Heiko119/iStock via Getty Images

Ever since 2016’s question article, “Abbott Laboratories: Should I Stay Or Should I Go?”, my sundry Abbott (NYSE:NYSE:ABT) articles have been generally laudatory. In this article, I am again questioning Abbott’s ongoing investment thesis.

Abbott has benefited from huge COVID test revenues.

As COVID lockdowns rolled/roiled across the US during March and April of 2020, economic activity took a huge hit. Surgical procedures were even more dramatically devastated.

Unlike its medical device peers, Abbott was heavily insulated from loss during this period by its clever seizure of opportunity from the COVID disaster. Its heroic development of “no fewer than eight COVID-19 tests”:

…while encumbered by, a worldwide pandemic that was just beginning in January of 2020, … seems like an impossibility.

Abbott pulled it off as the pandemic was growing. In time it had a COVID-19 testing franchise embracing the various components shown below:

It pulled in COVID-19 testing-related sales totaling ~$3.9 billion in 2020 and ~$7.7 billion in 2021 (2022 10-K, pg. 22). So far thru Q2, 2022, it has COVID-19 testing-related sales totaling ~$5.6 billion (Q2, 2022 10-Q, pg. 23).

While these huge revenues foster wonderful growth metrics for Abbott, they are illusory because they are of highly uncertain duration and they are highly unlikely to continue at anywhere near this level.

Abbott’s situation with its COVID testing revenues reminds me of Gilead (GILD) with its SOVALDI/HARVONI/EPCLUSA problem. Its HCV therapies brought Gilead huge treasure, but since they cured HCV without ongoing therapy, they guaranteed dropping revenues.

The cash influx was nice, but Gilead has not done so well over the years; hopefully its path is not predictive of Abbott. Abbott’s diversified device business is sufficiently different from Gilead’s more limited therapy business that seems a safe bet. Unfortunately some similarities are cropping up.

