Justin Sullivan

Thesis

On October 6th, Advanced Micro Devices, Inc. (NASDAQ:AMD) announced preliminary third quarter results and disappointed the market with a weak performance. But honestly, at this point who has not expected it? After a disastrous Q2 for Intel (INTC), almost all leading chip developers including Micron (MU), Nvidia (NVDA) and Samsung (OTCPK:SSNLF) have warned that Q3 results will miss expectations. Of course now there is a profit warning also for Advanced Micro Devices.

Following the announcement, AMD shares are down approximately 5% (extended trading hours reference). And the company’s valuation is slowly approaching an attractive risk/reward set-up. But for now, I advise to “HOLD.”

For reference, AMD shares are down almost 55% YTD, versus a loss of “only” 22% for the S&P 500 (SPX).

AMD’s preliminary Q3 Results

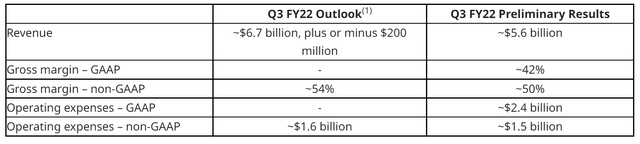

Advanced Micro Devices, which is expected to announce official Q3 2022 results on November 1st, released preliminary results that the company will likely miss earnings estimates as compared to the company’s prior guidance (Q2 guidance). The company estimates that Q3 revenues will likely fall around $5.6 billion, which is $1.1 billion lower than what the company estimated only 3 months ago. Moreover, AMD’s profitability has materially contracted, as the company expects gross profit margin to fall by about 4 percentage points to 50%.

The press release highlighted multiple reasons for the profit warning, including “lower revenue driven by lower Client processor unit shipments” as well as the realization of a “lower average selling price.” AMD also commented on operating expenses, which have negatively been influenced by approximately $160 million of inventory related and pricing related charges.

AMD’s Chief Executive Officer Dr. Lisa Su commented (emphasis added):

The PC market weakened significantly in the quarter … While our product portfolio remains very strong, macroeconomic conditions drove lower than expected PC demand and a significant inventory correction across the PC supply chain.

As we navigate the current market conditions, we are pleased with the performance of our Data Center, Embedded, and Gaming segments and the strength of our diversified business model and balance sheet. We remain focused on delivering our leadership product roadmap and look forward to launching our next-generation 5nm data center and graphics products later this quarter.

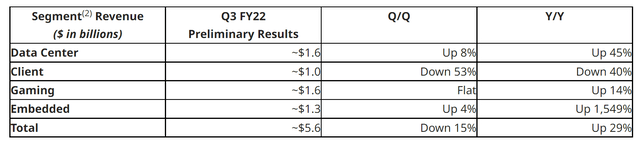

Notably, AMD’s client segment is expected to have lost about 40% of revenues year over year, and 53% quarter-over-quarter. However, the chip-developer’s other segments such as gaming, data centers and embedded solutions remained relatively resilient (see below).

Thoughts About The Semi Industry

Investors should consider that AMD’s preliminary Q3 results have been released in the context of a global slowdown for chip demand. Notably, after a disastrous Q2 performance from Intel, almost all major chip developers have highlighted challenges, including Micron and Nvidia. On Friday morning October 7th, even Samsung has issued a profit warning.

Accordingly, AMD’s results should not surprise the market. The fact that AMD shares are nevertheless down about 5% (pre-market reference) is in my opinion more a reflection of a mechanical selling response following a profit warning than a sincere repricing of new information.

In my opinion, the profit warning from AMD does not signal any notable danger — given that the demand slowdown appears much more industry-related than company-specific. Investors should note, however, how rapidly and aggressively the slowdown has materialized versus AMD managements’ Q3 guidance in July.

A Buying Opportunity?

AMD is slowly approaching a valuation that offers investors a reasonable risk / reward opportunity. As of October 7th, AMD is priced at a one year forward P/E of x16, a P/B of x1.9, and a P/S of x4.

I would like to point out, however, that most of AMD’s price multiples still imply a premium to the sector median valuation within the semiconductor sector, while AMD’s profitability and growth do not necessarily justify such a premium.

That said, I remain slightly cautious investing in AMD stock short-term — I don’t think there is a need to rush. But I acknowledge that, long term, AMD could be an attractive investment pick. Investors should consider that the structural tailwind for higher chip consumption remains strong — given trends in automotive, IoT connectivity, VR/AR and gaming. In fact, the global demand for semiconductors is expected to surpass $1 trillion by 2030, growing at a CAGR of about 10%. And there is little doubt that AMD will manage to capture a sizeable share of this opportunity.

Trade Recommendation – Selling Puts

There could be an interesting trade opportunity for investors who are comfortable trading options and seeking to accumulate AMD stock despite the ongoing weakness in the chip industry. Specifically, given the elevated volatility levels (61.2% implied volatility), investors could write January 20th dated $60 Strike PUTs and collect a $6 premium (about 10%, and 39.5% annualized). In my opinion, the premium that an investor receives from writing PUTs would either provide investors with a nice margin of safety if the stock is assigned, or generate an attractive return if the options expire worthless.

Be the first to comment