da-kuk

Since launching XPOVIO, Karyopharm (NASDAQ:KPTI) has continued to execute their growth strategy, which has led to a significant increase in total revenues, net product revenue growth, licensing revenue, and milestone revenue. The company is attempting to maximize XPOVIO’s growth in multiple myeloma while ensuring their clinical pipeline will ultimately contribute to the growth narrative in the future. Despite the company’s recent performance, the market continues to overlook KPTI’s growth and has focused on the endometrial cancer setback. I am looking to take advantage of this opportunity and will add to my dormant KPTI position during this indiscriminate market-wide sell-off.

I intend to review Karyopharm’s recent performance and will highlight the company’s long-term growth prospects. In addition, I point out some notable downside risks that investors should be aware of. Finally, I discuss my plans for my dormant KPTI as we finish 2022.

Recent Performance and Disconnect

Thus far, Karyopharm’s commercial performance has been respectable with the company reporting solid double-digit and triple-digit growth over the past few years.

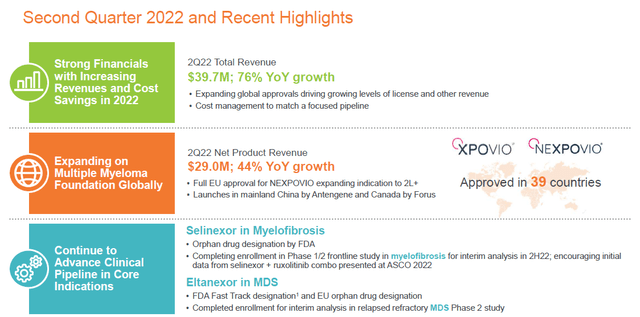

In Q2 Karyopharm grew total revenues to $39.7M up from $22.6M in Q2 of 2021. Karyopharm pulled in $10.7M from license and milestone revenue, which comprises of $6.5M from the Menarini Group and $1.5M from FORUS Therapeutics. XPOVIO delivered strong year-over-year growth in the U.S. during Q2 achieving $29M in net product revenue compared to $20.2M in Q2 of last year, representing 44% growth year-over-year.

KPTI Q2 Highlights (Karyopharm)

This growth is not just a one-off event… in fact, the company has been reporting significant revenue growth since launching XPOVIO.

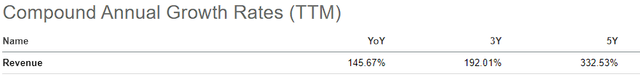

Revenue Compound Annual Growth Rates (Seeking Alpha)

Indeed, one must expect a company to report exponential growth in the first few years of a commercial launch of a drug. However, the market has not respected this growth with KPTI’s share price barely trading in the green over the past 12 months.

Growth Prospects

Karyopharm has several opportunities to unlock considerable additional growth. First, Karyopharm is building upon their current multiple myeloma franchise by penetrating earlier lines of therapy. Karyopharm reported “a positive shift in perception of XPOVIO in the second to fourth line per the intent to prescribe data” as more than 90% of patients are starting the lower dose once weekly exposure-based triplet regimen. Moreover, Karyopharm continues to see growth in the community setting with penetration from 64% in Q1 to 67% in Q2 in the top 20% of myeloma accounts. This is significant considering that roughly 80% of myeloma patient volume in the U.S comes from the top 20% of prescribers. So, it looks as if XPOVIO still has some growth to extract from the myeloma market.

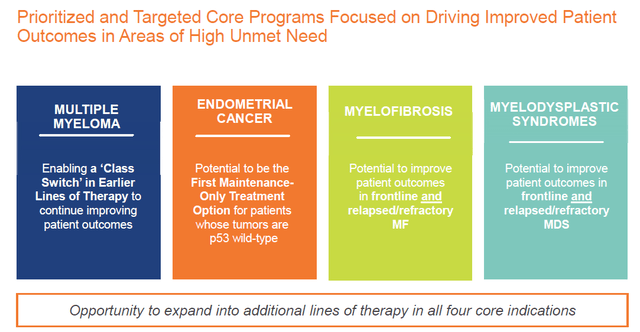

Karyopharm Revenue Estimates (Seeking Alpha)

In fact, Karyopharm updated their XPOVIO net revenue guidance to $120M to $130M signifying 27% year-over-year growth at the midpoint.

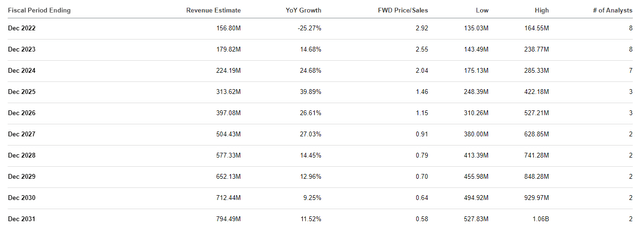

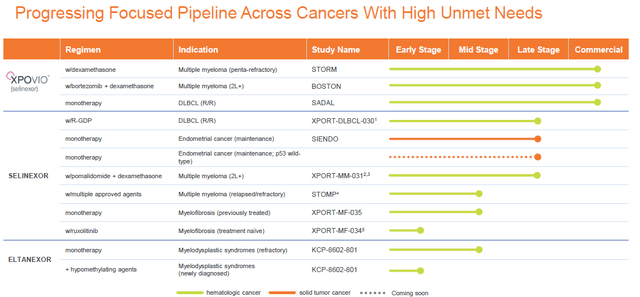

In addition to XPOVIO in multiple myeloma, Karyopharm’s clinical pipeline contains several mid and late-stage programs including endometrial cancer, myelofibrosis, and myelodysplastic syndromes.

Karyopharm’s Core Programs (Karyopharm)

Together, Karyopharm believes these programs have the prospects to obtain several approvals over the next four years that can dramatically expand their markets.

Karyopharm Pipeline (Karyopharm)

Karyopharm also has several partners that are expected to provide steady licensing and milestone revenue streams in the coming years. At this time, Selinexor is now approved in 39 countries, through their partners, Antengene, FORUS, and Menarini. XPOVIO recently received full approval in the EU, so we should see some growth in partnership revenues.

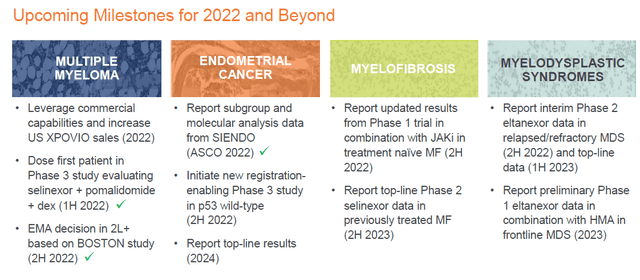

Looking ahead, the company has highlighted some milestones that should give us some insight into the company’s long-term growth potential.

Karyopharm Upcoming Milestones (Karyopharm)

I would circle the interim Phase II data (2H of 2022) from eltanexor in relapsed/refractory MDS and the top-line data readout (1H of 2023) to be some of the most important near-term catalysts. After that, I am looking at the top-line results from silenexor’s Phase III trial in endometrial cancer expected in 2024. If the company gets selinexor back on track for endometrial cancer, we could see Karyopharm take advantage of the unclaimed maintenance therapy for the p-53 wild-type population, which is about 50% of all endometrial cancer patients. If approved these programs should deliver substantial revenue in the coming years.

So, the company’s flagship product has plenty of room to grow, as well as their partnership revenue, and potential growth from pipeline programs. If all goes well, Karyopharm has the ingredients to hit the projected double-digit growth for the remainder of the decade.

Downside Risks

Despite my bullish outlook for KPTI, the company has a few risks that could hurt its growth narrative. First, Karyopharm has legitimate competition in the late-line setting with new T-cell engaging therapies, immunotherapies, and cell therapies. Admittedly, most of these therapies are being performed at academic centers, which is not XPOVIO’s primary target. Still, these cutting-edge therapies could continue to claim more of the multiple myeloma market with new approvals and expanded use. Second, the company could fail to expand selinexor’s label into endometrial cancer and other solid tumors, which will have a dramatic impact on the company’s long-term growth outlook. Third is funding… luckily, Karyopharm is “well-funded into early 2024,” which allows them to unlock some additional growth from XPOVIO before they need to fundraise. However, we don’t know how XPOVIO will perform in the coming quarters, and we don’t know how the upcoming data readouts will be received. As a result, we could see more downside, which could force the company to raise at a lower valuation.

Considering these points, I still have KPTI in the Compounding Healthcare “Bio Boom” speculative portfolio with a 3 out of 5 conviction rating.

My Plan

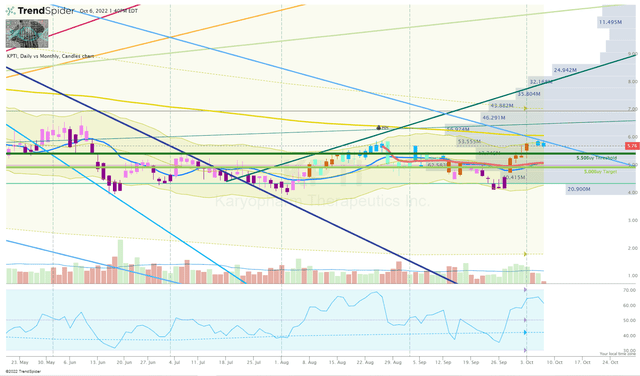

As I mentioned in my introduction, my KPTI position has been dormant since August, but I am moving the ticker up on my priority list as we move closer to year-end. I believe Karyopharm should be able to maintain its commercial momentum and potentially accelerate growth in the coming years as they get more programs through the FDA. This potential could be revealed with some of these key near-term catalysts and milestones, so I cannot bet the share price will continue to trade near my buy targets.

KPTI Daily Chart (Trendspider)

Therefore, I am going to place a number of buy orders at key technical levels around my Buy Targets. Once those orders are filled, I will immediately set equivalent sell orders at my Sell Targets, in order to get the position back into a “House Money” state.

Long term, I am committed to holding a respectable position in KPTI in anticipation the company can maximize XPOVIO and/or be acquired at a premium valuation.

Be the first to comment