littleny

Introduction

Keurig Dr Pepper (NASDAQ:KDP) is one of the largest drink manufacturers in the world. In 2018, the company merged two very different product types into one company, creating a business with staple brand names in soda, juice drinks, and coffee. While Dr. Pepper and Snapple brands are the consistent staples, the K-cup coffee for Keurig brewers is the growth engine. Keurig Dr Pepper makes up 80% of the total K-cup market and is selling these like crazy. At 27x earnings, I think the company makes for a good long-term investment.

Financial History

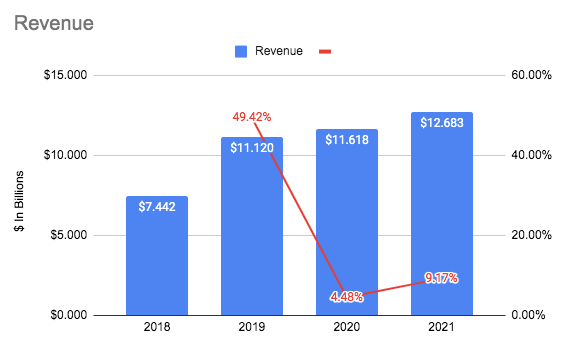

Keurig Dr Pepper Revenue (SEC.gov)

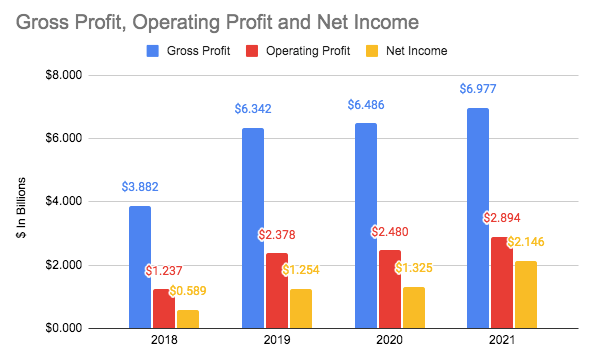

Keurig Dr Pepper Gross Profit, Operating, and Net Income (SEC.gov)

Keurig Dr Pepper has had a very consistent financial history since the merger. The business has seen stable revenues since 2018 and an overall CAGR of 14.26% since 2018. Operating income has seen the same trend and has grown at a rate of 23.68%. Net income on the other hand has grown at a clip of 38.16%, with the primary difference due to the 62% increase in 2021.

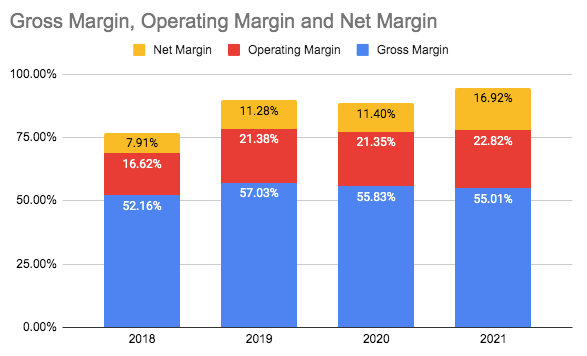

Keurig Dr Pepper Margins (SEC.gov)

Net income increased in 2021 due to the sale of equity of the BodyArmor brand. Taking this amount off the bottom line gives the company a net income of around $1.6 billion. This is more in line with previous years, with an adjusted net margin of 12.8%. Looking at margins shows Keurig Dr Pepper’s consistency, with very stable gross and operating margins since 2018.

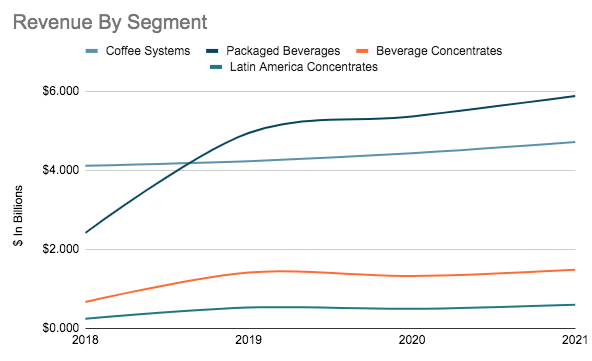

Keurig Dr Pepper Revenue By Segment (SEC.gov)

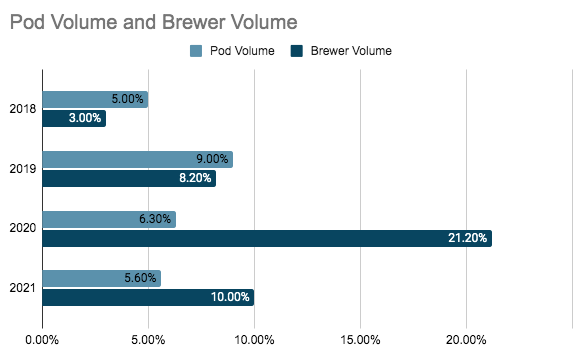

Keurig Dr Pepper Volumes (SEC.gov)

Looking deeper at each segment of the business, shows where the company is seeing growth. The most consistent segment the business is the coffee systems segment which has seen just 3.47% growth per year since 2018. The growth engine of this business is the package beverages segment, which includes the manufacturing and distribution of K-Cups, Dr. Pepper brands, and Snapple Brands. Just a note, the company makes over 80% of all K-Cups in the United States. This segment saw growth of 24.93% per year over the period analyzed. A major contributor to this growth pattern is the growing volumes of pod use. This can be seen in the above chart along with brewer volumes. What this shows to me is that Dr. Pepper and Snapple brands are the mature cows of the business while Keurig is still growing and the star. Looking at the over segments, Beverage Concentrates and Latin America also grew by 22.08% and 25.17% per year each. Overall, great results for the business and stable operations.

This Year

Looking at Keurig Dr Pepper’s midyear results show much of the same consistent trends as prior years. The only difference is the softness in the market for brewers and pods. Revenue for the half year was $6.632 billion for a gain of 9.8%. Operating and net income were up 11.9% and 3.9%, respectively. Margins were consistent, with the gross, operating, and net margins at 52%, 23%, and 12% each. As for each segment, Coffee Systems was pretty much flat due to brewer volume being down 4.6%, attributable to the rebuild of retail inventories. Packaged Beverages saw a 13% gain, despite a 0.4% decline in pod volumes. This segment managed to grow from higher sales volumes and a better pricing mix. Beverage Concentrates and Latin America also grew 16.5% and 22.3% each, led by a better pricing mix. Overall, Keurig Dr Pepper is performing well at the midyear mark. Volumes for some key products are a little soft, but the rest of the portfolio is making up for this.

Balance Sheet

While the business operations are very stable, the company kind of lacks in the balance sheet. Liquidity could be much better, as the company only has a current and quick ratio of 0.56x and 0.37x. The inventory turnover also isn’t incredibly high at around 7x. But for what the company lacks in liquidity, it makes up in low leverage. Keurig Dr Pepper only has a debt-to-equity of 0.98x, which means the company has been funded by more equity than debt. Overall, while I would like to see better liquidity, the company’s stability helps reduce this balance negative.

Valuation

As of writing, Keurig Dr Pepper trades around the $40 price level. At this level, the business trades at a P/E of 26.7x the estimated 2022 EPS. The company also trades at 2.25x book value and offers a 1.87% dividend yield. Taking this all together, it seems the business is trading at fair value. At this price, it would be a good value to start a position for a long-term hold.

Conclusion

Keurig Dr Pepper is a great and stable business. The company has stable and growing segments to propel revenue and net income growth. Making up 80% of the total pod market allows for a stable line of growth, no matter what. Pair this with the staple brands like Dr. Pepper and Snapple, the company has a diverse setup. While the midyear of 2022 doesn’t show as strong of demand as last year, it seems to be due to inventory/supply side issues. I believe that Keurig Dr Pepper will continue previous trends for a while. Therefore, at 27x estimated EPS, I think the company is a solid long-term purchase.

Be the first to comment