VioletaStoimenova

“If the reputation of a company’s products and services is its face, the talent brand is its heart and soul.”- Hank Stringer

One of the notable tenets of the recent melt-up move in equities is the way small-caps have performed off late. As noted in the “Leaders-Laggers” section of this week’s edition of The Lead-Lag Report, a ratio capturing the performance of small-caps versus the constituents of the S&P500 is at its highest point in over a year.

If you’re on the lookout for reasonably priced stories in the small-cap space, may I reiterate the investment case for Kforce Inc. (NASDAQ:KFRC), a professional staffing firm that is primarily noted for providing HR solutions in the tech domain (90% of its revenue).

Admittedly, this year tech has received a bad rap from all and sundry; in fact a few days back, I had gone into great detail over some of the ills surrounding the sector in a Lead-Lag Live discussion with a digital correspondent of CNN News.

Twitter

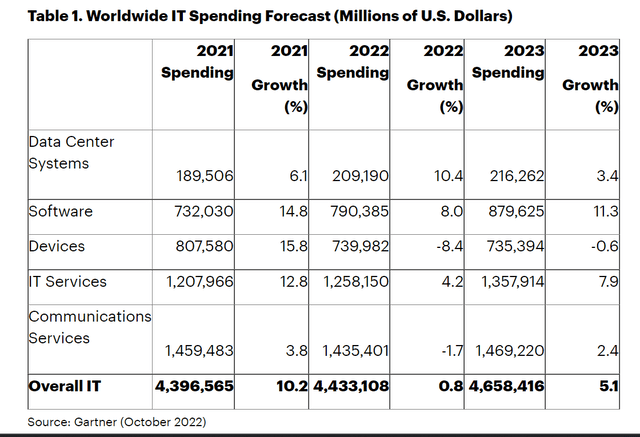

Even if you think that the halcyon days of tech may be a thing of the past, I don’t believe this impacts all sub-segments of tech equally, and something like tech-related hiring could continue to remain resilient. One could also argue that if enterprises don’t continue to press the pedal on digital business initiatives that were kickstarted after the pandemic, they could be quickly left behind when the cycle turns. After a flattish performance in 2022, Gartner now expects IT spending to pick up by 5% next year.

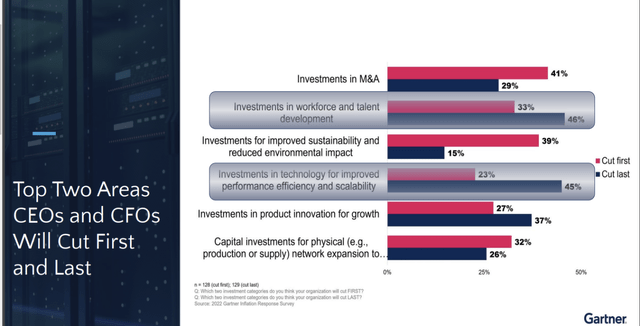

Gartner also ran a survey to determine in which areas CEOs and CFOs would be likely to trim budgets, and investments in workforce and technology were a couple of areas that were deemed to be relatively indispensable.

Twitter

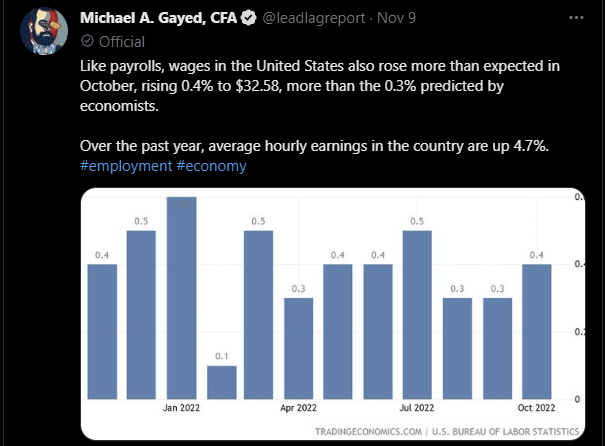

Then, if you track the timeline of the Lead-Lag Report, you’d note that I put out a lot of content related to the employment market; in one of my recent tweets, I highlighted the pace at which earnings have been trending up.

Twitter

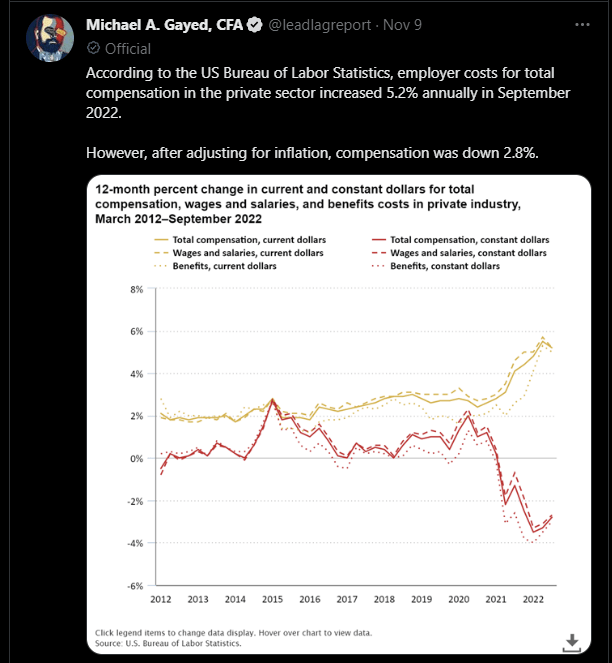

However, in nominal terms, whilst earnings may be growing at a healthy pace, in real terms it is still declining. Thus, if enterprises want to keep hold of their best talent in this environment, they will have to stump up even more attractive packages. Besides, as debated in my Lead-Lag Live chat with Professor Blanchflower, having raised earnings since the pandemic, companies don’t have an awful lot of elbow room to bring earnings back down.

