Editor’s note: Seeking Alpha is proud to welcome The Value Corner as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

South_agency/E+ via Getty Images

Anheuser-Busch InBev (BUD) is currently trading at share prices equivalent to those last experienced back in the early 2010s. The company has grown significantly since then, while continuing to increase its profitability and cash flow generation abilities through diligent debt management and unrivaled business economics. Therefore, I believe the time is right to enter into a position on AB InBev, taking advantage of a great company at an unbeatable price.

Industry Background

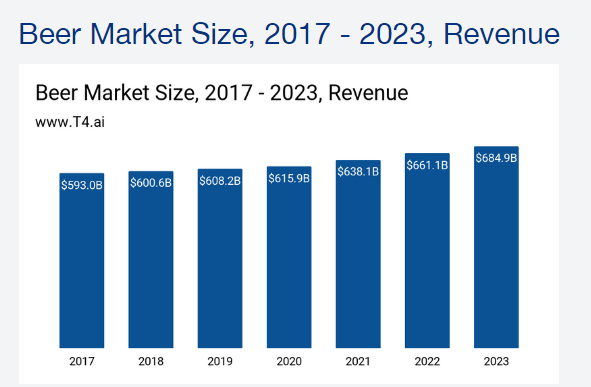

The global beer industry currently consumes 2 billion hectoliters (HL) of beer a year compared to only 1.3 billion in 1998. To put this figure into context, across all forms of beverages, beer consumption is only outperformed by a single drink: water. Currently the industry is worth over $640B globally, with expectations for the beer market to reach up to $750B in 2027.

However, the growing competition from non-beer alternatives such as wines, hard seltzers, and spirits is a crucial factor to consider when analyzing a brewery. Therefore, it is critical for breweries to continue differentiating their beer products in a saturated alcoholic drinks environment to ensure they maintain the levels of sales volumes and revenues to remain competitive.

T4 Strategy and Advisory

The onset of the COIVD-19 pandemic led to a significant shift in the way in which beer is consumed. While pre-pandemic approximately 34% of beer consumption was “on-trade” – i.e., beer was being enjoyed by consumers within establishments such as bars and restaurants – post-pandemic the numbers are believed to be around 26% on-trade and 74% off-trade, or at home.

While global pandemic restrictions have significantly eased, the resulting return to pre-pandemic consumer habits now presents a reversal of the issues breweries faced when adjusting their production networks back in 2020. This has led to increased production costs, particularly affecting the transportation and packing of finished cans and bottles.

Company Background

BUD is a multinational brewery based in Leuven, Belgium. Operating across 150 countries and selling over 500 brands of beer, AB InBev is the largest brewing company in the world. The company has been formed through a conglomeration of mergers culminating in 2016 to form the beer giant we now know today as Anheuser-Busch InBev SA/NV.

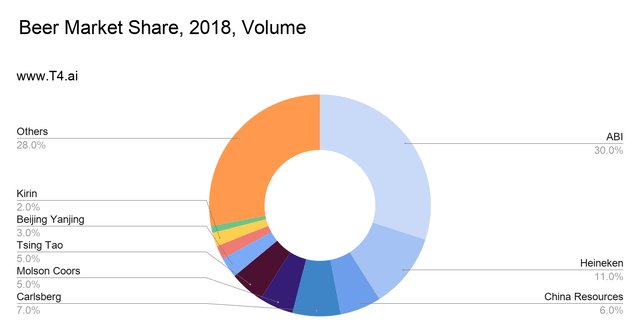

AB InBev currently controls 30% of the total market share for beer, having brewed 582 million HL in 2021. This is significantly larger than its nearest competitor Heineken NV (OTCQX:HEINY), which only enjoys 11% global market share, brewing 221 million HL.

The primary strategy for AB InBev is to acquire smaller breweries in order to access the valuable intangible assets these companies own (i.e., their brands). Thereafter, AB InBev streamlines the production processes for these breweries in order to reduce production costs and bring their operating procedures in line with AB InBev standards, thus unlocking greater economies of scale. This allows for increased operating margins, increased total volumes of beer produced, and an increase in the total percentage of market share controlled.

While their acquisitions have slowed since their purchase of the South African brewer SAB Miller, this can largely be attributed to their desire to decrease their long-term debt in order to satisfy investor sentiments. Consequentially, this will allow AB InBev to ensure that future mergers and acquisitions remain possible for the firm. While this strategy has led them into what was a significantly disproportionate debt/equity ratio, AB InBev has been making strides since 2016 to reduce their debt overhead and has demonstrated that they can remain incredibly profitable while doing so.

Economic Moat

Analysts are often quick to assign the attribute “wide economic moat” to large firms. Such arguments are often made with reference to huge market capitalizations and short-term popularity. However, for once it is truly correct to say that AB InBev has the widest economic moat of any company not only in the beer industry, but on a consumer discretionary sector level, too.

The advantages AB InBev enjoys primarily come from their powerful cost advantage as well as their huge portfolio of beer brands.

Beverage Daily

From a cost perspective, AB InBev knows their business, and they know it well. The beer industry is incredibly scalable with regard to the production process. From the procurement of raw materials to the scale of brewing, and all the way down to distribution and packaging, AB InBev is able to negotiate with suppliers over larger quantities and later payables than their competitors.

In 2021, AB InBev had an average day’s payables of 266.34, while, for example, their nearest competitor Heineken only operates using 111 days. This difference illustrates the extent to which AB InBev pushes their suppliers in the pursuit of increased operating margins and thus improved operating cash flow. This is one of the key factors which allows AB InBev to achieve the lowest net PP&E/hectoliter ($27B/582M HL) production costs of just $45.84/HL.

Furthermore, AB InBev has a five-year average operating margin of 28.65%, while Heineken only manages 12.23% over the same five-year period. AB InBev operates 34% more efficiently in terms of operating margins compared to their nearest competitor.

AB InBev |

The other factor that makes AB InBev a truly wide-moat firm is the massive number of brands (and thus intangible asset value) that they own. To be precise, AB InBev sells over 500 brands globally. Furthermore, out of the top 10 most valuable beer brands, AB InBev owns six of them – including the top spot, Corona Extra.

This is reflected in the 21% proportional value of their intangible assets ($40,430m) when considering AB InBev’s non-current assets ($193,678m). The advantage with intangible assets such as brands is that they have an indefinite useful lifetime, with the primary decider of utility being how well AB InBev manages to maintain their image in the public eye. Considering that many of their brands have existed for a long time – such as Budweiser, which dates back to 1876, or even Hoegaarden, which dates all the way back to 1445 – it’s clear that AB InBev understands how to keep a brand alive.

AB InBev |

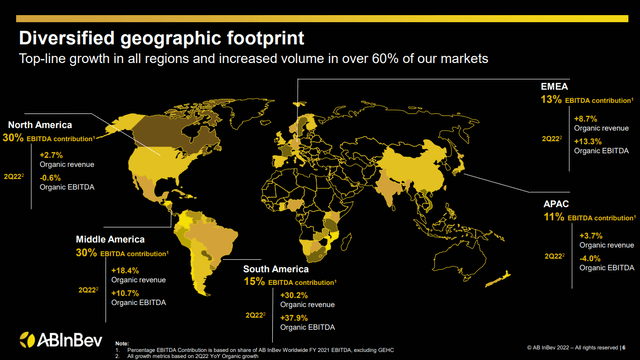

Furthermore, AB InBev has decided to engage in the production of hard seltzers and is continuously expanding their “Beyond Beer” portfolio in an effort to capitalize on the latest alcoholic beverage trends. While their volumes of beer sales have decreased in the North American market (-3.4%), the huge growth in other regions (+5.9% in Middle Americas and EMEA, and +6.6% in South America) easily offsets this.

AB InBev are in the middle of a strategic rebalancing of their North American product portfolio, not only to take advantage of the aforementioned “Beyond Beer” categories, but also to significantly increase the premium nature of their offerings. They are achieving this by pushing brands such as Stella Artois at the expense of Budweiser sales. Due to the higher price of these offerings, the slightly decreasing North American volumes are not entirely surprising.

Financials Analysis – H1 2022

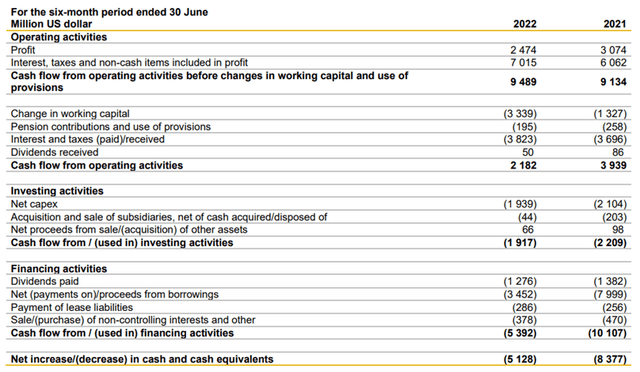

The cash flow statement allows us to analyze the profitability powerhouse that is AB InBev. In the first half of 2022 (ended June 30), AB InBev posted an operating cashflow (before changes in working capital and provisions) of $9.49B, up 3.9% from the same period in 2021. Once adjusted for taxes, payables and provisions this figure amounts to approximately $6B.

After subtracting the current capital expenditure on PP&E (about $2B), this would suggest AB InBev operated the first half of 2022, achieving a free cash flow of $4B. Considering that they chose to reinvest a majority of this ($3.34B) back into their working capital, I believe it would not be unrealistic to expect shareholders to reap the rewards in the coming years.

Furthermore, the sheer magnitude of the FCF generated illustrates the efficiency and aforementioned low tangible capital costs/hectoliter brewed, highlighting the extent to which AB InBev has managed to streamline their operations.

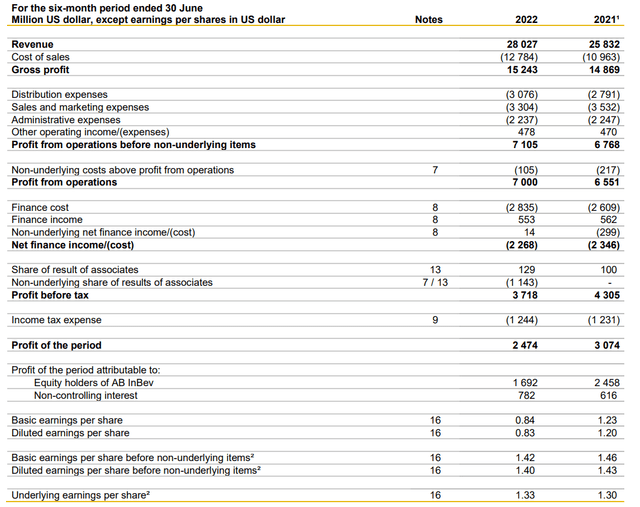

Considering the income statement, in the first half of 2022 AB InBev posted revenues of $28B. This represents an 8.5% increase in compared to the same period in 2021. Furthermore, their operating profit increased 5% up to $7.1B.

Unfortunately, however, their gross profit only increased 2.5% to $15.2B. This was, according to AB InBev, due to a significant 10% increase in the price of cans and transportation. This culminated in an almost 15% increase in the cost of sales, which is the root cause for the rather weak growth in gross profits.

While initially surprising, the $1.41B cost in non-underlying shares of results of associates was due to AB InBev bearing an impairment charge. This was due to them forfeiting all financial benefits from their Turkish subsidiary Efes, as a result of Efes’ operations in Russia during the current escalations in the Russian-Ukrainian war. This is the primary reason profit before tax was reduced to only $3.71B, a decrease of 14% compared to the first half of 2021. Of course, this naturally led to a decrease down to $0.84 EPS compared to $1.23 the previous year. Interestingly, AB InBev has been kind enough to include the underlying earnings per share not including the $1.4B impairment due to Efes, which actually shows an increase from $1.3 in 2021 to $1.33 in 2022.

The Bitter Hops – Debt

Finally, we must consider the debt situation at AB InBev. In truth, this might singlehandedly be the biggest reason investors have remained so bearish with the stock, despite the strong industry performance and monster cash flows.

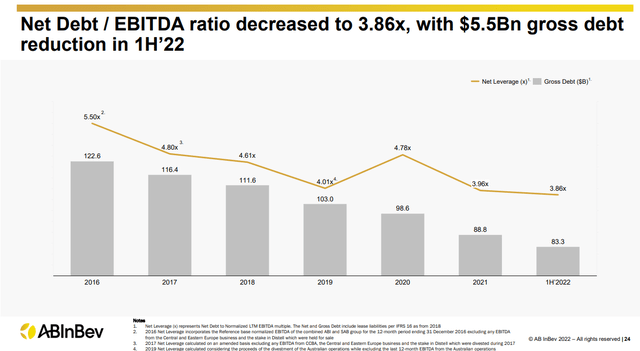

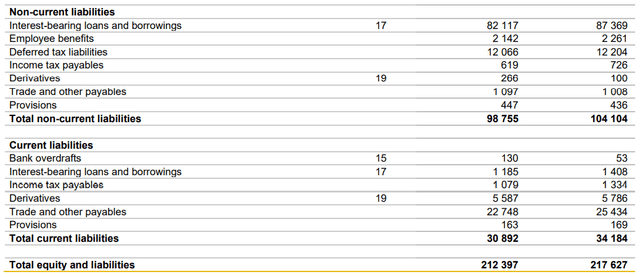

In total, AB InBev has $82B in long-term debt (interest-bearing loans and borrowings) with short-term liabilities mounting to $1.2B. After considering the $7B AB InBev has in cash and cash equivalents, their current net debt position is approximately $76B. It’s worth already noting that (as illustrated below) AB InBev has continuously been reducing their levels of net debt down from a staggering $122.6B in 2016, while simultaneously reducing their net leverage down to much more acceptable levels of around 3%-4%.

While even their cash generating prowess cannot sooth the truly huge pile of debt AB InBev has acquired (primarily since the acquisition of SAB Miller in 2016), there luckily is one key factor which can redeem them: their exemplary debt management strategy. Between 2022 and 2025, AB InBev only sees $3.2B of their debt maturing. Furthermore, the average weighted maturity is only 16 years. This will give AB InBev some invaluable breathing time to refinance their positions and strengthen the sentiment among investors as we approach the end of the decade.

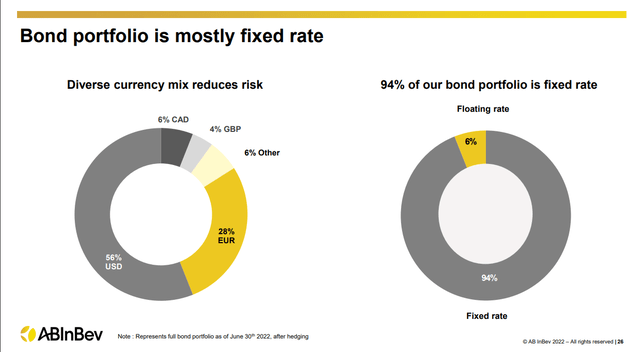

Another example of truly robust risk management is that AB InBev has 94% of their debt bond portfolio on fixed rates. This means that from a debt perspective, the significantly steepening interest rate market should have little to no effect on their financing expenses. When this strategic financial management is combined with a continuously decreasing gross debt, the growth outlook for future free cash flow looks to be very positive indeed.

Valuation

AB InBev is currently trading at a P/B value of 1.35, with a forward P/E of just 15.94. That compares to its five-year average FWD P/E of 21.64 and price/book of 1.96. From these simple metrics, it is my opinion that the current share price fails to reflect the true intrinsic value of this company. However, let’s back this thinking up by examining the change in overall value of AB InBev over the past 10 years.

Let’s start with simply addressing the historical share price of AB InBev. Currently trading around the $47 mark (as of Oct. 6, 2022), shares have not been this cheap since the late 2010s. This raises the question: What form was the company in back then compared to now? Well, for starters, back in 2012 the company had gross profits of just $23B compared to the $31.2B realized in 2021.

Cash flow from operating activities has equally increased from $13B in 2012 to $14.8B in 2021. These significant increases in operating profits and cash flows illustrate that the company has progressed financially into a stronger and even more efficient money-making machine.

Another great metric for addressing the change in scale of the company in the past 10 years is to consider their intangible assets. Back in 2012, their total gross goodwill and other intangible assets amounted to $77B, while in 2021 this has grown to a behemoth $160B. This reflects the acquisition of SAB Miller in 2016 and illustrates how much more brand power the company has now as compared to the 10 years prior. Finally, it’s worth noting the growth in the number of hectoliters of beer being brewed. In 2012, Anheuser-Busch brewed 403 million HL, while in 2021 this figure was 582 million HL.

Simply put, the company now is in an entirely different league with regards to scale and profitability than it was in 2012. Considering the share price now reflects those last seen in 2010, I think it is fair to say an undervaluation exists in the market for BUD shares.

Summary

It’s clear that AB InBev is beginning to see the light at the end of their debt-ridden tunnel. While their net debt remains high, the cash flow generating abilities of the company – combined with significant working capital investments – suggest the firm is ready to bounce back into favor.

While the current inflationary marketplace is not particularly welcome news with regard to the cost of sales, the significant number of unique events that have impacted AB InBev’s profitability seem to be mostly in the past. Therefore, I will be expanding my current position in AB InBev as the current share price is simply too low to ignore.

Be the first to comment