AsiaVision

Investment Summary

Following a period of rapid upside in August 2022, shares of Karuna Therapeutics, Inc. (NASDAQ:KRTX) have flatlined and failed to extend the rally.

Moreover, the company made a change to its leadership yesterday, appointing Bill Meury as the new CEO over [now former] chief executive Steve Paul M.D. Paul will now transition into the role of president of R&D and chief scientific officer (“CSO”). This presents a tangible risk in our opinion, and investors shouldn’t discount the fact that it may mean there isn’t an appropriate buyer for KRTX out there at present.

Net-net, we rate KRTX a hold. That’s not to say we don’t see upside in the stock – we’ve identified technical price targets to $264 – but from a risk evaluation and mitigation perspective, we’re happy to remain trigger heavy on the sidelines for now. Here, we’ll delve into the moving parts of the addressable market, and provide context on the company’s KarXT investigational compound.

KRTX CEO transition

The question we now ask is what the move means for KRTX’s prospects as an acquisition target from larger players in the space.

As you may or may now know, KRTX has been dubbed a prime M&A target from many on the sell-side [see here, and also here]. The reshuffling of executives begs the question if there is in fact a buyer out there.

What’s most relevant to investors in the KRTX investment debate is its KarXT formula, indicated in the treatment of psychiatric and neurological conditions, including schizophrenia, and psychosis in Alzheimer’s disease. We had been constructive on KRTX up until this point. However, with the latest developments, there’s risk that potential buyers aren’t even interested at this point.

This sentiment was echoed by Stifel’s Paul Matteis in a recent note. That analyst’s response was the “natural reaction that there must be no imminent buyer (why else would this happen now?).”

Alas, it will be telling on Meury’s next moves in pushing the company’s KarXT compound towards commercialization.

KarXT momentum still compounding

KRTX’s investigational KarXT formula is an orally–administered pharmacological treatment for patients suffering from schizophrenia and other psychotic disorders. KRTX believes the investigational compound has potential for efficacy in adjacent treatment markets of major depressive disorder and dyskinesia associated with Parkinson’s disease. In order to understand the market opportunity, we have to first explain the underlying fundamentals of the Schizophrenia treatment market.

Schizophrenia is a complex mental disorder characterized by a wide range of symptoms. Its precise etiology is unclear, but it is thought to involve a combination of genetic, psychological and environmental factors. The most widely accepted theory of the pathogenesis of schizophrenia is the neurodevelopmental model. This model suggests that schizophrenia is caused by a disruption of normal brain development early on in life.

Moving to KarXT, it is composed of a unique combination of two active ingredients:

- Xanomeline, and

- Trospium.

Xanomeline is a muscarinic M1/M4 receptor agonist that works to reduce psychotic symptoms. Trospium is an antimuscarinic agent that may help reduce side effects associated with xanomeline.

Brannan and colleagues (2021) investigated the compound in the New England Journal of medicine, finding a benefit over placebo in treating schizophrenia. A separate exploratory analysis by KRTX in 2021 illustrated its trend towards improving cognition.

The pharmacokinetics of KarXT have also been studied in a number of clinical trials. Xanomeline has a rapid absorption rate and is rapidly distributed throughout the body, with peak concentrations being achieved in the plasma within 1 hour of administration. The volume of distribution for xanomeline is reported to be 0.9–1.0 L/kg, and the oral bioavailability is reported to be 25%. Xanomeline is extensively metabolized and is mainly excreted via urine. The half–life of xanomeline is reported to be 2.4 hours.

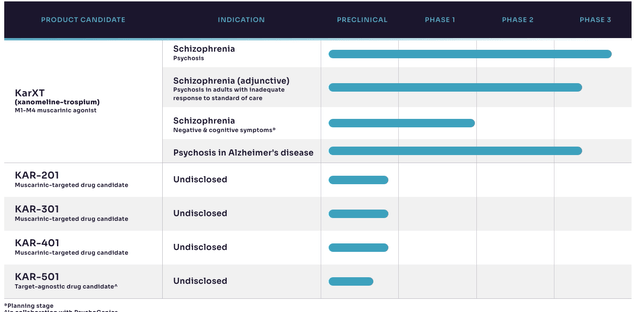

Meanwhile, Trospium has a rapid absorption rate and is distributed throughout the body with peak concentrations being achieved in the plasma within 1–2 hours of administration. The volume of distribution for trospium is said to be 2.5–5.5 L/kg and the oral bioavailability is reported to be 60–90%. Trospium is extensively metabolized and is mainly excreted via urine. The half–life of trospium is reported to be 8–11 hours. KRTX’s full pipeline is observed in Exhibit 1.

Exhibit 1. KRTX development pipeline

Image: Karuna Therapeutics website, see “Pipeline”.

Turning to the economics of the global schizophrenia treatment market, our analysis found that it is expected to grow at a healthy rate in the upcoming years. It was valued at $7.16Bn in 2021 and is anticipated to reach $12.53Bn by 2031, a CAGR of 5.1%.

The growing prevalence of mental health disorders such as schizophrenia, bipolar disorder, and depression, and the launch of novel medications, are the key growth drivers of the schizophrenia treatment market. Additionally, the growing awareness regarding mental health disorders and the associated treatments, rising availability of funds for research, and increasing acceptance of generic drugs are further creating opportunities for the market growth.

Moreover, the increasing number of government initiatives for mental health awareness, the launch of new treatment guidelines, and the increasing investment in research and development activities are also contributing to the growth of the schizophrenia treatment market.

For instance, the National Institute of Mental Health (NIMH) and the National Alliance on Mental Illness (NAMI) have been involved in various initiatives such as the “Know the Signs” campaign to raise awareness about mental health disorders. Additionally, the growing inclination towards generic medications and the high cost associated with branded drugs are also influencing the growth of the schizophrenia treatment market.

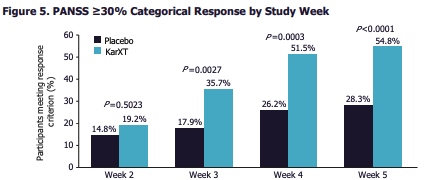

KRTX presented the safety and efficacy data of KarXT from the recent Phase 3 EMERGENT-2 clinical trial at the American College of Psychopharmacology’s (“ACNP”) annual meeting held on December 4-7th. Categorical response data from the trial is noted in Exhibit 2.

Exhibit 2. Categorical response data from KRTX’s EMERGENT-2 clinical trial [from ACNP AGM, December 2022]

Note: See “Figure 5. PANSS≥30% Categorical Response by Study Week” (Data: Safety and Efficacy of KarXT (Xanomeline-Trospium) in Patients With Schizophrenia: Results From a Phase 3, Randomized, Double-blind, Placebo-controlled Trial (EMERGENT-2) American College of Psychopharmacology (ACNP) Annual Meeting; 2022 December 4-7. Retrieved from KRXT website. )

Hence, we agree with other Seeking Alpha authors that there is plenty of promise in KarXT formula. However, the question become of what the stock will do, until its EMERGENT-3 clinical data readouts.

However, the question is just how the company intends to [hopefully] obtain approval and then commercialize the drug. Hence why it is viewed as such an appropriate M&A target in the eyes of so many. However, there’s reason to believe that, with the recent CEO change, the probability of a potential buyer may be thinner amid the state of the macroeconomic landscape. Whilst corporate balance sheets are relatively strong in this domain, there is still the question of capital budgeting and the most appropriate use of financing at a multi-year high cost of capital.

Alas, we believe KRTX has a means to go in order to justify itself as a major acquisition target. Of course, we are more than happy to be wrong on this one for obvious reasons.

Valuation and conclusion

Valuing KRTX stock is inherently difficult in the absence of cash flows, earnings.

It involves prescribing a multitude of potential scenarios and cash flows, based on comparable labels, and the total addressable market (“TAM”), then assigning a probability of success to this. In the current market, this is more a guessing game than not in our opinion.

Hence, as in similar cases, we’ve used our technical studies to gauge price visibility on the stock.

You can see price evolution has been flat for KRTX since its upsized stock offering in August, with the stock trading below the 50DMA and 250DMA.

Moreover, the longer-term volume trend is descending. The combination of flat price action and evaporating volume is evidence of heavy resistance in our opinion.

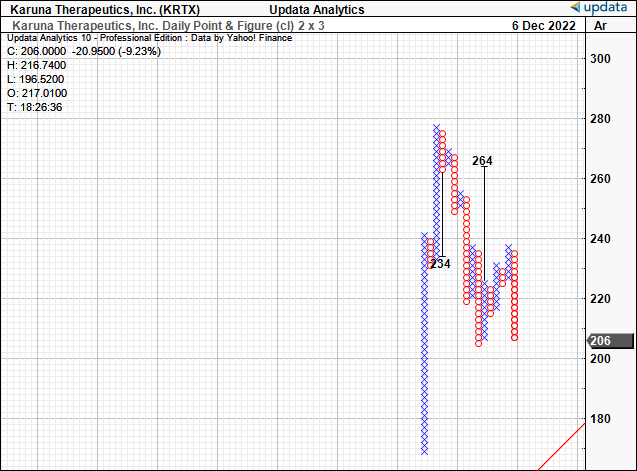

Exhibit 3. KRTX 18-month price evolution using weekly bars. Shares trade flat with volume drying up = resistance.

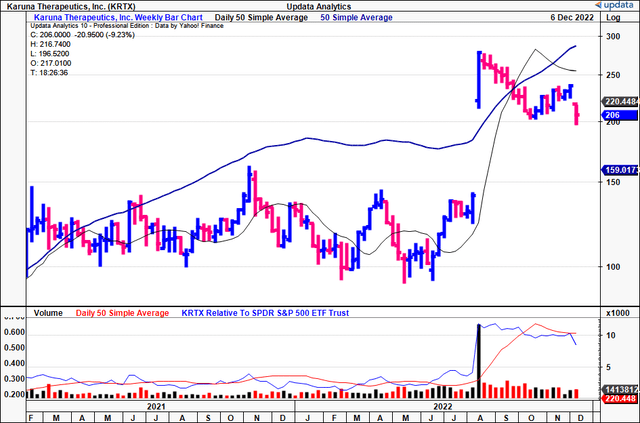

Nonetheless, there is objective evidence to suggest the stock could rally to $264, a region it had been comfortable with in previous times. This would represent a sizeable upside potential from the current market price.

However, in the absence of any near-term catalysts, we’d estimate that it would be difficult for KRTX to thrust off its current base to that level. This helps confirm our neutral thesis.

Exhibit 4. Upside targets to $264, yet lack of catalysts to suggest it can get there.

Data: Updata

Consequently, given all of the available data, we rate KRTX a hold until further clarification on its suitability as an M&A target is obtained. Data is compounding for Karuna Therapeutics’ KarXT label, but, as has been mentioned previously, the market is crowded, and cash burn is an issue in this current environment. Moreover, the transition of Karuna Therapeutics, Inc.’s CEO spells potential risk that there may not even be an appropriate buyer identified at present.

Be the first to comment