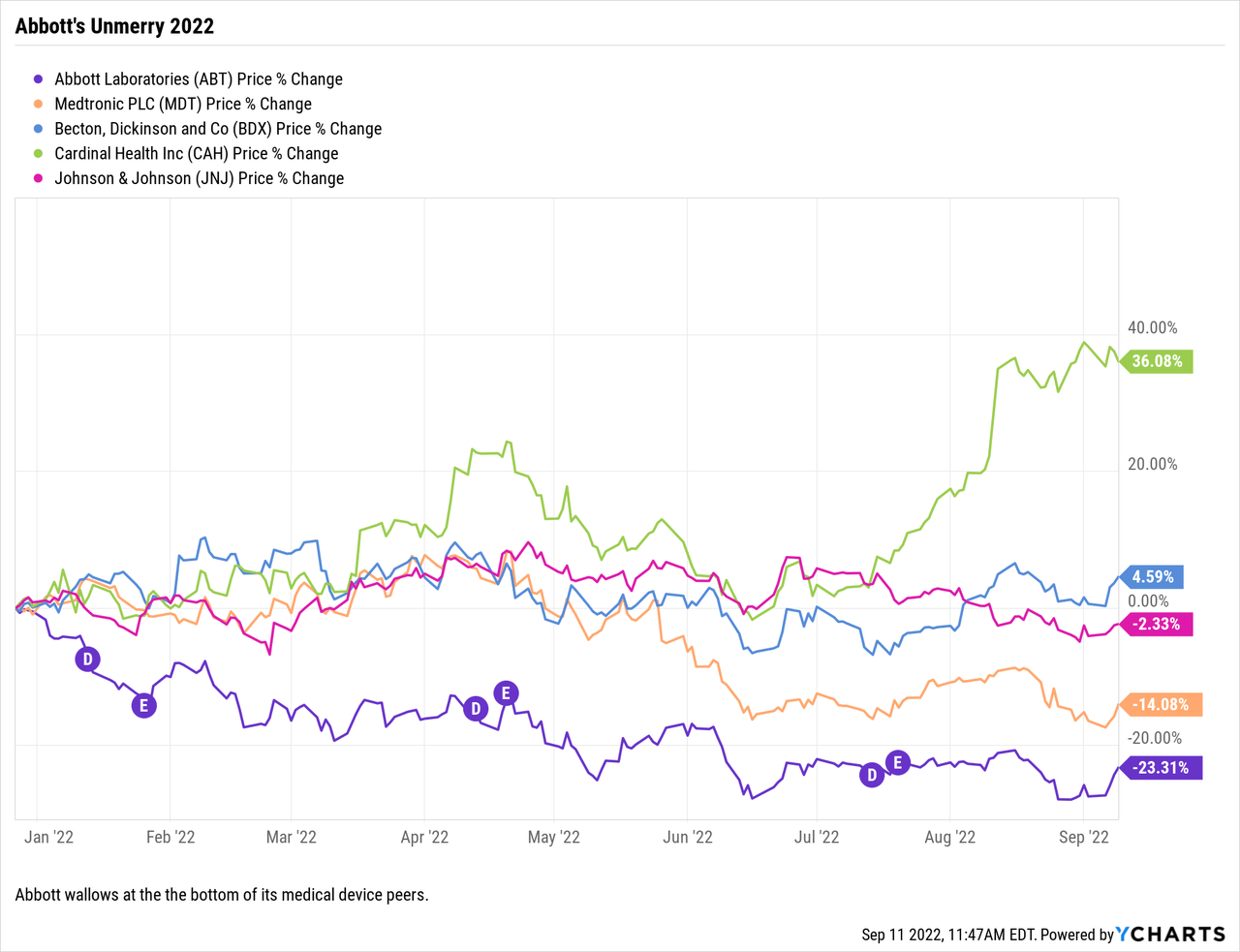

Despite strong revenues, Abbott has faced peak to trough price erosion of nearly 30% since Christmas 2021.

Santa left Abbott shareholders with Yuletide bounty of a peak $142.60 Abbott share price on 12/27/2021. So far 2022 has been all about his un-gifting of this happy tiding as shown by its chart below:

I was chagrinned and surprised to see that Abbott brought up the nether extreme of its key competitors.

This is particularly strange insofar as the pandemic has been so troublesome for the run of device companies who, like Abbott, have suffered from erratic procedure volumes. Unlike the run of its peers as discussed above, Abbott has had a compensating pandemic benefit of billions in COVID-19 test revenues. Its listed competitors have not. This brings up the titular question, what gives?

Unusually, several factors are working to hold Abbott back.

Abbott’s recent news feed has included several downbeat issues. Tight government funding for COVID-19 testing is one. However, the bigger issue and one that keeps popping up with disturbing continuity has to do with its baby formula ills.

In 02/2022 Abbott issued its 8-K announcing its “proactive, voluntary recall” of Similac-brand baby powder manufactured at its Sturgis Michigan plant. During its Q1, 2022 earnings call, CEO Ford reported the following comforting update:

…we initiated a voluntary recall in February of certain infant formula products manufactured at one of our U.S. facilities. … we retain in-house samples of products that we ship to customers. Testing of retained samples related to this recall action by both Abbott and the FDA have all come back negative for … the bacteria that cause the reported illnesses.

Importantly, the FDA and CDC found that there is no genetic match between the strains of the bacteria identified in non-product contact areas of our facility and available samples obtained from customer complaints, suggesting a different source of contamination.

…no salmonella was found in our factory or product[:] the FDA ruled out any link to our facility. We hope these findings get parents, caregivers and other stakeholders renewed confidence in our products. We know the situation has further exacerbated industry-wide infant formula supply shortages. That’s why we’re doing everything possible to mitigate supply constraints by bringing in product from our FDA registered facility in Europe and ramping up production at our other U.S. plants.

The situation seemed under control, with Abbott having pre-emptively identified and appropriately resolved the issue, or so I thought. How wrong I was. Unknown to me, another less comforting narrative was in progress.

An 04/09/2022 USA Today article was not atypical. It reported that finding Similac had become almost a full time job for some desperate parents. It also included the following unfortunate sentence immediately after describing Abbott’s recall:

The Food and Drug Administration said two weeks ago that the formula maker failed to maintain sanitary conditions and procedures at that plant.

Despite my hopes and expectations that this formula issue was in the rearview mirror, it keeps popping up. An 08/23/2022 Seeking Alpha news report shows its current standing, including the following points:

- Abbott’s Sturgis Michigan plant still hasn’t been able to restart Similac production, the company is working to restart it “…as soon as we can”,

- Abbott is extending the Special Supplemental Nutrition Program for Women, Infants, and Children [WIC] until 09/30/2022,

- WIC provides beneficiaries with rebates they can use to buy Similac baby formula or a rival product free of charge,

- baby formula issues knocked Abbott’s H1 revenue from its nutrition segment by ~16% YoY.

Abbott announced good news on 08/26/2022 relieving point 1 above that it is restarting Similac production at Sturgis. Restarting the plant is not a final answer. Assuming no new hiccups, it will take 6 weeks before Abbott begins shipping product from the plant.

Given a paywalled New York Times 09/08/2022 article unleashing serious snark on Abbott’s hardball tactics in keeping the issue out of the headlines; there can be no doubt Abbott is fully focused on this issue.

Conclusion

What gives, is the question. The answer is that Abbott is facing serious headwinds from the macro environment; during its Q2, 2022 earnings call, CEO Ford averred that Abbott’s supply chain was strong. However, he called out challenges from inflation, healthcare staffing, recession risk factors, and most notably the strong US dollar which had an unfavorable 4.2% impact on Q2, 2022 sales.

It is also dealing with its COVID testing revenue uncertainties and its infant formula issues. These latter two seem likely to linger on for at least several more quarters.

In summary, we have a situation where Abbott, a consummate blue chip and dividend aristocrat, is trading at $109.55 as I write on 09/12/2022. This is a tempting discount to the average $124.89 price target of 22 analysts. For those looking to start a position in a solid company likely to hold its value, this is a nice entry point.

Be the first to comment