Twitter

Yes, I recognize that some plain vanilla components of an enterprise’s workforce may be susceptible to cuts, but for something like tech which is an increasingly specialized skillset, I don’t believe earnings are at any risk of staying stagnant.

For KRFC, a higher earnings trajectory and sustained commitment to digital investments will reflect very well on its average bill rates which are currently at elevated rates of $88 per hour. To highlight how high this is, consider that in a domain such as finance and accounting average bill rates are closer to the $50 per hour mark! Incidentally in the recently concluded Q3, KFRC’s bill rates not only grew by 8% in annual terms but also by 1.4% in sequential terms! KFRC’s management stated that going forward they expect these bill rates to cross levels of $90 per hour. It isn’t just bill rates, even the average assignment length of employment contracts is getting stretched in the tech space, and is currently closer to 10 months.

KFRC’s operating model is also relatively insulated by the fact that it is not dependent on just a few set of clients but rather caters to 70% of the Fortune 500 companies.

Quite unlike a lot of other cyclicals that are financially levered, KFRC only has minuscule net debt to the tune of $7bn (incidentally the lowest in a decade) so one doesn’t have to fret over the excessive pace at which the Fed has been tightening rates.

KFRC is also one of those names that is exceedingly generous with its distributions; it typically pays out 75% of its operating cash flows via dividends and buybacks. During the Q4 results management stated that this year they would likely distribute 100% of operating cash flow to its shareholders.

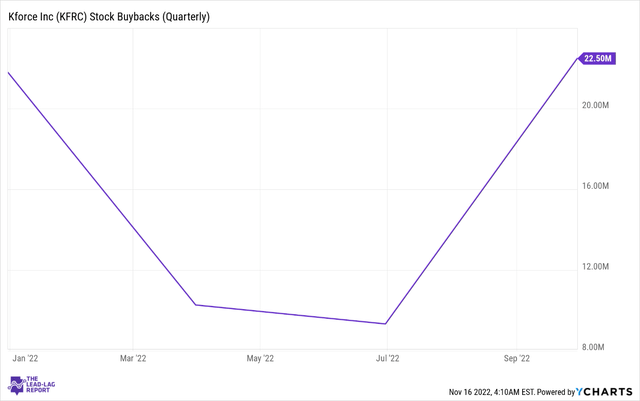

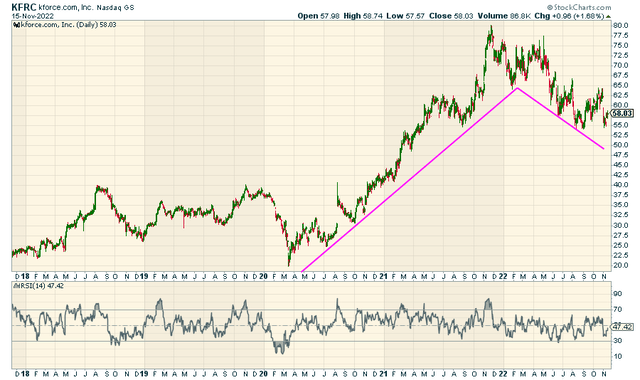

Note that in the recently concluded quarter, they deployed a higher quantum of funds towards buybacks (22.5m) as the share is currently in the midst of undergoing its first bout of correction, after a steep uptrend for two years. In February this year, the board increase the buyback outlay to $100m and so far the company has only deployed $43m. If the share continues to correct, I would expect management to indulge in more pronounced buyback momentum.

Conclusion

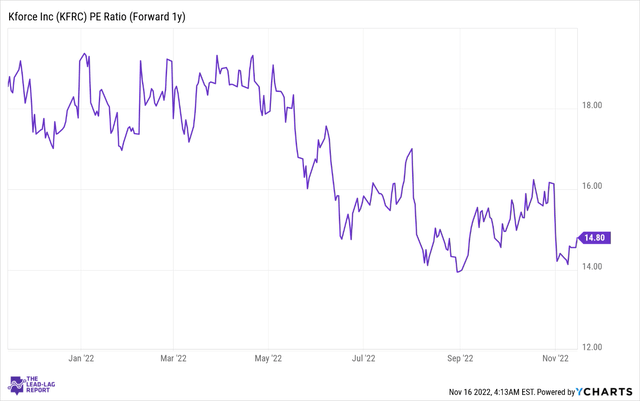

Finally, it’s also worth considering that the KFRC stock, which was previously deemed to be quite pricey, is now available at reasonable rates. According to YCharts, on a forward P/E basis the stock trades at 14.8x, lower than its long-term average and a long way from the 18-19x levels seen last year.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment