.shock/iStock via Getty Images

Introduction

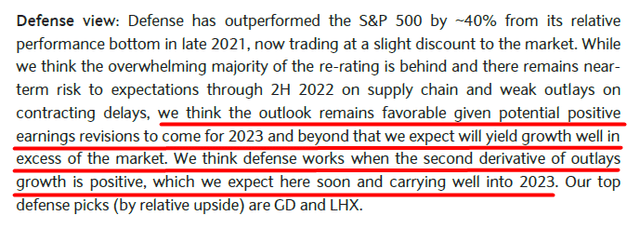

A few days ago, I came across an equity research report from Barclays that looked at the state and prospects of the U.S. aerospace and defense industry. If you are interested in the opinion of the analysts of this English bank, I have made a screenshot for you with my notes:

Barclays (August 16, 2022), author’s notes

VirTra Inc. (NASDAQ:VTSI), a small, $83 million defense simulator company, was not mentioned in that report, but it was the company I immediately thought of.

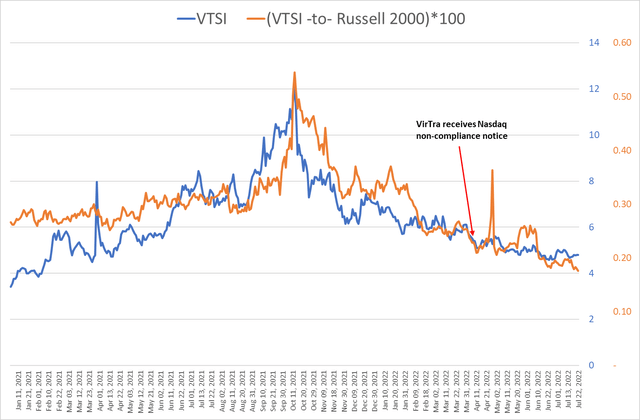

I initiated coverage of VirTra Inc. in August 2021, when 1 share of the company was trading at $7.5, showing a weak reaction to a relatively strong quarterly report. I alerted readers to the fact that the stock reacted poorly to such a strong report, and over the next 30 trading days following that article, VirTra stock posted a gain of >60%, which cannot be explained by phenomenal market growth (the Russell 2000 Index was up 0.95% over the same period).

TradingView with author’s notes

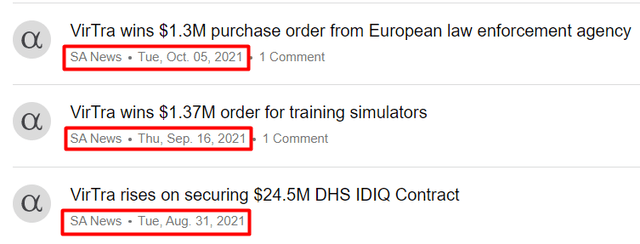

In my opinion, the mispricing that existed at that time disappeared after the report, among other things, due to a series of positive news about the potential for expanding the company’s backlog.

Seeking Alpha with author’s notes

But as we all know, that was followed by November – the month when the tech bubble began to burst, taking small companies like VirTra with it. Since then, VTSI stock has lost all of its power over the broad small-cap index (Russell 2000), and the receipt of Nasdaq’s Non-Compliance Notice finally ended the confidence of growth investors.

Author’s calculations, based on Investing.com

However, now that VTSI has lost ~60% off its highs and is trading at 16 times FY2023 GAAP earnings, I feel the need to revisit my last thesis to answer the question: Is VirTra a run-of-the-mill growth trap or is it really a company with significant growth potential in the coming years?

My updated thesis

When I look at the sharp sell-off in VTSI stock in recent months and relate it to the company’s high-quality fundamental profile, I conclude that VirTra has every chance of turning around and offering its shareholders an above-average return in the future.

My reasoning

Let me refer you to my last article to give you a better understanding of the company’s business model.

VirTra serves different law enforcement, military, educational and commercial markets, including U.S. governmental (60% of total revenue), commercial (24%), and international (16%) customers. In terms of products sold, it defines the following 5 categories, according to the recent 10-Q report (Q1 2022):

- “Simulators and accessories” (84.57% of total sales) – simulator products including screen-based and vehicle-based simulator systems, and training devices;

- “Extended service-type warranties” (9.91%) – separately priced extended service type warranties for periods of up to four years after the expiration of the standard one-year warranty;

- “Customized software and content” (2%)- customizable software training solution;

- “Installation and training” (3.52%) – customer system installations/training;

- “Licensing and royalties” – sales-based royalty exchanged for the license of intellectual property (“That’s Entertainment” royalties/licensing fees, a former related party).

As we already know, the company had some problems in the past in terms of reporting. According to management, the reason why the company didn’t publish any new reports was due to the new ERP (“Enterprise Resource Planning”) system, the introduction of which caused problems with the preparation of the reports and their subsequent audit.

In January 2021, VirTra, Inc., a Nevada corporation (the “Company”) implemented a new company-wide Enterprise Resource Planning system (“ERP system”), which replaced three independent systems used for financial accounting purposes. The Company has encountered various issues with the ERP system which have delayed the preparation of the year-end financial statements and thus delayed the audit.

For the foregoing reasons, the Company requires additional time to complete the procedures relating to its quarter-end reporting process, including the completion of the Company’s financial statements. Therefore, the Company has been unable to file its Annual Report for the fiscal year ended December 31, 2021 and will be unable to file the Quarterly Report for the quarter ended March 31, 2022 by May 16, 2022, the prescribed filing due date for the Quarterly Report. The Company does not expect to file the Quarterly Report within the extension period provided under Rule 12b-25 under the Securities Exchange Act of 1934, as amended.

Source: SEC filing [March 31, 2022]

Anticipating the risks of delisting, VTSI’s Board of Directors appointed John Givens as Co-Chief Executive Officer on May 2, 2022 (he’s been a member of the board of directors for VirTra since November 2020). According to GlobeNewswire, John not only has a successful track record in operations but also as an entrepreneur who managed to create a company that had achieved many times the capitalization of VirTra:

In 2010, he founded the U.S. company of Bohemia Interactive Simulations (BISim), and during his tenure as president of the company, he led the business to becoming one of the most widely deployed simulation products throughout all branches of the U.S. and allied military forces, culminating in the 2022 purchase of BISim by BAE Systems plc for $200 million.

He has received numerous awards and honors throughout his career, including the simulation industry’s “Pioneer Award” for outstanding contributions and innovations to the training and effectiveness of U.S. and overseas soldiers, sailors, and airmen. He also serves as the Co-Chair on the National Center for Simulation (NCS) board of directors, an association of defense companies, government, academic, and modeling and simulations industry members. Givens graduated with a Bachelor of Science degree in Computer Science from Florida Institute of Technology and proudly served in the United States Army.

Source: From GlobeNewswire

The company was required to file both its 2021 annual report and its 10-Q (for Q1 2022) by August 12 in order for its shares to remain listed on NASDAQ. Thanks to the new co-CEO, VTSI managed to do this in time, and now we have the opportunity to look at the results of management’s work.

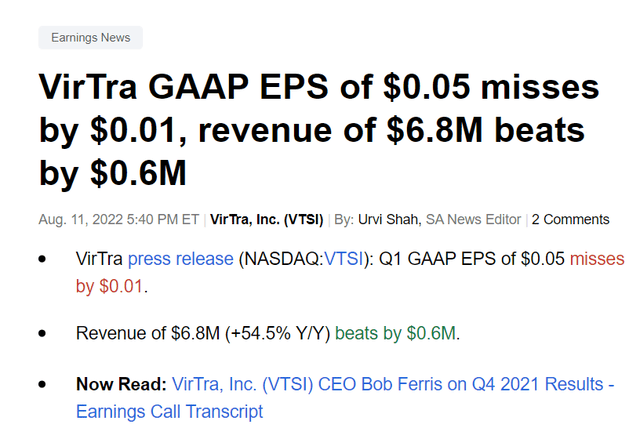

Unfortunately, the company’s results for the first quarter fell short of analysts’ expectations:

Q1 2022 total revenue was up 52% (YoY), but due to faster COGS growth (+64% YoY) and an increase in other expenses, VirTra reported a 12% decline in net income, which, against the backdrop of an increase in the number of shares outstanding (+38.47% YoY), resulted in low EPS that disappointed the Street.

