to go back to being ahead of dividend growth, increasing coverage. That should help increase the security of the dividend, in the absence of a major business shock such as an economic crash.

Valuation is Attractive

At the moment, the company trades on a price-to-earnings ratio of under 8, which I regard as attractive.

The market capitalization is around £15bn. Over the past five years it has earned around £8.5bn in post-tax profits. Legal & General earnings tend not to be smooth but the long-term trajectory is both positive and strong. So I expect the coming five years could be at least as good, even if the economy performs poorly, thanks to the resilience of some of the company’s business areas. That means that the whole company can be bought for less than a decade’s worth of earnings. That looks like good value to me for a well-established, highly cash generative company with the wind in its sails.

Is there a Capital Growth Opportunity?

The income may be very well, but what about capital growth? Over the past few years, after all, Legal & General has not seen much share price growth. It is within 3% of where it stood five years ago.

That has been true before. Between May 1998 and March 2007, for example, the shares grew only 4%. They then crashed and bottomed out around March 2009 before getting to roughly their current range in 2015 where they remain, albeit that seven-year period has contained a couple of big falls, notably in 2020.

Ignoring the fact that if I had bought these shares at their nadir in March 2009 I would now be earning around a 75% annual yield (!), I think the 2007-09 price history is instructive. Legal & General was an excellent business back then and hardly new (it has been around since 1836) yet its price crashed, partly because of the company’s dividends falling (as I detailed in Legal & General: An Attractive Dividend Choice Yielding Over 6%). But clearly a financial crisis knocked the stock dramatically out of its trading range. If that happens again I would load up (as I did in 2020).

So in the short-to medium-term, I would not be buying the shares in pursuit of capital growth. Longer term, though, the share price could move higher just as it did between the end of the good run in 2007 and the start of the current price range in 2015. When the next economic dislocation causes the shares to fall (as I expect it to, just like 2020) I would see a particularly appealing buying opportunity, as not only would there be a long-term capital growth opportunity but also most likely a high yield (investors who got in at the March 2020 low are now in receipt of an 11.7% yield).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment