todamo/iStock Editorial via Getty Images

Kinder Morgan (NYSE:KMI) is one of the largest midstream companies in the world with a market capitalization of more than $40 billion. The company has a dividend yield of almost 6%, and an impressive portfolio of assets. As we’ll see throughout this article, the company has a unique ability to continue generating substantial shareholder rewards.

Kinder Morgan Assets

Kinder Morgan has an impressive asset portfolio that’ll enable continued shareholder rewards.

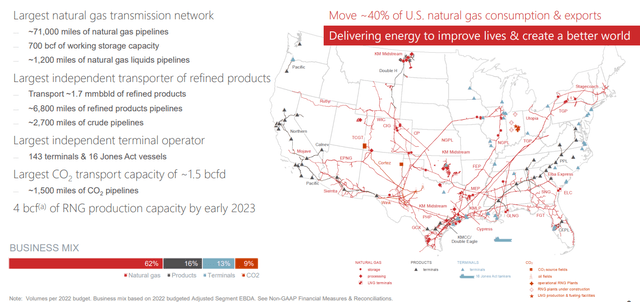

Kinder Morgan Assets – Kinder Morgan Investor Presentation

Kinder Morgan has an incredibly strong portfolio of assets with the largest natural gas transmission network and substantial storage. That storage has panned out during times such as Winter Storm Uri. The company is also the largest transporter of refined products and the largest independent terminal operator in the market.

The company also has enormous CO2 transport capacity and is bringing significant RNG capacity online. These assets will continue to grow and makeup the backstop of Kinder Morgan’s assets.

Kinder Morgan Financial Strength

Kinder Morgan has strong financial strength that could enable continued shareholder returns.

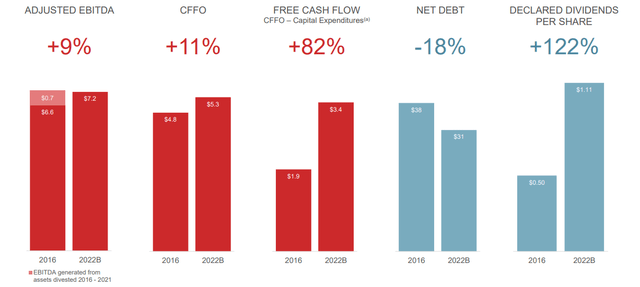

Kinder Morgan Financial Strength – Kinder Morgan Investor Presentation

Kinder Morgan has continued to improve its financial strength. The company, over the last 5 years, has increased adjusted EBITDA by 9% and CFFO by 11%. Net debt has been reduced by 18%, saving substantial interest, with a continued ability to be reduced ever further. The company has managed to increase FCF and dividends by much further than other numbers.

The company’s financial strength and cash flow will continue to grow from capital spending and improved financial metrics. The company could reduce its net debt to 0 over the upcoming decades, saving $1+ billion in annual interest expenditures. The company can combine that with capital spending to achieve long-term growth.

Kinder Morgan Capital Spending

Kinder Morgan continues to have a substantial backlog of assets that the company is using opportunistically.

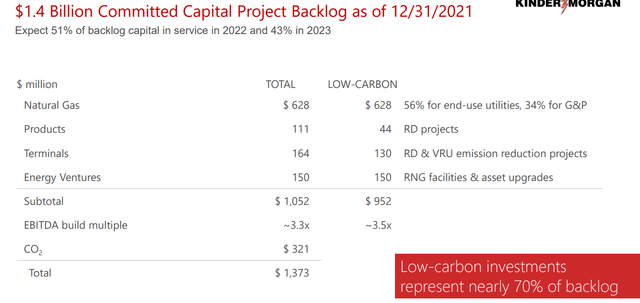

Kinder Morgan Capital -Kinder Morgan Investor Presentation

Kinder Morgan has a $1.4 billion capital project backlog. The company is putting 51% of this in service in 2022 and 43% in 2023. Low-carbon investments represent nearly 70% of the company’s backlog. These continued in service projects will enable hundreds of millions in additional cash flow and continued overall shareholder rewards.

It’s worth noting that the company is focused on low emission renewables but it’s also taking advantage of capital growth opportunities where it matters. The company’s capital spending isn’t egregious but it’s also enough for the company to continue opportunistic growth.

Kinder Morgan Shareholder Return Potential

Kinder Morgan has the ability to generate substantial shareholder rewards. The company’s 2021 DCF is expected to be $4.7 billion. From this, the company is expected to spend roughly $2.4 billion in dividends and $1.3 billion in capital. That’s $3.7 billion. The company has $1 billion left that it can use for a variety of shareholder rewards.

The company has announced potential plans for $750 million in share buybacks. That alone will save the company more than $40 million in annual dividend expenditures. In additional to that, the company can focus on debt paydown or a variety of other shareholder rewards, such as more share buybacks.

However, the company spends its capital we see the potential for massive shareholder rewards making the company a valuable investment.

Kinder Morgan Risk

Kinder Morgan’s risk is volumes. The company has been steadily building up its contracts, and long-term contracts mean reliable cash flow, however, they’re not insusceptible to a long-term decline in volumes. That’s been evidenced with some companies during COVID-19, and it remains a substantial risk worth paying attention to.

Conclusion

Kinder Morgan has one of the hardest to replace asset portfolios on the market. The company moves 40% of U.S. natural gas, something that’s essential at a time when natural gas exports can be expected to increase significantly. The company is opportunistically spending capital and is focused on high returns for investors.

The company has an almost 6% dividend yield it can comfortably afford and a double-digit DCF yield. We expect the company to focus on debt reductions and opportunistic share buybacks that’ve already announced. That focus will enable continued shareholder rewards and helps highlight Kinder Morgan as a valuable investment.

Be the first to comment