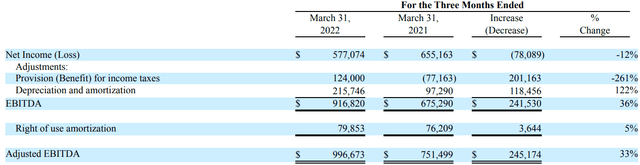

But in general, the company’s results were not deplorable, considering such a long pause in reporting. VirTra still managed to grow operationally in the first quarter of 2022, posting a 33% year-over-year increase in adjusted EBITDA:

Compared to last year, the company received 13.51% fewer bookings in Q1 2022, but the backlog grew by 30.43% over the same period, which I think is quite good.

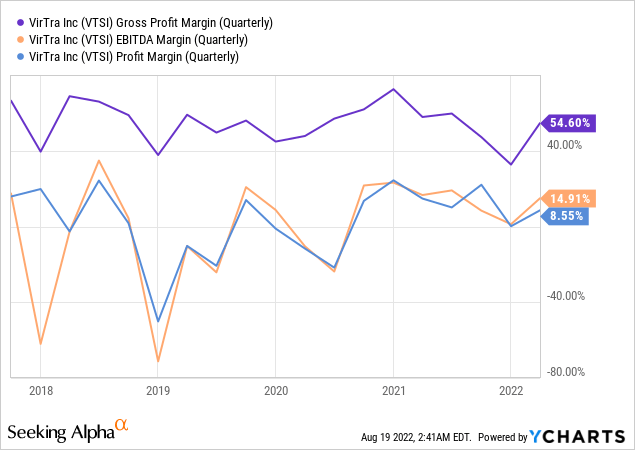

As CEO Bob Ferris said at the latest earnings call, gross profit margins for Q4 2021 and subsequently for the entire FY2021, were below historical averages as the company pursued a strategically important military contract. Based on the Q1 2022 results, we can see that this was really a short-term pain – now the gross margin has returned to its average, dragging the other margins along with it, despite the faster-growing costs mentioned above.

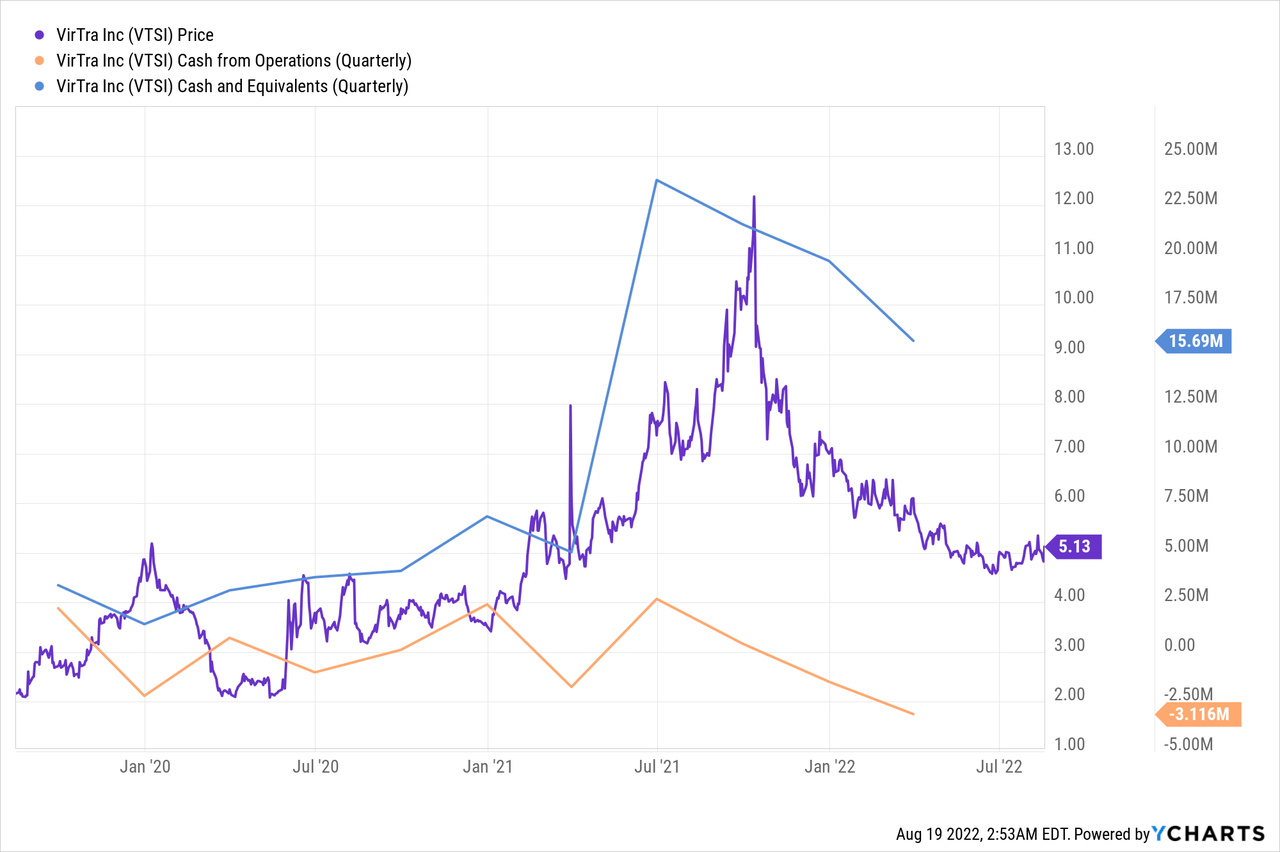

In terms of cash generation, VirTra still has some work to do here – cash outflow almost doubled to $3.116 million in Q1 2022. However, thanks to the additional share issuance, the company still has a lot of cash on the balance sheet, so I do not expect further equity dilution.

If you look at the structure of the cash flow statement, you can see that the outflow came from a large increase in working capital. John Givens, the newly appointed co-CEO, attributed the record inventory levels to a desire for a steady supply of products.

In many ways, the Q4 2021 and Q2 2022 reports contained a large number of one-time items that disappointed investors somewhat. But that’s what one-off items are for – as the business develops, they usually disappear.

I am optimistic about the continued expansion of the company’s backlog – one of the key catalysts for this is likely to be the development of the Orlando operations. In this regard, the new co-CEO has rich experience and connections in the market, where he believes there is not yet such a high-quality simulator the company is ready to deliver:

So I’ve been in the Orlando market for multiple decades. And the reason why you have to have presence there is that is the acquisition epicenter of the planet for the military, all branches. So it’s the visibility. So we recently actually opened up an office, where we’ll be placing simulators there so that all those acquisition officers and everybody that’s buying anything in the simulation environment comes to Orlando, they’ll come into our office, and be able to look at review and actually get their hands on our products, the technology that VirTra has today, some of it is as the industry has, but much of it is what the industry doesn’t have. So the only group that has really benefited from this technology and the innovative items that have been put together is the law enforcement. And this is what’s going to drive that what I might call it’s just an untapped market for this type of quality product.

