Terry Wyatt

Kimberly-Clark Corporation (NYSE:NYSE:KMB) is on the verge of joining the prestigious Dividend King club, which currently has 45 members. Earning a spot on the Dividend Aristocrat is hard enough, but becoming a Dividend King is an accomplishment that few companies will achieve. Dividend Kings have raised their annual dividend for 50 consecutive years while being a member of the S&P 500. KMB has raided its dividend for 49 consecutive years, and more than likely will be crowned a Dividend King in Q1 of 2023 as its 50th dividend increase is paid. If you’re an income investor, the idea of owning Dividend Kings is compelling as the likelihood of receiving annual dividend increases becomes a high probability. With KMB about to crossover from Dividend Aristocrat to Dividend King, I wanted to take a deeper look into them. While I believe KMB is a great company, I feel it’s a bit overvalued and would rather allocate the capital to a dividend ETF such as the Schwab U.S Dividend Equity ETF (SCHD), which owns 4.42 million shares of KMB.

Looking through KMB’s financials and providing the reasoning as to why I believe shares are overvalued

It would be difficult to argue that KMB is a poorly run company because that isn’t the case. KMB is a solid company, generating tens of billions in revenue annually, producing billions in net income and Free Cash Flow [FCF]. You don’t get to this level without doing many things well. While I respect what KMB has done operationally and the financial success it has achieved, my opinion is that shares are overvalued at their current level. KMB trades at $126.84 with a market cap of $42.37 billion. KMB pays a dividend of $4.64, which is a forward yield of 3.66%. While I am intrigued by its yield and potential Dividend King status, I don’t believe these prices are an optimal entry point.

Seeking Alpha

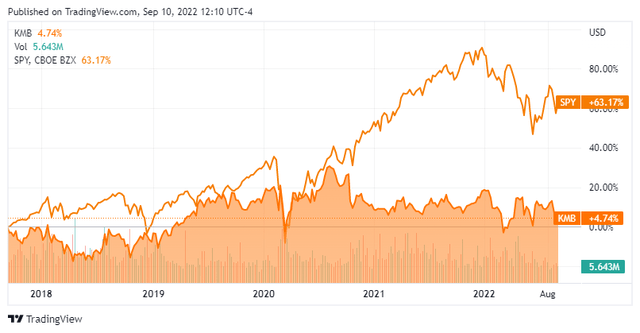

When I am looking at income investments, I need to consider what the long-term price history against the S&P has done and if it has underperformed, do I think shares are potentially mispriced? Over the past 5 years, KMB has traded sideways, which I am not punishing them for, but the SPDR S&P 500 Trust (SPY) has appreciated by 63.17%. If I am going to forgo almost 60% in capital appreciation, I need a larger dividend yield than 3.66%. When I invest in REITs, I expect them to trade sideways, but the difference is that when they are yielding between 6-9% my reinvested dividends work at a much quicker pace, and over time my cash flow is significantly increased. I can’t get excited about a company with a 3.66% yield that is trading sideways.

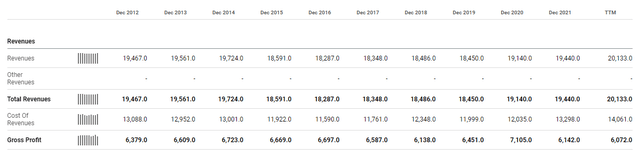

With that said, I start looking into the financials to determine if I believe the market is mispricing shares, or if KMB is overvalued. The first aspect I look at is growth. Is KMB growing, or have they reached their organic capacity? Over the past decade, KMB has seen its revenue decline YoY 3 times and increase 7 times. Over the past decade, KMB has grown its revenue by $666 million, which is 3.42%. From 2015 – 2019 KMBs revenue fell under $19 billion annually, and recently KMB has strung together several years of YoY revenue increases. In 2021, KMB had its 4th largest fiscal year from a revenue perspective, behind 2014, 2013, and 2012. Currently, in the TTM, KMB’s revenue is the largest it’s been, exceeding $20 billion, but with the fiscal year not closed, we will have to wait and see if 2022 becomes a record revenue year. Even if revenue stays at this pace, KMB will finish 2022 with $20.13 billion of generated revenue which is 3.42% revenue growth over a decade. Without revenue growth it’s hard to get excited about future capital appreciation, especially in an inflationary environment.

Seeking Alpha

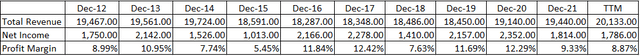

With revenue growth that’s almost non-existent, I need to look at KMB’s margins. Prior to doing the math, I would assume that KMB would be experiencing declining margins as inflation increases the cost of revenue and operating expenses. Below I created a grid indicating KMB’s profit margin annually since fiscal year 2012. Since the close of 2020, KMB’s profit margins have declined by -3.42% to 8.87%. KMB is still a profitable company and generates billions in net income, but the combination of declining profit margins and flat revenue isn’t a compelling combination for future capital appreciation in its share price.

Steven Fiorillo, Seeking Alpha

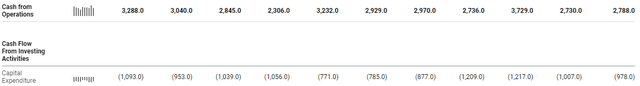

Moving to the cash flow statement, KMB has been stagnant with the cash produced from operations after stripping out 2020 as it looks to be an anomaly. KMB hasn’t been able to generate additional cash from operations, and if you leave 2020 in the picture, KMB is generating significantly less cash than it did from a smaller revenue base.

