JLGutierrez

Hawkish rhetoric weighed heavily on the major market averages yesterday in front of today’s jobs report. Several Fed officials talked tough about the ongoing fight against inflation with Neel Kashkari emphasizing that rates need to go up a lot more, while Raphael Bostic asserted that the fight has just begun. The only data point that lags these comment by a greater amount is the rate of inflation itself. Investors should focus on what the Fed does and not what its officials say it will do. Look no further than the Fed’s outlook for interest rates and inflation one year ago to prove my point. In other words, it saw a continuation of near-zero interest rates and no inflation at all.

Finviz

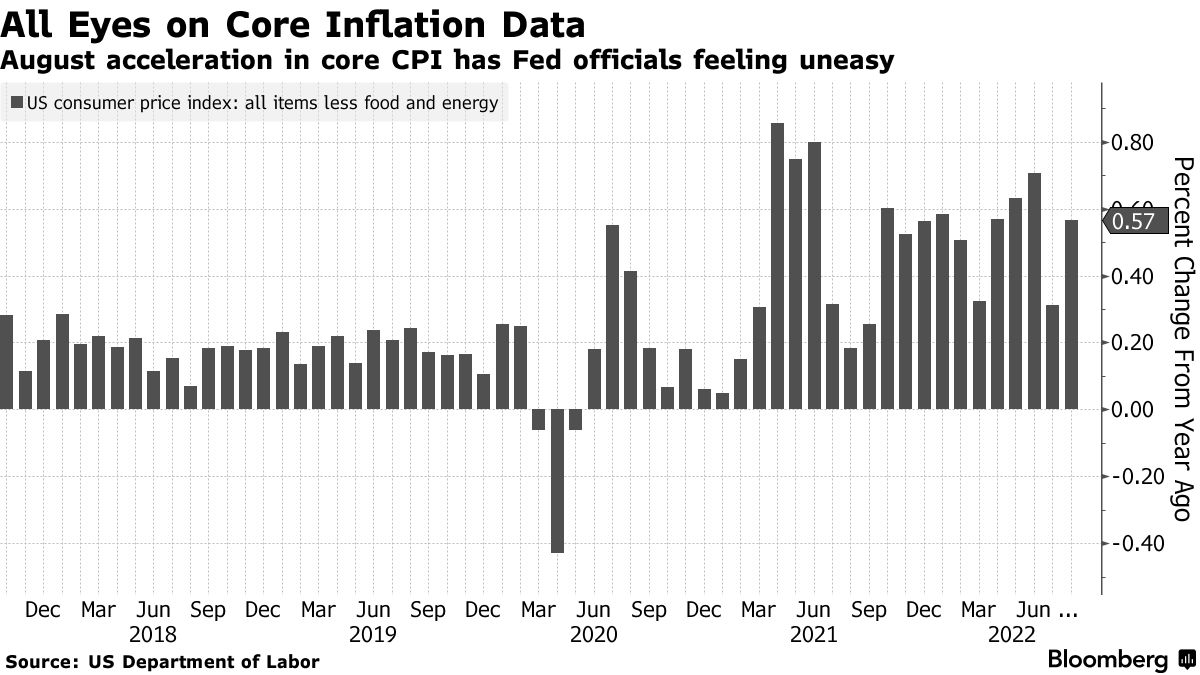

Minneapolis Fed President Neel Kashkari said “until I see some evidence that underlying inflation has solidly peaked and is hopefully headed back down, I’m not ready to declare a pause.” The pause he speaks of is halting the increase in short-term interest rates that is tightening financial conditions. The problem with this statement is that the rate of inflation moves with a significant lag, while monetary policy works with an equally long lead time. This is why it is nonsensical to talk about what policy will be in the future based on what inflation has been over the past 12 months.