Source: John Givens (Co-CEO), latest earnings call

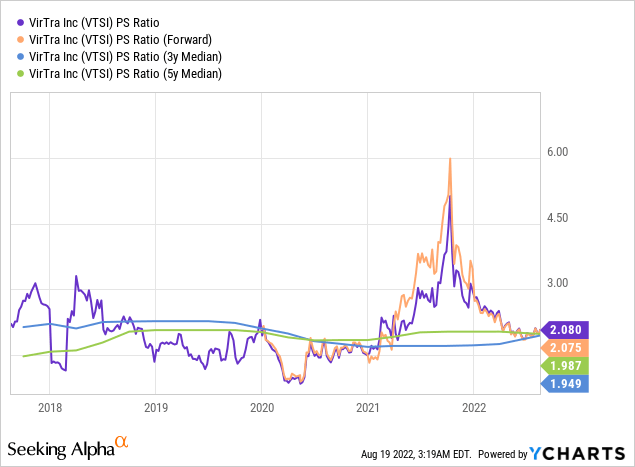

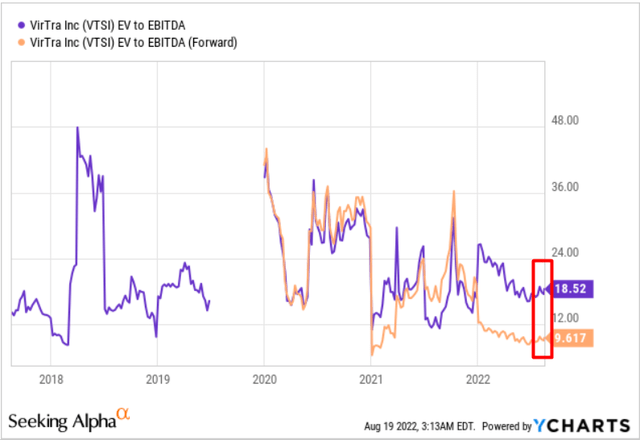

Due to the temporary difficulties the company experienced last year and early this year, as well as general market conditions, VTSI’s forward multiples differed from TTM (trailing twelve months) – what we haven’t seen before:

However, it is worth noting that this trend is not observed in all valuation multiples. For example, the price-to-sales multiples on both a forward and TTM basis are slightly above the median values of the last 3 and 5 years, meaning that the company is fairly valued at the current price level.

However, these multiples could shrink sharply as the company’s margins continue to improve and one-time items gradually disappear from the books. The Orlando expansion could also provide a significant tailwind to multiples as it supports booming sales and bookings/backlog. Therefore, I reiterate my early buy recommendation and recommend starting accumulating VTSI stock at current levels.

Risks and Takeaway

As the U.S. economy slips into recession (which I believe is not far off), nano-cap stocks like VTSI will likely face increasing selling pressure from retail investors (and not only). All potential dip buyers should be aware that companies with such a small market capitalization come with higher risks, and it is always worth doing your own due diligence before buying.

As for the company itself, I see the risks of a protracted operational recovery that could continue to put pressure on financials and prevent VTSI stock from growing in the medium term.

Despite the risks, however, the potential rewards seem to me to be asymmetrically higher – the new co-CEO, with his experience, has most likely taken some important steps to ensure that the company will be able to publish its reports regularly and continue to grow organically acquiring new markets like the one in Orlando.

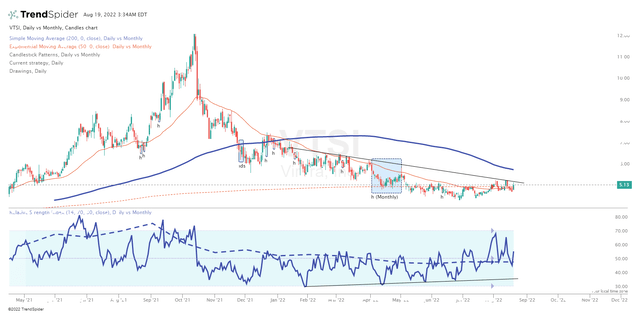

Technical analysis is not my specialty, but for the sake of variety, I would like to show you how I see the technical picture in the case of VTSI:

The quotes show a downward movement with a slowdown, while the RSI indicator is in a divergence, which could indicate a possible reversal of the current trend. The price has recently started to test the 50-day exponential moving average and is trying to recover toward the regular 200-day moving average, which seems to be a bullish sign against the backdrop of the divergence.

Another signal of reversal is the Hummer pattern formed on the monthly timeframe – the software’s multi-timeframe analysis allows you to see it on the daily chart. Following this pattern, we have seen the stock start to form a local bottom.

The results of my technical analysis suggest that the immediate target in case of a successful report (for Q2 2022) is ~$6.2-6.4 (the intersection of the Volume by Price and 200-day MA in the chart above), which is about 21-25% above yesterday’s closing price. Forward multiples do not argue against these results. So I believe VirTra remains an interesting niche player in the defense industry with good growth potential.

Feel free to share your opinion on VirTra stock in the comments section below!

Final note: Hey, on September 27, we’ll be launching a marketplace service at Seeking Alpha called Beyond the Wall Investing, where we will be tracking and analyzing the latest bank reports to identify hidden opportunities early! All early subscribers will receive a special lifetime legacy price offer. So follow and stay tuned!

Author’s note: Special thanks to fellow SA contributor Danil Sereda (see our association in my bio description) for running the TrendSpider software to obtain the above information.

Be the first to comment