The P/FCF metric is a longtime favorite of mine that has recently become popular as FCF has become important again. FCF is often looked at as one of the best measures of profitability as FCF excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet. To some investors, FCF is more important to analyze than net income because it’s harder to manipulate as it is a true indication of the company’s cash. FCF is also the pool of capital that companies can utilize to repay debt, pay dividends, buy back shares, make acquisitions, or reinvest in the business.

In the TTM, KMB has produced $1.8 billion of FCF, which places them at a price to FCF multiple of 23.66x. I can’t allow myself to pay the same multiple for KMB’s FCF as Apple (AAPL). AAPL trades at $157.37, which is a market cap of $2.53 trillion. AAPL has generated $107.58 billion of FCF in the TTM, which places AAPL at a price to FCF multiple of 23.51x. Over the past 4 years, AAPL has grown its FCF by $54.09 billion (101.1%). I like paying between an 18-22x price to FCF multiple for a company, and KMB is slightly out of this range, but it’s certainly reasonable compared to many companies in the market today. The problem I have is that I don’t believe KMB should be given the same price to FCF multiple as AAPL, especially when AAPL has demonstrated significant growth across the board and KMB has treaded water.

Seeking Alpha

Kimberly-Clark has a strong dividend but it’s not enticing enough for me to invest just yet

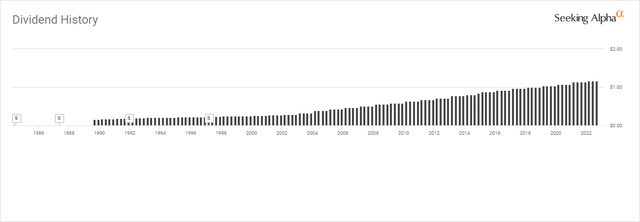

The Dividend Aristocrat is about to be crowned a Dividend King as investors have enjoyed 49 consecutive years of dividend increases. There is nothing to complain about when it comes to the dividend. KMB pays $4.64 per share for a forward yield of 3.66%. KMB has a dividend payout ratio of 82%, which indicates there is more than enough room in the earnings for future increases. KMB also has a 3.82% 5-year dividend growth rate.

Seeking Alpha

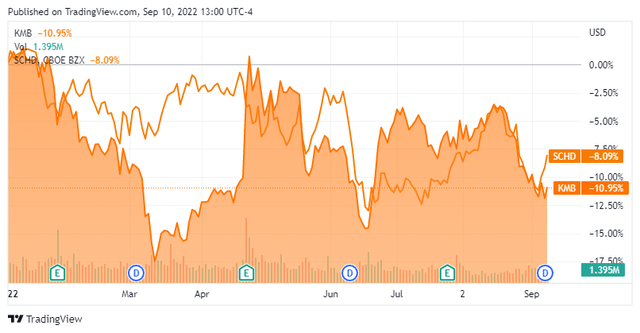

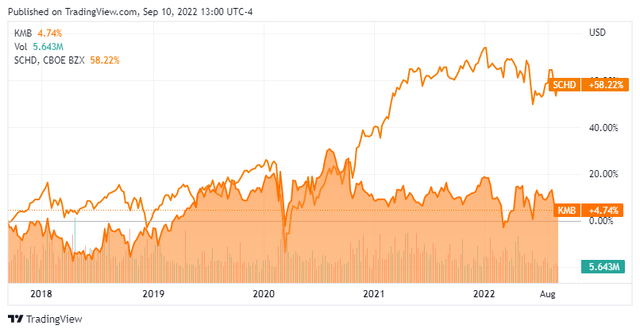

While KMB is a phenomenal dividend company, the 3.66% yield doesn’t do enough for me due to the spread between SPY and KMB from a capital appreciation standpoint. If its dividend had a yield that rivaled some REITs such as Omega Healthcare Properties (OHI) it would be a different story. Today I would rather deploy capital to SCHD than KMB when looking for dividend income. In 2022, SCHD has declined by -8.09% compared to -10.95% for KMB. Over the past 5 years, SCHD has appreciated by 58.22% compared to 4.74% for KMB. SCHD pays an annual dividend of $2.43, which is a forward yield of 3.27%. SCHD has a 5-year dividend growth rate of 13.32% and 9 consecutive years of dividend growth. KMB becoming a Dividend King is great, but I don’t believe an investment at these prices will be the best allocation of capital as the yield can be replicated in SCHD with much more potential for capital appreciation in the future.

Seeking Alpha

Seeking Alpha

Conclusion

KMB is a great company that I want in my dividend income portfolio, but not at today’s prices. I would rather buy shares of SCHD, and gain indirect exposure to KMB. SCHD has provided better downside protection in 2022 and outperformed KMB significantly over the previous 5-years. If I am going to allocate capital toward KMB, I need to set aside the likelihood of them becoming a Dividend King next year and think about the investment from a numbers aspect. I believe I would do better in a REIT such as OHI or an ETF like SCHD rather than investing in KMB today. Due to KMB’s financials, I would want to pay the price to FCF multiple of around 18x, which would put its market cap at $32.7 billion. This would put KMB at roughly $96.85 per share, a 23.64% decline from today’s prices. KMB’s yield would also jump to around 4.79%, which would be much more enticing considering the other options in the market today. If shares fall to $100 or lower, I will get interested quickly in adding KMB to my dividend income portfolio.

Be the first to comment