Bloomberg

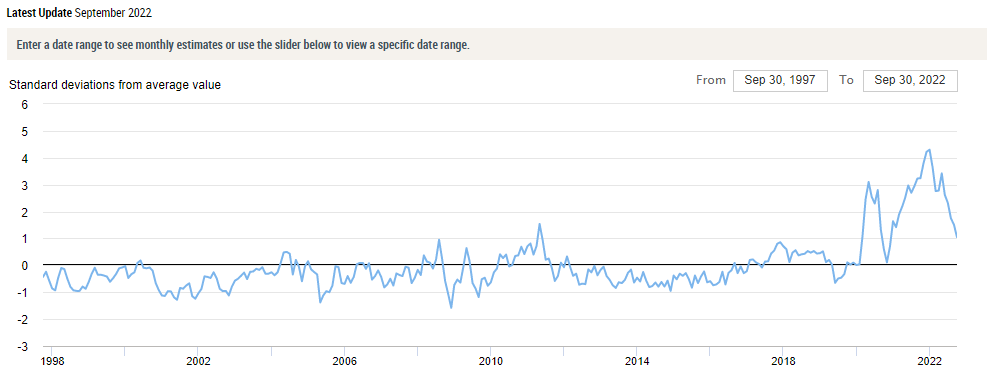

I think the Fed’s tough talk is designed to manage inflation expectations, which remain on target, and contain any enthusiasm for risk assets that could bolster the wealth effect. That goal has been accomplished. As for what inflation will look like a year from now, I continue to focus on leading indicators like the New York Fed’s Global Supply Chain Pressure Index (GSCPI), which eased for a fifth consecutive month in September to levels that are closing in on the historical average.

New York Fed

This indicator peaked in December 2021, while the rate of inflation did not peak until June 2022 at 9.1%, which was six months later. Therefore, the plunge in the GSCPI over the past six months tells us that the rate of inflation will follow over the coming six months. These are the types of indicators that investors should be focusing on to predict where inflation will be 6-12 months from now. They tell me that Fed policy is already sufficiently restrictive to bring the rate of inflation down to the Fed’s target.

Stocks are reeling today on news that the economy created another 264,000 jobs, while the unemployment rate fell from 3.7% to 3.5%. The consensus sees that encouraging the Fed to raise interest rates higher and for longer, but the unemployment rate is another lagging indicator. It fell because of a decline in labor participation. What was encouraging is that the annualized increase in wages fell another tenth of a percent to 5%. That is more important than the unemployment rate in terms inflationary indicators.

Seeking Alpha

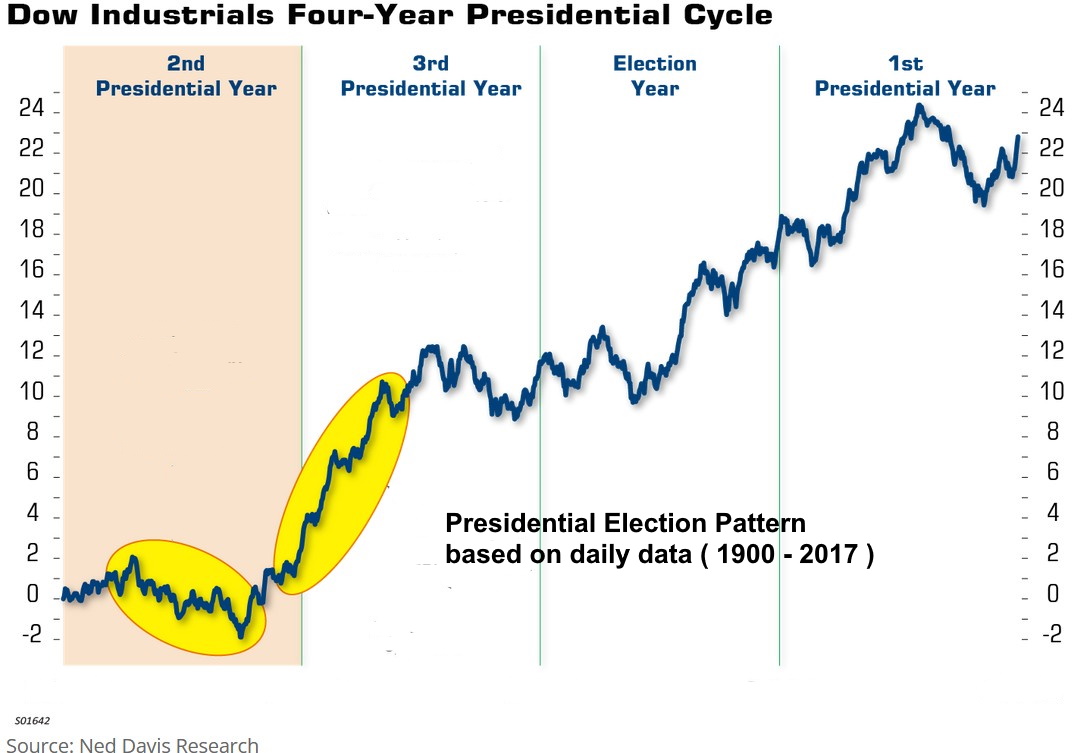

When we combine the peak Fed funds rate, which I expect to see before the end of this year, with the presidential cycle, we have a powerful tailwind for the stock market. This sets an extremely bullish precedent for 2023, as the rate of inflation falls, and the U.S. economy fulfills my expectations for a soft landing.

Ned Davis

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment